The MNBC Funded Program Supports New Home Down Payment and Closing Costs

BRITISH COLUMBIA – Métis Financial Corporation of British Columbia (MFCBC) in partnership with Métis Nation British Columbia (MNBC) has launched a First-Time Home Buyers Program (FTHBP) to support Citizens of the Métis Nation of BC who are ready to purchase their first home.

FTHBP is a one-time grant that provides Métis people with financial assistance to invest in their first property in BC, whether a condo, townhouse, duplex, detached house, or family home. The grant was introduced to increase opportunities for home ownership among Métis citizens who have the resources to obtain a mortgage, but are challenged in saving enough money for a down payment and closing costs.

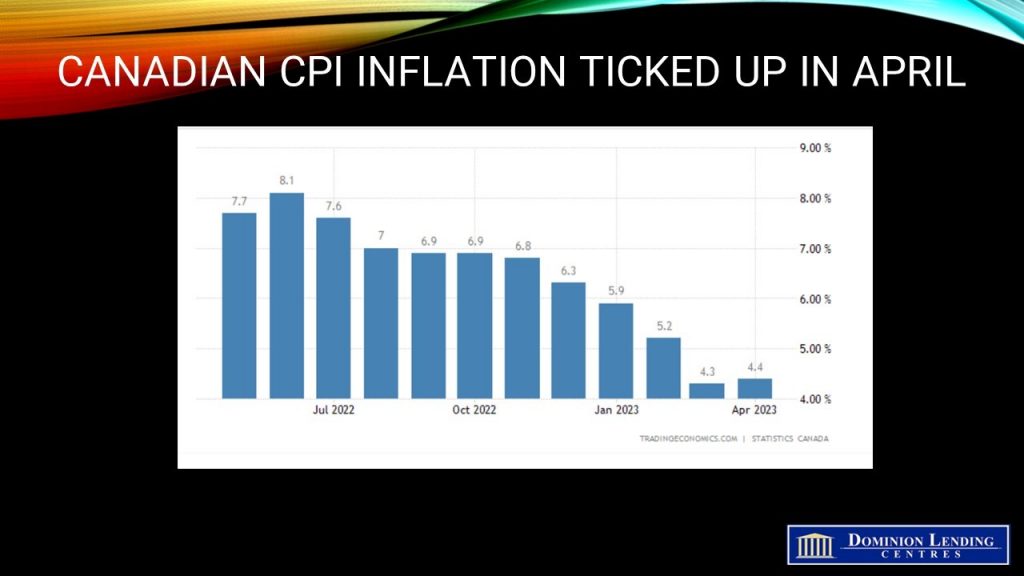

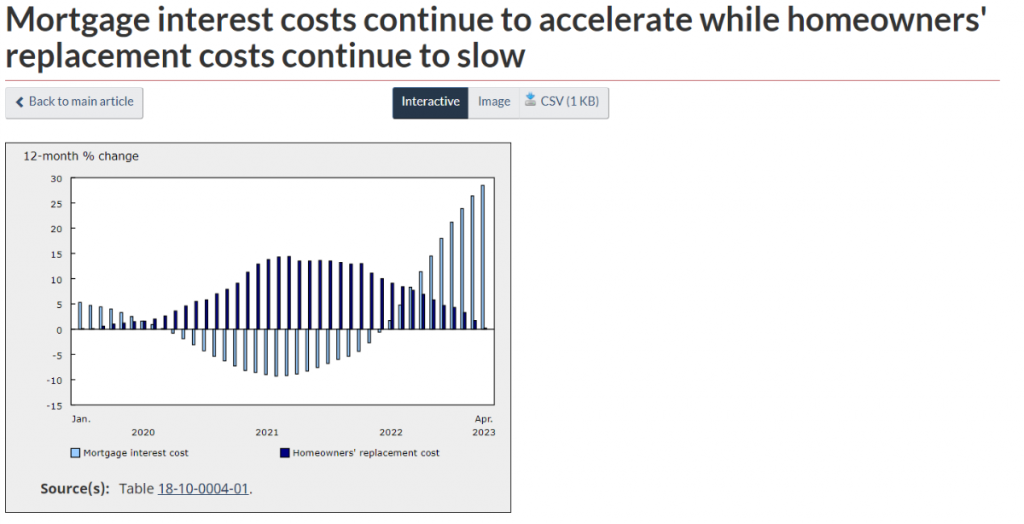

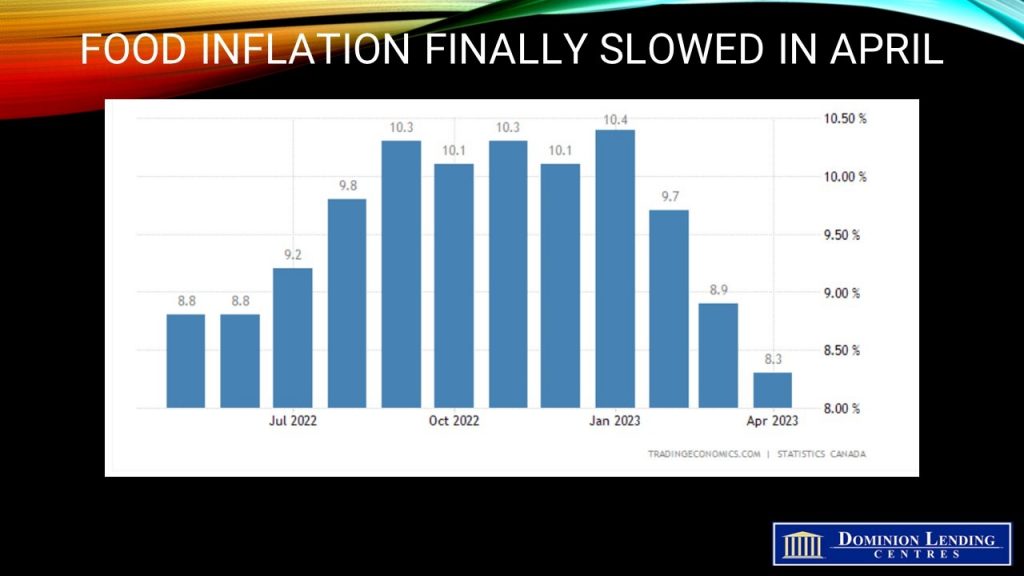

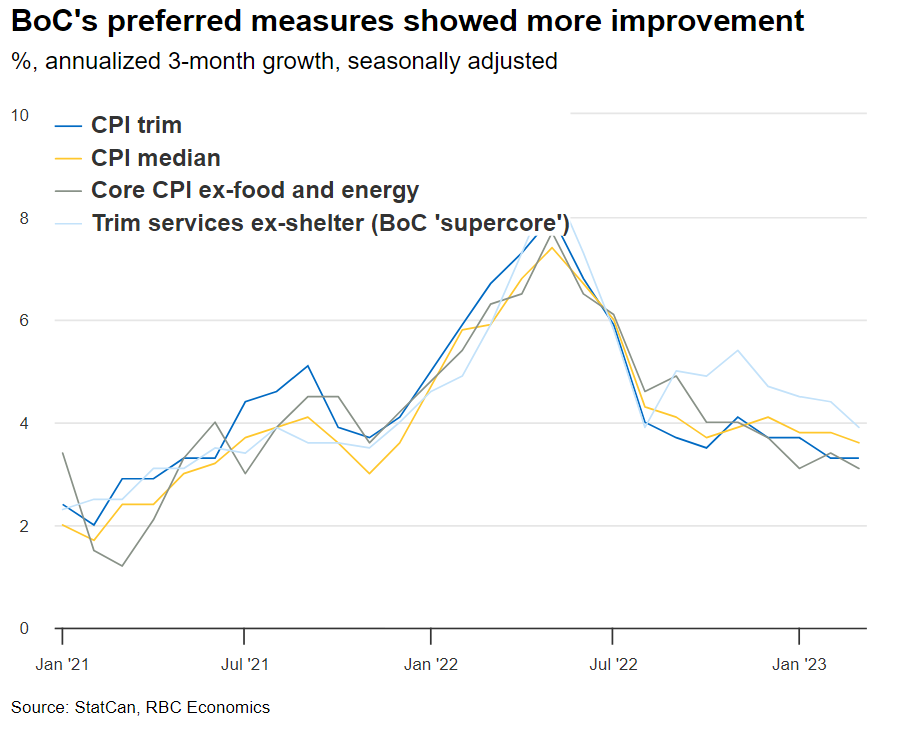

“We are thrilled to be able to expand opportunities for homeownership within the Métis community, particularly in such a challenging economic climate,” said Evan Salter, CEO of MFCBC. “With soaring interest rates, inflation and the cost of living continuing to rise, it’s become extremely difficult for most people to afford a house in BC. We introduced the First-time Home Buyers Program to help Métis families secure homes they might not otherwise have been able to afford, with no requirement for repayment.”

