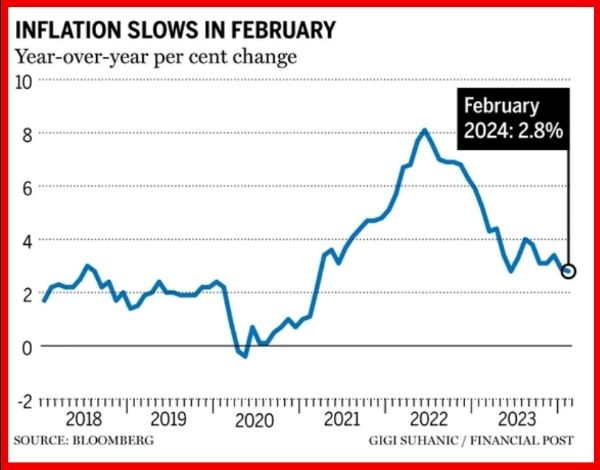

The Consumer Price Index (CPI) rose 2.8% year-over-year in February, down from the 2.9% January pace and much slower than the 3.1% expected rate. Gasoline prices rose in Canada for the first time in five months, which led many analysts to forecast a rise in February inflation as seen in the US. However, offsetting the increase in gas prices was a deceleration in the cost of cellular services, food purchased from stores, and Internet access services.

Excluding gasoline, the headline CPI slowed to a 2.9% year-over-year increase in February, down from 3.2% in January. Prices for rent and the mortgage interest cost index continued to apply upward pressure on the headline CPI.

On a monthly basis, the CPI rose 0.3% in February, the same as in January. The most significant contributors to the monthly increase were higher travel tours and gasoline prices.

On a seasonally adjusted monthly basis, the CPI rose 0.1% in February.

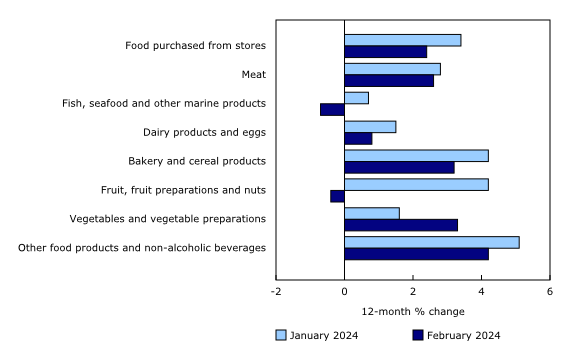

Prices for food purchased from stores continued to ease year over year in February (+2.4%) compared with January (+3.4%). Slower price growth was broad-based, with prices for fresh fruit (-2.6%), processed meat (-0.6%), and fish (-1.3%) declining. Other food preparations (+1.4%), preserved fruit and fruit preparations (+4.0%), cereal products (+1.7%), and dairy products (+0.6%) decelerated in February.

February was the first month since October 2021 that grocery prices increased slower than headline inflation. The slower price growth is partially attributable to a base-year effect, as food purchased from stores rose 0.7% month over month in February 2023 due to supply constraints amid unfavourable weather in growing regions and higher input costs.

While grocery price growth has been slowing, prices continue to increase and remain elevated. From February 2021 to February 2024, prices for food purchased from stores increased by 21.6%.

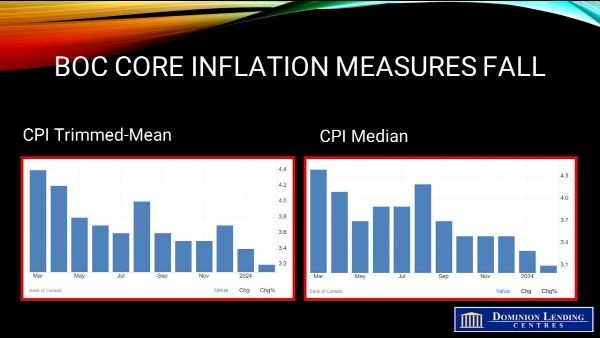

The Bank of Canada’s preferred core inflation measures, the trim and median core rates, exclude the more volatile price movements to assess the level of underlying inflation. The CPI trim slowed two ticks to 3.2% in February, and the median also declined two ticks to 3.1% from year-ago levels, as shown in the chart below.

