By Alyssa Davies • September 26, 2023

Homeowners and buyers in Canada have been through a lot in the past few years. So, it’s no surprise that the homebuyer sentiment for Canadians may come with feeling anxious and pressured about homeownership.

Being a homeowner has been an adventure, whether it be a global pandemic, a shaky economy, rising interest rates or soaring inflation. With adventures like this come plenty of emotions, financial stress and unavoidable change.

To determine what homebuyers feel, we surveyed 800 respondents. We asked them to measure their home-buying experience between 2020 and 2023. Plus, we wanted to hear about their feelings on the current economy and real estate market. Here’s what we found:

Key Takeaways on Homebuyer Sentiment:

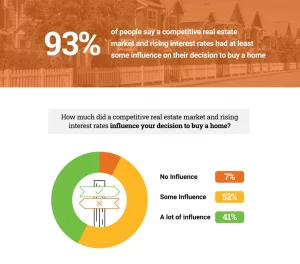

93% of people say a competitive real estate market and rising interest rates had at least some influence on their decision to buy a home

30% of Canadian homeowners feel their finances are tight

Only 3% of Canadians ‘never worry’ about being able to afford their mortgage when it comes up for renewal

45% of Canadians would still be happy in their home even if there were another interest rate increase before the end of this year

Homebuyers Rush to Secure Mortgages Before Prices Rise

Home prices have been all over the map in the past three years. Prices were at $567,332 in 2020, peaking at $703,875 in 2022 and dropping to around $662,103 in 2023. Because of this, many homebuyers were in a rush to buy a home before they could no longer afford the cost.

In fact, 93% of people say a competitive real estate market and rising interest rates had at least some influence on their decision to buy a home. And another 43% of buyers said that because home prices were rising, they wanted to break into the market before homes became even more unaffordable.

When Your Choice is Between a Competitive Rental Market and an Expensive Real Estate Market, It Isn’t Easy

For Brianne Harrison, buying felt like the only option. In 2018, she went to three different rental viewings only to be rejected because landlords chose tenants willing to pay the most monthly rent. “People were offering to pay more than what was listed out of desperation to find a place,” says Harrison, who bought a home in Kawartha Lakes, a municipality in Central Ontario.

Her experience isn’t unique. As of August 2023, a rental report from Rentals.ca and Urbanation says the average rent in Canada is $2,078 per month. Compared to July 2021, rental prices have increased by 21% — and year-over-year increases are 8.9%.

Because of this, many Canadians feel pushed into homeownership and see homes as a source of security, even when prices are high.

“Many people cannot afford today’s rental prices,” says Harrison. “Most people cannot afford to buy at today’s housing prices.” Ultimately, Harrison had to make an impossible choice. Even though she feels that renting is the more affordable option, the risk of being displaced into an unstable rental market wasn’t worth the price difference.

