Welcome to the December issue of my monthly newsletter!

As we get closer to the end of the year, we have some special New Year resolutions for your home! Plus, check out some of my favourite holiday desserts. In addition, don’t miss the latest economic insights direct from Dr. Sherry Cooper!

New Year Resolutions for Your Home

The New Year is approaching! While we are in the spirit of goal planning and setting our intentions for the coming months, don’t forget about your home!

There are several things you can do to make your home and finances work for you in 2024:

Review Your Home Budget (or make one!): Money can be a stressful subject, but creating a home budget and keeping it updated whether annually, bi-annually, or monthly can truly help you get a handle on your cash flow and what you are spending on. An annual review of your budget at minimum to account for changes in wages, loan payments, expenses and more is a great way to get 2024 off to a balanced start! This is also a good opportunity to think about future renovations, vacations or expenses so you can start a savings fund to meet your goals!

Embrace Minimalism: Heading into January is a great time to take stock of your home and life. For many people, embracing minimalism has allowed them to declutter their minds and increase clarity to focus on what matters in life. Clearing out old furniture, clothes, or anything that doesn’t bring you peace, is a great way to live in the moment and align your home.

Cut Your Carbon Footprint: Your home is a great place to cut energy! Everything from switching off the lights when you leave a room to dialing down your air conditioner and heating, to installing LED bulbs and energy-saving showerheads or toilets, can help you save in the long run and ensure your home is more energy-efficient for the New Year!

Get Growing: Got a green thumb or simply looking for a new hobby? Consider starting a garden at home! Whether you place large planters in your backyard, some pots on the patio, or grow some herbs in your kitchen, this can be a great way to nurture your mind and body! Plus, it adds a little extra life to your home!

Improve Your Work/Life Balance: If you are still working at home and haven’t yet nailed down a dedicated space for your office, 2024 is your year! Having a separate space for your work versus your life can help you with decluttering your brain and maximizing your time and focus both on the clock and off.

Make the Most of Your Mortgage Renewal: As discussed in our last issue, your mortgage renewal is a great opportunity to make your home put in the work for you! With lots of renewals coming up in 2024, now is the time to start thinking ahead! Choose to consolidate debt, utilize home equity, get a better rate, and more at renewal time.

Contribute to Your RRSP: Don’t forget — February 29, 2024, is the last day to make RRSP contributions for the 2023 tax year! Before your RRSP deadline, there are a few things to consider to help you get a jump start in planning for the future and increasing your peace of mind: should you invest in an RRSP or focus on paying down your mortgage? Is a debt consolidation mortgage right for you? Should you consider the Home Buyers’ Plan to help fund your down payment on your first home?

Favourite Holiday Desserts

The holidays are a wonderful time of year for the merriment, music, lights… and treats!

You’ll need to throw out the scale for this list of scrumptious holiday dessert ideas.

Gingerbread Cookies: Did you know? The oldest recorded gingerbread recipe, dating to the 16th century, is kept in the Germanic National Museum in Nuremberg! A tried-and-true classic for a reason, gingerbread is a particularly festive go-to! Whether you create gingerbread men or a gingerbread house – or a whole town (we won’t judge!) – you need the right recipe!

CLICK HERE TO DOWNLOAD THE RECIPE CARD!

Nanaimo Bars: Over the years, this delicious treat has gone by many names… The first recipe originated in the 1952 edition of the Women’s Auxiliary Nanaimo Hospital Cookbook where it was simply named “chocolate square”. A similar recipe was later published in a 1953 edition of the Edith Adams’ Cookbook with the name “Nanaimo Bar”. The recipe clipping still hangs in the Nanaimo Museum! A no-bake dessert bar, this mouth-watering treat consists of three main layers: graham wafer crumb and shredded coconut for the bottom, a custard-flavored butter icing in the middle, and a chocolate ganache on top.

CLICK HERE TO DOWNLOAD THE RECIPE CARD!

Peppermint Fudge: Originating in the 19th century, fudge is not necessarily new… but with so many additions to flavourings, it never gets old! This season, try one of our favourites – peppermint fudge! Easy to make and waiting to be enjoyed.

