Noone Benefits From Tariffs

Despite having negotiated the current trade agreement among the U.S., Mexico, and Canada during his first administration, Donald Trump broke the terms of that treaty on Saturday. He triggered a global stock market selloff after fulfilling his threat to impose tariffs on Canada, Mexico, and China. These levies are set to take effect Tuesday unless a last-minute deal is reached during Trump’s phone calls with the leaders of Canada and Mexico today. The European Union is next on Trump’s list for potential tariffs, and the EU has promised to “respond firmly” if this occurs.

Trump has imposed tariffs of 25% on goods coming from Mexico and Canada, 10% on Canadian energy, and 10% on goods from China. He justified these actions by claiming they would force Mexico and Canada to address issues related to undocumented migration and drug trafficking. However, while precursor chemicals for fentanyl come from China and undocumented migrants enter through the southern border with Mexico, Canada accounts for only about 1% of both issues.

The affected countries are preparing their responses. Canada has launched a crisis plan reminiscent of its response to the COVID-19 pandemic, while Mexican President Claudia Sheinbaum has developed a “Plan B” to protect her country. In contrast, China’s response has been more subdued. It pledged to implement “corresponding countermeasures” without providing further details.

The Wall Street Journal, typically considered a conservative publication, criticized Trump, labelling this as the “dumbest trade war in history.” The Journal stated, “Mr. Trump sometimes sounds as if the U.S. shouldn’t import anything at all, that America can be a perfectly closed economy making everything at home. This is called autarky, and it isn’t the world we live in or one that we should want to live in, as Mr. Trump may soon find out.”

Trump inherited a strong economy from his predecessor, President Joe Biden. However, as White House Press Secretary Karoline Leavitt confirmed Trump’s decision to levy the tariffs on Friday, the stock market plunged. Trump, who previously insisted that tariffs would boost the economy, acknowledged today that Americans might experience “SOME PAIN” due to the tariffs. He added, “BUT WE WILL MAKE AMERICA GREAT AGAIN, AND IT WILL ALL BE WORTH THE PRICE THAT MUST BE PAID.”

Trump has admired tariffs and often praises President McKinley for his extensive tariff impositions. After 450 amendments, the Tariff Act of 1890 raised average import duties from 38% to 49.5%. McKinley, known as the “Napoleon of Protection,” increased rates on some goods while lowering them on others, always aiming to protect American manufacturing interests. His presidency saw rapid economic growth, bolstered by the 1897 Dingley Tariff, which aimed to shield manufacturers and factory workers from foreign competition.

While Trump claims the McKinley tariffs made the U.S. a global economic leader, other factors contributed to this outcome. During the late 19th century, U.S. immigration surged, and American entrepreneurs learned from Britain’s best practices, which was then the world leader in technological advancement.

Consider the U.S. auto industry, which operates as a North American entity due to the highly integrated supply chains across the three countries. In 2024, Canada supplied nearly 13% of U.S. auto parts imports, while Mexico accounted for almost 42%. Industry experts note that a vehicle produced on the continent typically crosses borders multiple times as companies source components and add value most cost-effectively.

This integration benefits everyone involved. According to the Office of the U.S. Trade Representative, the industry contributed more than $809 billion to the U.S. economy in 2023, representing about 11.2% of total U.S. manufacturing output and supporting 9.7 million direct and indirect U.S. jobs. In 2022, the U.S. exported $75.4 billion in vehicles and parts to Canada and Mexico. According to the American Automotive Policy Council, this figure rose by 14% in 2023, reaching $86.2 billion.

Without this trade, American car makers would struggle to compete. Regional integration has become an industry-wide manufacturing strategy in Japan, Korea, and Europe. It aims to leverage high-skilled and low-cost labour markets to source components, software, and assembly.

As a result, U.S. industrial capacity in automobiles has grown alongside an increase in imported motor vehicles, engines, and parts. From 1995 to 2019, imports of these items rose by 169%, while U.S. industrial capacity in the same categories increased by 71%. Thousands of well-paying auto jobs in states like Texas, Ohio, Illinois, and Michigan owe their competitiveness to this ecosystem, which relies heavily on suppliers in Mexico and Canada.

