Welcome to the November issue of my monthly newsletter!

As we get closer to the end of the year, we have some tips for your upcoming mortgage renewal, plus how to winterize your home!! Also, hear the economic forecast straight from our Chief Economist, Dr. Sherry Cooper.

Mortgage Renewal Benefits

Is your mortgage coming up for renewal? Do you know about all the incredible options renewing your mortgage can afford you?

If not, I have all the details here on how to make your mortgage renewal work for you as we start to think about 2024.

Get a Better Rate

Are you aware that when you receive notice that your mortgage is coming up for renewal, this is the best time to shop around for a more favourable interest rate? At renewal time, it is easy to shop around or switch lenders for a preferable interest rate as it doesn’t break your mortgage. With interest rates expected to come down as we move into the New Year, taking some time to reach out to me and shopping the market could help save you money!

Consolidate Debt

Renewal time is also a great time to take a look at your existing debt and determine whether or not you want to consolidate it onto your mortgage. For some, this means consolidating your holiday credit card debt into your mortgage, for others it could be car loans, education, etc. Regardless of the type of debt, consolidating into your mortgage allows for one easy payment instead of juggling multiple loans. Plus, in most cases, the interest rate on your mortgage is less than you would be charged with credit card companies.

Start on that Reno

Do you have projects around the house you’ve been dying to get started on? Renewal time is a great opportunity for you to look at utilizing some of your home equity to help with home renovations so you can finally have that dream kitchen, updated bathroom, OR you can even utilize it to purchase a vacation property!

Change Your Mortgage Product

Are you not happy with your existing mortgage product? Perhaps you’re finding that your variable-rate or adjustable-rate mortgages are fluctuating too much and you want to lock in! Alternatively, maybe you want to switch to variable as interest rates start to level out. You can also utilize your renewal time to take advantage of a different payment or amortization schedule to help pay off your mortgage faster!

Change Your Lender

Not happy with your current lender? Perhaps a different bank has a lower rate or a mortgage product with terms that better suit your needs. A mortgage renewal is a great time to switch to a different bank or credit union to ensure that you are getting the value you want out of your mortgage if you are finding that your needs are not currently being met.

Regardless of how you feel about your current mortgage and what changes you may want to make, if your mortgage is coming up for renewal or is ready for renewal, please don’t hesitate to reach out to me! I’d be happy to discuss your situation and review any changes that would be beneficial for you to reach your goals; from shopping for new rates or utilizing that equity! I can help you find the best option for where you are at in your life now and help you to ensure future financial success.

Winterizing Your Home

We Canadians are no strangers to the chill of the winter season!

As we shift into the final few months of 2023, now is a great time to check your home before the cold front hits. Below I have included a few tips that could help you save on bills, prevent future repair costs, and be more comfortable all winter long.

- Inspect Your Fireplace: There is no better time than now to have your fireplace inspected to ensure optimal efficiency and heat output. Whether you have a wood-burning, gas, or electrical fireplace, proper maintenance can go a long way for your heating bill!

- Maintain Your Furnace: While you’re having your fireplace inspected, don’t forget to maintain your furnace! If your furnace is getting up there in age, you may want to also consider replacing it as typically newer furnaces are more efficient than the previous generation, which could help save on energy costs. Either way, ensuring your furnace is in working order will guarantee top output and a cozy winter!

- Clean The Gutters: The last thing you want is your gutters to be clogged when the snow hits! Cleaning your gutters from Fall leaves and other debris will help ensure proper drainage for melting snow. For those who want to go the extra step, consider gutter guards which can help keep out unwanted objects from your gutters.

- Examine Your Roof: While you’re prepping your gutters for the winter, it is a good idea to also examine your roof. A few things to look for include broken or missing shingles, damaged flashing, staining from water leakage, and ventilation.

- Consider a Programmable Thermostat: According to experts, a degree drop in your home temperature can measure up to 1% on your heating bill. For those of us who don’t like to have cold feet all season, smart thermostats are a great way to keep warm and optimize your energy savings! Ideally, you want to set your thermostat to turn on in the morning, off when you go to work, and back on in the evening to ensure a toasty welcome.

- Insulate Windows: Always be sure to check your windows for any gaps or water leakage and get them resealed as soon as possible. If you live in a particularly cold location, consider swapping out your windows to double-paned glass for an added layer of insulation. Another tip to keep the cold from seeping in through your windows is swapping out your curtains for a heavier, thermal-lined set which can do wonders!

- Check Your Pipes: Checking pipe joints for leaks that could cause rot and damage will save you trouble in the future. Repair any cracks you find, especially those around electrical outlets and alarm system lines. You can also consider foam pipe insulation, which is fairly easy to install and could help prevent energy loss and potential water damage from frozen pipes.