CLICK HERE TO DOWNLOAD THE RECIPE CARD!

Peanut Brittle: Brittle is thought to be one of the first candies ever made… and there is a lot of confusion around how it came to be. Some claim it happened by accident as a New England woman was making taffy and accidentally added baking soda in 1890! Another theory dates brittle as far back as the Celts where it was enjoyed as a traditional Celtic dessert, making its way from Europe to America! Still today, peanut brittle continues to stand the test of time as a favored treat.

CLICK HERE TO DOWNLOAD THE RECIPE CARD!

Economic Insights from Dr. Sherry Cooper

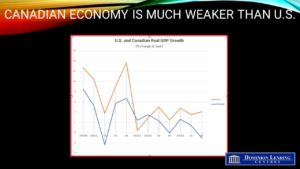

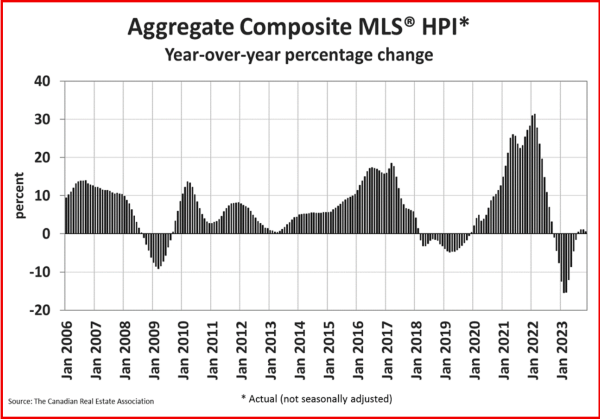

As we move into yearend, we have every reason to believe that the economy has slowed and inflation, while still above target, has dropped significantly. But slower inflation does not mean falling prices in most markets. Yes, gasoline prices are down, and food inflation has slowed, but the purchasing power of households has not improved.

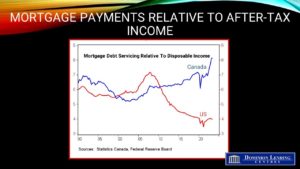

Consumer confidence is down as many households fear their mortgage renewals, where rising monthly payments will dig even deeper into their discretionary income.

