Jobless Rates Hits 22-Month High–Led by Losses in Finance and Real Estate Employment

Today’s StatsCanada Labour Force Survey for November was a mixed bag. Total employment gains were stronger than expected. However, the rising unemployment rate and drop in hours worked were signs of mounting economic weakness, especially in the financial and real estate sectors.

Employment in Canada rose by 24.9K in November 2023, following a 17.5K rise in October and above forecasts of 15K. Employment went up in manufacturing (+28K) and construction (+16K). On the other hand, there were declines in wholesale and retail trade (-27K) and finance, insurance, real estate, rental and leasing (-18K). November marks the fourth consecutive month of job gains. Still, the Bank of Canada noted in its October meeting that “recent job gains have been below labour force growth and job vacancies have continued to ease,” suggesting a slowdown in labour demand. The monthly employment gain averaged 39K so far this year, while monthly population growth has averaged 80.8K.

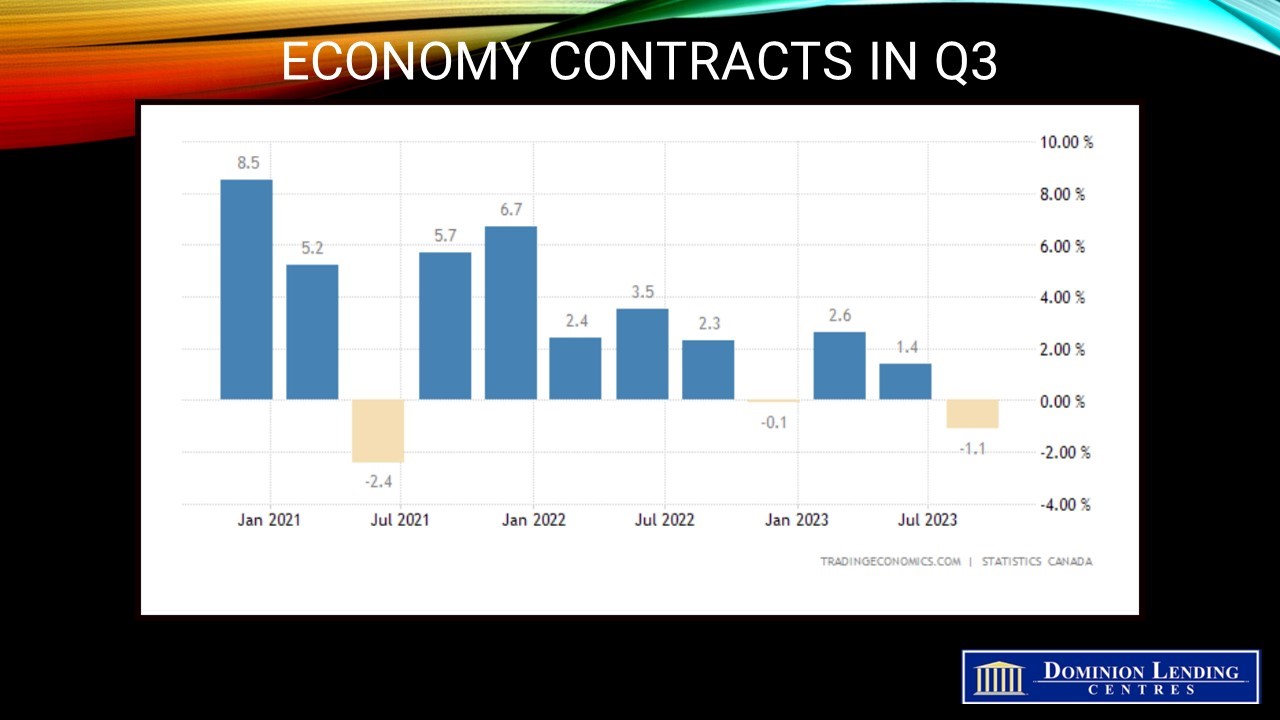

Rapid population growth–driven by Canada’s open-door policy–has boosted economic activity. Despite dramatic tightening by the Bank of Canada, labour markets remain resilient. While yesterday’s GDP release showed a 1.1% decline in growth in the third quarter, housing, government spending and private consumption added to growth. More recent data for Q4 suggest a pick-up in overall activity. Today’s employment data shows stronger-than-expected jobs gains in November.