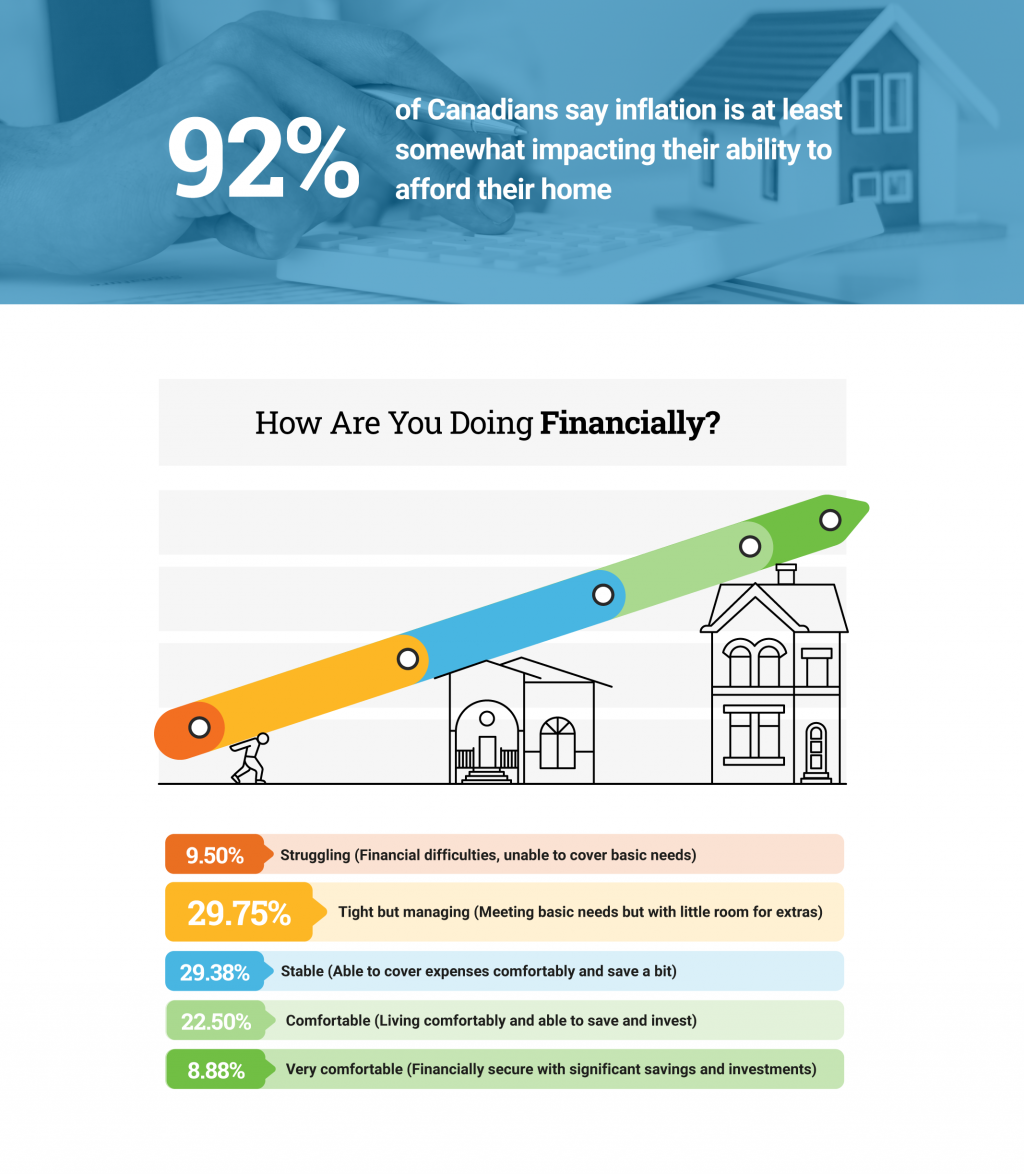

92% of Canadians say Inflation is At Least Somewhat Impacting Their Ability to Afford Their Home

Although home prices can dramatically impact buyers and their decision-making process, that’s not the only thing impacting homebuyer sentiment. Inflation is another challenge for homeowners.

In June 2022, inflation hit a 41-year high of 8.1%, making many of Canadians’ essentials, like gas and groceries, unaffordable. These increased costs and expensive real estate have not made affording necessities easy.

Today, 30% of Canadian homeowners feel their finances are tight. But, say they’re managing. In other words, they’re still able to meet their basic needs but with little room for extras.

Inflation has come down dramatically from the 8.1% we saw in 2022, but it did surge to 4% in August. The Bank of Canada’s target inflation rate is between 1% and 3% — meaning there is still work to be done. So, even with lower inflation, the damage has been done, and homeowners must get used to living on a tighter budget.

Strict mortgage guidelines and the mortgage stress test exist to stop Canadians from getting into more debt than they can handle. And most experts encourage homeowners to spend 30% or less on their household expenses. But, 27% of Canadians spend between 31% to 40% of their income on housing. So, many homeowners are spending more than what’s recommended on their homes.

