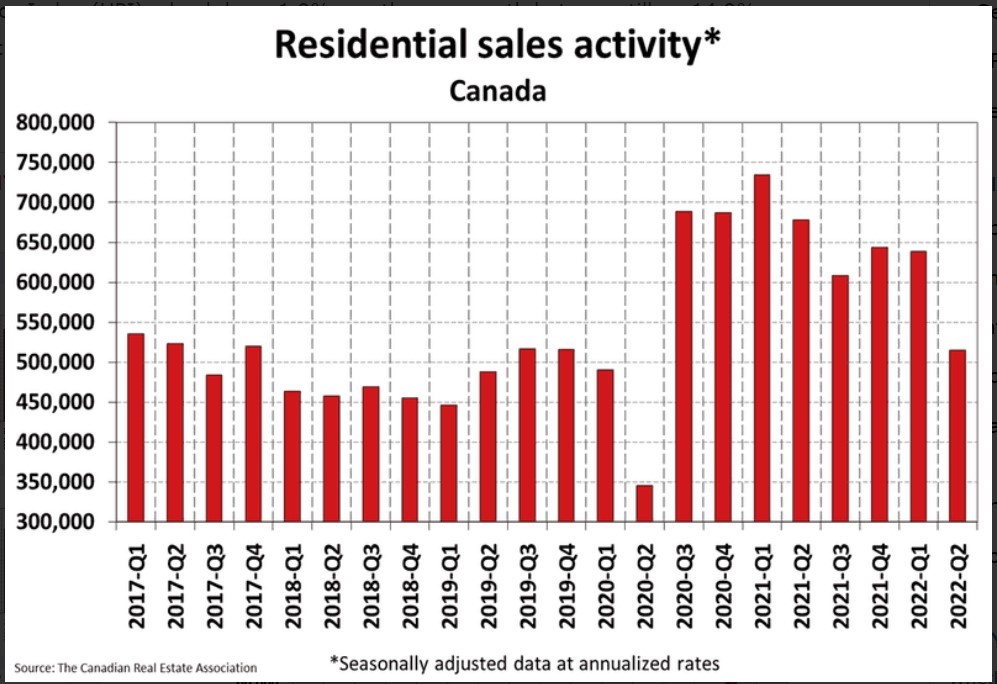

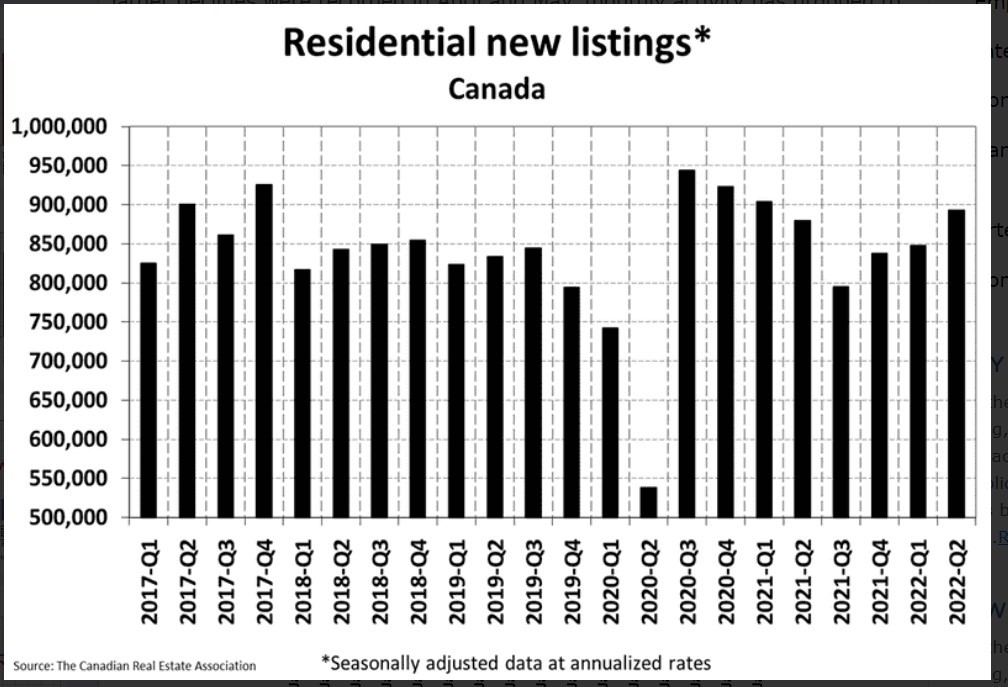

Mortgage specialists say they’re busier than usual these days answering panicked calls from Canadians holding a variable mortgage or set to renew who want to know how to save money in the face of rising interest rates.

