Welcome to the November issue of my monthly newsletter!

This month, I wanted to highlight some tips around refinancing your mortgage and considerations to make at renewal time! Plus, with the holidays just around the corner, I have included some of my favourite DiY gifting ideas to help get you started! Scroll down for all the details.

Refinancing Your Mortgage

Refinancing your mortgage can be a smart financial move for many reasons, and as your trusted mortgage advisor, I’ve seen how much it can benefit homeowners!

Ideally, refinancing is done at the end of your mortgage term to avoid penalties, but the timing can vary depending on your goals.

For some, it’s about unlocking the equity in their home to fund renovations or cover big expenses like college tuition. For others, it’s an opportunity to consolidate debt, lower their interest rate, or change up their mortgage product.

Let’s take a closer look at some of the ways refinancing your mortgage can help!

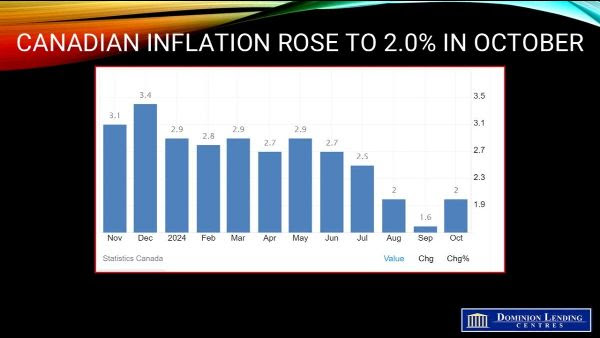

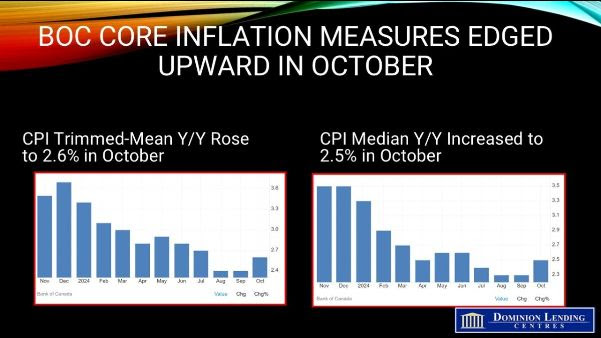

- Get a Better Rate: As interest rates have continued to decrease with the Bank of Canada updates these past few months, now is a great time to consider refinancing for a better rate and lower overall mortgage payments! Experts anticipate the Bank of Canada will move to have the overnight rate down to 2.75% next year.

- Consolidate Debt: When it comes to renewal season and considering a refinance, this is a great time to review your existing debt and determine whether or not you want to consolidate it onto your mortgage. In most cases, the interest rate on your mortgage is less than you would be charged with credit card companies or other forms of financing you may have. Plus, having all your debt consolidated into a single payment can keep you on track!

- Unlock Your Home Equity: Do you have projects around the house you’ve been dying to get started on? Need funds for a large purchase such as a new vehicle or post-secondary education? When you are looking to renew your mortgage, it is a great opportunity to consider refinancing in order to take advantage of the home equity you have built up to help with these larger changes in your life!

- Change Your Mortgage Product: Are you unhappy with your existing mortgage product? If you have a variable-rate or adjustable-rate mortgage, you may be considering locking it in at the lower rates. Alternatively, you may want to switch your current fixed-rate mortgage to a variable option with the interest rates expected to continue decreasing into 2025. You can also utilize your refinance to take advantage of a different payment or amortization schedule to help pay off your mortgage faster!

PLUS! Some latest changes by the Government of Canada will make it even easier for you when it comes to your renewal and refinancing options:

- Those of you who may have an uninsured mortgage will no longer have to pass the stress test as of November 21st. This means that you have more flexibility when it comes to rates and mortgage products in renewal cases where you wish to switch lenders without adding additional funds to your mortgage!

- Beginning January 15, the federal government will allow default-insured mortgages to be refinanced to build a secondary suite. If you’ve been considering adding a suite to your property, you may be eligible to access up to 90% of your home’s equity for this purpose.

No matter your plans or situation, please don’t hesitate to reach out to me for expert mortgage advice!

DiY Holiday Gifting Idea

Looking for some creative and thoughtful DIY holiday gifting ideas that are easy to make and can add a personal touch to your gifts this season?

These affordable, fun, and personalized options can suit anyone in your life – and they’ve never been easier to make

- Homemade Scented Candles: These are easy to make requiring only a few ingredients but can be a great statement for friends and family! Pick their favourite scent in essential oil (lavender, peppermint, cinnamon, sage, etc.) and mix in with melted wax and pour into jars with a wick! Plus, you can customize them further with fun holiday-themed tags or labels on the jars.