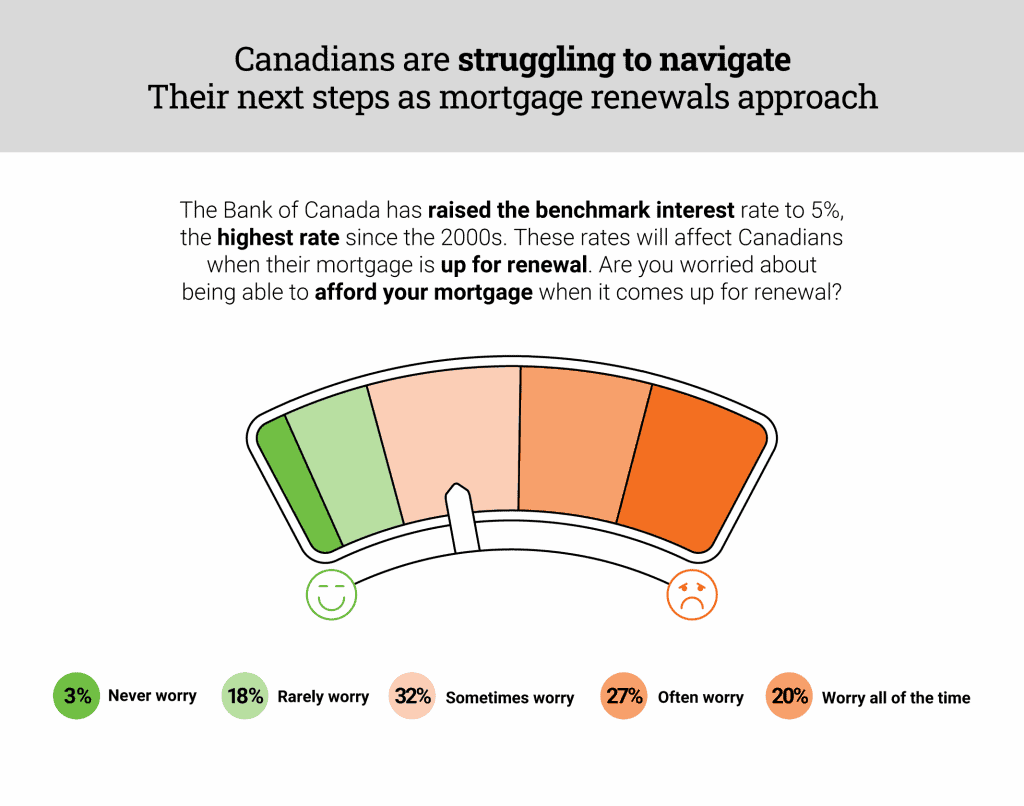

Only 3% of Canadians ‘Never Worry’ About Being Able to Afford Their Mortgage When it Comes Up for Renewal

The Bank of Canada has raised the benchmark interest rate to 5% in the past six months, the highest since the 2000s. Some think that there is potential for another rate hike in the near future. And inevitably, these rates will affect most Canadians when their mortgage is up for renewal.

So, does this impact homebuyer sentiment? When we asked Canadian homeowners if they are worried about being able to afford their mortgage when it comes up for renewal, it wasn’t surprising to see that only 3% never worry. On the opposite end of those who never worry are those who say that thinking about mortgage renewal causes them to worry constantly.

In this regard, 20% of Canadian homeowners say this is their reality. This is a significant increase of 9% from homeowners surveyed at the same time last year.

Navigating Renewal Anxiety

According to the survey data, most homeowners’ mortgages are up for renewal in two to three years. And there is no saying whether interest rates will continue to rise or drop over that period.

To better understand what Canadians can do to mitigate their anxiety, we spoke to Angela Calla. Calla is a mortgage expert and author who says there are options. “For any renewals coming up in the next six months, I strongly advise being proactive.”

Calla says that most renewals will result in a significant increase in payments. But, there are likely opportunities to minimize the payment increase. “Due to the volatility of interest rates, we regularly see lenders issuing non-competitive renewal offers (often 1% above market rates),” says Calla. “This is an important time to get a second opinion on your options.”

What Should Homeowners Facing Mortgage Renewal Do?

Some other options suggested by Calla for those facing mortgage renewal include:

- Increasing their mortgage amortization

- Switching from biweekly to monthly payments, saving around 8% annually

- Looking at a reverse mortgage

Unfortunately, only 37% of homebuyers use a mortgage broker. And this makes finding the best rates more difficult. Calla says that using a mortgage broker comes at no cost to the client. In addition, they get unbiased advice with the power of choice.

34% of Canadians Have Seen Their Mortgage Payments Increase Since Purchasing

The key interest rate jumping from 1.25% to 5% since the start of 2020 has been jarring for many Canadians. In particular, homeowners on a variable rate mortgage have been experiencing the most change. The rapidly rising rates have meant steadily increasing mortgage payments — and a lot of financial stress.

