In todays cash strapped society, we all want to make the best decisions to balance out our future.

How do we do that? Simple, break down the math, look at the numbers and do what’s comfortable to you. Where you will be surprised is that what you thought to be the right way, may not be once you know the breakdown. Without it we all carry misconceptions about finance.

Lets look at how to make a decision on…

- Is 25 or 30 year amortization better?

- Is a 5 or 10% down on a purchase better?

- Is it better to put 5% down and pay mortgage insurance or put 20% down?

Money is not intuitive, I’ll show you why (and help you save hundreds of thousands along the way). There are many different ones but lets put a few together to compare.

Testing Financial Intuition

To get started, a quick test for your intuition.

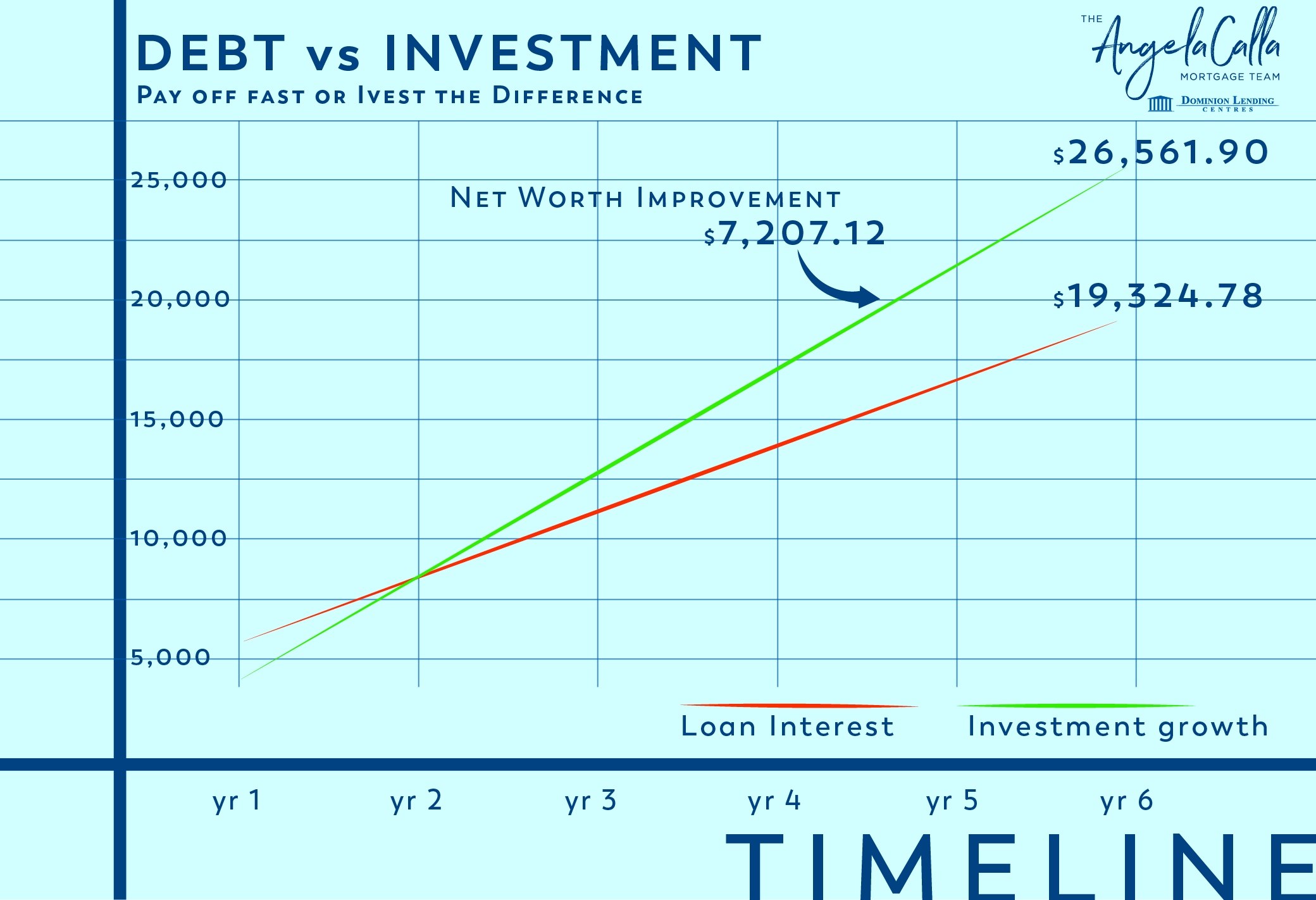

If you needed to buy a $100,000 car would you be better off to buy it in cash or to finance the car at 6% for 6 years and invest the $100,000 into a Guaranteed Income Certificate (GIC) yielding 4% inside your TFSA?

