Canadian Inflation Falls Within Bank of Canada’s Target Range; Food and Shelter Costs Remain High

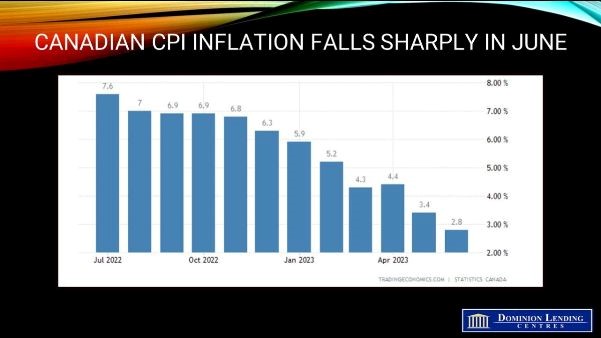

June inflation data released today by Statistics Canada showed that the Consumer Price Index (CPI) rose 2.8% year-over-year (y/y), slightly below expectations. This was the lowest CPI reading since February 2022.

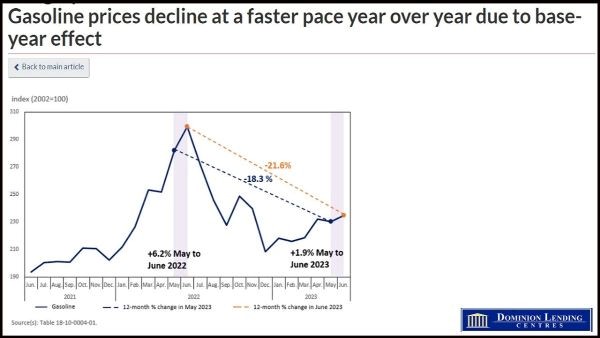

The decline in inflation was mainly due to lower energy prices, which fell by 21.6% y/y. Without this decline, headline CPI inflation would have been 4.0%. The year-over-year decrease resulted from elevated prices in June 2022 amid higher global demand for crude oil as China, the largest importer of crude oil, eased some COVID-19 public health restrictions. In June 2023, consumers paid 1.9% more at the pump compared with May.

Food and shelter costs remained the two most significant contributors to inflation, rising by 9.1% y/y and 4.8% y/y, respectively. Food prices at stores have risen nearly 20% in the past two years, the most significant rise in over 40 years. Shelter inflation rose slightly from 4.7% y/y in May.

The largest contributors within the food component were meat (+6.9%), bakery products (+12.9%), dairy products (+7.4%) and other food preparations (+10.2%). Fresh fruit prices grew at a faster pace year over year in June (+10.4%) than in May (+5.7%), driven, in part, by a 30.0% month-over-month increase in the price of grapes.

Food purchased from restaurants continued to contribute to the headline CPI increase, albeit at a slower year-over-year pace in June (+6.6%) than in May (+6.8%).

Services inflation cooled to 4.2% y/y from 4.8% y/y in May. This was due to smaller increases in travel tours and cellular services.

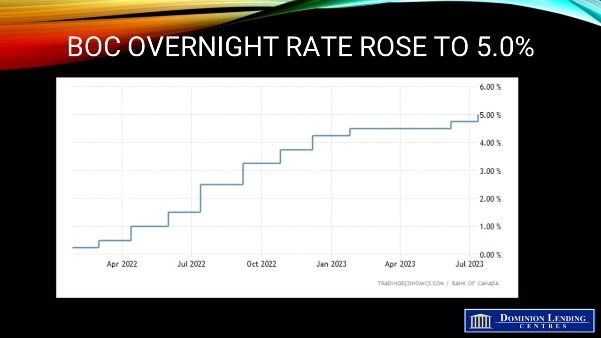

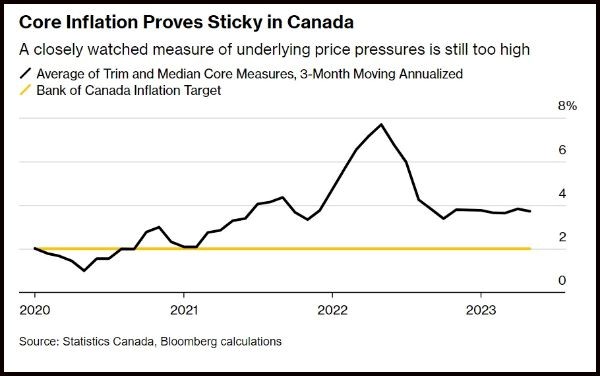

The Bank of Canada’s target range for inflation is 1% to 3%. While June’s inflation reading was within the target range, it is still higher than the Bank would like. The Bank raised the overnight policy rate twice in the past two months to reduce the stickier elements of inflation.

There were signs of easing price pressures for consumer goods also. Durable goods inflation continued to cool to 0.8% y/y in June. Passenger vehicle prices rose slower in June (+2.4%) than in May (+3.2%). The year-over-year slowdown resulted from a base-year effect, with a 1.5% month-over-month increase in June 2022 replaced with a more minor 0.6% month-over-month increase in June 2023. This coincided with improved supply chains and inventories compared with a year ago. Household furniture and equipment was up only 0.1% y/y in June, down from a peak of 10.5% last June.

