Welcome to the September issue of my monthly newsletter!

This month, I am covering what you need to know about condition-free offers, plus since the kids are headed back to school, now is a great time to teach them about money. Also, hear the economic forecast straight from our Chief Economist, Dr. Sherry Cooper!

Market Beware: Condition-Free Offers

When it comes to purchasing a home, most offers include “conditions” (or “subjects” if you are in the provinces of British Columbia or Manitoba), which are requirements or criteria to be met before the sale can be finalized and the property is transferred.

Some of the most common conditions include:

- Financing approval

- Home inspection

- Fire/home insurance protection

- Strata document review if applicable

The purpose of these conditions is to protect the buyer from making a poor investment and ensure that there are no hidden surprises when it comes to financing, insurance, or the state of the property.

These conditions are written up in the purchase offer with a date of removal. This is agreed to by the seller before the sale is finalized. Assuming the conditions are lifted by the date of removal, the sale can go through. If the conditions are not lifted (perhaps financing falls through or something is revealed during the home inspection), the buyer can waive the offer and the purchase becomes void.

In some cases, homebuyers choose to approach an offer without conditions. Below we have outlined the impact of what this means for buyers and sellers to help you better understand the risks and outcomes:

The purpose of these conditions is to protect the buyer from making a poor investment and ensure that there are no hidden surprises when it comes to financing, insurance, or the state of the property.

These conditions are written up in the purchase offer with a date of removal. This is agreed to by the seller before the sale is finalized. Assuming the conditions are lifted by the date of removal, the sale can go through. If the conditions are not lifted (perhaps financing falls through or something is revealed during the home inspection), the buyer can waive the offer and the purchase becomes void.

In some cases, homebuyers choose to approach an offer without conditions. Below we have outlined the impact of what this means for buyers and sellers to help you better understand the risks and outcomes:

Pros of Condition-free Offers

- Buyers: The main benefit of a condition-free offer for a buyer is the ability to “beat the competition” in a heated market. However, it is not without risks.

- Sellers: Typically, a condition-free offer will include a competitive price, willingness to work with the dates the seller prefers, and evidence that the buyer has already done as much research as possible. If time is sensitive for the seller because they are trying to purchase another home or want to move as soon as possible, they may also choose your offer over conditions offers to expedite the process.

Cons of Condition-free Offers

- Buyers: As a buyer submitting a condition-free offer, you are assuming a great deal of risk in several areas including financing, inspection, and insurance:

- Financing: While buyers may feel that they have a pre-approval and so they don’t require a condition to financing, it is important to recognize that a pre-approval is not a guarantee of financing. If you are submitting a condition-free purchase based on a pre-approval, buyer beware. The financing is subject to the lender approving the property and the sale; from the price and location to type of property or other variables the lender deems important. By submitting a condition-free offer without a financing guarantee (or an inspection, title check, etc.), there is a risk that the deal can fall through. Even when you do not include conditions on the offer, you still are required to finance your purchase. In addition, as deals are submitted typically with a deposit, there is a risk that if the condition-free offer falls through the buyer will lose their deposit. This amount can range vary in the thousands and is typically a percentage of the purchase price or down payment.

- Inspection & Insurance: If a buyer is also opting to skip the home inspection and home insurance protection conditions to have the offer accepted, then they assume huge risk as they do not know what they are getting and whether or not the property is up to code for insurance.

- Due Diligence: With condition-free offers, there is no opportunity for due diligence after the offer has been made. This requires the buyer to do all their research before their initial bid. Because it is firm and binding, a buyer who decides to back out will likely be met with serious legal ramifications. Submitting an offer without conditions is not due diligence and it is at the buyer’s behest.

- For Sellers: When it comes to the individual selling the property, there is less risk with condition-free offers but not zero. While the benefit is essentially there is no wait to accept the offer on the seller’s side, they do not know for sure if financing will come through.

Financing Around Condition-free Offers

When submitting a condition-free offer, it is essentially up to the buyer to do as much due diligence as possible before submitting. They will need to identify what the lender is looking for to make sure they walk away with a mortgage. Though approval is never certain, prospective buyers placing a condition-free offer should do their very best to secure financing beforehand.

