Good News On the Inflation Front Suggests Policy Rates Have Peaked

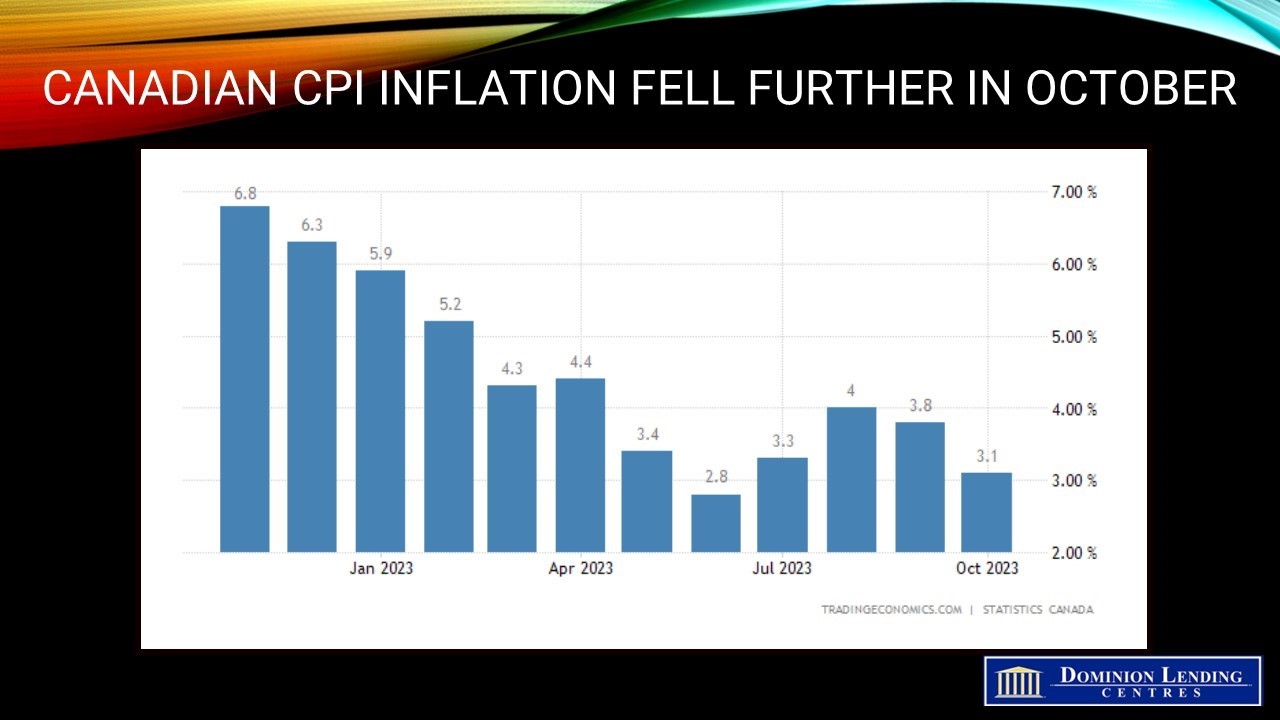

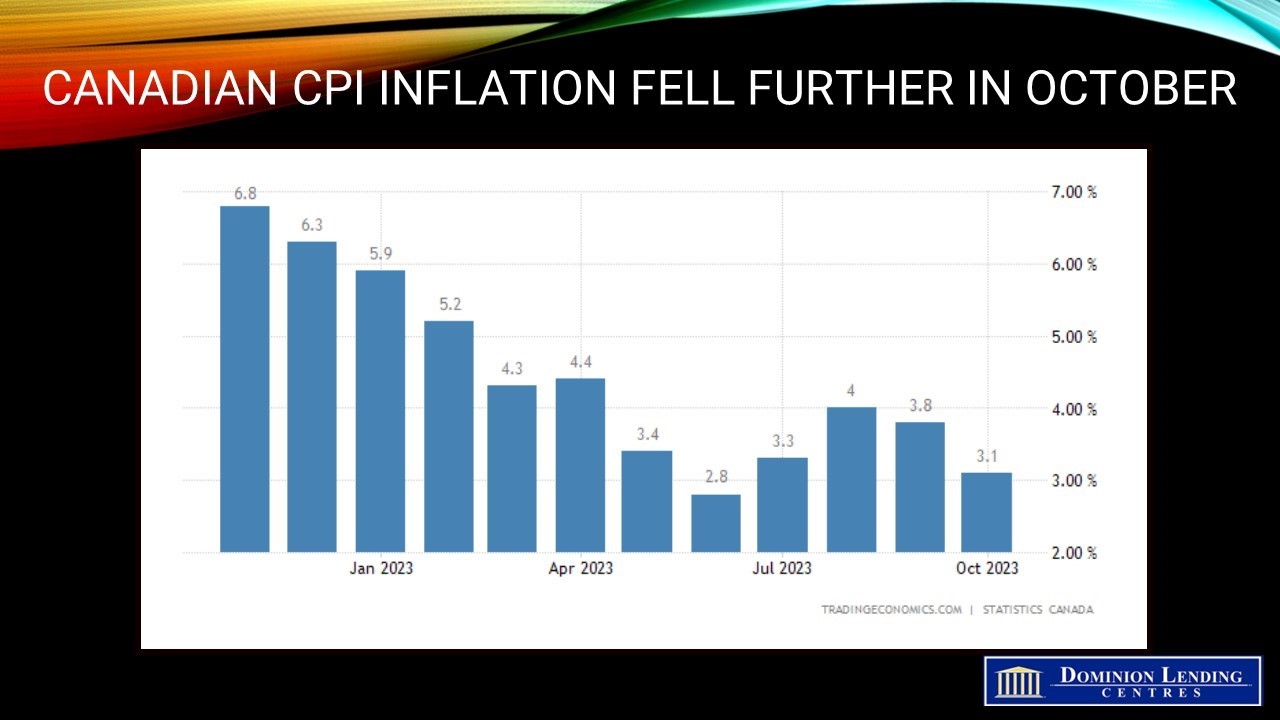

Today’s inflation report showed a continued improvement, mainly due to falling year-over-year (y/y) gasoline prices. The October Consumer Price Index (CPI) rose 3.1% y/y, down from the 3.8% rise in September. There were no surprises here, so markets moved little on the news. Excluding gasoline, the CPI rose 3.6% in October, compared to 3.7% the month before.

The most significant contributors to inflation remain mortgage interest costs, food purchased at stores, and rent.

Canadians continued to feel the impact of rising rent prices, which grew faster (y/y) in October (+8.2%) than in September (+7.3%). The national increase reflected acceleration across most provinces. The most significant increases in rent prices were seen in Nova Scotia (+14.6%), Alberta (+9.9%), British Columbia (+9.1%) and Quebec (+9.1%).

Property taxes and other special charges, priced annually in October, rose 4.9% yearly, compared with a 3.6% increase in October 2022. The national increase in October 2023 was the largest since October 1992, with homeowners paying more in all but one province, as municipalities required larger budgets to cover rising costs. Property taxes in Manitoba (-0.3%) declined for the third consecutive year, mainly due to reduced provincial education tax.

While goods prices decelerated by -1.6% as prices at the pump fell, prices for services rose 4.6% last month, primarily driven by higher prices for travel tours, rent and property taxes.

While grocery prices remained elevated, they also continued their trend of slower year-over-year growth, with a 5.4% increase in October following a 5.8% gain in September. While deceleration continued to be broad-based, fresh vegetables (+5.0%) contributed the most to the slowdown.