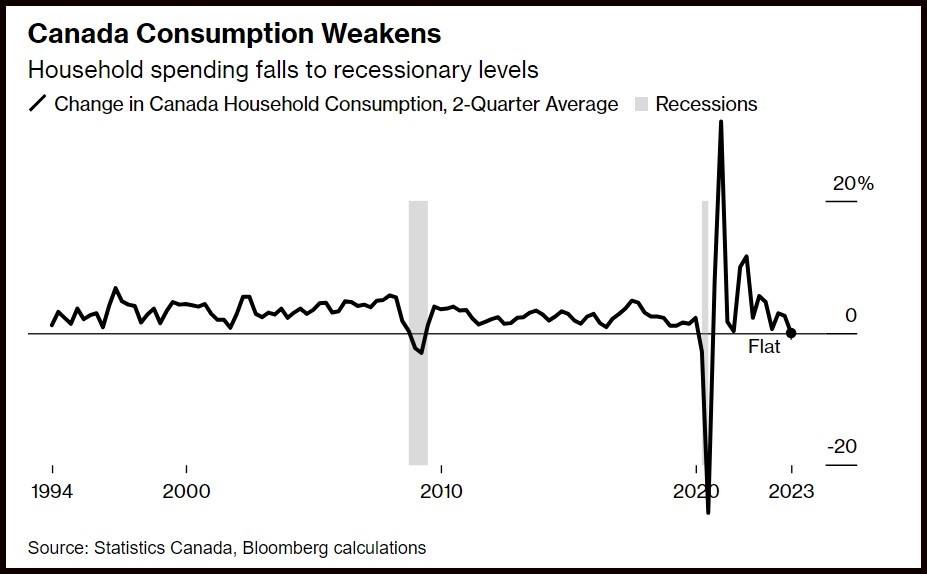

In other data released last week, Canadian retail sales also surprised on the high side. Consumers splurged in September and October, a surprise resurgence in spending even as high interest rates restrict household budgets. Retail receipts rose 0.8% in October. That’s the biggest jump since April and followed an unexpected 0.6% increase in September, which far exceeded the median estimate of a flat reading in a Bloomberg survey of economists.

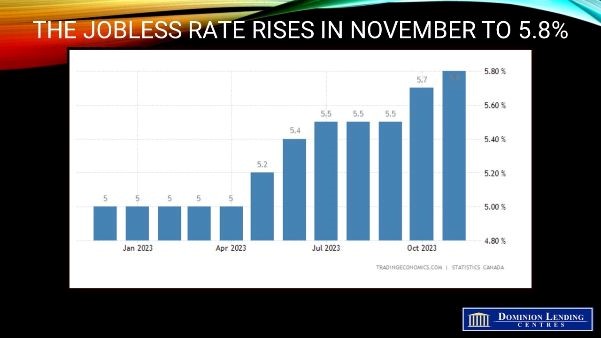

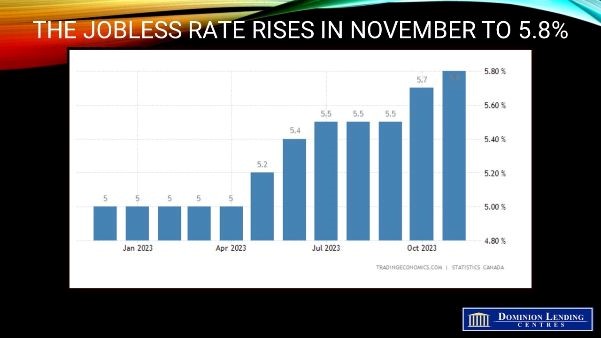

The unemployment rate increased for the second consecutive month, continuing its upward trend since April. The unemployment rate rose 0.1 percentage points to 5.8% in November, bringing the cumulative increase since April 2023 to 0.8 percentage points. Compared with a year earlier, unemployed people in November were more likely to have been laid off from their previous job, reflecting more difficult economic and labour market conditions in 2023 compared with 2022.

In construction, employment increased by 16K (+1.0%) in November, building on an increase of 23K (+1.5%) in October. While employment declined in construction through the spring and summer of 2023, gains in October and November brought employment levels to within 15,000 of the peak reached in January 2023. According to the most recent data on building construction, investment in building construction, mainly residential building construction, trended down for most of 2023 before partially rebounding in August and September.

Employment declined by 27K (-0.9%) in wholesale and retail trade in November, adding to a drop of 22K (-0.7%) in October. As of November, employment in the industry was at its lowest since December 2022.

Employment in finance, insurance, real estate, rental and leasing fell by 18K (-1.3%) in November. Since July, employment in this industry has declined by 63K (-4.4%), the steepest decrease of any sector over the period.