- Stock Up on Supplies: There are a few things you might want to consider stocking up on ahead of time for the winter season, such as flashlights and batteries, ice melt, extra pet food and canned goods, and an emergency storm kit that includes an extra flashlight, candles, portable radio, water, and snacks.

With a little preparation, you can keep your home in good shape without needing to feel the cold bite of winter!

Economic Insights from Dr. Sherry Cooper

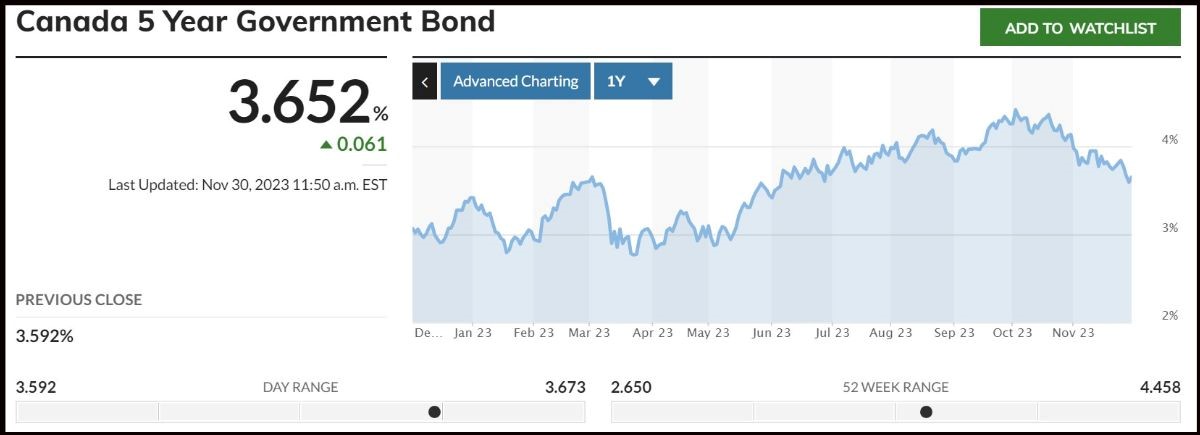

The Canadian economy is showing continued signs of slowing as inflation decelerates. This opens the door for a continued pause in rate hikes. Indeed, with any luck, the Bank might have finished its tightening cycle.

One more rate hike is possible, especially if continued Middle East tensions lead to a sustained oil price increase, but the odds are against it.

This does not suggest, however, that interest rates will decline anytime soon. Headline inflation in September was posted at a 3.8% year-over-year pace, well above the Bank’s 2% target. Wage inflation remains at roughly 5%, and inflation expectations remain high.