Bottom Line

The next meeting of the Bank of Canada Governing Council is on April 10. Before then, we will see two more important data releases:

- The Bank of Canada Business Outlook Survey and Canadian Survey of Consumer Expectation and;

- The Labour Force Survey for March.

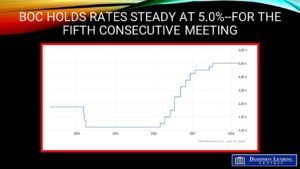

Neither of these reports will likely derail the central bank’s move to cut interest rates by the June 10 meeting. Indeed, they could begin to cut rates at the April meeting. This would no doubt trigger a whopping Spring housing market, which is likely to be strong. There is significant pent-up demand for housing, and the prospect of home price increases could well move buyers off the sidelines if a surge in new listings comes to fruition.

The Canadian economy is particularly interest rate sensitive because of the vast volumes of mortgages that will be renewed in the next two years. Mortgage delinquency rates are already rising, so a gradual decline in interest rates is welcome news.

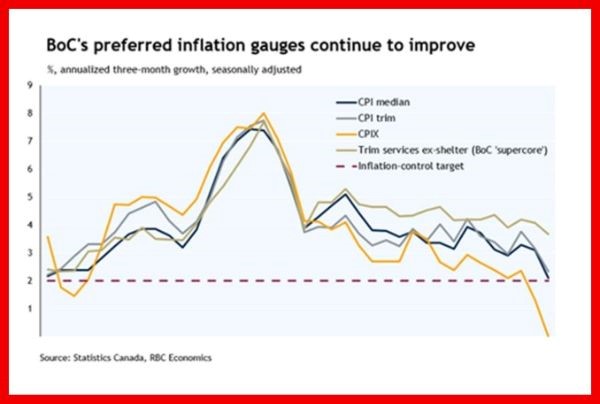

As the chart below shows, the three-month rolling average growth rates for the CPI trim and median core measures averaged 2.2% in February–their lowest reading in three years.

According to the Royal Bank economists, “Building on the January CPI report that was already showing broad-based easing in price pressures in Canada, the February report today reaffirmed those trends. Different measures of core inflation decelerated, and the diffusion index that measures the scope of inflation pressures also improved. That measure, however, was still showing slightly broader price pressures than pre-pandemic “norms”, suggesting there’s still room for more improvement.”

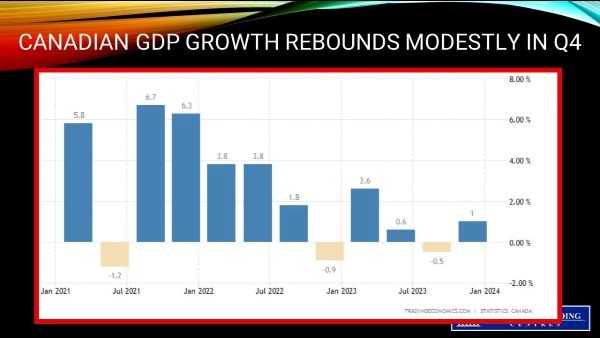

With the economy’s slow growth trajectory, the central bank has every reason to begin cutting interest rates soon.

(Article Courtesy of Dr. Sherry Cooper, Chief Economist, DLC)

Angela Calla is an 19-year award-winning woman of influence which sets her apart from the rest. Alongside her team, Angela passionately assists mortgage holders in acquiring the best possible mortgage. Through her presence on “The Mortgage Show” and through her best-selling book “The Mortgage Code“, Angela educates prospective home buyers by providing vital information on mortgages. In light of this, her success awarded her with the 2020Business Leader of the Year Award.

Angela is a frequent go-to source for media and publishers across the country. For media interviews, speaking inquiries, or personal mortgage assistance, please contact Angela at hello@countoncalla.ca or at 604-802-3983.

Click here to view the latest news on our blog.