Let’s break it down.

If we buy the car in cash our cost is limited to $100,000 but we lose out on the opportunity to invest the $100,000 and own a depreciating asset instead.

If we decide to finance the car and invest the money instead we have to consider taxes, risk(s) and payments on the debt. We are assuming we invest in something guaranteed (GIC) and hold the investment inside our Tax Free Savings Account (TFSA), which means no taxes!

The financing on the car would cost $1649/m with a total interest cost over six years of $18,731.

If we invest the $100,000 at 4% for six years we will end up with $126,531.9

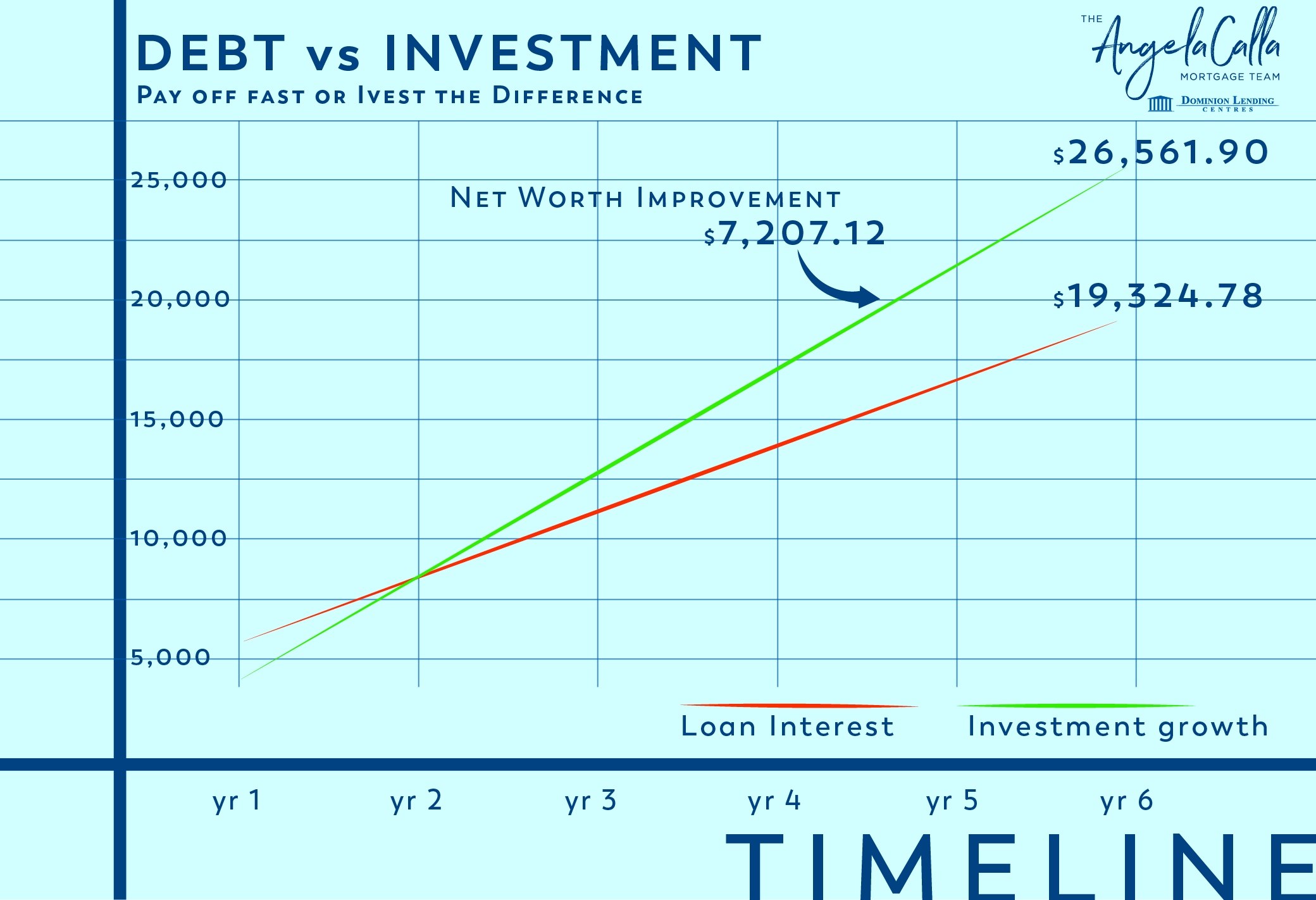

I share this example because it feels counter intuitive that borrowing at 6% interest to invest at 4% could lead to a $7800 profit.

The key here is visualizing the debt vs the investments.

Example #1

The debt starts off at a higher cost but due to the balance rapidly declining the investments come out ahead.

