Will the May Inflation Decline Thwart Another Rate Hike in July?

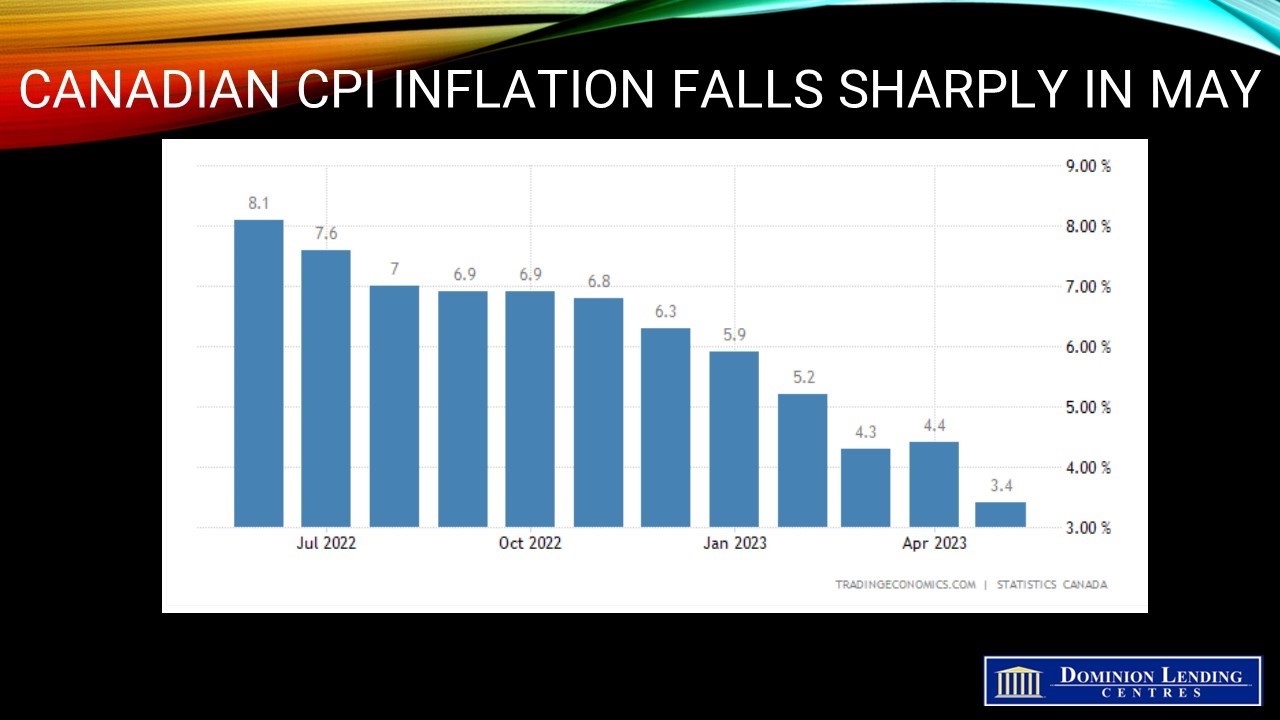

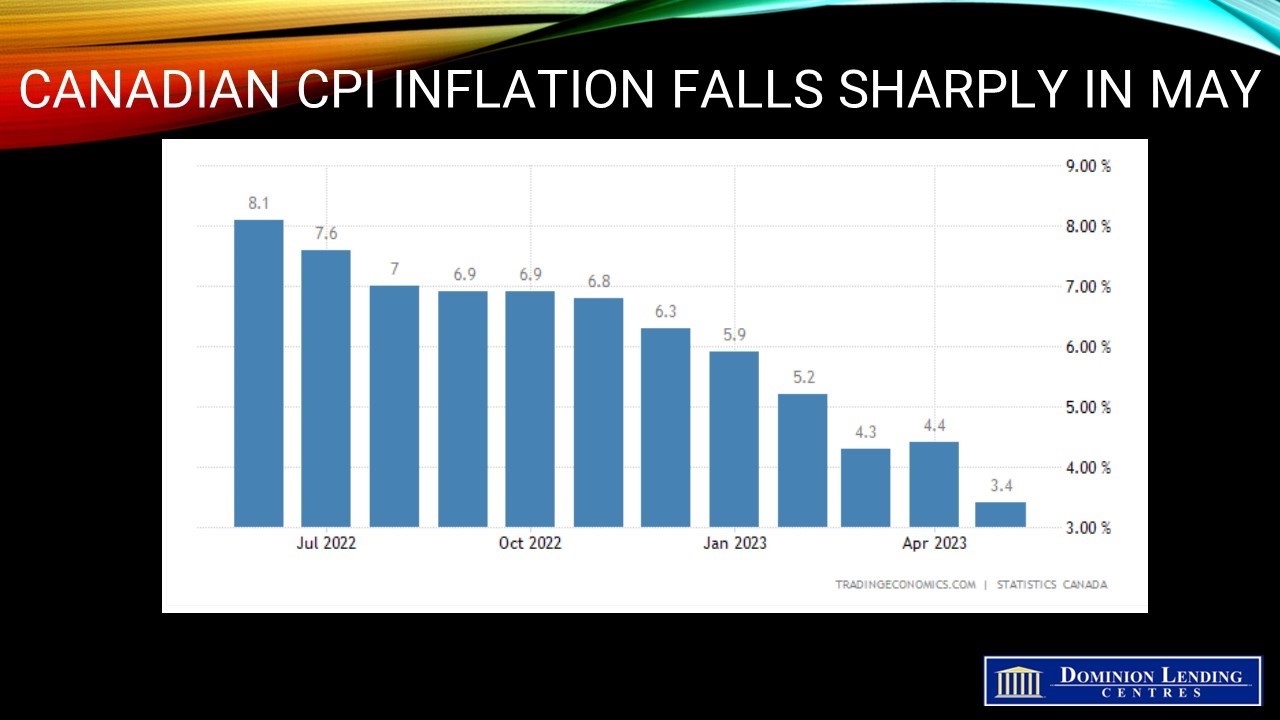

The May inflation data, released this morning by Statistics Canada, bore no surprises. The year-over-year (y/y) inflation measured by the Consumer Price Index (CPI) at 3.4% was just as expected–down a full percentage point from the April reading. This is the smallest increase since June 2021. Economists hit this one on the head because we knew dropping the April 2022 figure from the y/y calculation would considerably lower May inflation.

