Cole’s Notes on our Annual MPC conference

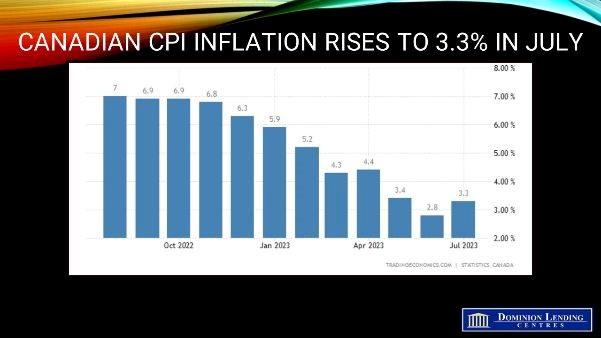

Inflation is a lagging indicator

Bank of Canada will choose a recession over high inflation (Central Banks worldwide are seen as inflation fighters)

Bank of Canada would rather overshoot (increase more than needed and/or stay higher for longer than needed) despite the economic risk that presents

Currently, the odds of BoC overshooting is 80%

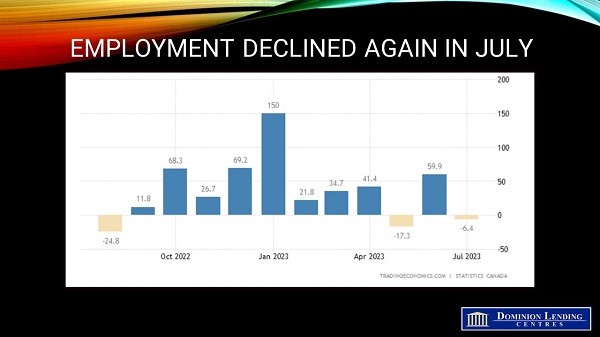

GDP is down 3% on a per capita basis right now

Immigration and $165 Billion in excess savings have saved the economy up until now

Savings have been depleted and people are relying more on credit resulting in more effective monetary policy re higher rates.

With GICS offering over 5%, even those with savings aren’t spending as much as they look to buy GICs with higher returns than what we have seen for years

Spread between BoC and US Fed Reserve is currently only 25bps where typically the spread is 75bps (with Canada being lower)

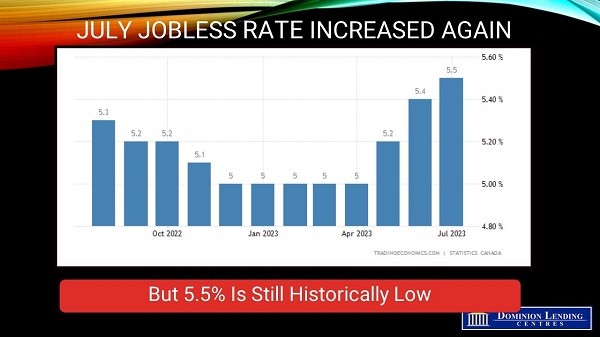

BoC is more effective with rate increases as Canadians carry more debt and are subject to rate increases sooner (US has 30 year rate terms while we are typically 1-5 year fixed)

Canada has the lowest rate of inflation of the G7 nations (due to our high debt loads and shorter rate terms)

During Covid, about 80% of inflation was driven by supply chain issues – these are now resolved – monetary policy has no impact on supply chain. Retailers used supply chain as an excuse to increase prices and improve profits

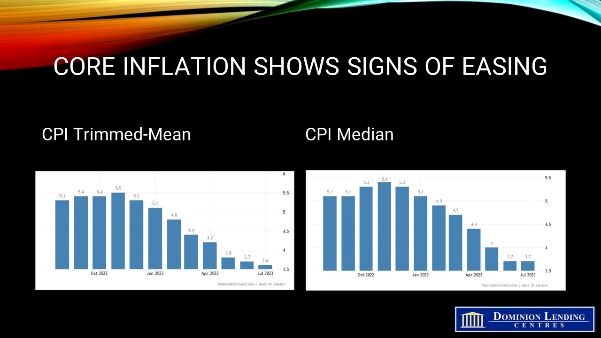

Today, 80% of inflation is cause by demand making monetary policy more effective and retailers profit margins are shrinking

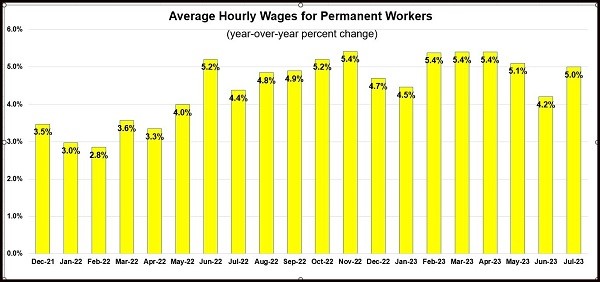

80% of the cost of services is wages – labour market is finally normalizing and wage growth is slowing. Fewer people are quitting jobs and changing industries.

Predictions:

Ben predicts that if month over month inflation today comes in at > 2%, expect a rate increase on the 25th – said as of yesterday, odds are 50/50

He expects the overnight rate will settle around 3% (currently 5%) with the first decreases beginning in Jun/July 2024

57% of ALL mortgages in Canada renew in 2025/2026- Rates MUST come down or we are in deep trouble

Expect prices to be under pressure over the next 6 months. More listings with fewer qualified buyers

Don’t expect to see improvements to affordability

Foreign Student population is mis-counted by 250,000 people – when asked where their primary residence is by Stats Can, many report their home country despite living in Canada AND, it’s assumed they will leave the country within 30 days of student visa expiring. Some leave, but many remain applying for extensions, PR, work permits – this accounts for another approx. 750,000 people not being counted

Unless the government gets a handle on housing, there could be rental strikes, civil unrest, increased anti-immigration sentiment. Removing GST on purpose built rentals helps, but not enough. Projects (rental and owner-occupied) suffer lengthy delays exacerbating issues.

Angela Calla is an 19-year award-winning woman of influence which sets her apart from the rest. Alongside her team, Angela passionately assists mortgage holders in acquiring the best possible mortgage. Through her presence on “The Mortgage Show” and through her best-selling book “The Mortgage Code“, Angela educates prospective home buyers by providing vital information on mortgages. In light of this, her success awarded her with the 2020Business Leader of the Year Award.

Angela is a frequent go-to source for media and publishers across the country. For media interviews, speaking inquiries, or personal mortgage assistance, please contact Angela at hello@countoncalla.ca or at 604-802-3983.

Click here to view the latest news on our blog.