As a valued member of our community, we want to ensure that you make informed decisions when it comes to purchasing presale properties in British Columbia. Buying a presale property can be an exciting investment opportunity, but it’s crucial to navigate the process wisely to avoid potential pitfalls. In this article, we’ll outline some common mistakes to steer clear of when entering the presale market in BC.

Neglecting Due Diligence:

One of the most significant mistakes buyers make is not conducting thorough research. Before committing to a presale property, investigate the developer’s reputation, project timeline, and financial stability. Verify their past projects, reviews, and track record to gain confidence in your investment. You absolutely need to use your own realtor (independent of the developer and its associates) speak with your mortgage broker, financial planner, and lawyer Consideration for what will happen and what the back up plan is in the event of

– income change

-relationship or health status change

-potential resale restrictions,

-where the deposit and closing costs are coming from, there cost and risk in value for when the closing date is or can be delayed.

Its essential to not only look at your personal life circumstances, but what you will do if the market changes and more money is demanded due to shift in market conditions or time for completion.

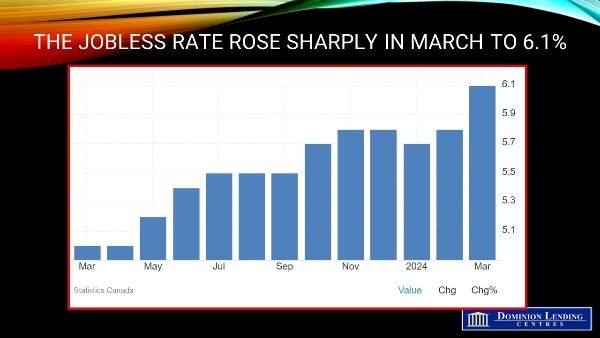

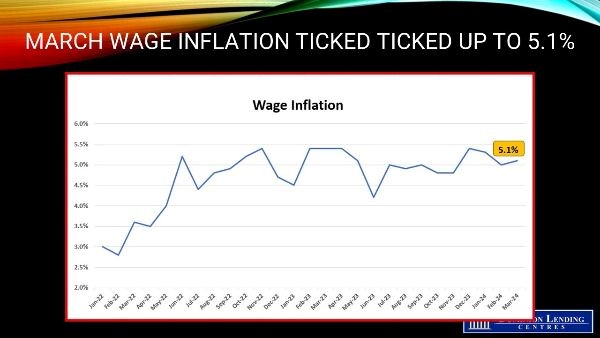

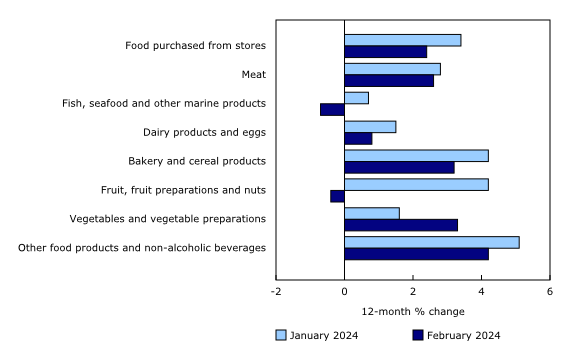

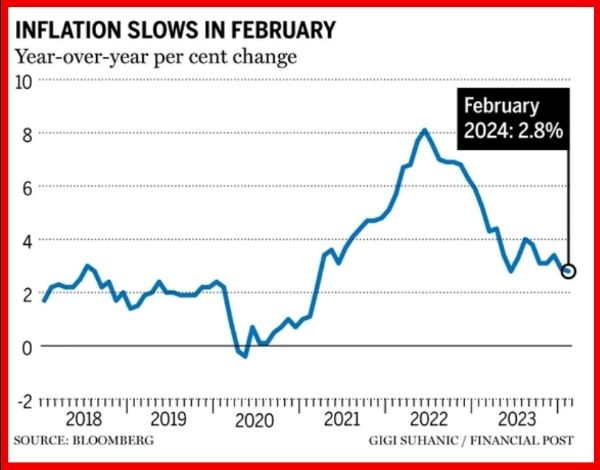

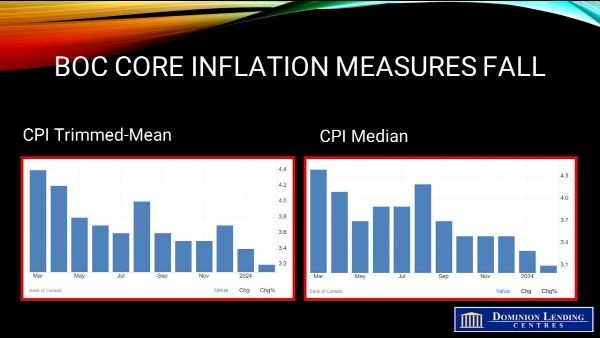

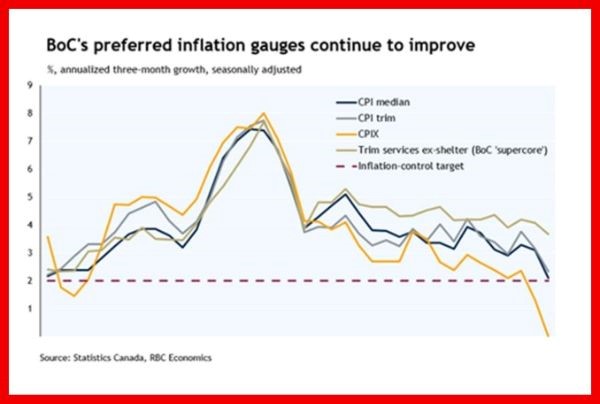

Ignoring Market Trends:

Keep a close eye on the current real estate market trends in BC. Failing to understand market conditions can lead to overpaying for a property or investing in an area that may not yield the expected returns. Consult with real estate experts, review market reports, and stay informed about economic factors influencing property values. The costliest mistake we see if clients going to a developer directly, who is biased to sell there product they are NOT there to give unbiased advise.

Underestimating Costs:

Presale prices may seem attractive, but it’s crucial to account for additional costs such as closing fees, GST, Property Transfer Tax, Property Taxes, and Strata Fees. Ensure you have a comprehensive understanding of all associated costs to avoid financial surprises down the line.

Overlooking Contract Details:

The presale contract is a legally binding document, and overlooking its details can lead to complications. Pay close attention to clauses related to completion dates, potential delays, and warranty information. Consult with a legal professional to ensure you fully comprehend the terms and conditions. While the presale market is regulated by the provincial government, contracts for presales or preconstructed units are not. He also said they can be sticky to negotiate, and the wording is weighted in favour of developers. Not only can the developer refuse to consider an “assignment” option, it’s also not required to deliver exactly what the buyer saw in a showroom.