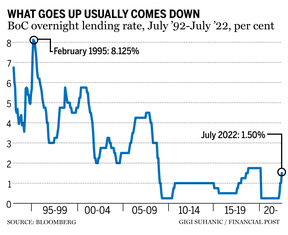

Earlier this month, the Bank of Canada raised its benchmark lending rate a full percentage point, bumping it up to 2.5 per cent. This prompted Canadian banks to hike their prime lending rate to 4.7 per cent — the highest it’s been in more than 10 years.

“The really interesting thing about what’s going on is the incredible speed of the rate increases.… We’ve gone from 1.79 to 5.09 in a very short time — 22 months,” said Ron Butler, mortgage broker and one of the founders of Butler Mortgage, which operates across Canada.

He says people have grave concerns about just how far the rate is going to go, especially since it’s widely speculated Canada’s central bank is expected to boost its rate another 0.5 to 1.0 per cent in the fall.

“The horror show we’re experiencing right now, it just seems to be going up, up and up,” said Butler.

Shop around

Butler says whether you are a new home buyer or you are coming up for renewal, it’s worth looking around at the rates being offered by different banks before signing any contracts.

“In today’s marketplace, if one bank is offering you 5.09 and another bank is offering you 4.89 or 4.79, if there’s a quarter or half a per cent difference, I mean, you would want to get that because literally every dollar counts,” said Butler.

But applying to different banks can hurt a person’s credit score, says mortgage specialist Angela Calla, who is based in British Columbia.

Calla suggests that instead, people use a mortgage broker to hunt for the best deals because their services are free — they’re compensated by the lender — and they can compare rates and options using just one application.

She says mortgage brokers are not biased to a particular institution. She says they give the pros and cons of products and services.

“There’s a whole significant aspect of mortgage lenders and products that are only available through mortgage professionals, so consumers are completely limited if they didn’t know that this option existed,” said Calla.

But she says they’re not all created equal.

“We all run our own practices and have different approaches and strategies on how we continually help individuals manage their mortgage to ensure that they have the best strategy in place for the changes in the market, as well as their personal lifestyle,” said Calla.

Age-old question

Fixed or variable?

Calgary mortgage broker Lori Grill says unfortunately there is no right or wrong answer.

She says both have their risks and their benefits.

“Sometimes they want somebody to tell them what to do, which I will never do. You have to make your own decisions on that. I can give you the numbers and give you my knowledge, and that’s about it,” said Grill, specialist with the Mortgage Group.

Variable rates are usually determined by discounting the prime rate. But they can also match prime or be slightly higher.

Generally, variables are lower than fixed rates but can float higher at times.

With variables, Grill says it’s important to focus on the long game and being able to ride out the peaks and valleys.

But for some, she says, paying a little higher of a fixed rate is worth it to gain stability in budget planning, especially when other things, from the price of groceries and gas to the pandemic, are unstable.

“Those things are totally out of your control, but if you can control your mortgage payment, then maybe it’s time to lock in,” said Grill.

If you do lock in to avoid future rate hikes, she says be warned that you may be kicking yourself if the rates start to drop again.

She recalls paying a 13 per cent interest rate in the 1990s in Calgary on a one-year, fixed-term mortgage. She says she eventually decided to lock in to a five-year, fixed-term at 11 per cent, only to end up paying a penalty to break her mortgage to go with a variable one when the rates began lowering.

Not all variables are equal

If you do choose a variable rate, Grill suggests people increase their payments to match the comparable fixed-rate terms if they can — because that added money goes directly to the principal and will help you pay off your mortgage sooner.

Butler says that advice is now more important than ever these days with respect to variable mortgages that offer static payments regardless of rate changes.

That means when the interest rate goes up, less of your payment goes toward the principal. In some cases, the rates go so high, you reach what the banks call a trigger point.

“The trigger point is when the interest grows so much within the mortgage payment that there no longer is any principal being paid and that you actually have a mortgage that’s growing each month because the payment isn’t covering the interest,” said Butler.

In those cases, the banks reach out to the customer and either ask for a lump sum payment to cover the principal or radically change the payment structure.

Butler expects to see more people with these types of mortgages reach their trigger points this fall if the Bank of Canada raises its rate another 75 basis points.

To avoid that, homeowners should be topping up their static variable mortgages now, he says.

Other cost-cutting tips

Customers can change the frequency of payments, which are typically monthly, biweekly and weekly. Accelerated biweekly and accelerated weekly plans are also options but cost more over the year. Experts say monthly tends to be a lower amount than other offerings.

They can also increase their amortization period.

But Butler says that requires a whole new mortgage application and not everyone may be able to qualify with the more rigorous stress tests now in place.