In other words the average balance of the debt over six years is drastically smaller than the average balance of the investment over the same time period. (debt is getting smaller each year whereas the investment is getting larger)

We need to question the financial assumptions we are making because with the way the world is going it doesn’t feel like getting ahead is getting easier.

Comparing Financial Strategies

25 Year VS 30 Year Amortization

Let’s look at the story of Bill and Mary.

Next month they are each purchasing a home for $625,000 and will be neighbours. Bill, a self proclaimed financial expert, takes every chance he can get to tell others how smart he is… but that is all about to change.

During their first site visit to see their homes being built Bill and Mary start chatting. They both plan on putting 20% down to avoid mortgage insurance but are debating over 25 and 30 year mortgages. Bill quickly informed Mary that she was being irresponsible if she took a 30 year mortgage. Bill, certain of his financial expertise and intuition, eagerly shouted off reason after reason on why Mary was a fool to not listen to him.

With a 25 year mortgage she would…

“You get a lower rate!”

“You pay off the mortgage faster!”

“You pay way less interest!”

With Bill red in the face and out of breath Mary thought on what he had said. If Bill borrows $500,000 on a mortgage at 5% paid off over 25 years he saves $99,927 compared to Jill taking a 30 year mortgage at 5.1% (generally there is a 0.1% premium for a 30 year mortgage amortization).

(5% at 500k = $373,246 total interest vs 30 year at 5.1 = $473,173)

Mary knew conventional wisdom taught that the best course of action is to be like Bill and to pay off our debts faster. Many would agree that the 25 year mortgage is the better choice…

But Mary was not “most Canadian’s” and instead of following the pack she decided to look at the math to decide what is best. Mary let Bill know she would think about it which only irked him more. He knew he was right… why wasn’t she listening to him?

25 vs 30 Year Mortgage Over 25 years

That night Mary begins to think about the situation…

If Bill takes a 25 year mortgage his monthly payments are $2910.82. If Mary takes the 30 year mortgage her monthly payments are $2703.26 or $207.56 lower. At the surface level Bill is paying an extra $62,268 (207.56 X 25 years) to avoid paying $162,180 (2703 X 5 years). Sounds like a pretty good choice but she thinks there may be a way to have her money work harder.

If Mary takes the 30 year mortgage she could invest the $207.56 into her Tax Free Savings Account (TFSA) each month.

She pulls out her calculator, pen and paper and begins to crunch the math…

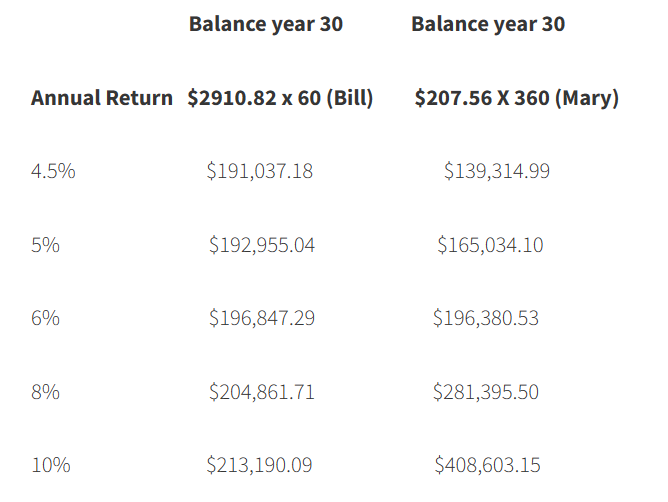

Here is what Mary would end with based on her potential investment returns over 25 years.

Annual Return Balance Year 25

4.5% $110,699.98

5% $118,554.11

6% $136,283.45

8% $181,595.15

10% $244,294.10

Keeping in mind that Mary’s mortgage would have a balance of $142,900.48 after 25 years she would need to earn at least 6.3% to break even and a return of 7%+ would put her ahead.

If she could average 10% per year she would be $142,656.16 ahead (after paying off her mortgage balance). An extra $142,000 could help Mary retire sooner, pay for her kids tuition or help them buy their first home… ok with the way things are going micro condo… but it could help! An extra $142,000 is great but this article is about challenging the financial assumptions we make and we have made a big assumption… we are paying off the mortgage after 25 years.

Can We do Better?

Mary shows Bill her idea of investing the difference in payments each month and proudly declares herself more financially savvy than Bill. Bill storms off and thinks about everything Mary has said. He stays up all night thinking about how he can do better than Mary. If Bill pays off his mortgage over 25 years he will be mortgage free. He could then invest his full mortgage payment ($2910.82) each month for the last five years! Eureka he’s done it. He’s certain he can do better than Mary. Meanwhile Mary stays up all night thinking on how she could do better. She decides she’s not going to pay off her mortgage early and instead will save her $207.56 every month for 30 years.