Tariffs will also disrupt the cross-border trade of agricultural products. In fiscal 2024, Mexican food exports represented about 23% of U.S. agricultural imports, while Canada supplied approximately 20%. Many leading U.S. growers have relocated to Mexico because of regulatory limits and economic advantages. Unless a last-minute deal is reached during Trump’s calls with the leaders of Canada and Mexico today. The European Union is next on its list for potential tariffs, and the EU has promised to “respond firmly” if this occurs.

Trump slapped tariffs of 25% on goods from Mexico and Canada, 10% on Canadian energy, and 10% on goods from China. He said he was doing so to force Mexico and Canada to do more about undocumented migration and drug trafficking. Still, while precursor chemicals to make fentanyl come from China and undocumented migrants come over the southern border with Mexico, Canada accounts for only about 1% of both.

The countries affected by the tariffs are also preparing their defences. Canada has launched a crisis response that parallels the COVID pandemic, while Mexican President Claudia Sheinbaum has developed a “Plan B” to protect her country. China’s reaction was more subdued. They pledged to implement “corresponding countermeasures,” though they did not provide further details.

The Wall Street Journal, hardly a bastion of progressive thought, lambasted Trump, saying this is the “dumbest trade war in history.” The Journal said, “Mr. Trump sometimes sounds as if the U.S. shouldn’t import anything at all, that America can be a perfectly closed economy making everything at home. This is called autarky, and it isn’t the world we live in or one that we should want to live in, as Mr. Trump may soon find out.”

Trump inherited the best economy in the world from his predecessor, President Joe Biden. However, on Friday, as soon as White House press secretary Karoline Leavitt confirmed that Trump would levy the tariffs, the stock market plunged. Trump, who during his campaign insisted that tariffs would boost the economy, said that Americans could feel “SOME PAIN” from them. He added, “BUT WE WILL MAKE AMERICA GREAT AGAIN, AND IT WILL ALL BE WORTH THE PRICE THAT MUST BE PAID.”

Trump loves tariffs and lauds President McKinley for his massive tariff imposition. After 450 amendments, the Tariff Act of 1890 increased average duties across all imports from 38% to 49.5%. McKinley was known as the “Napoleon of Protection,” and rates were raised on some goods and lowered on others, always trying to protect American manufacturing interests. McKinley’s presidency saw rapid economic growth. He promoted the 1897 Dingley Tariff to protect manufacturers and factory workers from foreign competition, and in 1900, secured the passage of the Gold Standard Act.

President Trump has said the McKinley tariffs made the US a global economic leader, but much else was responsible. Over the late 19th century, US immigration increased sharply. American entrepreneurs put a great store in the best practices of Britain, then the global leader in technological development.

The U.S. auto industry is North American because supply chains in the three countries are highly integrated. In 2024, Canada supplied almost 13% of U.S. auto parts imports, and Mexico provided nearly 42%. Industry experts say a vehicle made on the continent crosses borders a half-dozen times or more as companies source components and add value in the most cost-effective ways.

Everyone benefits. The Office of the U.S. Trade Representative says that 2023 the industry added more than $809 billion to the U.S. economy, or about 11.2% of total U.S. manufacturing output, supporting “9.7 million direct and indirect U.S. jobs.” In 2022, the U.S. exported $75.4 billion in vehicles and parts to Canada and Mexico. According to the American Automotive Policy Council, that number jumped 14% in 2023 to $86.2 billion.

American car makers would be much less competitive without this trade. Regional integration is now an industry-wide manufacturing strategy employed in Japan, Korea, and Europe that aims to source components, software, and assembly from various high-skilled and low-cost labour markets.

The result has been that U.S. industrial capacity in autos has grown alongside an increase in imported motor vehicles, engines, and parts. From 1995 to 2019, imports of automobiles, engines, and parts rose 169%, while U.S. industrial capacity in cars, engines, and parts rose 71%. Thousands of good-paying auto jobs in Texas, Ohio, Illinois, and Michigan owe their competitiveness to this ecosystem, which relies heavily on suppliers in Mexico and Canada.