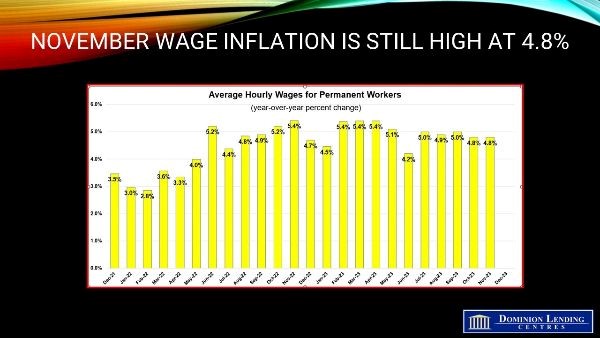

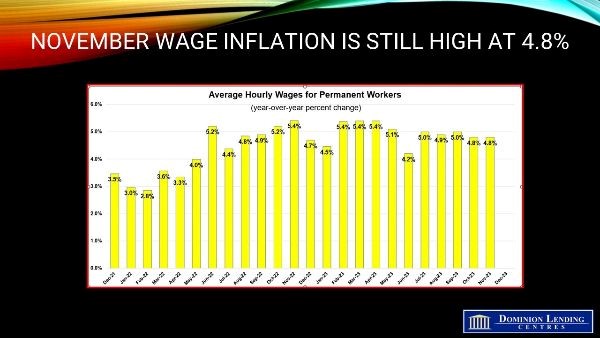

Wage growth was steady at +4.8% y/y, still well above what the Bank of Canada targets, given the productivity decline.

On the soft side, hours worked fell 0.7% despite a significant rise in full-time employment. That’s the largest monthly drop since early 2022 and doesn’t bode well for GDP growth in the month after the surprise strength in October’s flash estimate released yesterday.

Bottom Line

Last week, Governor Tiff Macklem said interest rates may be restrictive enough to restore price stability. He added that more downward pressure on inflation is in the pipeline, with the economy expected to remain weak for the next few quarters.

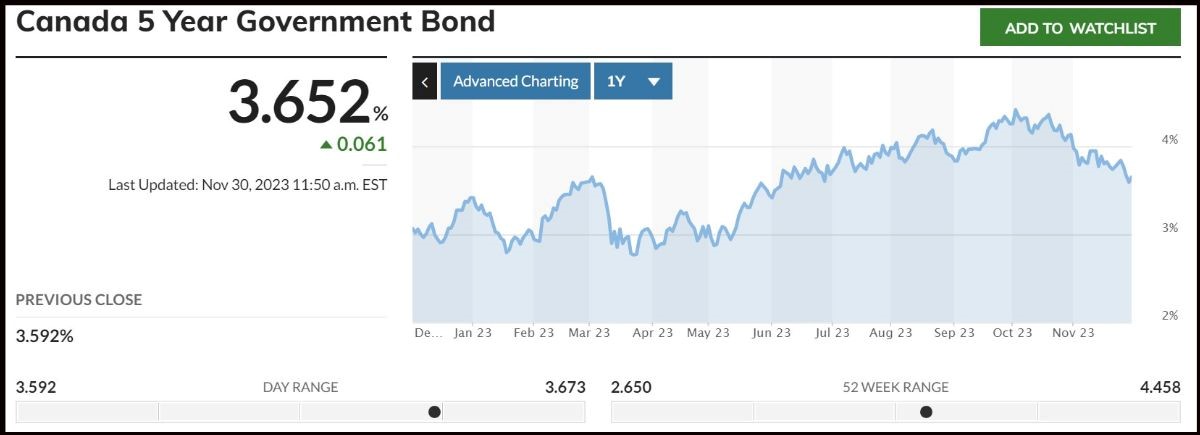

All the relevant data are in now for the Bank of Canada decision next Wednesday, December 6th. The Bank should maintain its pause and suggest that monetary easing may commence in the coming months depending on a continued decline in inflation. Right now, markets are forecasting the first rate cut in April 2024. That would certainly make for a robust spring housing market. I expect a 200 basis point drop in the overnight rate by the end of 2024 to 3.0%. This would imply a commensurate decline in VRMs. Fixed mortgage rates have already begun to drop owing to the sharp decline in mid-term bond yields. An acceleration in the drop in fixed mortgage rates is likely next year, as the spread between FMRs and market yields is still historically high.

(Article courtesy of Dr. Sherry Cooper, Chief Economist, DLC)

Angela Calla is an 19-year award-winning woman of influence which sets her apart from the rest. Alongside her team, Angela passionately assists mortgage holders in acquiring the best possible mortgage. Through her presence on “The Mortgage Show” and through her best-selling book “The Mortgage Code“, Angela educates prospective home buyers by providing vital information on mortgages. In light of this, her success awarded her with the 2020Business Leader of the Year Award.

Angela is a frequent go-to source for media and publishers across the country. For media interviews, speaking inquiries, or personal mortgage assistance, please contact Angela at hello@countoncalla.ca or at 604-802-3983.

Click here to view the latest news on our blog.