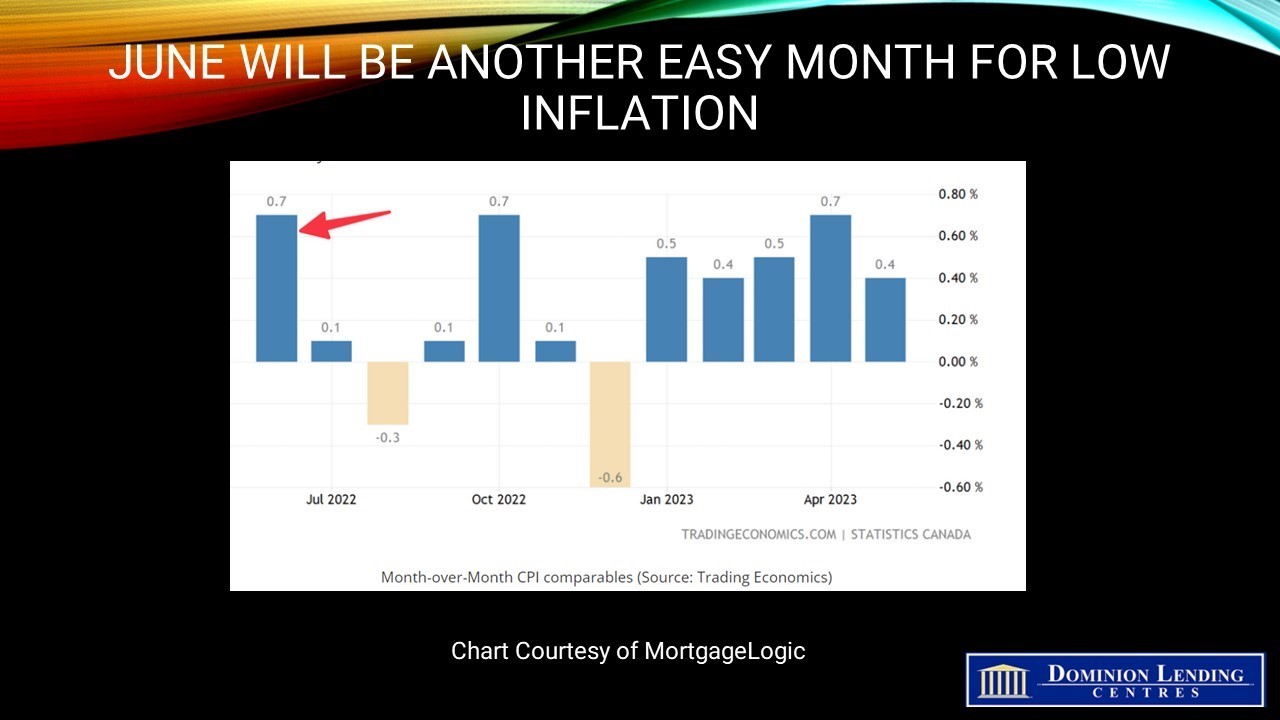

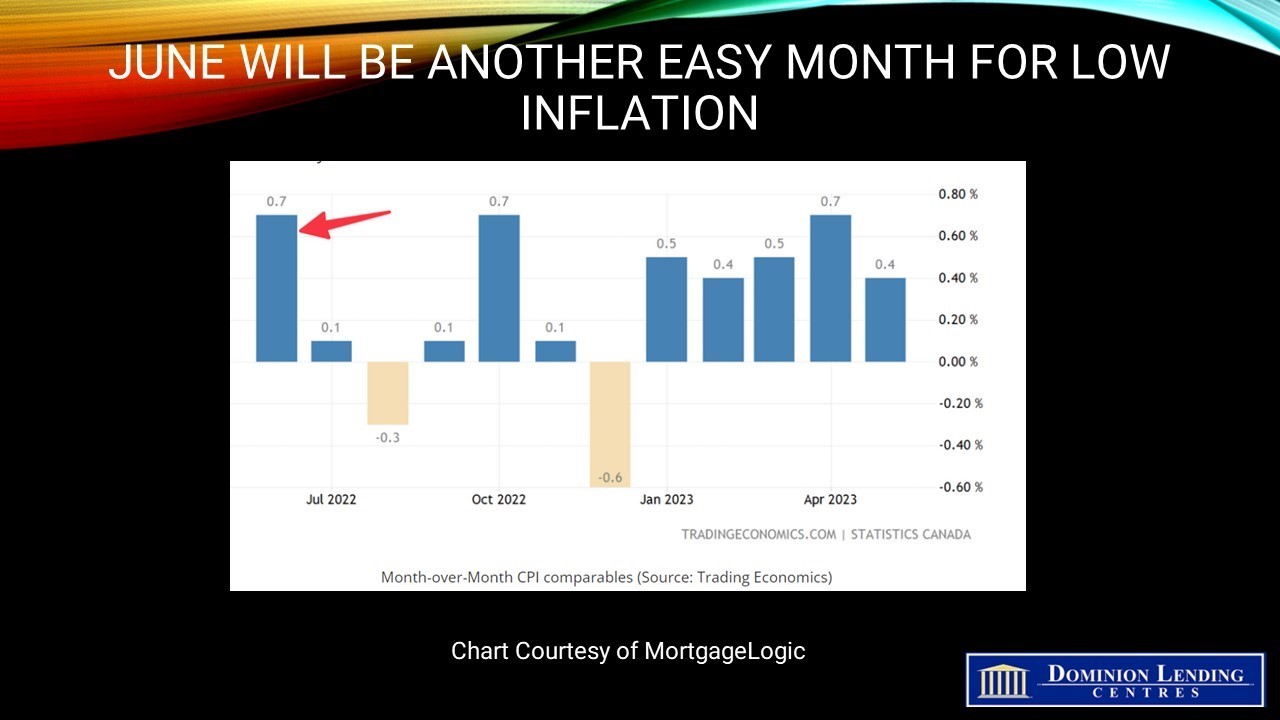

By May of last year, y/y inflation had already risen sharply to 7.7%, mainly due to dramatic energy price increases reflecting the impact of the Russian invasion of Ukraine. Inflation peaked at 8.1% in June ’22, suggesting low inflation next month as well. This is why the Bank of Canada predicted that inflation would fall to 3% by this summer.

