- Why are more buyers attempting to back out of real estate deals right now? Is it because they cannot secure financing? Buyer’s remorse? A lower-than-expected appraisal?

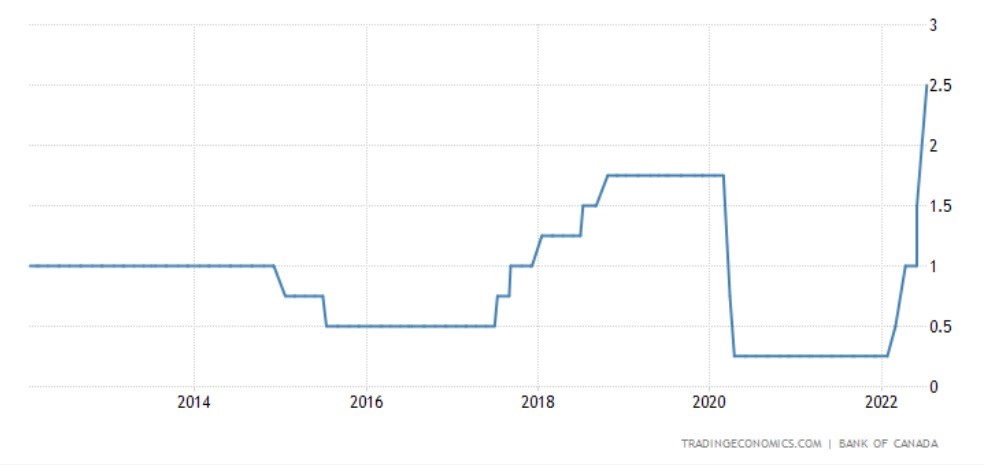

Some may experience “buyer’s remorse” which it’s normal to feel in any market. Today with rates on the rise, inflation at a 40-year high, the increased cost of everything, staffing and supply shortages, and Russia attacking Ukraine; the compound effect of all of that is a natural consideration to proceed with caution.

For borrowers that had a pre-approval in place for 90 or 120 days, the rate they have is much lower than current rates so they can also be very grateful that they have secured a good option for their family. It is important that as soon as an offer is agreed upon, an appraisal is paid for and arranged to ensure that the price remains at purchase and not lower, or else there will be a shortfall to make up with gifted funds from family or a higher mortgage amount.

I have seen these market changes before and I am sure it will repeat itself again in my career as it has in the past. People still need to move, they go through a divorce, move for new job opportunities or lifestyle, and wind up estates. When we know change is constant we plan together for it the best we can by building in the security of rate holds, the protection of good contracts, and optimization of different markets and strategies.

- In 2021 and early 2022, many people were buying without conditions of financing or inspection. How does this complicate matters for buyers?

Yes, another past market experience, despite our best advice to borrowers we had hoped would not repeat itself was back in 2021 and early 2022. Just because a market appears to be going up with limited supply does not mean you shouldn’t do your due diligence. Going in without the precautions in place left borrowers assuming the risk, period. As long as they were comfortable with that risk, it was their choice to bear it with the circumstances at hand. We saw some buyers forced to come up with extra money, get co-signers last minute, or have to take more expensive lending options. In either case or market, if the home is suited for you then that is just a part of your journey.

- What’s the difference between making an offer and signing a purchase agreement?

An offer is something the buyer makes to the seller. It does not become a purchase agreement until both parties agreed to the terms of the offer.

- If a would-be buyer breaks a deal, how much are they on the hook for? Can they be sued?

They can be on the hook for damages as well as the deposit and of course all the legal fees that will arise. The deposit will be held in trust until both have come to an agreement which can be an extended period of time. This is why sellers want the largest deposit possible to avoid any legal battle or people potentially backing out.

- Could a buyer have a harder time getting a mortgage in the future if they back out of a deal?

Not for the mortgage part as borrowers have offers they back out of all the time during their subject period and the conditions they set for themselves. They simply don’t remove their subjects, get a release and move on, all part of due diligence. Backing out if they have no conditions or after they have removed them is what makes it a legal battle between the buyer and seller only as no mortgage is registered yet.

Angela Calla is an 18-year award-winning woman of influence which sets her apart from the rest. Alongside her team, Angela passionately assists mortgage holders in acquiring the best possible mortgage. Through her presence on “The Mortgage Show” and through her best-selling book “The Mortgage Code“, Angela educates prospective home buyers by providing vital information on mortgages.

In August of 2020, at the young age of 37, Angela surpassed $1 Billion dollars in funded personal mortgages. In light of this, her success awarded her with the 2020Business Leader of the Year Award.

Angela is a frequent go-to source for media and publishers across the country. For media interviews, speaking inquiries, or personal mortgage assistance, please contact Angela at hello@countoncalla.ca or at 604-802-3983.

Click here to view the latest news on our blog.