Affordable Housing Is A Key Theme In Federal Budget 2022

Today’s budget announced a $10 billion package of proposals intended to reduce the cost of housing in Canada (see box below). The fundamental problem is insufficient supply to meet the demands of a rapidly growing population base. Thanks to the federal government’s policy to rapidly increase immigration since 2015, new household formation has risen far faster than housing completions, both for rent and purchase. This excess demand has markedly pushed home prices to levels beyond average-income Canadians’ means.

The measures announced in today’s budget to increase housing construction, though welcome, are underwhelming. The Feds can control the construction of lower-cost housing through CMHC. Still, most home building is under the auspices of the municipal governments, where the red tape, zoning restrictions and delays abound. The federal government increased funds to help local governments address these issues, but NIMBY thinking still prevents increased housing density in many neighbourhoods.

The headline policy announcement for a two-year ban on foreign residential property purchases may sound reasonable. Still, according to Phil Soper, chief executive of Royal LePage, “It will have a negligible impact on home prices. We know from the pandemic period, when home prices escalated with virtually no foreign money, that our problem is made-in-Canada.”

According to the Financial Post, Soper added that measures like the tax-free savings account for young Canadians would be encouraged to help them achieve their dreams of homeownership in a typical real estate market. However, in a low-supply environment with pandemic-fuelled price gains, these measures would only add more demand without addressing the supply issue. Only a few first-time buyers would be able to take advantage of it.

The Home Buyers’ Bill of Rights that would end blind bidding and assures the right to a home inspection and transparent historical sales prices on title searches is also long overdue.

The First-Time Home Buyer Incentive has been extended to March 2025. This program has been a bust. Buyers do not want to share the equity in their homes with CMHC. The Feds are taking another kick at the can, “exploring options to make the program more flexible and responsive to the needs of first-time homebuyers, including single-led households.” To date, the limits on the program have made them useless in high-priced markets such as the GTA and the GVA.

Budget 2022 Measures To Improve Housing Affordability

Tax-Free Home Savings Account

- Introduce the Tax-Free First Home Savings Account that would give prospective first-time home buyers the ability to save up to $40,000. Like an RRSP, contributions would be tax-deductible, and withdrawals to purchase a first home—including investment income—would be non-taxable, like a TFSA.

New Housing Accelerator Fund

- With the target of creating 100,000 net new housing units over five years, proposes to provide $4 billion over five years, starting in 2022-23, to launch a new Housing Accelerator Fund that is flexible to the needs and realities of cities and communities, while providing them support such as an annual per-door incentive or up-front funding for investments in municipal housing planning and delivery processes that will speed up housing development.

New Affordable Housing

- To ensure that more affordable housing can be built quickly, Budget 2022 proposes to provide $1.5 billion over two years, starting in 2022-23, to extend the Rapid Housing Initiative. This new funding is expected to create at least 6,000 new affordable housing units, with at least 25% of funding going towards women-focused housing projects.

An Extended and More Flexible First-Time Home Buyer Incentive

- Extension of the First-Time Home Buyer Incentive–which allows eligible first-time homebuyers to lower their borrowing costs by sharing the cost of buying a home with the government–to March 31, 2025. Explore options to make the program more flexible and responsive to the needs of first-time homebuyers, including single-led households.

A Ban on Foreign Investment in Canadian Housing

- Proposes restrictions that would prohibit foreign commercial enterprises and people who are not Canadian citizens or permanent residents from acquiring non-recreational, residential property in Canada for a two-year period.

Property Flippers Pay Their Fair Share

- Introduce new rules so that any person who sells a property they have held for less than 12 months would be subject to full taxation on their profits as business income, applying to residential properties sold on or after January 1, 2023. Exemptions would apply to Canadians who sell their home due to certain life circumstances, such as a death, disability, the birth of a child, a new job, or a divorce.

Rent-to-Own Projects

- Provide $200 million in dedicated support under the existing Affordable Housing Innovation Fund. This will include $100 million to support non-profits, co-ops, developers, and rent-to-own companies building new rent-to-own units.

Home Buyers’ Bill of Rights

- Bring forward a national plan to end blind bidding. Among other things, the Home Buyers’ Bill of Rights could also include ensuring a legal right to a home inspection and ensuring transparency on the history of sales prices on title searches.

Multigenerational Home Renovation Tax Credit

- Provide up to $7,500 in support for constructing a secondary suite for a senior or an adult with a disability, starting in 2023.

Doubling the First-Time Home Buyers’ Tax Credit

- Double the First-Time Home Buyers’ Tax Credit amount to $10,000, providing up to $1,500 in direct support to home buyers, applying to homes purchased on or after January 1, 2022.

Co-Operative Housing Development

- Reallocate funding of $500 million to a new Co-Operative Housing Development Program to expand co-op housing in Canada. Provide an additional $1 billion in loans to be reallocated from the Rental Construction Financing Initiative to support co-op housing projects.

There is also a laundry list of other programs to create additional affordable housing for Indigenous Peoples, Northern Communities, and vulnerable Canadians. Enhanced tax credits for renovations to allow seniors or disabled family members to move in; and for seniors to improve accessibility in their homes. As well, money is provided for long-term efforts to end homelessness.

To combat money laundering, the government said it would extend anti-money laundering and anti-terrorist financing requirements to all mortgage-lending businesses within the next year.

For greener housing initiatives, the government is planning to provide $150 million over five years starting this year to drive building code reform to focus on building low-carbon construction projects and $200 million over the same timeline for building retrofits large development projects.

