The Bank of Canada is widely expected to deliver a second consecutive quarter-point rate hike this Wednesday, which would bring its benchmark lending rate to a 22-year high of 5%.

It would also imply a similar increase to the prime rate by week’s end, bringing it to 7.20%. That would have an immediate impact on borrowers with a variable-rate mortgage or a personal or home equity line of credit.

Forecasts from all of the Big 6 banks, as well as 20 of 24 economists polled by Reuters, expect the Bank to hike rates at this week’s monetary policy meeting.

Observers say it’s unlikely that the Bank of Canada would have ended its rate pause last month for the sake of a single quarter-point increase, and that key economic data reports in recent weeks haven’t been weak enough to avert another hike.

“If the Bank thought policy wasn’t sufficiently restrictive on June 7, a single 25-bps rate increase last month probably wouldn’t be enough to bring things into balance,” economists from National Bank noted in a research note. “It’s true that recent data haven’t been as unambiguously strong as they were between the last two meetings, but data also probably weren’t weak enough to change their assessment in a material way.”

What the forecasters are saying…

On the rate decision:

- National Bank: “The BoC has been notoriously difficult to predict this hiking cycle, half of their 12 decisions since January 2022 coming out different than markets anticipated going in. So our message is this: expect a hike… but don’t be shocked if the BoC holds. They’ve done it before, and they could very well do it again.”

On the Monetary Policy Report

- BMO: “The 2023 GDP growth forecast will likely get an upgrade after the Q1 beat. In addition, Q2 GDP could get a modest bump higher from the 1% estimate in April. The Q3 forecast will be introduced, and expect something in the 0%-to-1% range. We’ll be watching to see if the upgraded growth history/near-term forecast impacts the timing of the closing of the output gap and, in turn, when inflation returns to the 2% target. Recall that the April MPR forecast had inflation returning to target at the end of 2024.”

On BoC guidance:

- National Bank: “Looking ahead, we don’t think the BoC will explicitly guide to additional rate increases in the press release (just as they didn’t in June), but we also don’t expect another pause declaration. Rather, they might introduce some less aggressive language that stresses the importance of moving more cautiously at clearly restrictive policy settings. A ‘dovish hike’ would take the pressure off September and allow a full three months to assess the impact of these latest 50 bps of hikes (in addition to the earlier 425 bps). We do expect that July’s hike will be the last of the cycle as the economy more clearly weakens over coming months.”

On rate cuts:

- Scotiabank: “It wasn’t long ago that markets were pricing BoC rate cuts to have been delivered by now. Note the plural reference. This easing of financial conditions was premature and the BoC had to lean against it in the face of the previously cited arguments. They have succeeded in doing so as markets have cried Uncle and are no longer pricing cuts this year or for much of next year for that matter.” (Source)

On inflation:

- Scotiabank: “Given that inflation expectations are continuing to indicate little faith in the ability of the BoC to hit its 2% inflation target over the coming years, monetary policy is already in a race against the clock to convince businesses and households as they make decisions about potential wage gains, contracts, purchasing and investment. With each passing month that the economy remains resilient and inflation remains uncomfortably high, the BoC runs the risk of never getting control of inflation.” (Source)

On employment and GDP:

- Desjardins: “With a full quarter of employment data, our tracking of Q2 2023 real GDP growth sits in the range of 1.5% to 2% (q/q annualized). That remains better than the 1% pencilled in by the Bank of Canada in its last Monetary Policy Report. The strong jobs print virtually assures another 25-bps hike at the Bank’s next meeting…and keeps the door open for more increases going forward. For the time being, the central bank should see the vitality of the labour market and resilience of the overall economy as warranting another rate hike.”

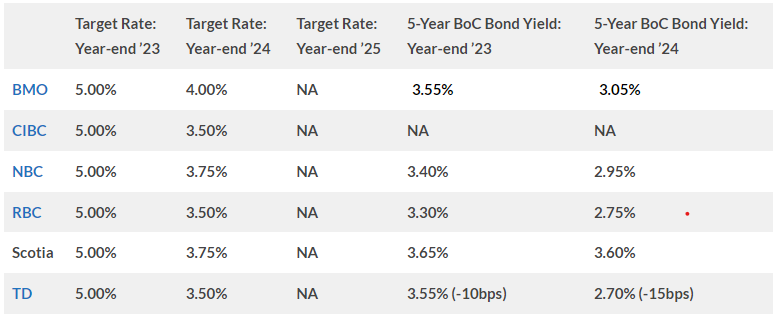

The latest Bank of Canada rate forecasts

The following are the latest interest rate and bond yield forecasts from the Big 6 banks, with any changes from their previous forecasts in parenthesis.

(Article courtesy of canadianmortgagetrends.com)

Angela Calla is an 19-year award-winning woman of influence which sets her apart from the rest. Alongside her team, Angela passionately assists mortgage holders in acquiring the best possible mortgage. Through her presence on “The Mortgage Show” and through her best-selling book “The Mortgage Code“, Angela educates prospective home buyers by providing vital information on mortgages. In light of this, her success awarded her with the 2020Business Leader of the Year Award.

Angela is a frequent go-to source for media and publishers across the country. For media interviews, speaking inquiries, or personal mortgage assistance, please contact Angela at hello@countoncalla.ca or at 604-802-3983.

Click here to view the latest news on our blog.