Whether you are buying your first home or have been a home owner for years, when you are looking at purchasing a property, finding the best mortgage solution for your specific situation can be an intimidating experience.

Working with a licenced mortgage broker will ease that tension, along with knowing the basics of what lenders are looking for will help you better understand the process.

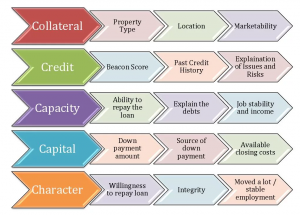

The Five C’s of Credit/Mortgages

The five Cs of credit is a system used by lenders to gauge the creditworthiness of potential borrowers. The system weighs five characteristics of the borrower and conditions of the mortgage, attempting to estimate the chance of default and, consequently, the risk of a financial loss for the lender.

Higher Risk = Higher Rates!

Know Your 5 C’s:

Every client has individual mortgage needs when buying a home and my goal is to find a mortgage loan that’s right fit for your situation! The first step in getting the mortgage process started involves understanding what lenders are looking for in order to get mortgage approval.

The approval process is called the Five C’s of Credit and they consist of:

• Collateral– the property that you are planning to purchase

• Credit – do you have good credit? Do you have a good history of repayment for all loans?

• Capacity – Proof of being able to pay for your mortgage with your provable income

• Capital – How much equity do you have in the property? The borrower’s net worth

• Character – The borrower’s willingness to repay the loan and their reliability

1. Collateral

Collateral reflects the strength of the property itself. Lenders look at if the property is owner occupied (do you live there) or is it a rental dwelling? Is the property a home, condominium or cottage? Is the property located in a metropolitan neighbourhood or a rural area? Is there a single family living in the home or multiple families? All these factors are considered by the lender for marketability when rating your property. An appraisal is one of the tools that will be used to assess the value of the property.

2. Credit

Shows the lender a snapshot of what the borrower’s repayment history has been over a period of time. This is the only way a lender can predict the borrower’s propensity to make future payments. The credit score (also called credit history, credit report, credit rating) is the primary measurement factor.

When you borrow money, your repayment history is reported to the credit bureau – this rating is called your credit score. How do you pay your bills – always on time or sometimes a few days late or not at all, will determine what type of credit rating will apply. Some other factors that affect your credit rating are if your credit card balance is greater than 25-50% of your credit limit, if any accounts have gone to collection, or if there have been multiple inquiries into your credit.

3. Capacity

The most important by far! How are you going to pay for your mortgage? The lender’s main concern is how you intend to repay your mortgage and will consider your income (from all sources) against your monthly expenses. Proof of income will differ depending on your employment status: salaried, commissioned, self-employed, full time, or part time. Lenders will determine what types of documents are required to confirm your provable income and how much mortgage you can qualify for. This is represented as TDS Total Debt Service Ratio and GDS Gross Debt Service Ratio.

4. Capital

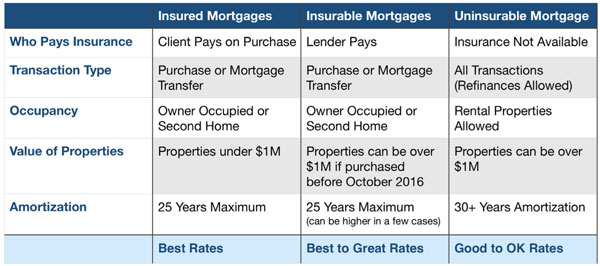

Capital refers to your personal net worth and how much equity you have in the property. Where is your down payment coming from? In Canada your minimum down payment is 5% for a “high ratio” insured mortgage* or a “conventional” mortgage with 20% down. The downpayment money can come from your own resources or can be gifted from a family member.

5. Character

Character is a subjective rating and basically reflects a combination of the above four factors. Your character tells a story to the lender about your individual situation. Lenders want to know that as a borrower, that you are trustworthy and will meet your payment obligations to them. Lenders will take factors such as length of employment, your tendency to save and use credit responsibly to establish your character and determine whether you are a borrower that they can trust with their mortgage.

The goal is to get a yes with your lender. The Five C’s of credit outlined above determine a borrower’s ability and willingness to make payments. Understanding what a lender is looking for allows you to set yourself up to put your best foot forward.

There you have it – the 5 C’s that lenders analyze when reviewing a mortgage application.

If you have any questions or concerns feel free to contact The Angela Calla Mortgage Team at Dominion Lending Centres, we’re here to help!

-Kelly Hudson

Angela Calla is a 14 year, award-winning Woman of Influence mortgage expert. Alongside her team, passionately assisting mortgage holders get the best mortgage, and educating them on The Mortgage Show on CKNW for over a decade and through her best-selling book The Mortgage Code available on Amazon. To purchase the book click here: The Mortgage Code by Angela Calla. Proceeds from a sales will help build a new emergency room at Eagle Ridge Hospital. Angela can be reached at callateam@dominionlending.ca or 604-802-3983.