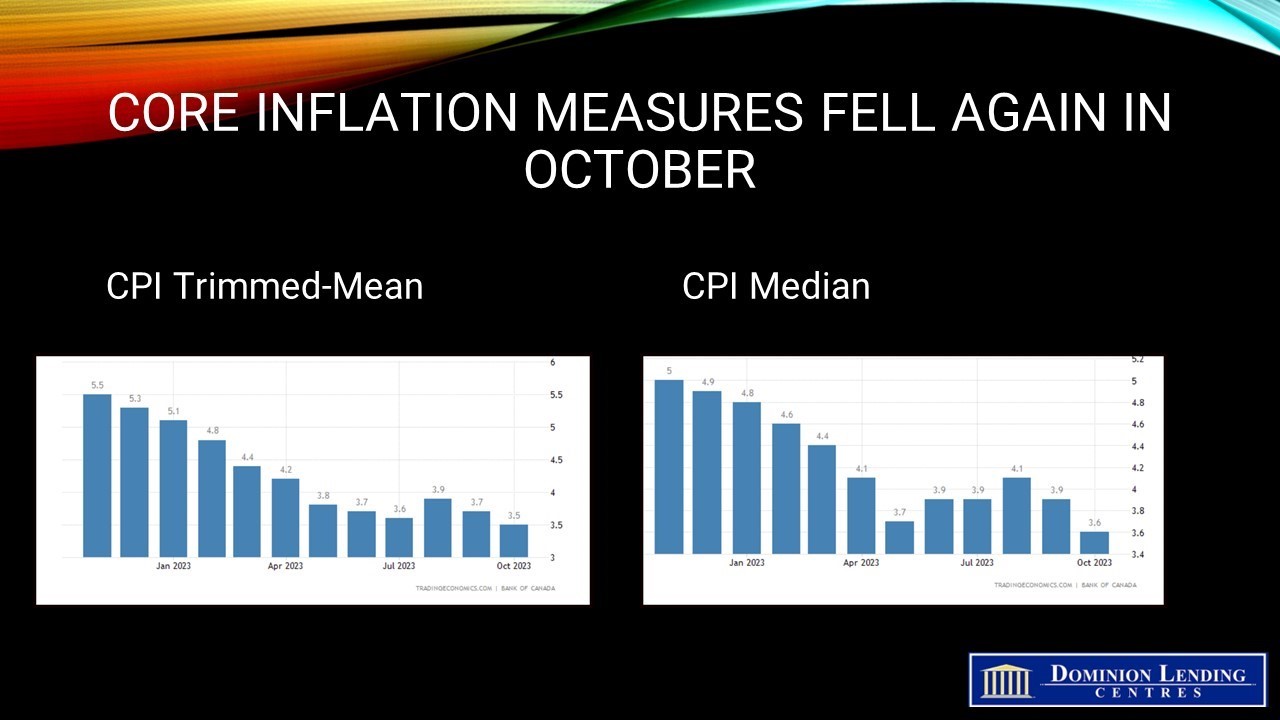

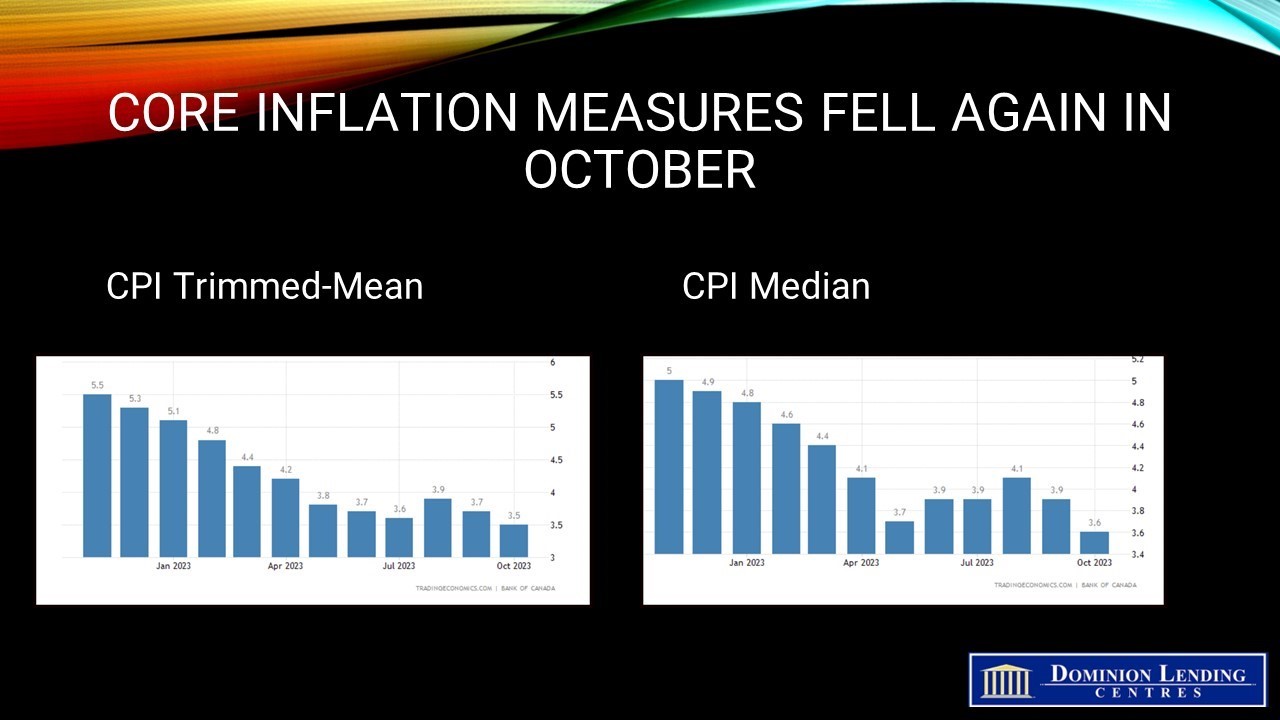

Excluding food and energy, inflation fell to 2.7% in October, down a tick from the September reading. Two other inflation measures closely tracked by the Bank of Canada–the so-called trim and median core rates–also eased, averaging 3.6% from an upwardly revised 3.8% a month earlier.

