Welcome to the April issue of my monthly newsletter!

Spring is here! To get you ready for the season, I have included some detailed information on what you can currently expect from the housing market, plus some small reno ideas that can have a BIG impact on your home!

In addition, enjoy Dr. Sherry Cooper’s economic insights around the latest interest rates and economic trends.

Get all the details below and have an amazing month!

2024 Spring Market Expectations

The spring housing market is just around the corner! Whether you’re looking to sell, buy, or want to ensure your mortgage is in order, knowing what to expect can help.

Here is the low down on what we are anticipating for various factors affecting the housing market this season:

- Interest Rates: While the Bank of Canada held the overnight rate steady at 5% for the past five meetings, it is expected that they will make the first interest rate cut in June or July this year, followed by additional reductions in the overnight rate to a more manageable level as the year continues. Experts are predicting that The Bank of Canada rate could drop to 3.75% by the end of 2024.

- Housing Prices: With interest rates expected to start coming down mid-year, that means more affordability and buyers in the market. As a result, it is expected that home prices will increase this year.

- Market Inventory: According to the Canadian Real Estate Association, the number of new properties listed has edged up 1.5% month-over-month in January, with this expected to rise as the interest rates drop.?

Looking to buy? For those of you who may be looking to purchase a home this Spring, here are some things that can help you be prepared:

- Get your finances ready by paying off as much of your debt as possible to improve your debt-to-income ratio and ensure you qualify for the best rate possible.

- Obtain a mortgage pre-approval before starting your search. This helps you understand your budget and makes your offer more appealing to sellers.

- Clearly define your priorities and preferences for a home. This will help streamline your search and make decisions more efficiently, especially as the market becomes more competitive.

First-time homeowner? Take advantage of first-time home buyer assistance if you have not been a homeowner in the past. You can find out more on the Government of Canada website here.

Looking to sell? If you want to sell your home this Spring, you will want to be ready to take advantage of the market! Some things you can do include:

- The first step is to find a reliable real estate agent who can help you with pricing and listing your home for sale. Not sure who to call? I can provide some references!

- Allow for open houses during evenings and weekends whenever possible to ensure you’re maximizing potential buyer foot traffic.

- I have even more tips on decluttering and getting your home ready to sell below!

Want to renew or refinance? If you’re not looking to sell or buy this Spring, you may still be looking for mortgage advice or assistance with your home and finances. Now is a great time to make sure your mortgage is working for YOU! With so many renewals coming up this year, keep in mind there are several benefits to taking time to review your renewal before you sign:

- Get a Better Rate: With interest rates expected to come down, taking time to reach out to me and shopping the market could help save you money!

- Consolidate Debt: Renewal is a great time to take a look at your existing debt and determine whether or not you want to consolidate it onto your mortgage. In most cases, the interest rate on your mortgage is less than you would be charged with credit card companies or other forms of financing you may have.

- Start on that Reno: Do you have projects around the house you’ve been dying to get started on? Renewal time is a great opportunity for you to look at utilizing some of your home equity to help with home renovations so you can finally have that dream kitchen and updated bathroom, or even utilize it to purchase a vacation property!

- Change Your Mortgage Product: Are you not happy with your existing mortgage product? Perhaps you’re finding that your variable-rate or adjustable-rate mortgages are fluctuating too much and you want to lock in! Alternatively, you may want to switch to a variable as interest rates level out. You can also utilize your renewal time to take advantage of a different payment or amortization schedule to help pay off your mortgage faster!

No matter your plans for this month or the coming season, don’t hesitate to reach out to me for expert mortgage advice!

Small Home Improvements That Make a BIG Impact

Whether you’re looking to sell your home this year, or just want to make some updates, I have put together six small home improvements that can make a BIG impact on your space! From improving sale ability to refreshing your home, here are some simple and affordable ideas to help get you started:

- Painting: One of the easiest ways to spruce up your home for a refreshed vibe or sale is to add a new coat of paint! While it is a relatively simple task for a new homeowner to take on, you might be surprised at how many people will pass on a house because they are not a fan of the paint colors or the flooring. A fresh coat of paint – especially more neutral colors such as beige, cream, light grays, and soft blues or greens – can do wonders to make a home feel appealing.

- Light Fixtures: I don’t know about you, but I haven’t taken a good look at my light fixtures in a while. However, potential buyers will! Light fixtures are another low-cost and relatively easy improvement you can make to your home. Upgrading to newer styles and ensuring they are clean, with fresh LED bulbs, will help add an extra sparkle to your home!