Taking inflation down to 3% will likely be easier than the drop from 3% to 2% because the low-hanging fruit has already been harvested. Many service prices are a lot stickier than the price of commodities and durable goods.

The May inflation slowdown was primarily driven by the 18.3% y/y plunge in gasoline prices resulting from the base-year effect. Excluding gasoline, the CPI rose 4.4% in May, following a 4.9% increase in April. A drop in natural gas prices (-3.5%) also contributed to the energy price deceleration.

Prices for durable goods grew at a slower pace year over year in May, rising 1.0% after increasing 2.2% in April. The increase in May is the smallest since May 2020 and coincided with easing supply chain pressures compared with a year ago. This was reflected in furniture prices (-2.9%), which fell by the largest amount since June 2020, and passenger vehicle prices (+3.2%), which showed the smallest increase since February 2021.

Grocery prices remain elevated–up 9.0% y/y–down only one tick from April. Prices for food purchased from restaurants rose slightly faster year-over-year in May (+6.8%) than in April (+6.4%), amid ongoing elevated labour shortages, input costs and expenses, which Stats Can data show job vacancies can disproportionately affect these businesses.

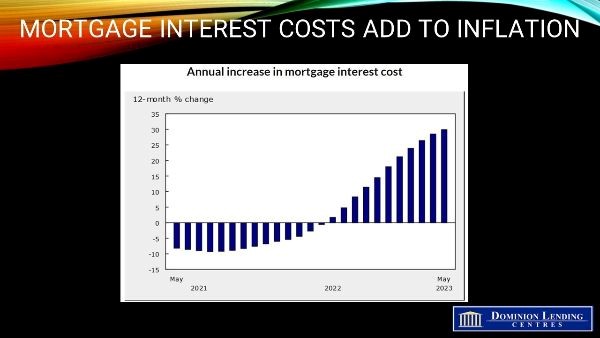

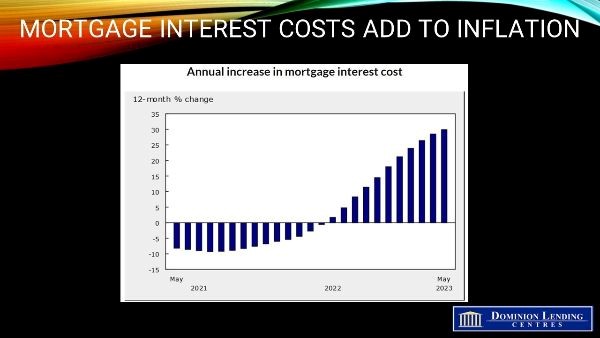

Rising interest rates also boost inflation. This is because mortgage costs are just over 3% of the CPI. They are a part of the most significant component of the index–shelter–which represents almost 30% of the index. The mortgage interest cost index rose by a whopping 29.9% in May, following a 28.5% increase in April. This was the largest increase on record for the third consecutive month, as Canadians continued to renew and initiate mortgages at higher interest rates. And, of course, this does not include the effects of the policy rate hike in June.

It takes time for the full effect of interest rate hikes entirely feed into the CPI. Mortgage interest costs will continue to rise as higher interest rates flow gradually through to household mortgage payments with a lag as contracts are renewed. And home-buying related expenses ticked higher in May, with higher home resale prices increasing realtor and broker commissions.

