The government of Canada just dropped its 2023 budget. Like last year, there were no major mortgage bombshells.

Below is a quick rundown of the budget updates with lending relevance.

Rate and inflation impact

We haven’t had a chance to dive deep into the inflation ramifications but suffice it to say, the budget’s projected $43 billion of new deficit spending over six years won’t help keep inflation and mortgage rates down.

Nor will federal debt, as a proportion of GDP, climbing from 42.5% to 43.5%.

On a positive note, however:

- Government bond issuance is expected to drop 7% this year (less supply keeps rates lower, other things equal)

- Federal debt-to-GDP is projected to decline from 43.5% to 39.9% by 2027-29 (although, government debt forecasts and long-range weather forecasts have much in common).

In practice, the effects of this government over-borrowing won’t be noticeable to your average Joe borrower — and that’s what our leaders count on.

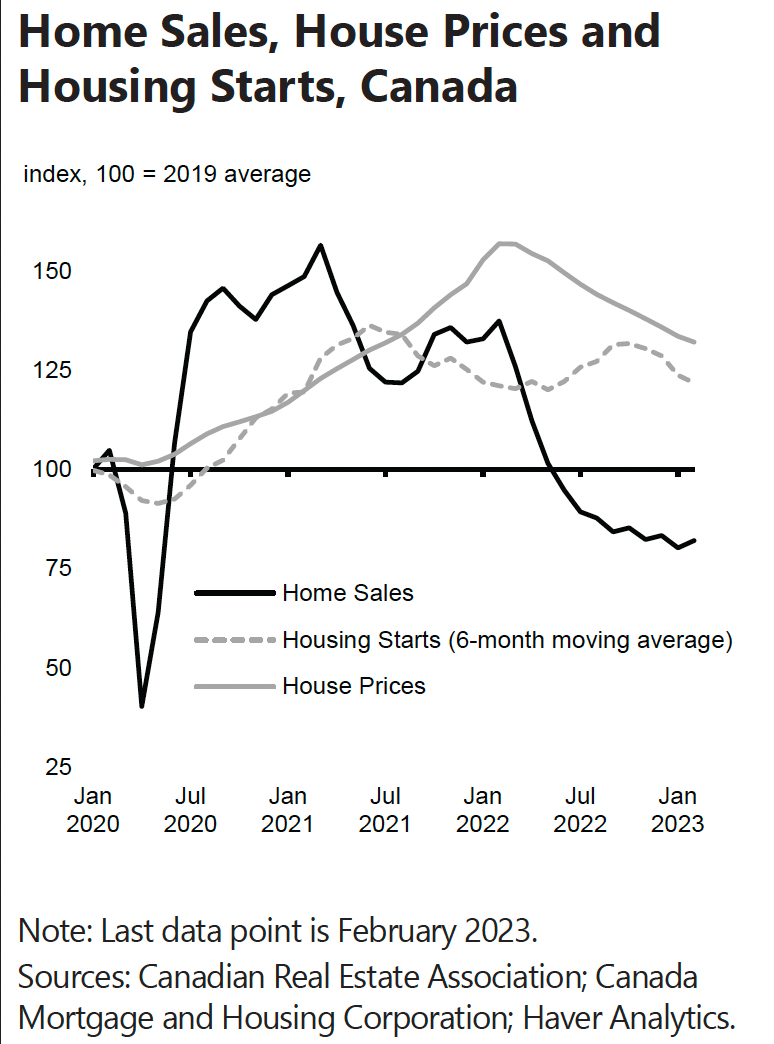

What is noticeable is the fact that high inflation has hammered home sales (-40%) and average national prices (-18.9%, per CREA) since the February 2022 peak.

The budget states:

“Continued progress on reducing inflation will be needed over the coming year to ensure that this period of elevated inflation is only temporary. As a result, there remains uncertainty about how long interest rates around the world will need to remain elevated.”

For what it’s worth, Finance Minister Chrystia Freeland says the measures in her budget are “carefully targeted” to avoid stoking inflation.

New lending-related policies

Here’s what the Liberals have proposed:

- Usury adjustment: The government intends to lower the criminal rate of interest from 47% (annual percentage rate) to 35%. According to the law firm Cassels, “’Interest’ is defined broadly under the Code and includes all charges and expenses in any form, including fees, fines, penalties, and commissions.”

- Distressed mortgagor relief: The Financial Consumer Agency of Canada will publish a guideline to “ensure that federally regulated financial institutions provide” mortgage borrowers with relief if they hit hard times, including extending amortizations, adjusting payment schedules, or authorizing lump-sum payments. The government says this guideline “will ensure that Canadians are treated fairly and have equitable access to relief, without facing unnecessary penalties, internal bank fees, or interest charges…” In practice, most mainstream lenders and all default insurers already offer such borrower “workout” programs. This measure would seemingly formalize and publicize it, potentially leading to higher non-payment rates (as more Canadians take advantage of perceived lender leniency).

- Lower CMB costs: The government “intends to undertake market consultations” by the fall on consolidating Canada Mortgage Bond issuance within the government’s regular bond issuance program. The goal is to “reduce” the cost of CMBs, which cost more to issue (carry higher yields) despite having the same credit rating as regular government bonds. The Department of Finance says it would “reinvest savings into important affordable housing programs.”

- FHSA to launch in four days: The government reiterates that financial institutions can start offering the Tax-Free First Home Savings Account on April 1, 2023. The FHSA is meant to help first-timers save for a down payment. It’s a new registered plan that allows first-timers to save $40,000 total ($8,000 a year) on a tax-free basis. Contributions will be tax-deductible, and withdrawals to purchase a first home will be non-taxable. “Tax-free in; tax-free out,” they say. The handful of big banks we spoke with claim they’ll have FHSA account applications available on launch day, but not through all channels (some will only offer applications online as of April 1, and not via human advisors). Here’s an FHSA example from the Budget:

Here’s an overview from RBC that compares all the registered plans.

Anticlimax…

All in all, this budget was mostly a non-event for Canada’s mortgage market. And that may be a good thing.

Albeit, it was all crickets for hoped-for measures like raising the default insurance property value limit to $1.25 million. The government now seems to view this idea, a policy it promised a few years ago, as a stimulus measure. As a result, average-priced homes in cities like Toronto and Vancouver will remain accessible solely to uninsured borrowers, those blessed with big down payments.

(This article is courtesy of Mortgage Logic)

Angela Calla is an 19-year award-winning woman of influence which sets her apart from the rest. Alongside her team, Angela passionately assists mortgage holders in acquiring the best possible mortgage. Through her presence on “The Mortgage Show” and through her best-selling book “The Mortgage Code“, Angela educates prospective home buyers by providing vital information on mortgages. In light of this, her success awarded her with the 2020Business Leader of the Year Award.

Angela is a frequent go-to source for media and publishers across the country. For media interviews, speaking inquiries, or personal mortgage assistance, please contact Angela at hello@countoncalla.ca or at 604-802-3983.

Click here to view the latest news on our blog.