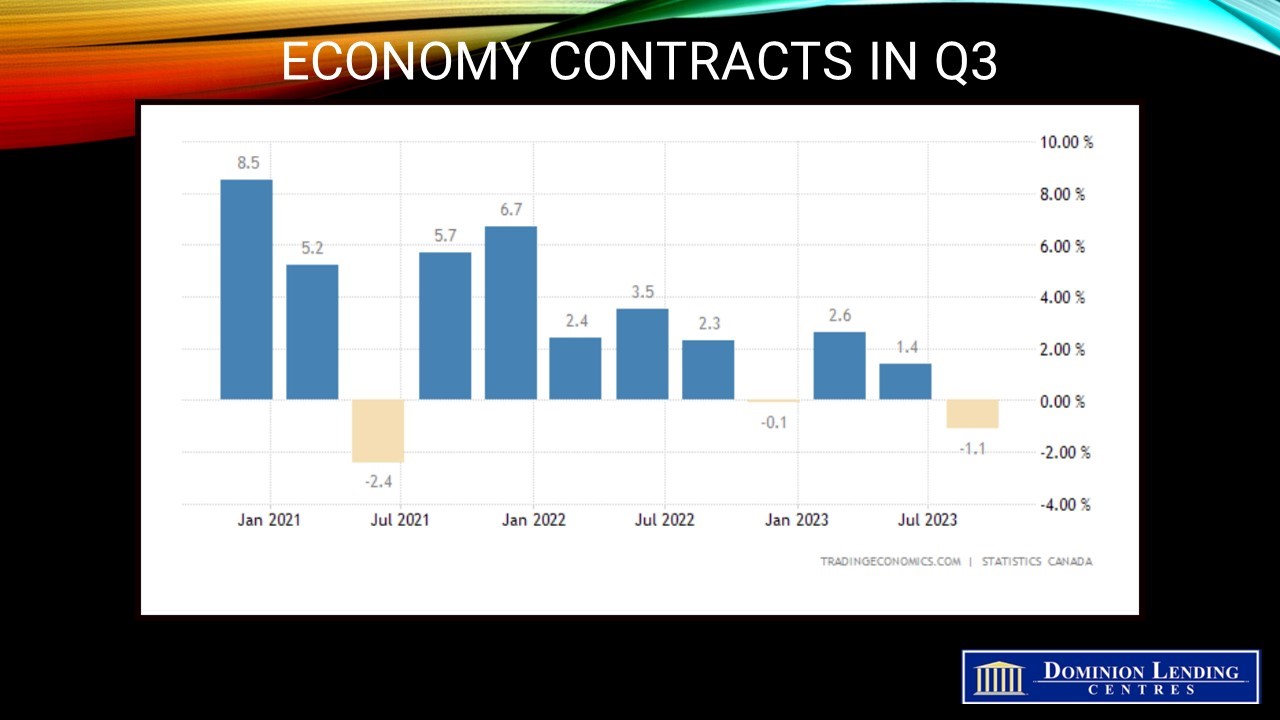

However, the economy is slowing, and excess demand in labour markets is waning. Third-quarter economic growth is likely to be less than 0.5%, and leading economic indicators are pointing to a further slowdown in the final quarter of this year and the first quarter of 2024.

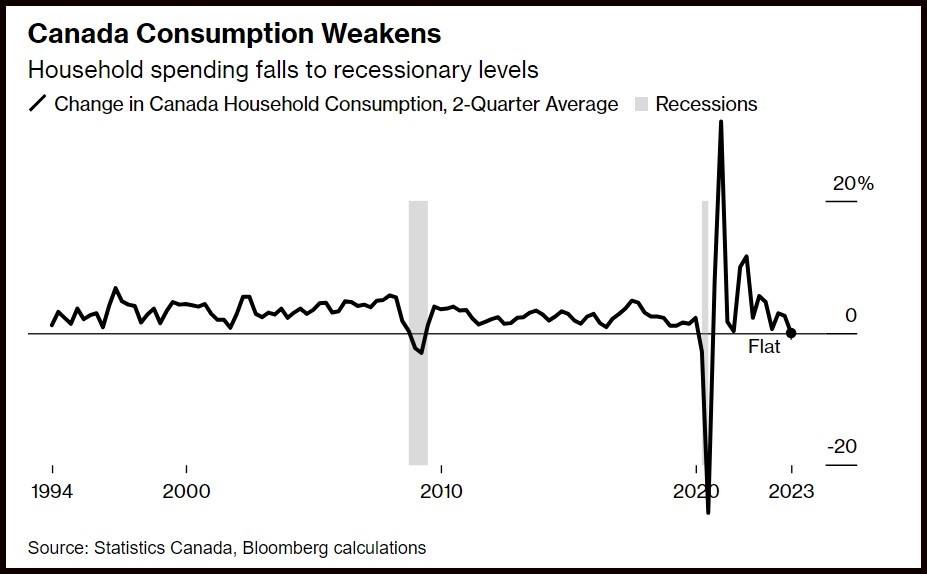

Canadian consumers, weighed down by record debt loads and high prices, are tightening their purse strings. Savings rates have fallen, and retail sales per capita have slowed markedly. Sales were down in six subsectors: car dealers, furniture, electronics, and appliance retailers.

Canadians are quickly rolling back their purchases of goods as more households face mortgage payment renewals. The Bank of Canada consumer survey suggested that families expect more adverse effects ahead as an increasing volume of mortgages come due for renewal or refinancing.

Businesses are also tightening their belts as the recent Bank of Canada Business Outlook survey showed considerable weakness. The Bank is counting on softening demand to translate into a slower inflation rate in the coming months.

I expect the central bank to cut interest rates in mid-2024, gradually taking the overnight policy rate down. In the meantime, housing markets will continue seeing a surge in new listings and more favourable buying opportunities.

Angela Calla is an 19-year award-winning woman of influence which sets her apart from the rest. Alongside her team, Angela passionately assists mortgage holders in acquiring the best possible mortgage. Through her presence on “The Mortgage Show” and through her best-selling book “The Mortgage Code“, Angela educates prospective home buyers by providing vital information on mortgages. In light of this, her success awarded her with the 2020Business Leader of the Year Award.

Angela is a frequent go-to source for media and publishers across the country. For media interviews, speaking inquiries, or personal mortgage assistance, please contact Angela at hello@countoncalla.ca or at 604-802-3983.

Click here to view the latest news on our blog.