Mortgage approval:

What are the ways you can ensure pre-approval on a mortgage? How can you protect yourself while searching for a mortgage?

Beware of those “pre-approval in 60 seconds” apps. Those are only pre-qualifications meant for infotainment purposes. This is not an actual pre-approval in any way shape or form. There is a big difference. The only way you can shop in confidence and protect yourself is with a “real” pre-approval.

In order to have a “real” pre-approval, your credit, income and down payment must be verified via the appropriate documentation (please note some documents have a shelf life of 30 days). The lender will then subject this to their approval of the property. Throughout the pre-approval period circumstances (job, debts, etc.) must stay the same. The Lender ALWAYS reserves the right to ask for additional documentation at any time.

How long does pre-approval last and should you seek pre-approval if you don’t have a home in mind?

A pre-approval can last up to 18 months for new construction or 120 days for an existing property. It’s important to note: the lenders that have the best rates don’t “hold rates” they only work on “live deals” there is a cost to hold money which is why only some lenders offer it.

How long does mortgage approval take?

Once an accepted offer is in place it’s best to have 5-7 business days to finalize your details. The lender will call your employer, review required strata documents relative to that property and may want to review an appraisal.

Anything a first-time homebuyer should know before they finalize their mortgage?

Just because you hold a rate with one lender, doesn’t mean that will be your final choice. Based on the property you choose and your closing dates, we may recommend a different lender once a contract is in place. It’s important to understand that strategy and process is circumstantial.

Utilizing a mortgage broker will protect your credit, give you the power of choice and unbiased advice. The access a mortgage professional will give you is unparalleled.

Once you have an offer in place you may be able to qualify for a monoline lender; this will help protect your equity as their pre-payment penalties are the lowest. If you are like 7/10 Canadians that end up breaking their mortgage early because of divorce, a growing family, job transfer, no longer love your neighbours or strata, this will help you protect your equity.

A mortgage professional with a proactive strategy put in place will help you achieve your financial goals and use the constantly changing market to your advantage.

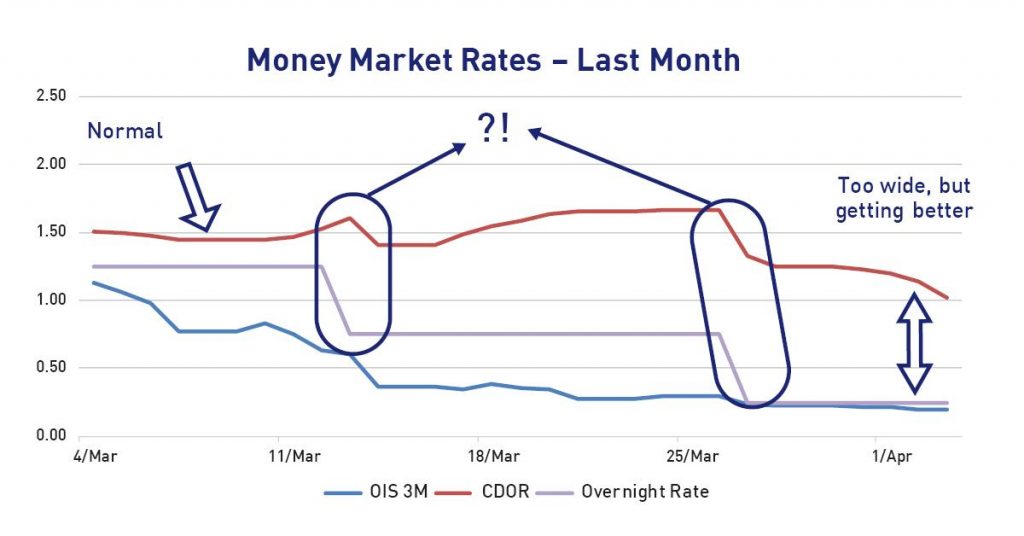

Shopping for a mortgage based on interest rates alone is the biggest mistake any potential mortgage holder can make. There are about 4 lines of rates available at all times based on your down payment, credit score, property type, amortization, occupancy, area of the property, utilized income, and closing date – the list goes on. Your mortgage professional will go over all the options that are applicable to you.

Angela Calla is a 16 year award-winning woman of influence mortgage expert. Alongside her team, passionately assisting mortgage holders get the best mortgage, and educating them on The Mortgage Show on CKNW for over a decade and through her best-selling book The Mortgage Code available on Amazon. To purchase the book click here: The Mortgage Code. Proceeds from all sales will be donated to Access Youth Outreach Services. Angela can be reached at callateam@dominionlending.ca or 604-802-3983.