Tariffs will also cause mayhem in the cross-border trade of farm goods. In fiscal 2024, Mexican food exports comprised about 23% of U.S. agricultural imports, while Canada supplied some 20%. Many top U.S. growers have moved to Mexico because limits on legal immigration have made it hard to find workers in the U.S. Mexico now supplies 90% of avocados sold in the U.S.

Canadian Prime Minister Justin Trudeau has promised to respond to U.S. tariffs on a dollar-for-dollar basis. Since Canada’s economy is so small, this could result in a larger GDP hit, but American consumers will feel the bite of higher costs for some goods.

None of this is supposed to happen under the U.S.-Mexico-Canada trade agreement that Mr. Trump negotiated and signed in his first term. The U.S. willingness to ignore its treaty obligations, even with friends, won’t make other countries eager to do deals. Maybe Mr. Trump will claim victory and pull back if he wins some token concessions. But if a North American trade war persists, it will qualify as one of the dumbest in history.

Bottom Line

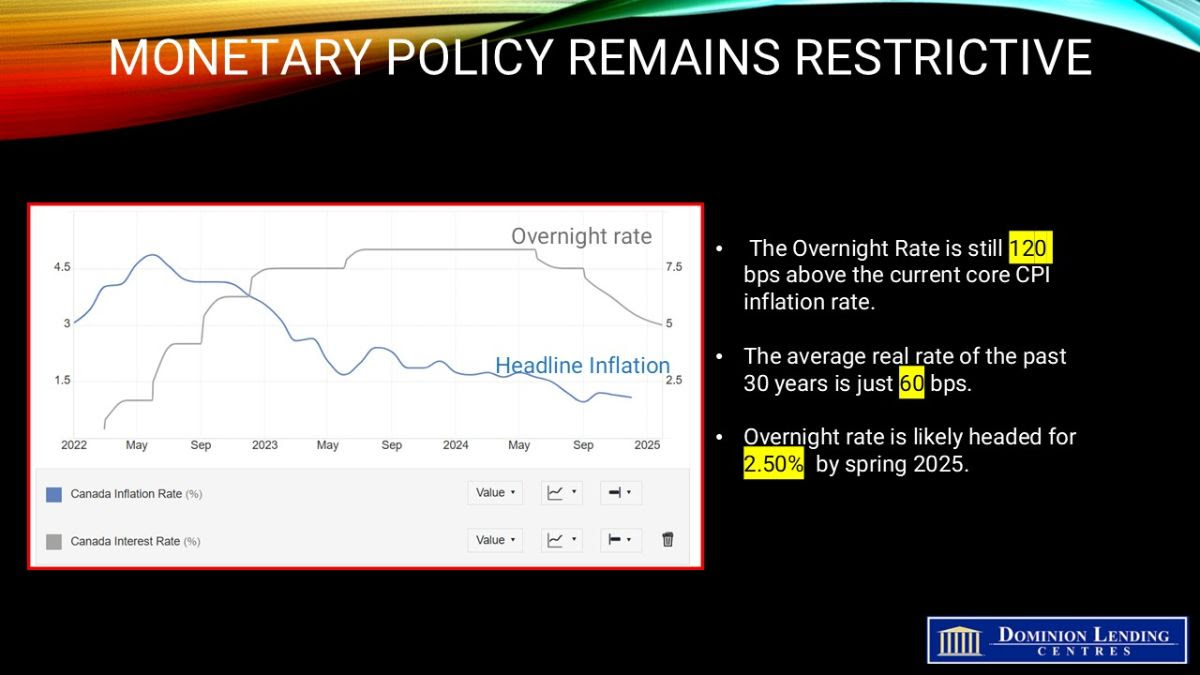

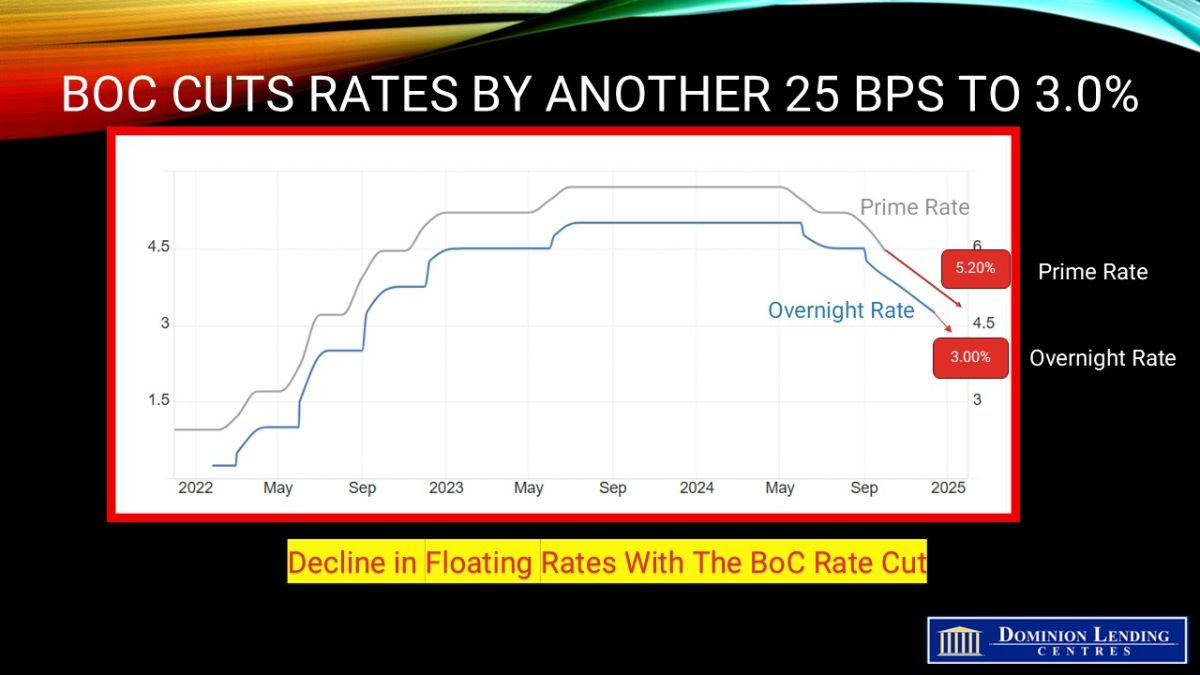

This is a lose-lose situation. Prices will rise in all three continental countries if the tariffs persist. While inflation is the first effect, we will quickly see layoffs in the auto sector and elsewhere. Ultimately, the Bank of Canada would be confronted with a recession and will ease monetary policy in response. Interest rates would fall considerably. The Canada 5-year government bond yield has fallen precipitously, down to 2.59%. In this regard, housing activity would pick up, similar to what we saw in 2021, with weak economic activity but booming housing in response to low mortgage rates.

I am still hopeful that an all-out trade war can be averted. There is room to negotiate. As stated by Rob McLister, “Trump underestimates the global revolt against this move, and that’s another reason why these tariffs may be measured in months, not years.” This will not be good for the US. Trump promised to reduce prices, yet sustained tariffs will undoubtedly cause prices to rise. Some of that increase will be absorbed by American importers and some by Canadian exporters anxious to maintain market share. Still, much of the tariff will be passed on to the American consumer in time. This, combined with a North American economic slowdown, will no doubt damage Mr. Trumps approval rating.

Article courtesy of Dr. Sherry Cooper, Chief Economist, Dominion Lending Centres

Angela Calla is an 19-year award-winning woman of influence which sets her apart from the rest. Alongside her team, Angela passionately assists mortgage holders in acquiring the best possible mortgage. Through her presence on “The Mortgage Show” and through her best-selling book “The Mortgage Code“, Angela educates prospective home buyers by providing vital information on mortgages. In light of this, her success awarded her with the 2020Business Leader of the Year Award.

Angela is a frequent go-to source for media and publishers across the country. For media interviews, speaking inquiries, or personal mortgage assistance, please contact Angela at hello@countoncalla.ca or at 604-802-3983.

Click here to view the latest news on our blog.