Contractual Obligations

Be mindful when it comes to purchasing offers versus purchase agreements. While your purchase offer is a written proposal to purchase, the purchase agreement is a full contract between the buyer and seller. The purchase offer acts as a letter of intent, setting the terms you propose to buy the home. If financing falls through, for example, then the contract is breached and this is where the buyer may lose the deposit.

It is also important to be aware of a breach of contract in the event that a seller chooses to take action. For example, if you submit a condition-free offer of $500,000 and cannot secure financing for that offer and the seller turns around and is only able to get a $400,000 deal with another buyer, they could potentially sue the initial buyer for the difference due to breach of contract.

Preparing a Condition-Free Offer

If you have decided to go ahead with a condition-free offer, regardless of the risks, there are some things you can do to mitigate potential issues, including:

- Get Pre-Approved: Again, this is not a guarantee of financing when you do make an offer, but it can help you determine whether you would be approved or not.

- Financing Review: Identify what the lender is looking for to make sure they walk away with a mortgage. Though approval is never certain, prospective buyers placing a condition-free offer should do their very best to secure financing beforehand.

- Do Your Due Diligence: Look into the property and determine if there have been major renovations or a history of damage. This could come in the form of a Property Disclosure Statement. While this statement cannot substitute a proper inspection, it can help identify potential issues or areas of concern. If possible, conduct an inspection before submitting your bid/offer.

- Get Legal Advice: This can help you determine your potential risk and ramifications of the offer should it be accepted, or otherwise.

- Title Review: Be sure to review the title of the property.

- Insurance: Confirm that you are able to purchase insurance for the home. Keep in mind, an inspection may be required for this but in some cases, you can substitute for a depreciation report if it is recent.

- Strata Documents (if applicable): Thoroughly review strata meeting minutes and any related documents to determine areas of concern.

While there are things that can be done to help with condition-free offers, it is still risky. Ultimately submitting an offer with conditions gives you the time and ability to gather information on the above, as well as access to the property or home for inspections.

If you are intent on submitting a condition-free offer, be sure to discuss it with your real estate agent as they can determine if a condition-free offer is necessary, or if perhaps a short closing window would suffice to seal the deal. A good realtor will keep you informed of potential interest and other bids during the process as well. Their goal should be to maximize your opportunity and minimize your risk. In addition, before making any offers, be sure to contact me to discuss your mortgage and financing so you can make the best decision.

Back to School: Teaching Kids About Money

Financial independence is a critical skill for future success that your children will not learn anywhere else.

Not only does financial literacy help your children have more success in life, but it allows them to move out sooner and it avoids delaying your retirement with additional expenses to support them.

So, how do you teach your children about money?

- Review Your Attitude Towards Money: The first and most important thing is to examine your own attitude towards money. Are you a penny pincher? Frivolous spender? Do you buy on impulse, or take a long time to make a purchase? How much debt do you have? Your financial habits will shape your children. To ensure that you are setting them up for their best financial future, parents need to consider what messages they are sending with their own money habits.

- Give Your Children an Allowance: Providing an allowance to your children (especially one in exchange for chores) is an age-old way of teaching your kids about money. A good guideline is $1.00 per year of your child’s age. For a 10-year-old, this would be $10 per week.

- Teach Your Child to Save: If you are giving your child $10 per week in allowance for chores, encourage them to put even just $1 per week into a piggy bank. In six months, show them how much money they have saved and talk to them about why it is important, and what they can do with that larger amount now.

- Encourage Kids to Think Before They Buy: While it’s hard to get a 10-year-old excited about an RRSP, there are other ways to help them plan ahead. One is to encourage them to think about their purchases before they commit. They saw a toy on TV and they have to have it – teach them about how advertisements are designed to make you want something. Ask them to wait a week. Do they still want it?

- Involve Your Children in the Family Finances: It is more valuable than you might think to let your kids see and hear you discuss financial planning; let them be part of opening and paying bills or planning vacations. Explain why and how much you pay for certain things and discuss affordable choices. This helps them be part of the conversation and will work to instill a sense of financial responsibility as they grow up.