- Update Your Hardware: Another overlooked aspect of a home are light switches and door handles. If your home is 20 years old, most likely your white light switch covers are not so “white” and your door handles are a little worn down. These are a cheap and easy replacement that will go a long way to boost your interior!

- Swap Out Your Window Coverings: Just like with a fresh coat of paint or new hardware, swapping out your window coverings is a small change that can make a big impact. Change your stale, white plastic blinds for wooden slats, or update your curtains to something fresh and vibrant!

- Refinish Your Cabinets: The kitchen is known to be a central space in most homes, but did you know roughly 80% of homebuyers feel that it is the most important space to consider when deciding on a new home? While a full kitchen renovation may be out of the question and all-new kitchen cabinets can cost thousands, there is a third option. Refinishing or repainting your cabinets is a great alternative for breathing new life into your kitchen!

- Curb Appeal: They say don’t judge a book by its cover but, when it comes to selling your home, first impressions matter. This is where curb appeal comes in! If a potential buyer pulls up to see overgrown weeds, clogged gutters, or cracked concrete, they are already going to have a negative impression of the home and it will be harder to impress them once they are inside. Attending to landscaping and any outside maintenance needs will go a long way in making your home more appealing. A pressure wash and a new coat of exterior paint can also do wonders to give your home a facelift!

By putting the effort into completing a few small changes around your home, you can reap big rewards when it comes time to sell – and increase your comfort in the interim!

Economic Insights from Dr. Sherry Cooper

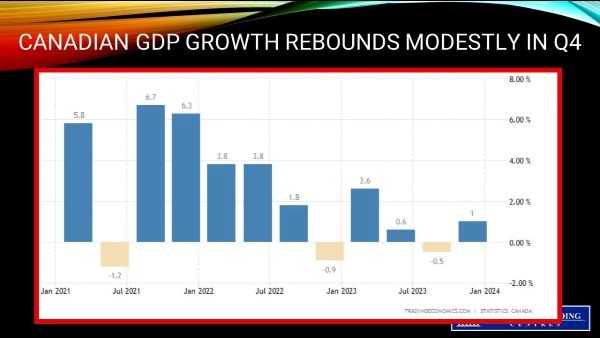

The Bank of Canada’s Governing Council was split on the timing of rate cuts this year when they deliberated before the March press release. But the February inflation data signaled that rate cuts should be coming soon. After all, inflation has slowed markedly along with the economy.

While the unprecedented influx of new immigrants has boosted economic activity, the overall outlook for consumer spending will be dampened by the large volume of mortgage renewals in the next two years. Many will suffer a double-digit monthly payment increase, undoubtedly dampening discretionary spending. High food prices already burden consumers. Even though food inflation has diminished, prices have not fallen.

A June rate cut is coming, and there is even a possibility of an easing in monetary policy at the April 10 meeting. The spring housing season will be buoyant. Home prices already began to rise in February. And while home sales have been weak, the sunshine might entice the pent-up supply of existing homes to the market. For every move-up and downsizing buyer, there is a new listing on the other side.

First-time homebuyers may also start to take the plunge for fear that prices will rise further. They can lock in a two- or three-year fixed-rate mortgage if they are nervous. Many have been saving their money since 2022.

The Alt-A market is also poised for a pick-up as many more alternative lenders have strong balance sheets and well-diversified portfolios and talk about creating a demand for Alt-A mortgage-backed bonds. These would be relatively high-yielding bonds with reasonable credit ratings owing to the diversity of mortgages from every province in Canada.

There will be challenges and intense competition with new digital lenders increasing for the first time in Canada—much delayed from the US market innovation. Mortgage brokers need to be experts in a much more comprehensive array of products and solutions, many of them new.

Angela Calla is an 19-year award-winning woman of influence which sets her apart from the rest. Alongside her team, Angela passionately assists mortgage holders in acquiring the best possible mortgage. Through her presence on “The Mortgage Show” and through her best-selling book “The Mortgage Code“, Angela educates prospective home buyers by providing vital information on mortgages. In light of this, her success awarded her with the 2020Business Leader of the Year Award.

Angela is a frequent go-to source for media and publishers across the country. For media interviews, speaking inquiries, or personal mortgage assistance, please contact Angela at hello@countoncalla.ca or at 604-802-3983.

Click here to view the latest news on our blog.