Which Mortgage and Financial Strategy is Better?

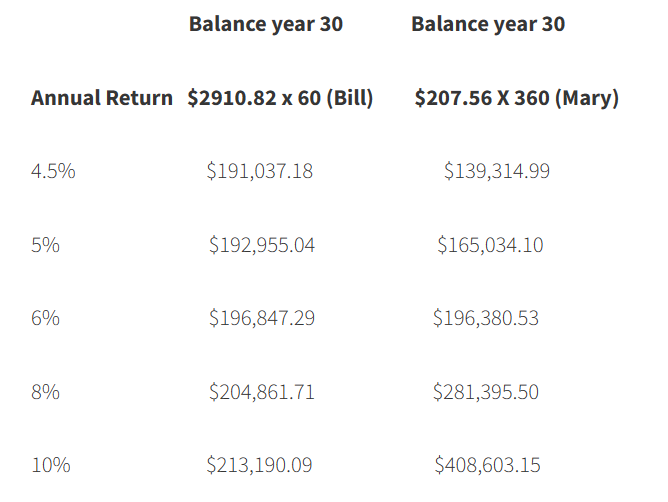

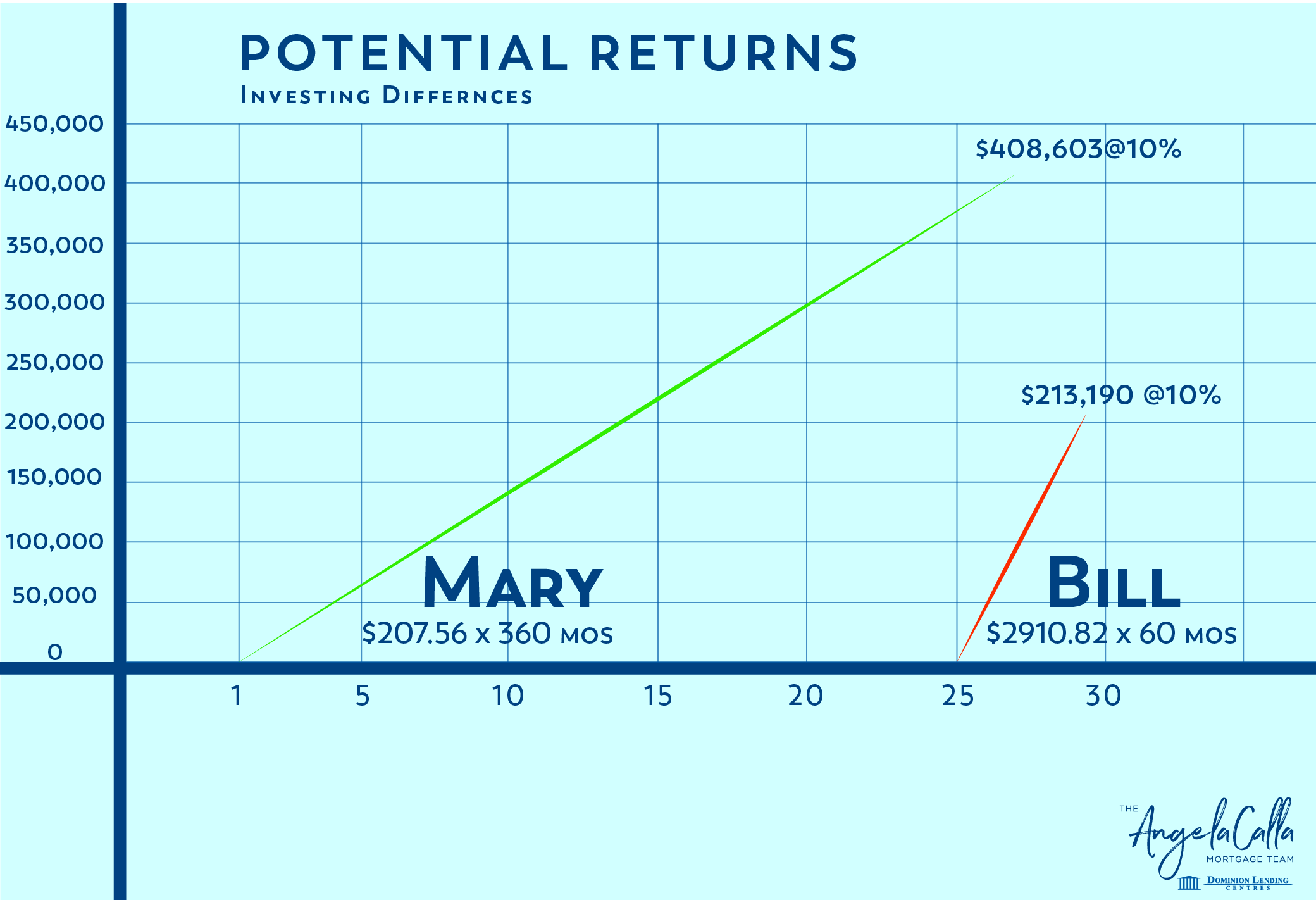

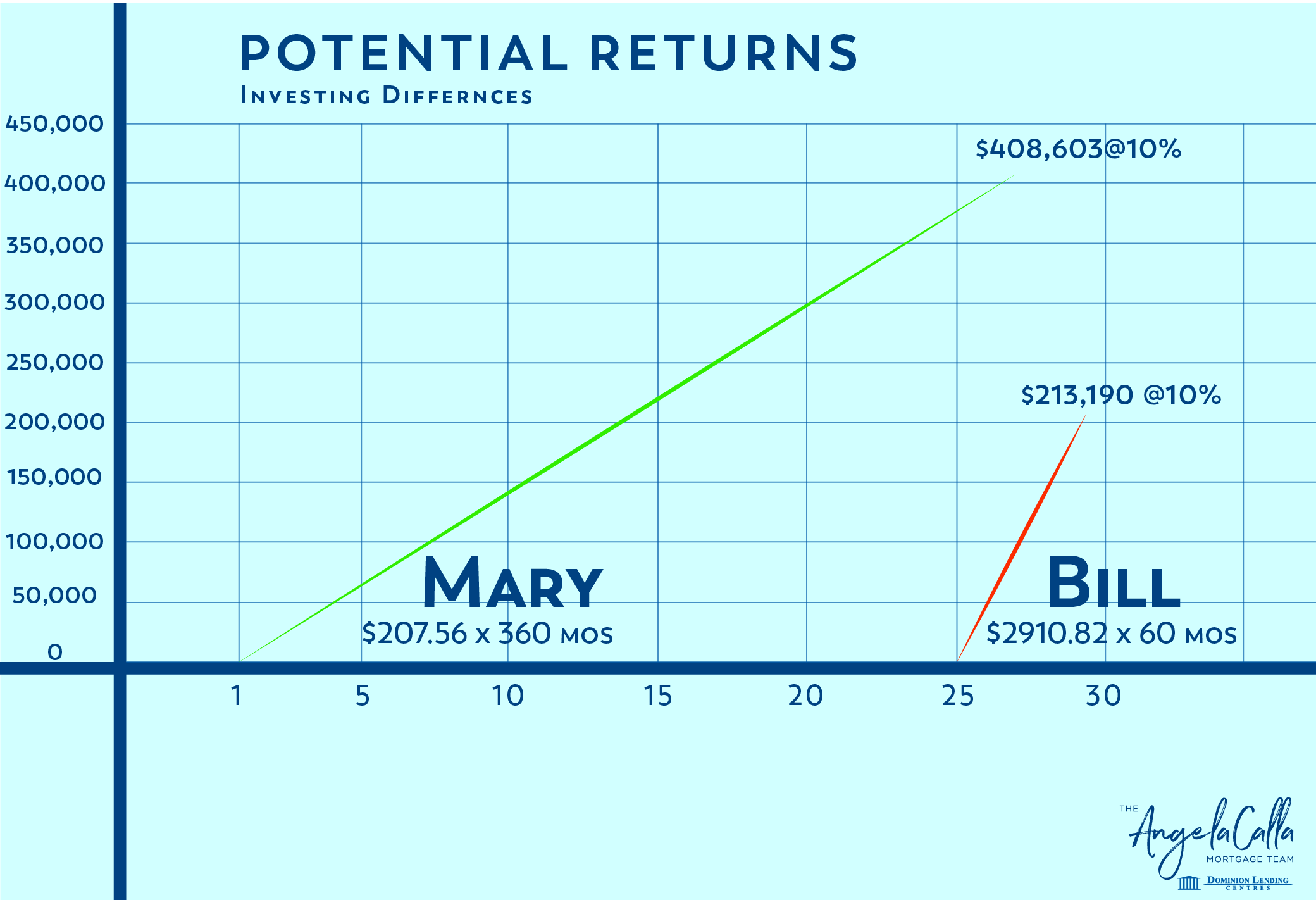

The next morning Bill and Mary end up on a call to see who is financially savvier. Who will have more money? Bill paying off his mortgage in 25 years and then investing $2910.82 each month for 5 years or Mary paying off her mortgage over 30 years and investing $207.56 each month?

Here is what they would have based on potential returns after 30 years.