Remember, you are the best example to your children about money. Don’t be afraid to share the ups and downs with them. Be patient with your kids, but don’t give up! The best thing you can do as a parent is to promote financial security and independence

Economic Insights from Dr. Sherry Cooper

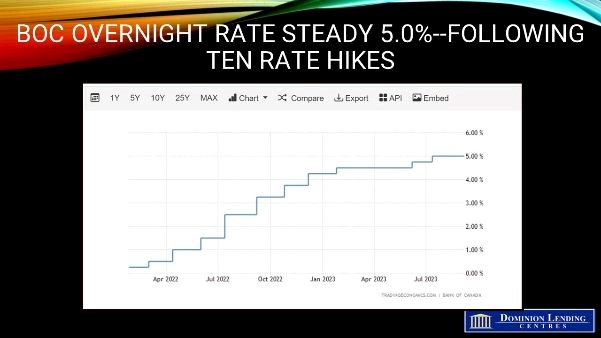

The Bank of Canada has a single mandate—to ensure that inflation returns to the 2% target. This means that the Bank will raise interest rates if inflation is too high and lower interest rates if inflation is too low.

The U.S. Federal Reserve, in contrast, has a dual mandate—to maximize employment given a 2% target for inflation.

July inflation data showed that the headline CPI inflation rose to 3.3%, up from 2.8% in June. One challenge in understanding year-over-year inflation data is base effects. Base effects occur when the current year’s inflation is compared to the previous year’s inflation, called the base year. If the base year has unusually high inflation, then the current year’s inflation will appear lower than it is.

For example, inflation in Canada was very high in June 2022. This means that inflation in June 2023 appeared to be lower than it is, even if there is no change in the underlying level of inflation.

Gasoline prices peaked in June 2022 and trended downward for most of the year. That makes y/y comparisons look worse starting last month. If you are only focusing on the annual change in inflation, you will be misled.

Looking at monthly changes in the headline inflation data can also be misleading because so many components of headline inflation are highly volatile. For example, monthly consumer prices in July rose 0.6% compared to only 0.1% in June. The y/y increase was smaller for core inflation measures. And if you exclude food, energy and mortgage rates, y/y inflation was quite moderate.

The main point here is that it’s complicated. I am more sanguine about last month’s inflation data than most Bay Street economists. The overall Canadian economy has slowed. Following the strong first quarter growth of 3.1%, Q2 GDP growth will likely come in at around a much more muted 1.2%. Job vacancies have fallen for a year, and the unemployment rate has risen to 5.5%–still low by historical standards but up from the record low this cycle of 4.9%.

The single major economic release ahead of the September 6 Bank of Canada policy decision is Q2 GDP, released on September 1. The BoC is expecting growth of 1.5%.

The impact on the economy of higher interest rates has a long lag. The full effects of the tightening will not be evident for a few more years. Given that most Canadian mortgage borrowers renew their mortgages every five years, the largest impact is yet to come. Nevertheless, higher interest rates have slowed the most interest-sensitive sectors.

Canadian new home prices edged down 0.1% in July, deepening the year-over-year decrease to 0.9%. In the same month, the yearly decline in the benchmark price of an existing home (as measured by the MLS HPI) eased to 1.5%. While prices for existing homes are still rising modestly, the momentum looks to have slowed as the market returns roughly to balance following the Bank’s latest two rate hikes.

Barring a massive upside surprise in Q2 GDP, the central bank will leave the policy rate unchanged at 5.0%. Longer-term market rates, however, have been rising, boosting fixed-rate mortgage yields. This results from economic and political concerns in the U.S. There is a good chance that overnight rates in Canada have peaked. If the economy remains too strong, the Bank will keep the door open for further tightening as inflation exceeds the 2% target.

Angela Calla is an 19-year award-winning woman of influence which sets her apart from the rest. Alongside her team, Angela passionately assists mortgage holders in acquiring the best possible mortgage. Through her presence on “The Mortgage Show” and through her best-selling book “The Mortgage Code“, Angela educates prospective home buyers by providing vital information on mortgages. In light of this, her success awarded her with the 2020Business Leader of the Year Award.

Angela is a frequent go-to source for media and publishers across the country. For media interviews, speaking inquiries, or personal mortgage assistance, please contact Angela at hello@countoncalla.ca or at 604-802-3983.

Click here to view the latest news on our blog.