Bottom Line

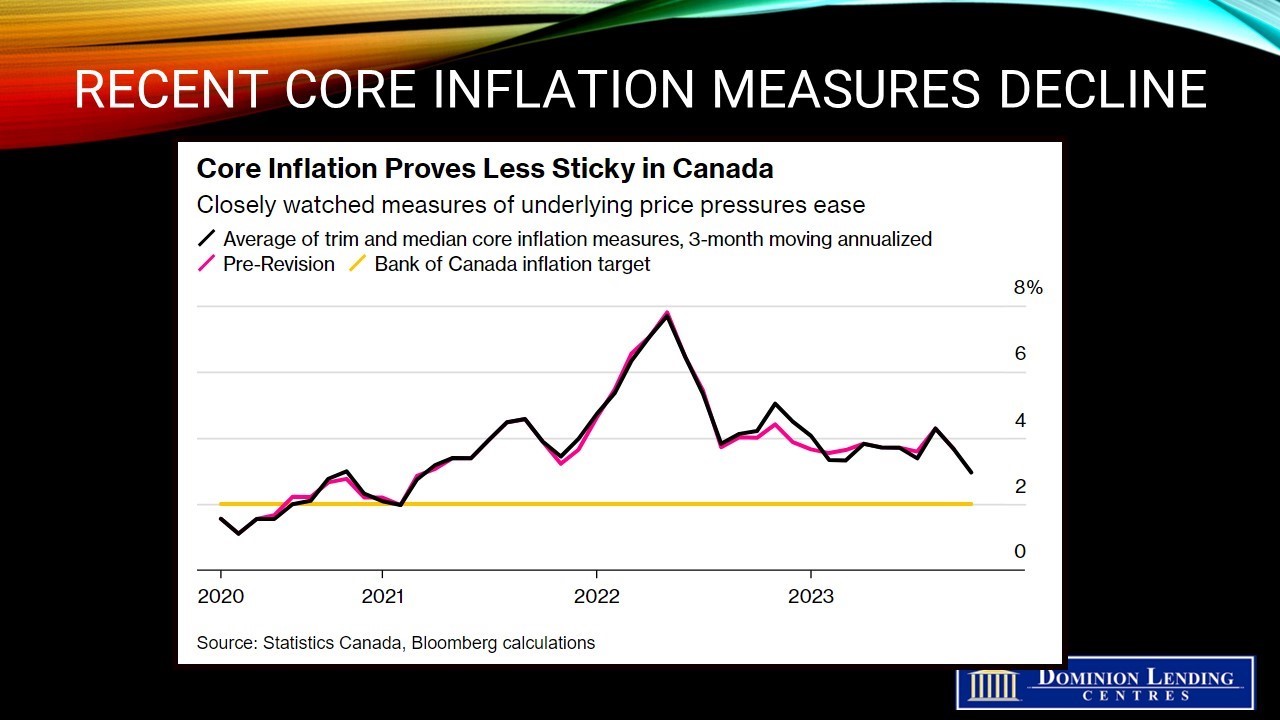

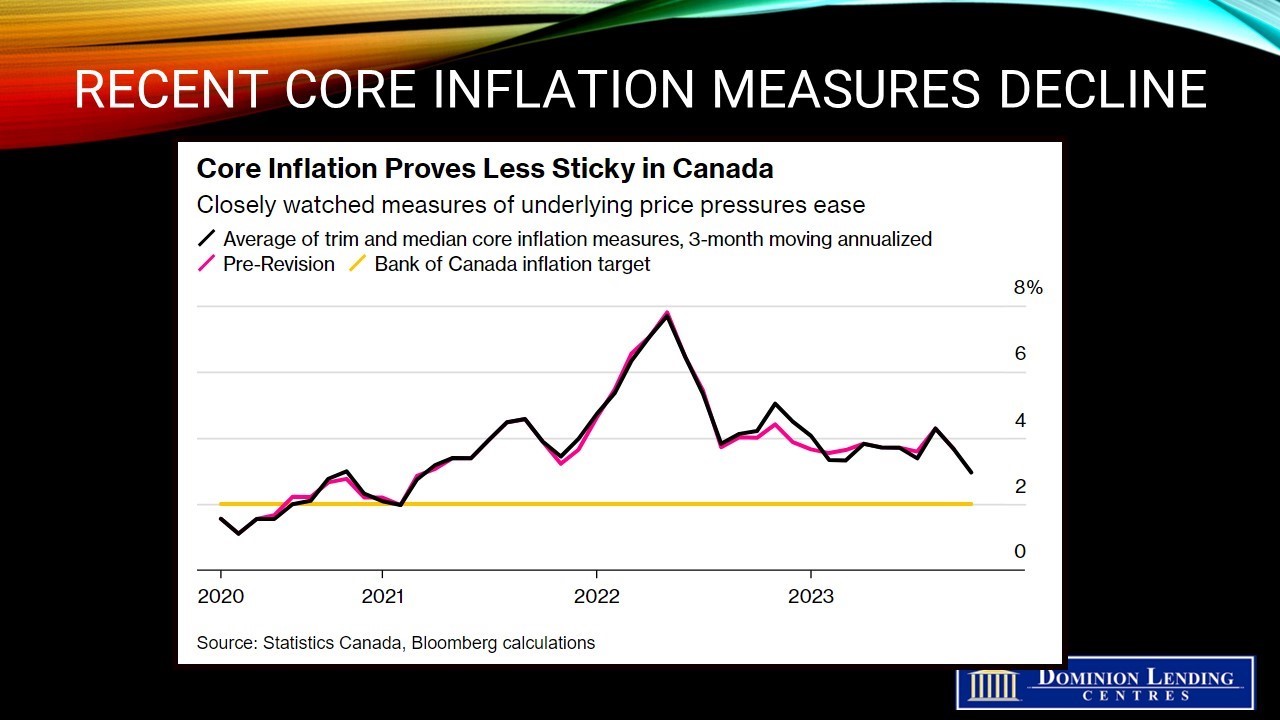

According to Bloomberg calculations, another critical measure, a three-month moving average of underlying price pressures, fell to an annualized pace of 2.96% from 3.67% a month earlier. It’s an important metric because Bank of Canada Governor Tiff Macklem has said policymakers are tracking it closely to understand inflation trends.

Today’s news shows that tighter monetary policy is working to bring down the inflation rate. In its Monetary Policy Report last month, the Bank of Canada expected the CPI to average 3.5% through mid-2024. Cutting its economic forecast, the Bank forecasted it would hit its 2% inflation target in the second half of 2025.

Given today’s data and the likely significant slowdown in Q3 GDP growth, released on November 30, and the Labour Force Survey for November the following day, policy rates have peaked. Governor Tiff Macklem will give a speech on the cost of high inflation in New Brunswick tomorrow, and the subsequent decision date for the Governing Council is December 6th. The Bank’s inflation-chopping rhetoric may be relatively hawkish, but the expectation of rate cuts could spur the spring housing market.

The economists at BMO have pointed out that “three provinces now have an inflation rate below 2%, while only three are above 3%, so much of the country is already seeing serious signs of stabilization. (Unfortunately, the two largest provinces have the fastest inflation rates—Quebec at 4.2% and Ontario at 3.3%).” There is no need for the Bank to raise rates again, and they could begin to cut interest rates in the second quarter of next year.

(Article courtesy of Dr. Sherry Cooper, Chief Economist, Dominion Lending Centres)

Angela Calla is an 19-year award-winning woman of influence which sets her apart from the rest. Alongside her team, Angela passionately assists mortgage holders in acquiring the best possible mortgage. Through her presence on “The Mortgage Show” and through her best-selling book “The Mortgage Code“, Angela educates prospective home buyers by providing vital information on mortgages. In light of this, her success awarded her with the 2020Business Leader of the Year Award.

Angela is a frequent go-to source for media and publishers across the country. For media interviews, speaking inquiries, or personal mortgage assistance, please contact Angela at hello@countoncalla.ca or at 604-802-3983.

Click here to view the latest news on our blog.