Bottom Line

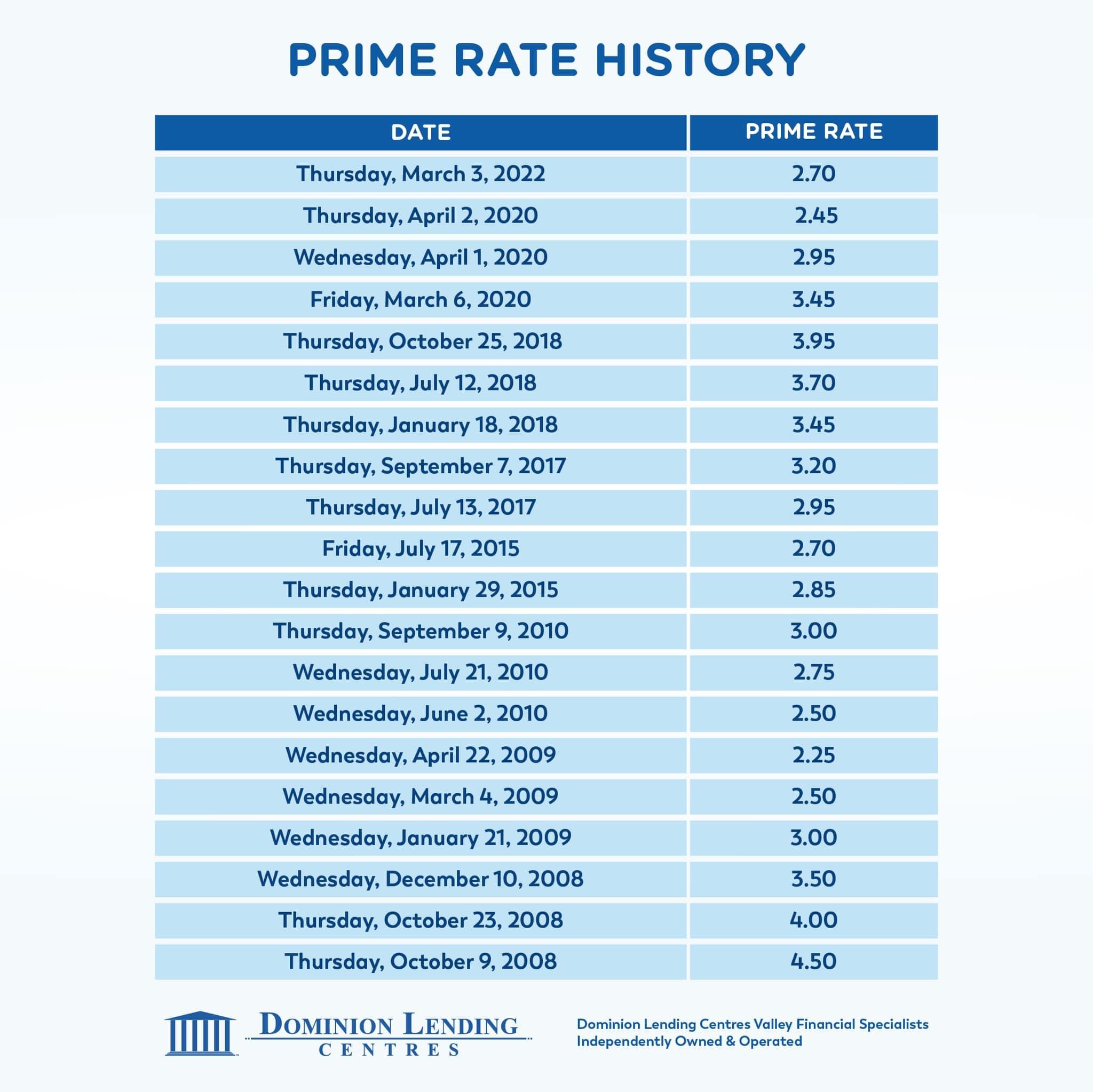

Nothing the federal government has done in today’s budget will make much of a difference in the housing market. What does make a difference is the spike in interest rates that is already in train. Fixed mortgage rates are up to around 4%, and variable mortgage rates have begun their ascent. There is still a record gap between the two, but the Bank of Canada will likely hike the policy rate by 50 bps next week. The Bank will probably hike interest rates at every meeting for the remainder of the year and continue into the first half of next year.

It is also noteworthy what Budget 2022 did not do. It did not address REITs or investment activity by domestic non-flipping purchasers. Some were expecting a rise in minimum downpayment on investor purchases or restrictions on using HELOCs for their funding.

Budget 2022 did not raise the cap of $1 million on insurable mortgages. It did not reinstate 30-year amortization, a favourite of the NDP. And, it did not follow the BC provincial government in allowing a “cooling-off” period after a bid has been accepted, technically giving would-be buyers more time to secure financing.

This article is from the Sherry Cooper Assoc.

Angela Calla is an 18-year award-winning woman of influence which sets her apart from the rest. Alongside her team, Angela passionately assists mortgage holders in acquiring the best possible mortgage. Through her presence on “The Mortgage Show” and through her best-selling book “The Mortgage Code“, Angela educates prospective home buyers by providing vital information on mortgages.

In August of 2020, at the young age of 37, Angela surpassed $1 Billion dollars in funded personal mortgages. In light of this, her success awarded her with the 2020Business Leader of the Year Award.

Angela is a frequent go-to source for media and publishers across the country. For media interviews, speaking inquiries, or personal mortgage assistance, please contact Angela at hello@countoncalla.ca or at 604-802-3983.

Click here to view the latest news on our blog.