You should have seen Bill’s face! Bested a second time… he was furious. As long as Mary earned over 6% she would come out ahead of Bill. If Mary averaged 10% (Keep in mind the largest US stock index, the S and P 500 has averaged 10.757% over the last 50 years) she would have $195,413 more than Bill (assuming he also averaged 10%). $195,000 could be life changing, while it’s not enough for financial freedom on its own, I doubt we could find many retiree’s right now who wouldn’t benefit from some extra money in the bank!

What would you do with the extra money? I have always wanted to travel but retiring sooner might be tempting!

While an extra $195,000 is great we are still making some big assumptions. We have broken down the merits between 25 and 30 year mortgages and there appears to be a clear winner. Does that mean that 30 year mortgages are always better than 25 year mortgages? Well remember the very first example I shared with the car… often the “best” financial choice can be counter intuitive.

Example #2

Should you Put 20% Down?

Bill and Mary both made an assumption that putting 20% down was a better choice than putting 5% down and paying a 4% mortgage insurance premium (essentially having 1% equity day one). Lets break it down and see!

Three weeks before closing Mary had been savoring her triumph over Bill but at the back of her mind she kept wondering if she could do even better. You know, really ruffle Bill’s feathers. She made some calls and realized that she could put 6% down (the minimum is 5% of the first $500,000, 10% of the balance above).

She knew it was a silly question but what if she put the minimum down and paid the mortgage insurance. She would have higher payments, a bigger mortgage, a dreaded 25 year amortization and her net worth would be lower day one (due to the 4% mortgage insurance cost). The silver lining would be an interest rate 0.25% lower and having the remainder of her down payment to invest right away but would it be enough to help her retirement?

