Welcome to the September issue of my monthly newsletter!

It is already September and I am excited to share my latest newsletter with you! This month, I have some details about the upcoming Fall market, along with expert tips for staging your home! Scroll down for all the details and have a great month.

2024 Fall Market Outlook

The initial Bank of Canada rate cuts this past summer did not spur housing activity as anticipated, but potentially more on the way will continue to affect the housing market outlook. New listing levels are expected to rise as sellers who may have held back enter the market with the hope that lower mortgage rates will attract additional buyers.

While the current Bank of Canada rate of 4.5% may still not be enough to make a dent in home affordability, it does provide a glimmer of hope for potential buyers as interest rates continue to fall.

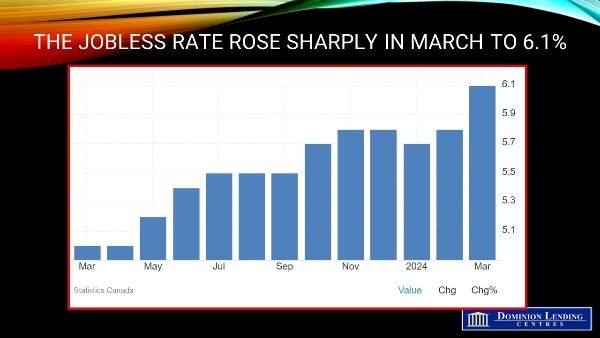

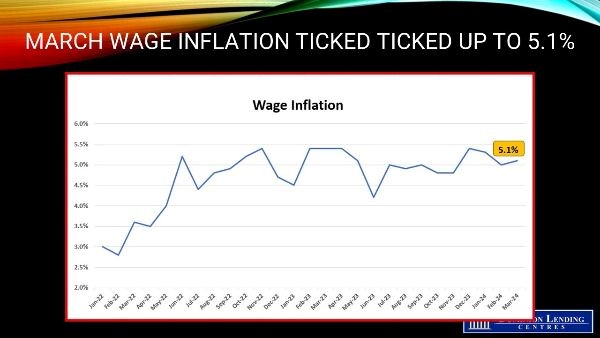

Canadians across the country are anxiously awaiting additional rate cuts, promoting future home affordability. While consumer confidence is beginning to rise, mortgage affordability will need to be balanced with rising unemployment to reduce the number of households with strained budgets.

In addition, while home prices have cooled a bit, home prices in Canada remain among the highest in the world’s most advanced economies (Japan, France, Germany, Italy, and the UK). These still -high prices have resulted in many potential first-time home buyers to withdraw for now. Higher property taxes, higher qualifying stress-test rates, and the current wave of mortgage renewals will also factor into how successful the Fall market will be.

In 2023 alone, the country saw an influx of 46% of new Canadians, which also contributes to housing demands and pricing. As rates continue to drop, the hope is that prices will stabilize owing to increased supply as demand rises.

If you are looking to get into the housing market as a buyer or seller, or simply have questions so you can best prepare yourself for a future move, don’t hesitate to reach out to me!

Expert Tips for Staging Your Home

Even in a sellers’ market, there are some ways you can improve your chances of increasing the number of offers and selling your home for the best value.

Check out these expert tips for staging your home to help make the best first impression possible:

- Clean and Declutter: Clean, clean, and clean some more! While you might not be able to stage each room in your home, it is vital to ensure that each space is cleaned and decluttered. Especially ensure that counters, carpets, flooring, and appliances are spotless! This not only signals pride of ownership, but it helps display the potential of the spaces to buyers.

- Depersonalize: While you’re working through and cleaning your spaces, make sure to depersonalize along the way. Ideally, any family photos, kids’ drawings, etc, should be removed or replaced with more general photography to better appeal to potential buyers.

- Focus on Key Spaces: The primary areas in your home are your living room, kitchen, dining room, and master bedroom. If you are not able to get to each room, these are the ones you should focus on to ensure your home is represented as best as possible.