Bottom Line

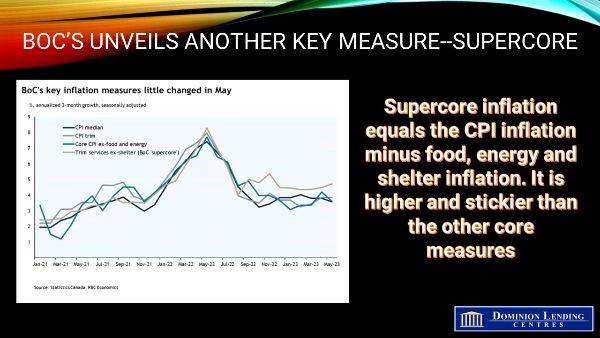

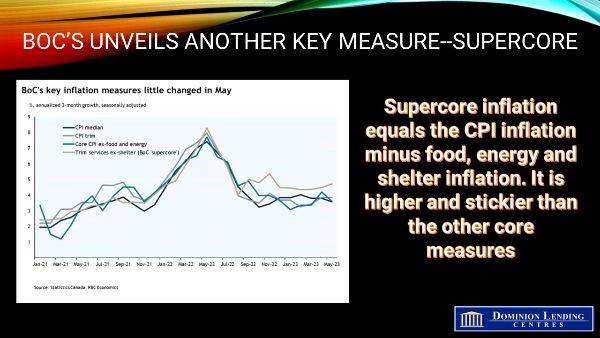

Achieving the 2% inflation target will take some effort. The Bank of Canada continues to be concerned that the Canadian economy remains too hot. Although unemployment relative to job vacancies has recently started to rise, the Bank remains troubled that excess demand will continue to push some prices upward. This is the cyclical component of inflation–inversely correlated with the unemployment rate–a version the Fed calls ‘supercore’ inflation. Supercore includes household services such as haircuts, personal care, babysitting, restaurant meals, travel, accommodation, recreation and entertainment.

It is roughly the CPI-trim (which filters out extreme price movements that might be caused by severe weather and other temporary factors) minus the price of food, shelter and energy. This measure has fallen less than the other core measures. Supercore inflation is about 5.5% y/y, compared to CPI-trim at 3.8%,CPI- median at 3.9% (see the chart below).

Looking at the recent monthly trends on a three-month annualized basis, CPI-trim was at 3.8% in May, down from 3.9%, and CPI-median was at 3.6%, down from 3.8% in April.

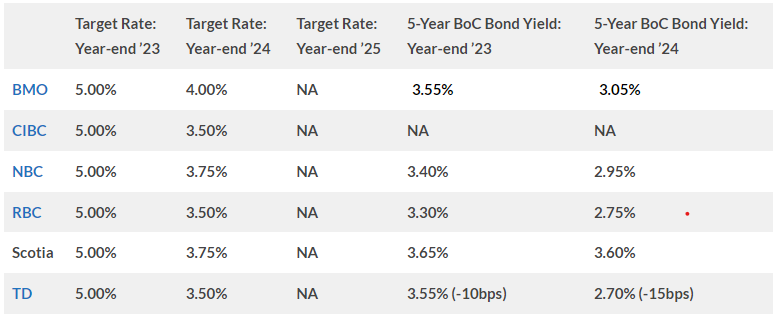

This is why the Bank of Canada emphasizes labour market data and overall spending measures. We will get two more important Statistics Canada releases before the July 12th BoC decision: the June 30th monthly GDP number for April and the all-important Labour Force Survey on July 7th. Unless these data show a meaningful economic slowdown or a rise in unemployment, the odds of another BoC rate hike are about 60%.

Dr. Sherry Cooper

Chief Economist, Dominion Lending Centres

drsherrycooper@dominionlending.ca

Angela Calla is an 19-year award-winning woman of influence which sets her apart from the rest. Alongside her team, Angela passionately assists mortgage holders in acquiring the best possible mortgage. Through her presence on “The Mortgage Show” and through her best-selling book “The Mortgage Code“, Angela educates prospective home buyers by providing vital information on mortgages. In light of this, her success awarded her with the 2020Business Leader of the Year Award.

Angela is a frequent go-to source for media and publishers across the country. For media interviews, speaking inquiries, or personal mortgage assistance, please contact Angela at hello@countoncalla.ca or at 604-802-3983.

Click here to view the latest news on our blog.