Bank of Canada Starts Hiking Rates, Signalling More To Come

The Governing Council of the Bank of Canada raised the overnight policy rate target by a quarter percentage point in a widely expected move and signalled that more hikes would be coming. This is the first rate hike since 2018. In a cautious stance, the Bank announced it was continuing the reinvestment phase, keeping its overall Government of Canada bonds holdings on its balance sheet roughly stable.

The Bank’s press release highlighted the major new source of uncertainty provided by the unprovoked invasion of Ukraine by Russia and suggested that it is a new source of substantial inflation pressure. Prices for oil, metals, wheat and other grains have skyrocketed recently. Moreover, this geopolitical distention negatively impacts confidence worldwide and adds new supply disruptions that dampen growth. “Financial market volatility has increased. The situation remains fluid, and we are following events closely.”

The Bank commented that economies have emerged from the impact of the Omicron variant more quickly than expected. Demand is robust, particularly in the US.

“Economic growth in Canada was very strong in the fourth quarter of last year at 6.7%. This is stronger than the Bank’s projection and confirms its view that economic slack has been absorbed. Both exports and imports have picked up, consistent with solid global demand. In January, Canada’s labour market recovery suffered a setback due to the Omicron variant, with temporary layoffs in service sectors and elevated employee absenteeism. However, the rebound from Omicron now appears to be well in train: household spending is proving resilient and should strengthen further with the lifting of public health restrictions. Housing market activity is more elevated, adding further pressure to house prices. Overall, first-quarter growth is now looking more solid than previously projected.”

Canadian CPI inflation has risen to 5.1%, as expected in January, well below the 7.5% level posted in the US.” Price increases have become more pervasive, and measures of core inflation have all risen. Poor harvests and higher transportation costs have pushed up food prices. The invasion of Ukraine is putting further upward pressure on prices for both energy and food-related commodities. All told, inflation is now expected to be higher in the near term than projected in January. Persistently elevated inflation increases the risk that longer-run inflation expectations could drift upwards. The Bank will use its monetary policy tools to return inflation to the 2% target and keep inflation expectations well-anchored.”

The final paragraph of the Bank’s press release speaks with great clarity: “The policy rate is the Bank’s primary monetary policy instrument. As the economy continues to expand and inflation pressures remain elevated, the Governing Council expects interest rates will need to rise further. The Governing Council will also be considering when to end the reinvestment phase and allow its holdings of Government of Canada bonds to begin to shrink. The resulting quantitative tightening (QT) would complement the policy interest rate increases. The timing and pace of further increases in the policy rate, and the start of QT, will be guided by the Bank’s ongoing assessment of the economy and its commitment to achieving the 2% inflation target”.

Bottom Line

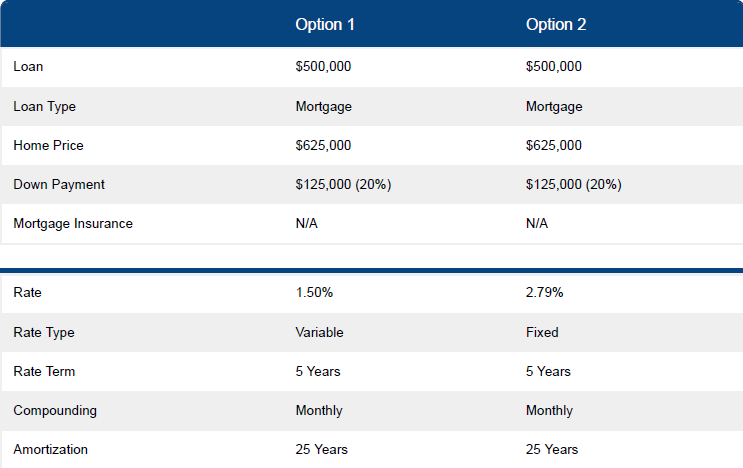

The Bank of Canada has made a clear statement regarding the outlook for a normalization of interest rates. We expect a series of rate hikes over the next year. Expect another 25 basis point increase following the next meeting on April 13. The increased uncertainty and volatility arising from the war in Ukraine is front of mind worldwide. Still, it will not deter central banks from tightening monetary policy to forestall an embedded rise in inflation expectations.

The Bank of Canada has postponed Quantitative Tightening, for now, a prudent move in the face of geopolitical uncertainty.

This article is credited to the Sherry Cooper Assoc.

Angela Calla is an 18-year award-winning woman of influence which sets her apart from the rest. Alongside her team, Angela passionately assists mortgage holders in acquiring the best possible mortgage. Through her presence on “The Mortgage Show” and through her best-selling book “The Mortgage Code“, Angela educates prospective home buyers by providing vital information on mortgages.

In August of 2020, at the young age of 37, Angela surpassed $1 Billion dollars in funded personal mortgages. In light of this, her success awarded her with the 2020Business Leader of the Year Award.

Angela is a frequent go-to source for media and publishers across the country. For media interviews, speaking inquiries, or personal mortgage assistance, please contact Angela at hello@countoncalla.ca or at 604-802-3983.

Click here to view the latest news on our blog.