- Consider a Fresh Coat: Did you know? According to a RE/MAX Canada Renovation Investment Report, 36% of buyers prefer a fresh coat of paint! This can go a long way to making your home look new and revitalized.

- Boost Curb Appeal: While you’re staging your home, don’t forget about curb appeal! The exterior of your home is just as important as the interior – if not MORE important for first impressions. A good place to start would be renting a power washer to scrub down your driveway and exterior walls.

Economic Insights from Dr. Sherry Cooper

As the Bank of Canada cuts interest rates, housing activity has remained relatively weak. Existing home sales were well below historical averages in July, while new listings edged upward. Prices have plateaued, and residential mortgage originations are tepid.

Mortgage balances grew by 3% annually in Q2, the second slowest quarterly pace since 2000.

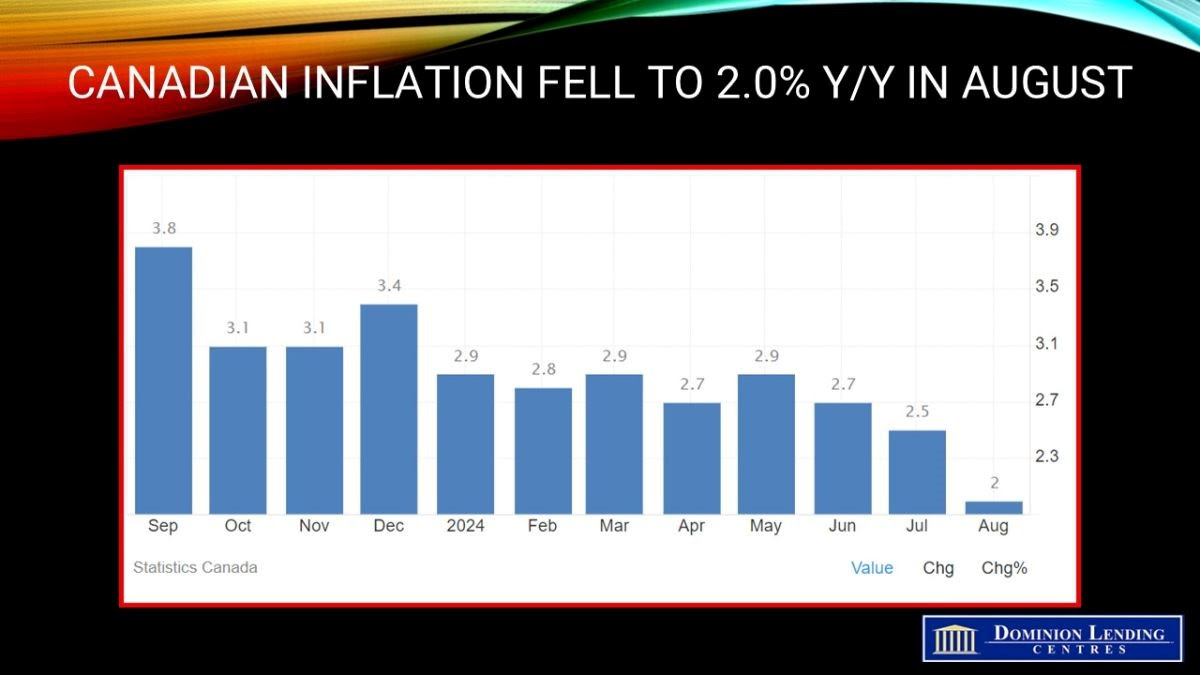

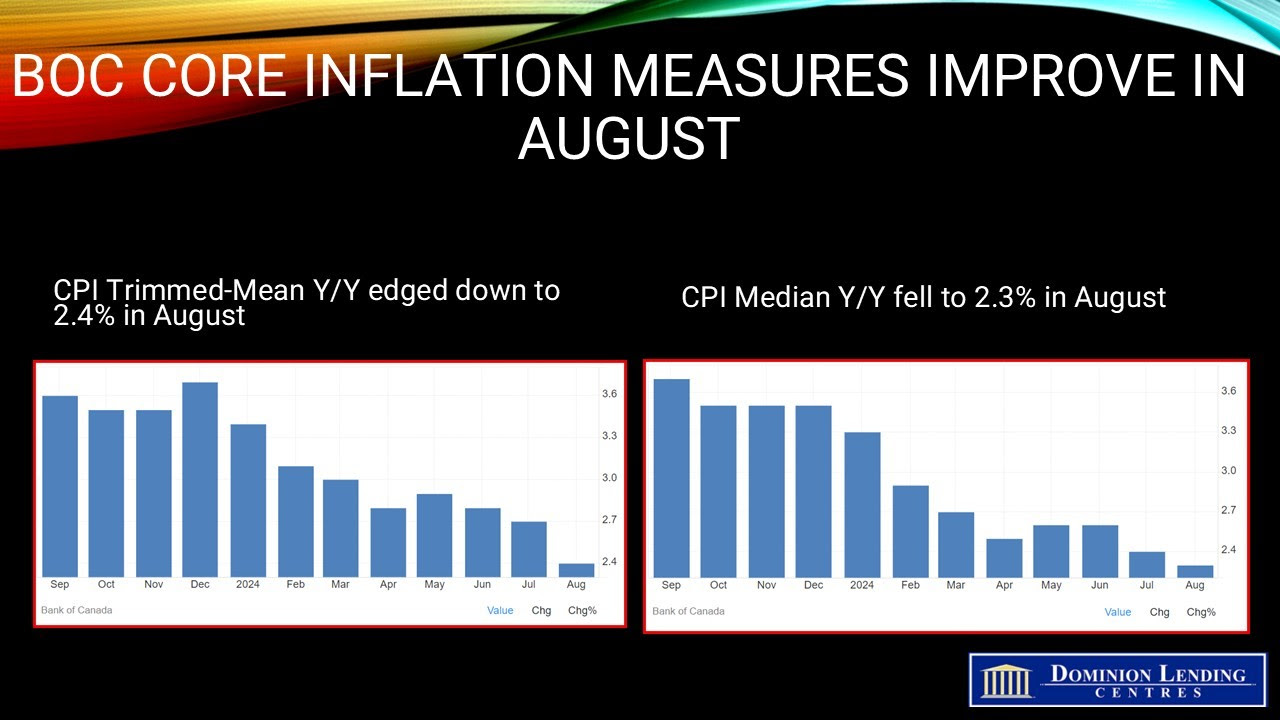

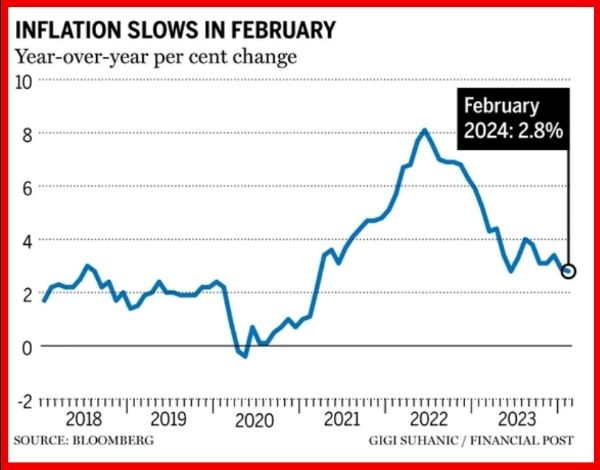

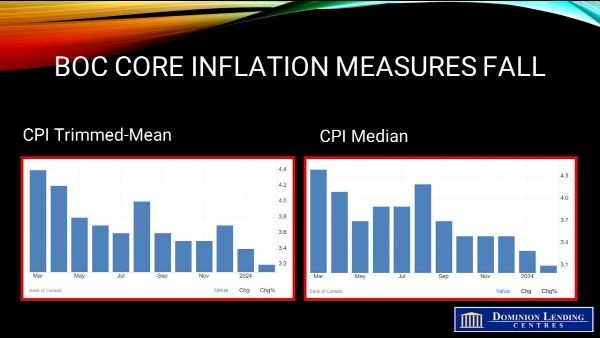

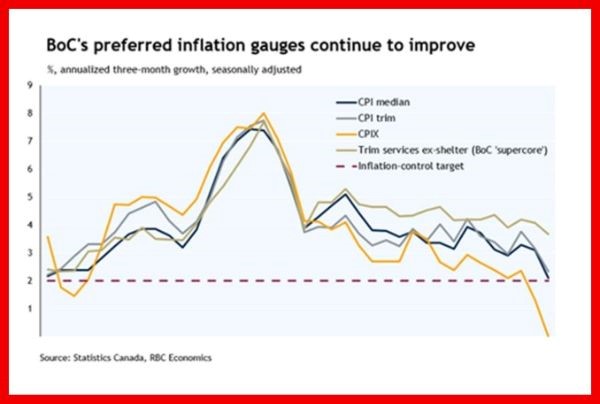

This portends a further dip in household debt-to-income ratios—welcome news, as elevated leverage drives household financial vulnerability. The central bank is widely expected to continue to cut the overnight policy rate at the remaining meetings this year and well into 2025. Monetary policy remains highly restrictive, with the policy rate at 4.5%, well above the 2.5% inflation rate.

