As the housing market continues to stir up homebuyers in Canada, the ongoing debate between variable and fixed rate holders is more prevalent than ever. To highlight some of these aspects more prominently, we have put together a breakdown of the distinctions you should know.

When it comes to adjustable vs variable, it is invaluable to know when payments change and when just the amortization changes and the subsequent effects. After a rate increase of a quarter point/0.25%, expect your payment to go up by $13 dollars per 100k in the mortgage amount. Unless you are with a lender like CIBC or TD that only changes the amortization so you would manually have to change your payment higher unless you stretch out the amortization.

Locking into a fixed rate – what the rate is at that time is unknown. It’s not the rate that it could have been or the variable rate as a fixed but whatever the rate is currently. Typically, it is 1.0-1.5% higher, which is likely one of the major reasons you took the variable rate in the first place, to benefit from those savings. When you lock into a fixed rate, you assume those terms meaning there could be an Interest Rate Differential (IRD) penalty if you need to break the mortgage early.

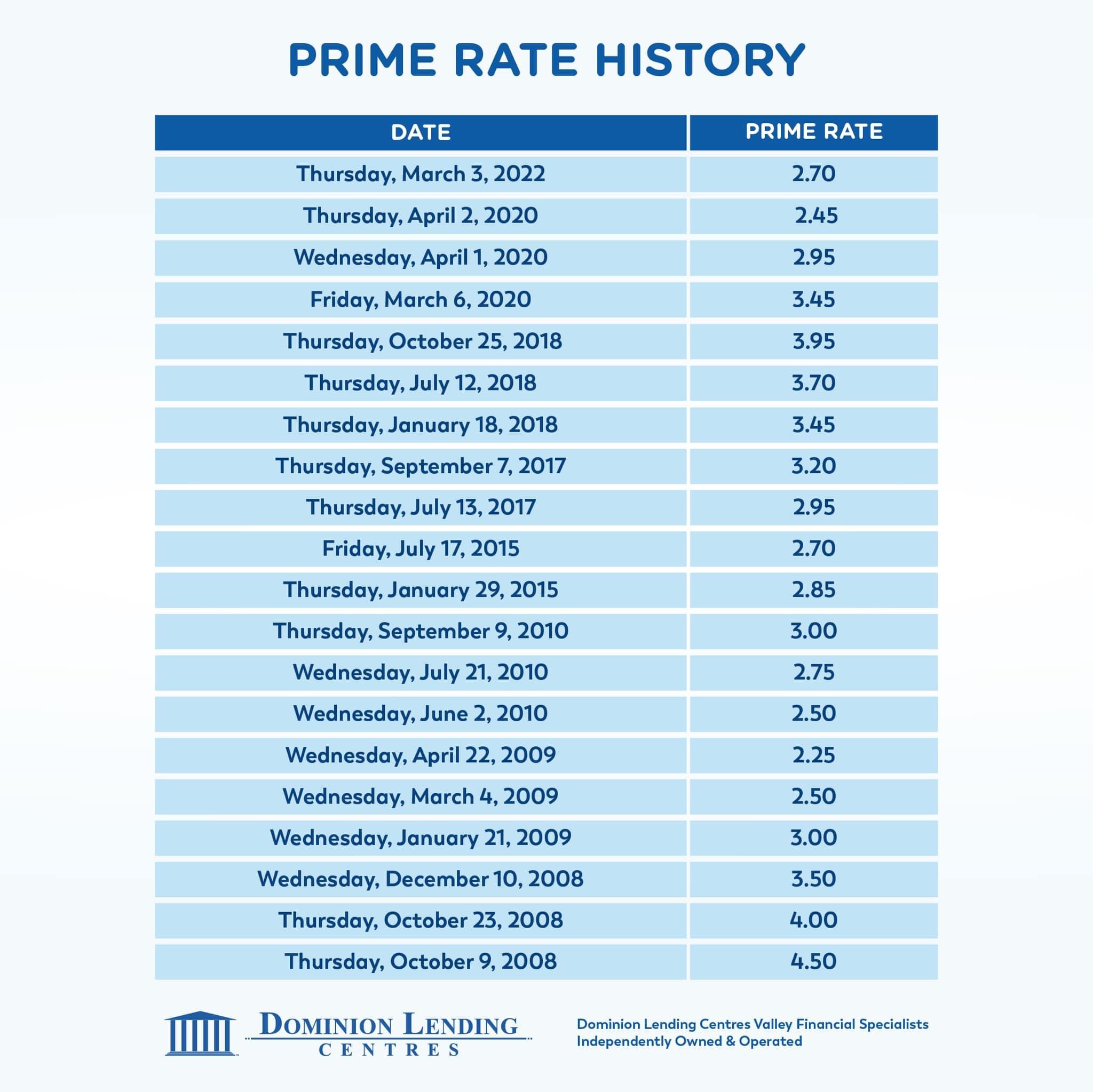

Bank of Canada meets 8 times a year, rates can stay the same, move up, or down most commonly in .25% increments.

It is important to note that Bank Prime and The Bank of Canada Prime are two different things. The one that impacts you is Bank Prime. When there is a change remember, the banks are not obligated to opt-in. Most times they do, however, in large, unprecedented times, sometimes measures change. In regular times, if Bank Prime is 3% and your discount is prime minus one, your rate is 2%, if prime goes up to 0.25% then your rate goes up to 2.25% and the bank prime is now 3.25%

Prime can be different depending on the lender so borrowers should be aware of what that lender’s prime is (i.e., TD). Therefore, understanding lender history is so crucial. Banks can adjust their pricing, so it’s best you go into your mortgage decisions understanding the options available.

Lock-in options will be offered as 3, 4, or 5-year terms. Depending on how far into a mortgage you are. The bond market is much more volatile than the Bank of Canada rate changes so your lock-in options can change very fast, and the borrower is responsible for securing those options and responding directly to the lender, with us being here to advise. As the borrower, it is your responsibility to understand these options and act accordingly as time is usually of the essence in these scenarios. As always, we are here to provide the options for you to decide.

Here are some of the main reasons people consider a variable rate mortgage:

- Flexibility not to front-load as much interest to the lender

- Cashflow design

- Qualifications and spread pending timing in economy/mortgage rate pricing

- Low exit is so easy to modify to utilize the equity

- Take advantage of lows in the market

- If paid at a fixed rate, significantly reduces the principal and therefore time of the mortgage

Sometimes it can be a lot of information to digest, but our team is here to explain and walk you through the whole process. So, if you are considering a variable rate mortgage, or have any questions about your existing mortgage, feel free to reach out to our team for a free consultation!

Angela Calla is an 18-year award-winning woman of influence which sets her apart from the rest. Alongside her team, Angela passionately assists mortgage holders in acquiring the best possible mortgage. Through her presence on “The Mortgage Show” and through her best-selling book “The Mortgage Code“, Angela educates prospective home buyers by providing vital information on mortgages.

In August of 2020, at the young age of 37, Angela surpassed $1 Billion dollars in funded personal mortgages. In light of this, her success awarded her with the 2020Business Leader of the Year Award.

Angela is a frequent go-to source for media and publishers across the country. For media interviews, speaking inquiries, or personal mortgage assistance, please contact Angela at hello@countoncalla.ca or at 604-802-3983.

Click here to view the latest news on our blog.