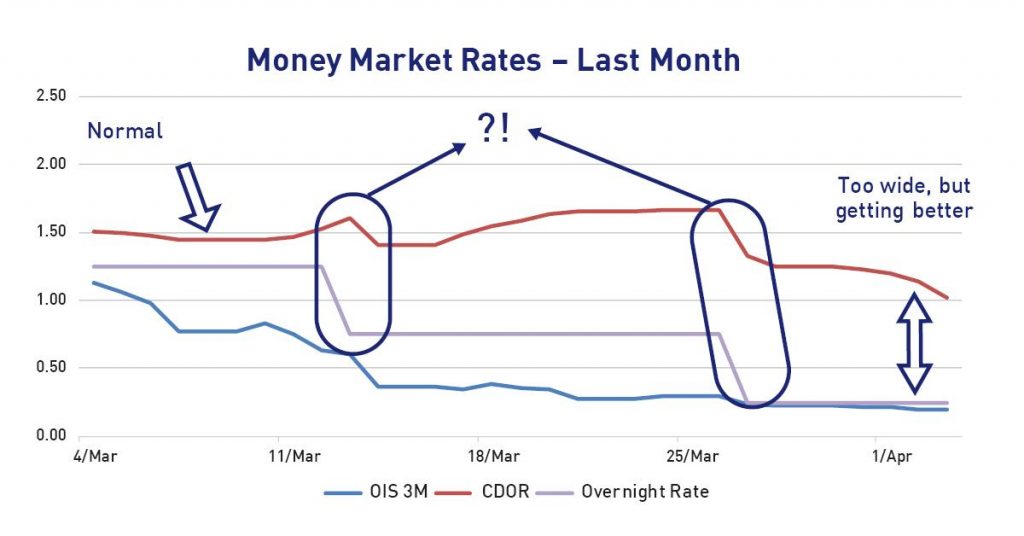

A bit about rates and government programs for those who are interested in some of the plumbing behind the scenes. With the Bank of Canada (BoC) dropping the overnight rate multiple times, we have seen lenders’ prime rates drop. But not all at the same time. The reason is, for many lenders like MCAP, something called CDOR is much more important than the BoC overnight rate. These two measures should correlate. Not this time. CDOR actually went up at first! Our cost of funds went up. I attach a little graph below. The BoC BA purchase program and CP purchase program is starting to fix many things, including CDOR. Thank you to the BoC! (can’t wait for CORRA). MCAP Prime is now able to be 2.45%. For fixed rate mortgages, government of Canada bond yields have declined, but MBS (mortgage backed securities) and CMB (Canada Mortgage Bond) spreads have widened, a lot. CMHC’s $150 billion IMPP should help bring these spreads in over time. Thank you CMHC! This would allow lenders to charge lower fixed rates soon. The spread on CMHC’s next purchase will guide the whole market.

Sourced from the President & CEO of MCAP, Mark Aldridge.

Angela Calla is a 16 year award-winning woman of influence mortgage expert. Alongside her team, passionately assisting mortgage holders get the best mortgage, and educating them on The Mortgage Show on CKNW for over a decade and through her best-selling book The Mortgage Code available on Amazon. To purchase the book click here: The Mortgage Code. Proceeds from all sales will be donated to Access Youth Outreach Services. Angela can be reached at callateam@dominionlending.ca or 604-802-3983.