FTHBP is a forgivable loan that provides a maximum of $20,000 towards a down payment or purchase price, and up to $3,000 toward closing costs. The loan is interest-free and does not need to be repaid, provided the terms and conditions of the program are respected for a period of five years from the date of purchase.

“This first-time home buyers program will help alleviate the financial burden of inflation and the rising cost of living for Métis people across British Columbia,” says Walter Mineault, Vice-President and Minister of Housing and Homelessness for Métis Nation British Columbia. “I took on the portfolio of housing and homelessness with the goal to help our citizens achieve the dream of home ownership which is all too often unattainable, and today we have taken a big step in achieving that goal.”

For more information about the FTHBP, including eligibility requirements, visit YourMetisHomeBC.ca.

(This article is courtesy of BusinessExaminer.ca)

Angela Calla is an 19-year award-winning woman of influence which sets her apart from the rest. Alongside her team, Angela passionately assists mortgage holders in acquiring the best possible mortgage. Through her presence on “The Mortgage Show” and through her best-selling book “The Mortgage Code“, Angela educates prospective home buyers by providing vital information on mortgages. In light of this, her success awarded her with the 2020Business Leader of the Year Award.

Angela is a frequent go-to source for media and publishers across the country. For media interviews, speaking inquiries, or personal mortgage assistance, please contact Angela at hello@countoncalla.ca or at 604-802-3983.

Click here to view the latest news on our blog.