We believe interest rates will continue to fall as the overnight rate heads for 2.75%. By later this year, housing activity is likely to pick up gradually.

In the meantime, Canadian homebuilding remains sturdy despite softness in the resale market and ongoing capacity pressures. Housing starts surged again in July. The data series is volatile, but the trend is strong at just under its recent all-time highs posted in 2021. The strength of residential starts has been dominated by multi-unit construction, while single-family starts have historically been very weak.

The home construction sector has suffered ongoing capacity pressures, including a shortage of construction workers, zoning restrictions and supply bottlenecks. These capacity pressures have delayed housing completions, bringing the number of dwellings under construction to fresh record highs.

Homebuilding has remained remarkably resilient, albeit at a much slower pace than the torrid population growth. The government plans to cool the growth in temporary immigration, but the Bank of Canada recently suggested that the slowdown is likely to be delayed and smaller than originally projected.

Meanwhile, Canadian labour markets are easing. Job vacancy rates have plunged, and unemployment has risen, especially for young workers and new immigrants.

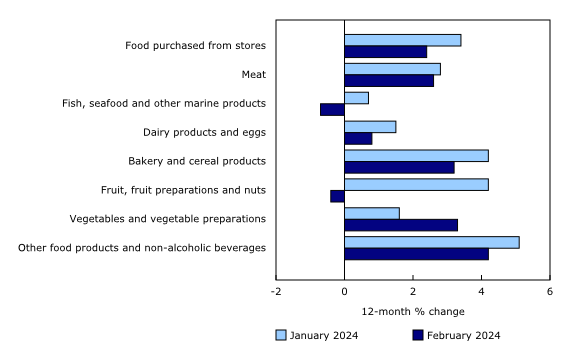

Economic growth has slowed to about 1% this year and will pick up only moderately next year. Inflation is falling without a recession. To be sure, some sectors have slowed meaningfully, especially manufacturing. Canadian businesses are bracing for billions of dollars in losses if the country’s two national railways shut down this week.

More than 9,000 workers at Canadian National Railway Co. and Canadian Pacific Kansas City Ltd. could either be on strike or locked out if no labour agreement is reached by Thursday, disrupting the supply chain industries.

Housing markets will begin to recover as lower interest rates do their job this fall.

Angela Calla is an 19-year award-winning woman of influence which sets her apart from the rest. Alongside her team, Angela passionately assists mortgage holders in acquiring the best possible mortgage. Through her presence on “The Mortgage Show” and through her best-selling book “The Mortgage Code“, Angela educates prospective home buyers by providing vital information on mortgages. In light of this, her success awarded her with the 2020Business Leader of the Year Award.

Angela is a frequent go-to source for media and publishers across the country. For media interviews, speaking inquiries, or personal mortgage assistance, please contact Angela at hello@countoncalla.ca or at 604-802-3983.

Click here to view the latest news on our blog.