One of the benefits of working with an independent mortgage professional; compared to getting your mortgage through a single institution, is choice. And as there are even more mortgage rules coming into place January 1st 2018, now more than ever, having access to a wide variety of mortgage products is going to ensure you get the mortgage that best suits your needs.

Working with an independent mortgage professional will give you access to varying products from many different lenders, some of these lender you may have never even heard of, but that’s okay. Sure, RBC, BMO, and CIBC, are more household names compared to say, MCAP, RMG, or Merix Financial, but as each lender has a different appetite for risk (there is always a risk when lending money) how do you know which lender is going to have the products that are going to be the best fit for you?

Typically the conversation develops into something like this: “I’ve never heard of this lender before, are they safe, I mean… I have no idea who they are”? And although that is a valid question, there is a simple answer. Yes. Yes they are safe. All the lenders we work with are reputable and governed by the same regulator as the big banks. Ultimately, you have their money, they don’t have yours! But let’s answer a few of the common questions often asked about these lenders accessed only through an independent mortgage professional.

Why haven’t I heard of any of these lenders?

Instead of spending all their money on huge marketing campaigns (like the Canadian big banks) which drives up the cost of their product, broker channel lenders rely on competitive products and independent mortgage professionals to secure new clients.

What happens if my lender gets purchased by another lender?

This actually happens quite a bit, however, it’s business as usual for you. Even if your mortgage contract gets sold, the terms of your mortgage stay intact and nothing changes for you.

What happens if my lender goes bankrupt or is no longer lending at the end of my term?

This would be the same as if the lender was purchased by another lender. The only difference is, at the end of your term, we would have to find another lender to place your next term. And as this is already good practice, it’s business as usual. Again, you have their money, they don’t have yours. The contract would stay in force.

Why don’t these lenders have physical locations?

Much like why you haven’t heard of these lenders, they save the money on advertising and infrastructure, and instead focus on creating unique products to give their clients more choice. These lenders rely on independent mortgage professionals for awareness and compete on product not public awareness.

Do they really have better products?

Yes. Well, I guess we have to define what is meant by better products. If by better products you mean a variety of products that suit different individuals differently, then yes. Across the board, each lender has a different appetite for a different kind of risk. For example, while one lender might not include child tax income as part of your regular income, another might. While one lender might look favourably on a certain condo development, another might not. Each lender sees things a little differently. Knowing the products and preferences at each lender is what we do!

When it comes to mortgage qualification, some broker channel lenders are more flexible than others (or the banks) and offer different programs that cater to self-employed, people who are retired, own multiple properties, or rely on disability income. While as it relates to the features of the mortgage, different lenders offer many different features.

Some mortgages can be paid off at an accelerated pace with little to no penalty, some accommodate different payment structure, some products are set at lower rate, but sacrifice flexibility.

At the end of the day, the goal should be to qualify for a mortgage that has the features that suit your individual needs. Regardless of which lender that is. If you would like to talk about your financial situation, and see which lender best suits your needs, please don’t hesitate to contact a Dominion Lending Centres mortgage specialist.

Michael Hallett

Dominion Lending Centres – Accredited Mortgage Professional

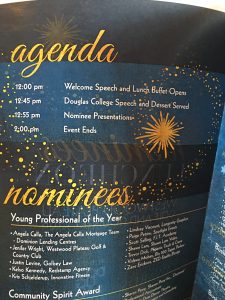

Angela Calla has been a licensed mortgage broker for 14 years. She has been with Dominion Lending Centres since its inception in January 2006. Residing in Port Moody, British Columbia, Angela is a regular expert guest on several news stations, television shows, radio programs and local and national publications. She was the AMP of the year in 2009, and has consistently been one of DLC and the industry’s top performers since 2006. She can be reached at callateam@dominionlending.ca or 604-802-3983