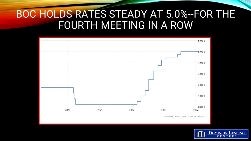

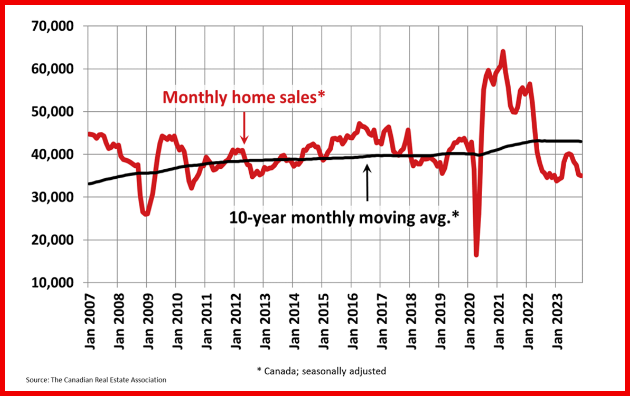

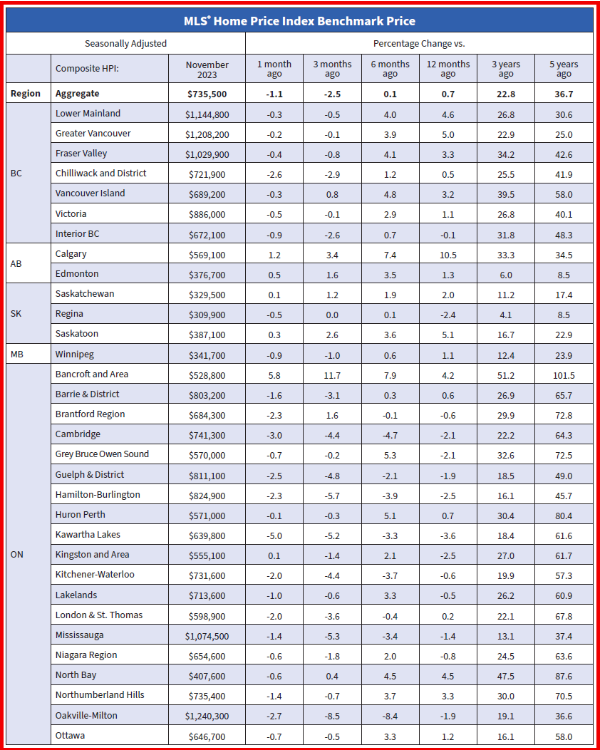

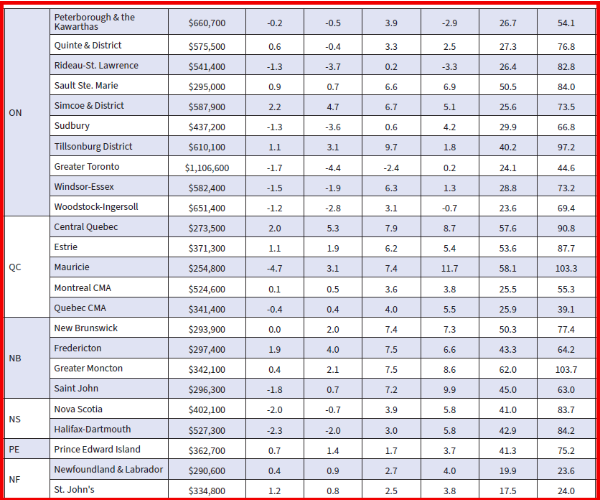

Mortgage arrears are still at historical lows, but credit card and auto loan delinquencies are rising. Housing markets have slowed considerably, even as lenders cut their fixed mortgage loan rates. Declines in variable-rate loans generally await an easing in monetary policy by the Bank of Canada, which is still likely at least six months away.

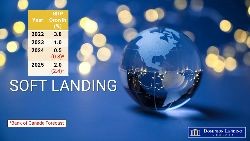

The good news is that interest rates have likely peaked. So far, the economy is on a glide path for a ‘softish’ landing. I doubt we will see two consecutive quarters of negative growth. And, if we do, the central bank will respond sooner with rate cuts.

The fiscal authorities’ hands are tied. Many accuse Ottawa of increasing budgetary red ink too quickly over the past eight years, especially during the pandemic. Now that market-determined interest rates have risen sharply, the debt financing costs are spiking. The Liberals’ popularity is waning, and while business is calling for investment tax credits and everyone wants more affordable housing, the feds can only marginally affect these issues, given budgetary and political constraints.

The latest gimmick is to reduce short-term rentals by restricting Airbnb properties in some ways, but that will again have a meagre impact. Encouraging construction with GST elimination and cheaper credit is helpful. Still, even if they do lead to 30,000 new rental properties, that’s a drop in the bucket when planned permanent immigration is slated for 500,000 people per year.

The real rebound in economic activity is coming when the BoC signals it will cut the overnight policy rate. In the meantime, it is now a buyers’ market in many localities as home prices decline. The spring housing market could show a meaningful pickup in anticipation of lower rates and more housing supply. Motivated sellers will be out there, and buyers can pre-approve and take their time finding the right fit. The multiple-bidding wars are over. The housing market will lead the economy upward next year.

Angela Calla is an 19-year award-winning woman of influence which sets her apart from the rest. Alongside her team, Angela passionately assists mortgage holders in acquiring the best possible mortgage. Through her presence on “The Mortgage Show” and through her best-selling book “The Mortgage Code“, Angela educates prospective home buyers by providing vital information on mortgages. In light of this, her success awarded her with the 2020Business Leader of the Year Award.

Angela is a frequent go-to source for media and publishers across the country. For media interviews, speaking inquiries, or personal mortgage assistance, please contact Angela at hello@countoncalla.ca or at 604-802-3983.

Click here to view the latest news on our blog.