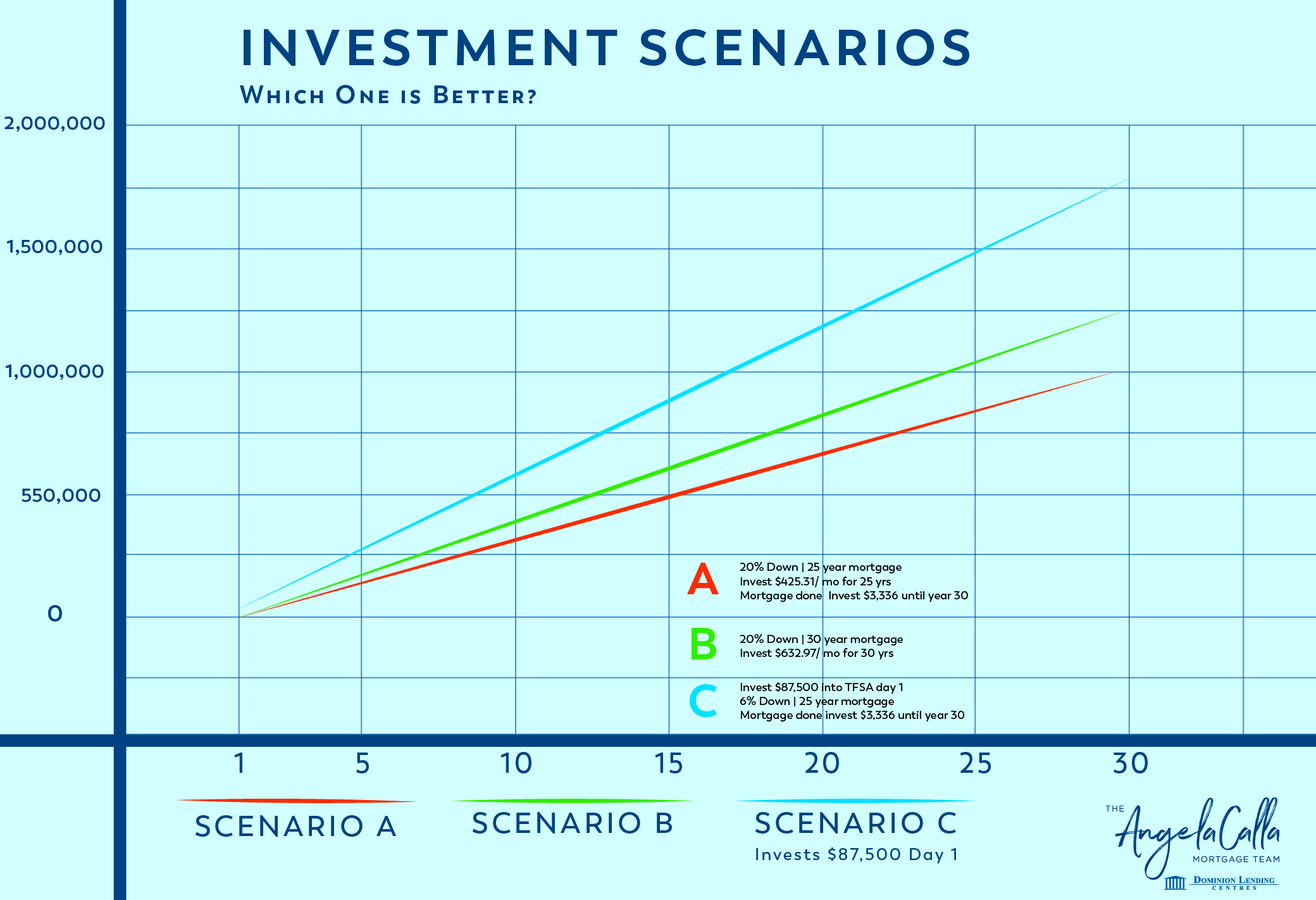

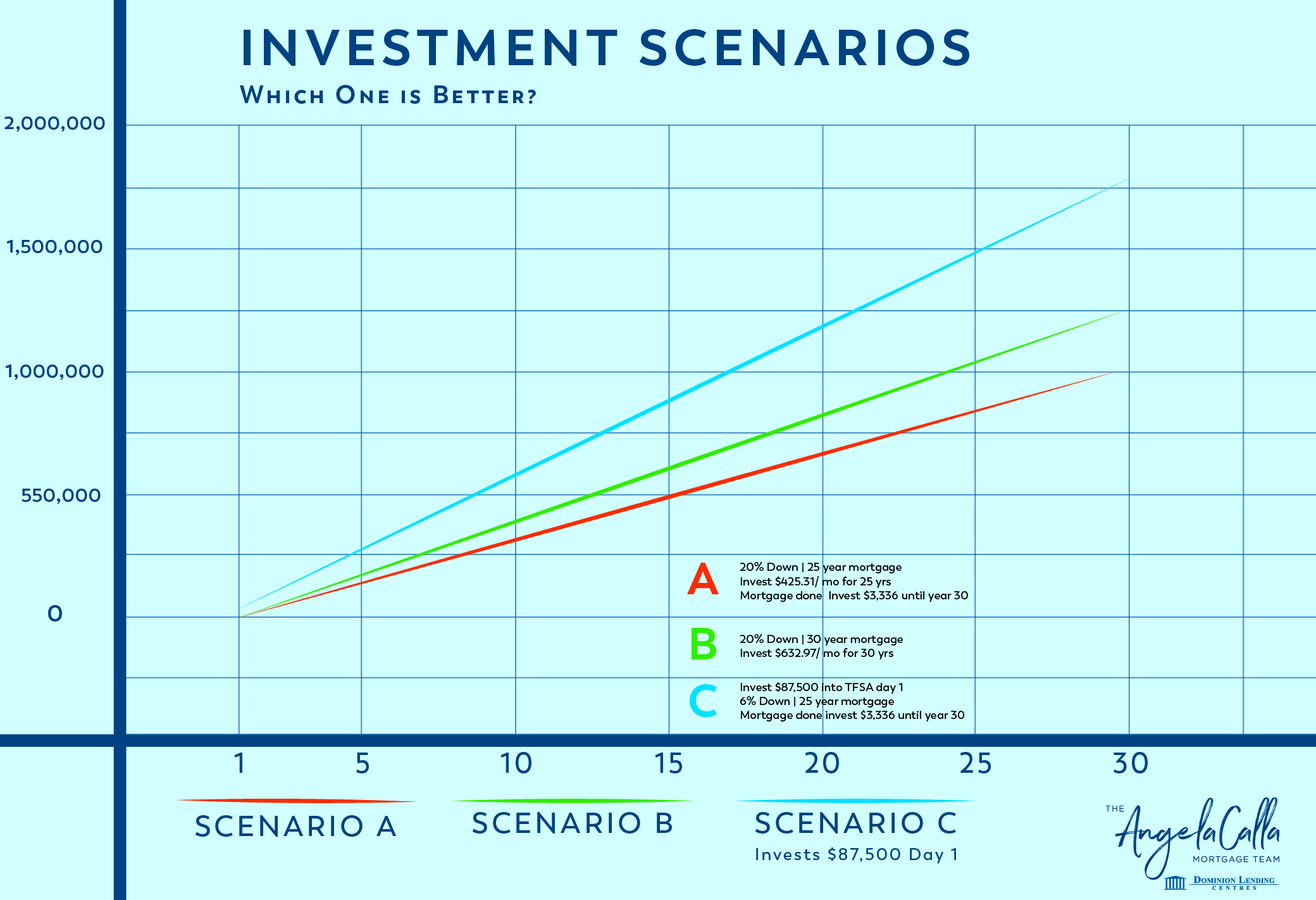

If Mary puts the minimum down ($37,500) she will have an extra $87,500 to invest and her new mortgage payment would be $3,336. To be fair we should consider the two 20% down scenarios (25 and 30 year) and assume the difference in payments is invested each month.