The June inflation data provides some relief to consumers, but it is clear that food and shelter costs remain a major concern. The Bank of Canada will closely monitor inflation in the coming months to see if it is on track to return to its 2% target. There is another CPI report before the Bank meets again on September 6th.

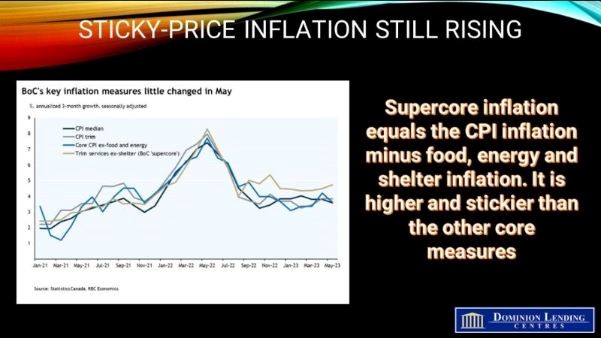

The Bank of Canada’s underlying inflation measures cooled further in May. CPI-trim eased to 3.7%y/y in June from 3.8% y/y in May, and CPI-median registered 3.9% versus 4.0% y/y in May. The chart below shows the closely watched measure of underlying price pressures, the three-month moving average annualized of the core measures of CPI. They continue to be just under 4%.

Canadian inflation continued to make encouraging progress in June. However, the cooling in headline inflation benefits from sizeable base effects due to the favourable comparison to high energy prices last June. The Bank of Canada (BoC) is watching its preferred core measures, which continue to show glacial progress.

Bottom Line

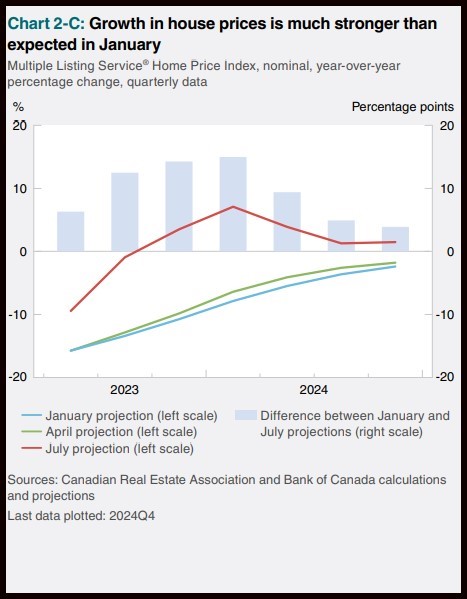

It takes time for the full effect of interest rate hikes to feed into the CPI. Mortgage interest costs will continue to rise as higher interest rates flow gradually through to household mortgage payments with a lag as contracts are renewed.

BoC Governor Macklem emphasized last week that the Bank has become worried about the persistence of underlying inflation pressures in the economy. The June inflation data likely provides some reassurance that things are moving in the right direction, but not fast enough for the Bank of Canada to let its guard down.

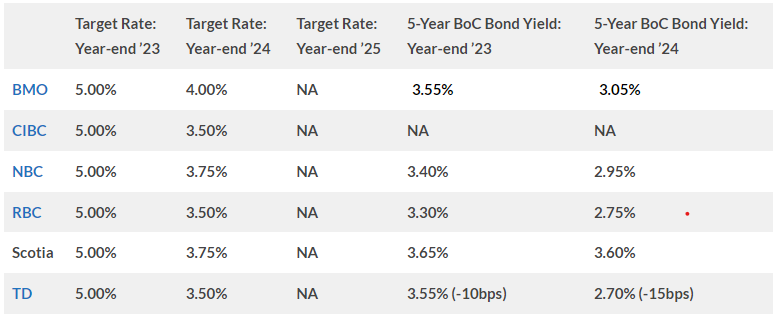

The BoC is facing a difficult balancing act. It needs to raise interest rates enough to bring inflation under control, but it also needs to be careful not to raise rates so high that it causes a recession. The next few months will be critical for the BoC as it assesses the risks of inflation and recession.

(Courtesy of Dr. Sherry Cooper, Chief Economist, Dominion Lending Centres)

Angela Calla is an 19-year award-winning woman of influence which sets her apart from the rest. Alongside her team, Angela passionately assists mortgage holders in acquiring the best possible mortgage. Through her presence on “The Mortgage Show” and through her best-selling book “The Mortgage Code“, Angela educates prospective home buyers by providing vital information on mortgages. In light of this, her success awarded her with the 2020Business Leader of the Year Award.

Angela is a frequent go-to source for media and publishers across the country. For media interviews, speaking inquiries, or personal mortgage assistance, please contact Angela at hello@countoncalla.ca or at 604-802-3983.

Click here to view the latest news on our blog.