Sierra Keane (name changed for anonymity) was one of those homeowners. She and her partner purchased their home in Toronto in 2021. Initially, their interest rate was 1.29%. But, the current interest rate as of July 2023 is 6.04%. This increase in mortgage rate means that Keane is now paying around $2,500 more monthly on their mortgage.

“At the time we bought our home, we expected that interest rates would rise over time and factored that into our budget,” says Keane. “However, we could have never predicted that it would increase this much or this quickly.”

Markets Can Change More Rapidly Than We Realize

Similarly, Stelios Grigorakis and Alexandra Rousianos purchased their home in February 2022 in Toronto. Their mortgage rate has gone from 1.25% to 6%. The couple got advice from a mortgage professional saying that a variable rate mortgage was the best option. The broker told them it would always be lower than a fixed rate. They also said there wasn’t any way the rates would increase as quickly as they did.

“We do wonder if the mortgage broker did their due diligence as rates began to go up,” says Stelios. The couple now wishes they had locked in their rate when it hit 2%. This is because today, every mortgage payment they make is going directly toward the interest instead of the actual loan.

When determining what mortgage type (variable or fixed rate) makes the most sense, Calla says that market conditions can change rapidly, and your mortgage strategy must be one you are comfortable with and can modify. “Any decision made or advised on is at the snapshot in time with the information at hand,” says Calla.

She says most of us are listening to the Bank of Canada and trusting that they know what is happening in our economy. So, when someone like Tiff Macklem says that interest rates are very low and will be there for a long time — it can impact our decisions.

Interest Rate Jitters: Canadians Eye Bank of Canada’s Next Move

For many Canadians, the anxiety of the next Bank of Canada decision has become a normal feeling. In fact, 9% of Canadians say they would be unhappy in their home if there were another interest rate increase from the Bank of Canada before the end of the year.

Daniel Foch, a real estate expert and investor, says to remember that interest rates are transitory and are not a permanent obligation. “If you’re doing things right, you should only be paying interest on your mortgage for 25 years,” says Foch. “Whereas the interest rate on the typical mortgage only lasts five years.”

This means you get four more chances of a better rate during mortgage amortization. While the Bank of Canada is trying to slow down the economy, which can be painful for homeowners, Foch says the alternative scenario could be worse.

“Imagine the Bank of Canada didn’t start hiking interest rates, house prices continued their record growth trajectory in 2022, and inflation was still over 8%.” Foch guesses this outcome would hurt far more people than the current path.

Regardless of what comes next, 45% of Canadians would still be happy in their home even if there was another increase before the end of this year. So, homebuyer sentiment is mixed. This hard-pressed but happy outlook tends to be a theme when looking at the happiness of pandemic homebuyers and post-pandemic buyers.

Comparing and Contrasting Homeowners’ Happiness Levels

It doesn’t matter when they bought; homeowners are happy with their home purchase today. When we look at those who bought their home during the COVID-19 pandemic, 40% are still very happy with their home purchase today. Similarly, of those who purchased their home post-pandemic, 42% are very happy with their home purchase today.

Costs are high, and there is anxiety about the future. But, Canadian homeowners are overwhelmingly happy with their living situation and feel they paid what their home is worth.

Survey Details

The Homebuyer Sentiment Survey 2023 data was collected online between August 24, 2023, and September 1, 2023.

The online survey asked 800 respondents various opinions and self-reports to measure their home buying experience and their homebuyer sentiment between 2020 and 2023. They shared their feelings about the current economy and real estate market.

The estimated margin of error is +/- 3 percentage points.

Angela Calla is an 19-year award-winning woman of influence which sets her apart from the rest. Alongside her team, Angela passionately assists mortgage holders in acquiring the best possible mortgage. Through her presence on “The Mortgage Show” and through her best-selling book “The Mortgage Code“, Angela educates prospective home buyers by providing vital information on mortgages. In light of this, her success awarded her with the 2020Business Leader of the Year Award.

Angela is a frequent go-to source for media and publishers across the country. For media interviews, speaking inquiries, or personal mortgage assistance, please contact Angela at hello@countoncalla.ca or at 604-802-3983.

Click here to view the latest news on our blog.