A) Bill will take a 25 year mortgage, investing the difference in payments ($425.31) for those 25 years. Once his mortgage is paid off he will invest $3,336 until year 30.

B) Mary could put 20% down and take a 30 year mortgage. She would invest the difference in payments ($632.97) each month for 30 years.

C) Mary would invest $87,500 into her TFSA day one and make no further investments until her mortgage is paid off year 25. Once her mortgage is paid off she will invest $3,336 until year 30.

Take a moment and think about what we have discovered so far. Which scenario do you think will do best?

Example #3

| Scenario |

A) Bill |

B) Mary |

C) Mary |

| Annual Return |

20% at 25 years + 60*3336 |

20% at 30 years |

6% down at 25 years + 60*3336 |

| 4.5% |

$ 502,239 |

$ 462,678 |

$ 546,719 |

| 5% |

$ 531,859 |

$ 503,872 |

$ 599,372 |

| 6% |

$ 600,112 |

$ 599,577 |

$ 728,220 |

| 8% |

$ 782,676 |

$ 859,140 |

$ 1,115,334 |

| 10% |

$ 1,052,183 |

$ 1,247,553 |

$ 1,771,222 |

The worst of the three options is putting 20% down and taking a 25 year mortgage, which may be surprising for some. The main reason this option performs poorly is due to its smaller investment potential. Essentially your ability to save for retirement is being neglected in order to have a larger down payment and to pay off the mortgage faster.

The middle option is putting 20% down and taking a 30 year mortgage. As we learned earlier it can be financially beneficial to pay a little more interest if we can make consistent contributions to our investments earlier in life.

Putting the minimum down payment and investing the difference performs the best in most circumstances. With a worst case benefit of roughly $45,000 and a best case benefit of $332,658 it could be a real game changer for many Canadians trying to optimize their planning.

I personally was quite surprised to see the minimum down payment scenario do the best. I expected the higher payments and $23,500 in mortgage insurance premiums to really hurt the scenario.

Even more Benefits?

Another perspective to consider is how likely each scenario would be able to deal with job loss, repairs etc.

Scenarios A and B (putting 20% down) have put all of their savings towards their down payment. While they have lower mortgage payments it would take their payment differences 17 years (25 year mortgage) or 11.5 years (30 year mortgage) to rebuild the $87,500 reserve fund scenario C (6% down) has.

We could shorten that time to rebuild a reserve fund by factoring in investment returns but even a “best” case scenario would still take around 8 years (10% return, $632.97 invested monthly).

In the same timeline the 6% down scenario (C) would have built up $187,500.

Overall putting the minimum down payment and maximizing TFSA’s appears to be the most financially effective scenario we have analyzed so far. It provides the greatest long term financial benefit as well as a most robust position for a home owner (larger financial reserves).

If you have any questions, feedback or thoughts on this concept let me know. The goal is to help families make better and more aware financial decisions. I welcome your views even if they disagree with mine! Together we can make this better so please reach out!

As I am sure you can imagine Mary was on top of the world. She had repeatedly bested Bill and improved the future of her family.

Her head hurt a little as the journey had been a challenging one… every time she thought she had the best answer she learned she was wrong. She quickly came to realize that she could not make generalizations or “rules”. At the most basic level a 25 year mortgage was better than a 30 year mortgage as it saved interest and paid off the mortgage faster. If she thought a little more a 30 year mortgage could outperform a 25 year mortgage by having lower payments and investing the difference. If she used this strategy to build investments and to pay off the mortgage year 25 she could have a great benefit. If she left the debt alone and kept investing for 30 years she could have an even better benefit.

By challenging her financial assumptions she quickly learned that this was not the best option either. She had assumed putting 20% down to avoid mortgage insurance was a far better choice than putting the minimum down payment. After crunching the numbers she had discovered that putting the minimum down and investing the remainder of her down payment would lead to a massive improvement in her retirement savings. As a bonus she would have a substantial cash reserve to help her deal with the unknowns of the future.

She was feeling good about everything she had learned, knowing that a deeper understanding of her finances would make future decisions easier. She no longer cared about besting Bill, being right certainly felt good but she cared more about her family’s future.

Angela Calla is an 19-year award-winning woman of influence which sets her apart from the rest. Alongside her team, Angela passionately assists mortgage holders in acquiring the best possible mortgage. Through her presence on “The Mortgage Show” and through her best-selling book “The Mortgage Code“, Angela educates prospective home buyers by providing vital information on mortgages. In light of this, her success awarded her with the 2020Business Leader of the Year Award.

Angela is a frequent go-to source for media and publishers across the country. For media interviews, speaking inquiries, or personal mortgage assistance, please contact Angela at hello@countoncalla.ca or at 604-802-3983.

Click here to view the latest news on our blog.