We have seen a return of the buyers’ market and many people are asking, how long will this last? While some renters without a down payment might be asking, how can I put a plan in place to own?

With the cost of living so high, and student debts coming out of school, many consumers question how they’re going to come up with a down payment for a home

Here are some ways you can get it done:

1. Decide how much you can save and pick a plan that works for you.

a) A 36-month plan saving $700/month will get you $25,200 (you will need about $2,000 for closing costs if you qualify as a first-time homebuyer)

b) A 24-month plan savings $600/month for $14,400

2. Get a gift from a family member

3. Borrow the down payment or a portion (which may also help with credit building)

4. A combination of all of the above

For those of you that want to partner with the government for a down payment and profit of home ownership, a new government program can be a helpful tool provided it stays past the October election. https://www.cmhc-schl.gc.ca/en/nhs/shared-equity-mortgage-provider-fund

You might be reading this and thinking, ‘yeah right, that is not reality.’ Or for some people, you know it might just be exactly what will help them move forward.

Perhaps you have graduated from school and your parents don’t charge you rent. Imagine if you could put one of your pay cheques every month aside and try living within those means and budget accordingly.

Or say you have a partner and one of you just started work in a specific trade and the other’s pay cheque went towards the “home purchase plan.”

Also, if you are within the qualifications to buy, you will be earning a combined household income of $125,000-plus per year, so taking those funds right from your pay cheque into your RRSP will have additional tax benefits too where you can use the refund for closing costs or amp up your down payment.

Here’s an example of how this worked for a lab technician and chef with a two-year old daughter.

They did a combination plan as they moved up to Canada from the U.S. two years ago, both got stable jobs and had no outside debt. They were paying $1700 a month rent. They used a $10,000 line of credit they took to put into investment to help establish Canadian credit. After getting the line of credit and placing it into a safe investment, they:

- Set up an RRSP and placed $600 a month on the loan and $700 a month into their RRSP

- Now this family is used to having a cash outlay of $3,000 per month which will be the actual expectation they have for when they buy a home

- With this plan, they take a mortgage for a test drive, save money on taxes, establish a great credit score and worked away toward their goal.

Are there holes in the plan? Yes, home prices may go up, there was interest on the loan they paid and they may have to adjust or modify their plan. Their employment can change, however, this practice will only benefit them no matter what life brings their way and there is a sense of empowerment when you have a plan and can see how you can get there.

Do you or someone you care about want to know how they can be set up with a multifaceted plan to help them move forward with a goal of owning a home?

Reach out today!

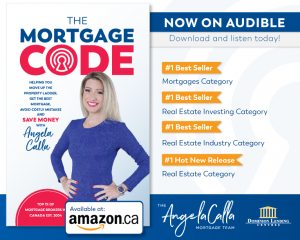

Angela Calla is a 15 year award-winning woman of influence mortgage expert. Alongside her team, passionately assisting mortgage holders get the best mortgage, and educating them on The Mortgage Show on CKNW for over a decade and through her best-selling book The Mortgage Code available on Amazon. To purchase the book click here: The Mortgage Code. Proceeds from a sales will help build a new emergency room at Eagle Ridge Hospital. Angela can be reached at callateam@dominionlending.ca or 604-802-3983.