Ignoring the Fine Print:

Developers often provide disclosure statements outlining important information about the project. Ignoring these documents can result in misunderstandings or unmet expectations. Take the time to read and understand all the fine print, seeking clarification on any points that may seem unclear. “That’s why the Real Estate Development Marketing Act requires developers to provide a disclosure statement and gives purchasers the right to cancel presale contracts within the first seven days, so consumers have time to think through their decision

Skipping Inspections:

Even though you’re purchasing a property that hasn’t been built yet, it’s crucial to hire a qualified inspector to assess the developer’s reputation and the quality of their previous constructions. An inspection can reveal potential issues and help you make an informed decision.

Overlooking Financing Options:

Buyers sometimes make the mistake of not exploring various financing options. Shop around for mortgage options with a mortgage broker, consider pre-approval, and be aware of the potential impact of interest rate changes on your financial situation. Always ensure you have a worst case scenario back up plan.

Neglecting Resale Potential:

Consider the long-term prospects of the property, including its resale potential. A presale property should not only meet your current needs but also be a sound investment for the future. Evaluate the neighborhood’s growth potential and amenities that contribute to long-term value. .” When a developer allows a contract to be re-assigned then a fee of one to three per cent of the sale price is usually charged to the original buyer and they remain legally liable to complete the purchase if the new buyer fails to do so.

By avoiding these common mistakes, you can approach the presale property market in BC with confidence and make decisions that align with your financial goals. If you have any questions or concerns, don’t hesitate to reach out to us directly for an introduction to experienced professionals to assist in guiding you through all aspects to ensure you understand the pros and cons tailored to your specific situation.

Happy house hunting!

Angela Calla is an 19-year award-winning woman of influence which sets her apart from the rest. Alongside her team, Angela passionately assists mortgage holders in acquiring the best possible mortgage. Through her presence on “The Mortgage Show” and through her best-selling book “The Mortgage Code“, Angela educates prospective home buyers by providing vital information on mortgages. In light of this, her success awarded her with the 2020Business Leader of the Year Award.

Angela is a frequent go-to source for media and publishers across the country. For media interviews, speaking inquiries, or personal mortgage assistance, please contact Angela at hello@countoncalla.ca or at 604-802-3983.

Click here to view the latest news on our blog.