Myth: There will be nothing left for my kids if I take a Reverse Mortgage

“I have kids so I don’t want to leave nothing for them”. I hear this and it’s not an accurate statement. A reverse mortgage is not only suitable for people without kids or for those not concerned with passing anything down to their kids.

We tend to look at the inheritance issue as binary – if these clients take a reverse mortgage there will be nothing left for their kids, if they don’t take a reverse mortgage the kids will have a good inheritance.

Take the example of clients with a $1.6M clear title home. They have minimal pensions and some investments. They are the definition of ‘house rich, cash poor’. An extra $2,000/month would make a huge difference to their lifestyle, but they want to be able to pass their home down to their kids so they have chosen to live a subpar retirement for the good of their children.

When we run the numbers on our Reverse Mortgage Income Advantage product with the clients receiving $2,000/month and assuming their home appreciates at 4% per year, their mortgage balance in 10 years will be $446,038. Their home will be worth $2,150,266, meaning their net equity will be $1,704,228. After 10 years their estate has grown, not been depleted.

What about after 20 years? Their mortgage balance will have increased to $1,552,022 and their home is now worth $2,889,778. Their net equity is $1,337,756.

These clients were able to stay in their home for 20 years with a $2,000/month annuity and now, instead of passing $1.6M on to their children, their kids will inherit just over $1.3M.

Would your clients be okay with their kids inheriting $1.3M vs $1.6M if it means they could have an additional $2,000/month for 20 years, remain in the home they love and enjoy their retirement?

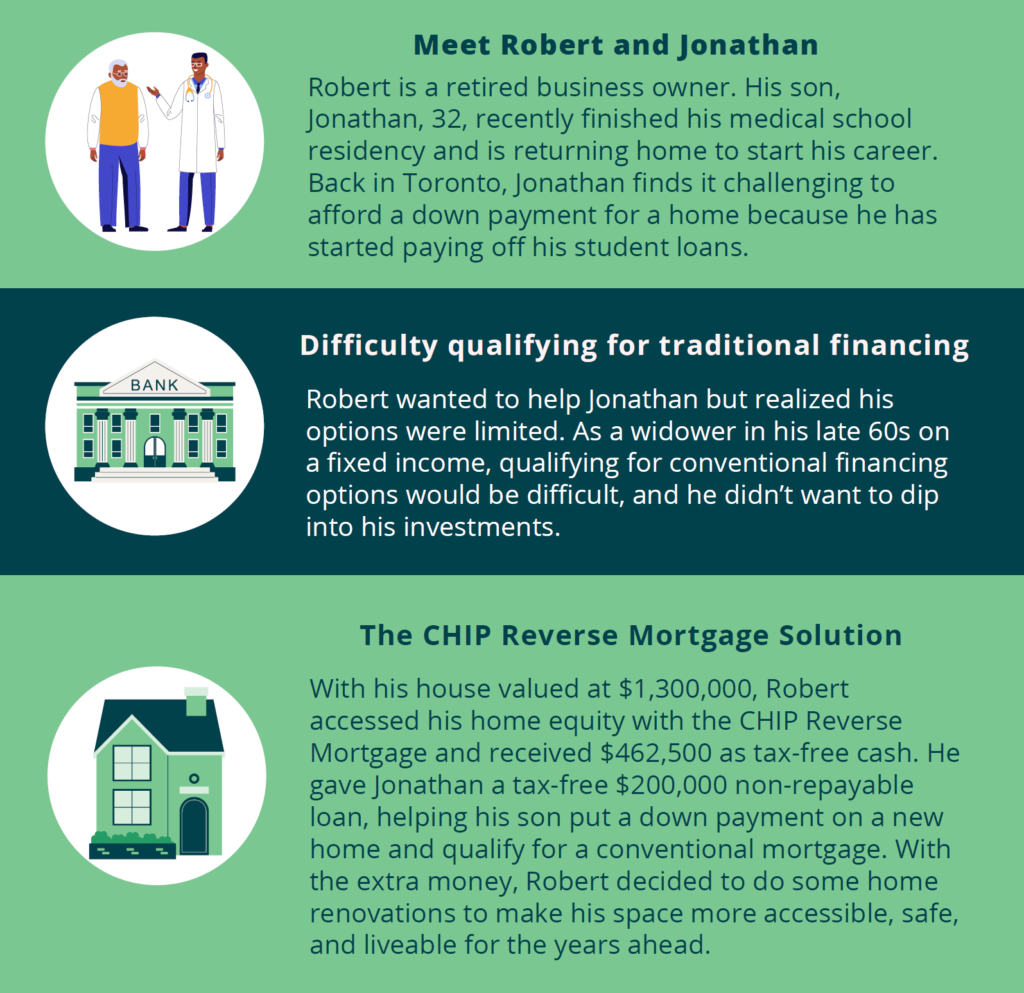

Recent Client Story – Maximizing Cashflow in Retirement

Jeff (71) and Janice (71) have a $2.1M home in New Westminster with a $410,000 mortgage. They received their TD renewal notice and could not afford the new payments on their pension income. They would have needed to significantly increase their investment withdrawals to cover the shortfall as they were already feeling stretched with the mortgage payment.

Reverse Mortgage approved loan amount: $826,500

They advanced $490,000, enough to payout their existing mortgage, add air conditioning to their home and have a little extra left over. They hadn’t been enjoying meals out or vacations the last couple years as money was tight. Their cashflow significantly improves now that they don’t have a mortgage payment.

Angela Calla is an 19-year award-winning woman of influence which sets her apart from the rest. Alongside her team, Angela passionately assists mortgage holders in acquiring the best possible mortgage. Through her presence on “The Mortgage Show” and through her best-selling book “The Mortgage Code“, Angela educates prospective home buyers by providing vital information on mortgages. In light of this, her success awarded her with the 2020Business Leader of the Year Award.

Angela is a frequent go-to source for media and publishers across the country. For media interviews, speaking inquiries, or personal mortgage assistance, please contact Angela at hello@countoncalla.ca or at 604-802-3983.

Click here to view the latest news on our blog.