Instead of a five-year, fixed term, people could choose a shorter term fixed mortgage to see whether the rates will drop in that time period.

“In 18 months, [the variable rate] could start coming back down again. It’ll never go down as low as it was. It’ll never be these super, super low rates that you got in December. That won’t happen again for a long time,” said Butler.

Customers can also consolidate their debt by adding it on to their mortgage, says Calla, which gives people more cash flow.

She says cutting back on expenses is important. Because she says that’s the point of the interest rate hikes, to slow inflation. And she says perhaps if Canadians heed the message, the hikes will stop — at least for now.

But she says her best advice right now is for those having a mortgage renewal next year, get a rate hold today until you decide what to do.

Because she says no one really knows for sure what the future brings.

“No economist has gotten it right 100 per cent,” said Calla.

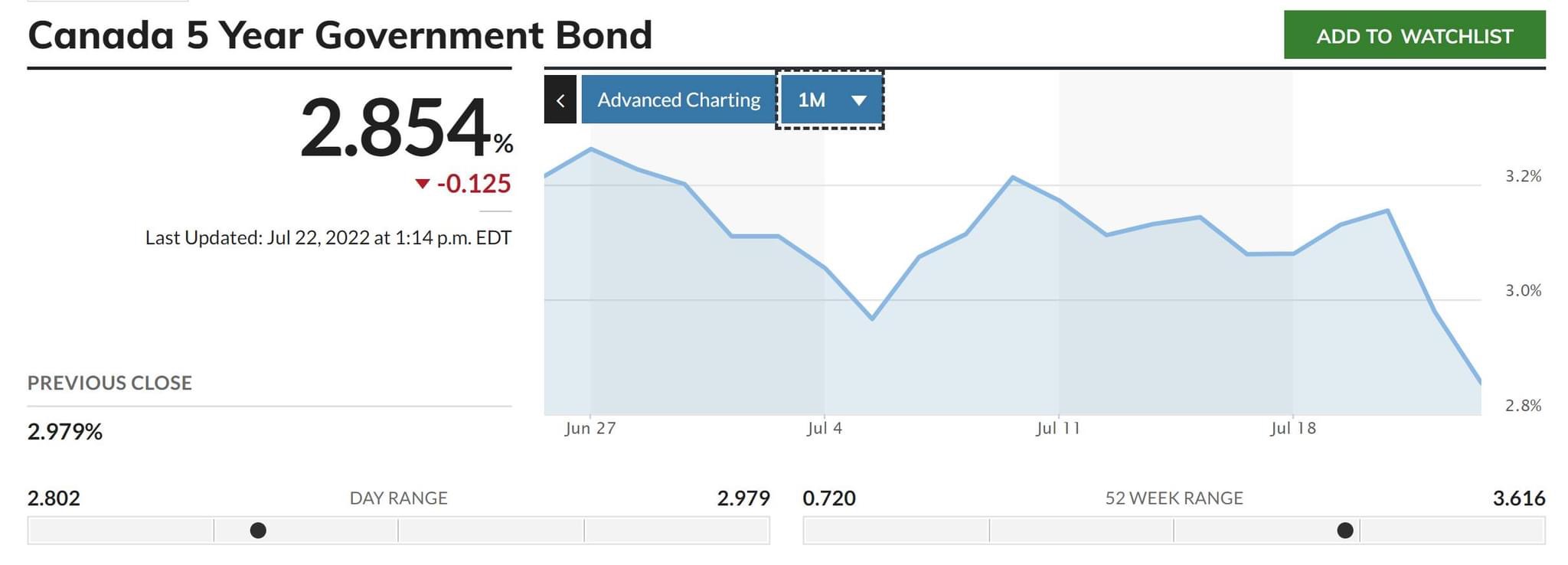

The economic factors that have to happen in order for the Bank of Canada and for the bond market to react to the market and decide what it’s going to do is based on influences that not a single human being has control over.”

(This article is courtesy of CBC)

Angela Calla is an 18-year award-winning woman of influence which sets her apart from the rest. Alongside her team, Angela passionately assists mortgage holders in acquiring the best possible mortgage. Through her presence on “The Mortgage Show” and through her best-selling book “The Mortgage Code“, Angela educates prospective home buyers by providing vital information on mortgages.

In August of 2020, at the young age of 37, Angela surpassed $1 Billion dollars in funded personal mortgages. In light of this, her success awarded her with the 2020Business Leader of the Year Award.

Angela is a frequent go-to source for media and publishers across the country. For media interviews, speaking inquiries, or personal mortgage assistance, please contact Angela at hello@countoncalla.ca or at 604-802-3983.

Click here to view the latest news on our blog.