- DiY Bath Bombs: Surprisingly easy to make, these bath bombs pair especially well with a homemade candle or handmade soap for the ultimate personal-scented bath set! Requiring just baking soda, citric acid, Epsom salts and essential oils to set in molds, these are a fun, low-cost gift idea!

- Handmade Soaps: Another great gift idea to make a personalized statement are handmade soaps! All you need is a soap base, essential oils, and additives to pour into molds to set! Want to get extra personalized? Find unique and fun molds that celebrate the personality of that friend or family member.

- Personalized Photo Calendars: Fun for the whole family, personalized calendars can be a great way to snapshot your previous year and highlight the good times as you head through 2025! You can have these created online or do it yourself by printing photos and a template, binding the pages with ribbon, and adding handwritten, personal notes on special dates!

- Custom Recipe Book: Do you have fun family recipes or have friends with a list of top treats? Why not create a custom recipe book with their favourite eats! All you need is a blank notebook or binder, printed recipes plus some photos for added personalization.

- Knitted Outdoor Wear: With the temperatures starting to drop, why not give the gift of comfort with a scarf or hat knitted with love? Combine their favourite colours or patterns and even add a personalized name tag!

The season of giving has never been easier with these affordable, fun and personalized gift ideas for all those special folks in your life.

Economic Insights from Dr. Sherry Cooper

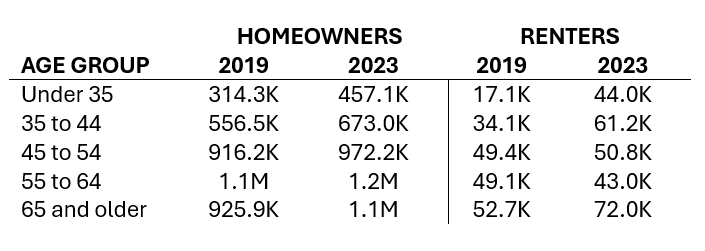

The 2024-2026 mortgage renewals “cliff” is manageable as long as the Bank of Canada cuts interest rates and the job market and economy don’t weaken too much. Owing to the 75 basis point rate decline through September and the 50 bps cut in October, not all mortgages will renew at higher rates next year.

Royal Bank economists estimate that total mortgage payments in 2025 will increase by about 0.1% of total household disposable income as many extend amortizations to keep payments low.

The jobless rate, though declining a tick in September to 6.5%, is meaningfully higher than before the pandemic and is likely to rise to 7% next year.

The total number of job openings in the economy is 25% below what it was a year ago, and if it were to weaken further, the unemployment rate would rise even more.

Earlier this cycle, there were more job vacancies than people looking for work, so the drop in job openings didn’t have a material impact on the economy. But that’s no longer the case. September’s inflation data confirms that the job market trend is downward.

Economic growth has been below potential since 2022, and preliminary third-quarter data indicate another slowdown to about 1.3% growth in Q3, well below the BoC’s initial forecast. Hiring intentions remain woefully inadequate in the face of staggering population growth.

Business start-ups are also sluggish, reflecting a business climate undermined by overly restrictive monetary policy.

The BoC must now aggressively cut interest rates. Monetary policy remains highly restrictive.

The Bank of Canada’s Business Outlook Survey shows no sign of stabilization in the short term. Indeed, hiring intentions were virtually unchanged in Q3 and remained below the historical average. A significant number of companies are overstaffed.

The latest data show that the private sector vacancy rate is plummeting and has reached its lowest level since 2016. More than half of all small- and medium-sized businesses are fearful of weakening demand for their goods and services.

The number of active companies fell sharply in the second quarter due to a sharp jump in business closures and a low number of start-ups. The stagnation in the number of active companies in Canada since 2022 is undoubtedly one consequence of the extremely powerful tightening of monetary policy.

Angela Calla is an 19-year award-winning woman of influence which sets her apart from the rest. Alongside her team, Angela passionately assists mortgage holders in acquiring the best possible mortgage. Through her presence on “The Mortgage Show” and through her best-selling book “The Mortgage Code“, Angela educates prospective home buyers by providing vital information on mortgages. In light of this, her success awarded her with the 2020Business Leader of the Year Award.

Angela is a frequent go-to source for media and publishers across the country. For media interviews, speaking inquiries, or personal mortgage assistance, please contact Angela at hello@countoncalla.ca or at 604-802-3983.

Click here to view the latest news on our blog.