Good morning! In light of the upcoming April Bank of Canada announcement, we’ve been getting a lot of messages from those of you with Variable Rate Mortgages, asking if you should lock in ahead of April’s potential rate increase: Rates are rising. Is it time to lock in your mortgage rate?

In her keynote speech last week, Deputy Governor of the Bank of Canada, Sharon Kozicki, asserted that the Bank of Canada is “prepared to act forcefully” to bring inflation back down to 2% by using its monetary policy tools. However, she also confirmed that the Bank is cautious about tightening its monetary policy too quickly which could further promote inequality and hardships for some households.

“While we will watch developments with respect to households closely as we proceed, it’s important to be clear: Returning inflation to the 2% target is our primary focus and our unwavering commitment. We have taken action and will continue to do so to return inflation to target, and we’re prepared to act forcefully” – Deputy Governor – Bank of Canada, Sharon Kozicki, March 25, 2022.

Many economists are now predicting that the Bank of Canada will announce a 0.50% increase to their key policy rate in their April 13th announcement.

So…is now a good time to panic? Should you lock into a Fixed Rate Mortgage? Fear of the unknown is a large driver in the mortgage market, and there is a reason why 3/4 of mortgages in Canada are Fixed Rate Mortgages. People find comfort in predictability…and so do the Banks. But it is also important to consider that 1/4 of Canadians with Variable Rate Mortgages have been the big winners and paid less overall interest for over a decade? Inevitably, rates will rise. The “emergency” low rates of the pandemic cannot last forever. We cannot predict the future. However, what we CAN do is explore the past and learn FOR our future.

Let’s look at some quick and easy numbers:

Let’s say you have a $500,000 balance with a 25-year amortization and a 5-year closed Variable Rate Mortgage at Prime Rate minus 0.80% right now. That 0.80% is called your “discount”, and you will have your discount for your entire 5-year Variable Rate term. With Prime Rate currently at 2.70%, this means that your current interest rate is 1.90% (2.70% – 0.80% = 1.90%), and your monthly payment is $2,095.01.

In contrast, current 5-year Fixed Rate Mortgages with many of the Big Banks have now risen from approximately 3.89% to 4.14%! With a $500,000 balance and a rate of 3.89%, these fixed-rate payments would be $2,600.37. Therefore, there is now an interest rate difference of nearly 2% between Fixed and Variable Rate Mortgages, and this amounts to a savings of $505.36 per month for Variable Rate Mortgage holders.

But let us imagine the Bank of Canada does act “forcefully”, as they say, and raises its key interest rate by a half percent in April (raising Prime Rate to 3.20%), this will drive your Variable Rate interest rate to 2.40%.

$500,000 at 2.40% = $2,217.99/month

$500,000 at 3.89% = $2,600.37/month

With a Variable Rate Mortgage, you would still be saving $382.38 per month.

Let’s say that the Bank of Canada acts even more aggressively and raises rates to “pre-pandemic” levels. After all, Prime Rate in October 2018 went as high as 3.95% and stayed that way until April 2020, when it dropped to 3.45% at the beginning of the pandemic. In this scenario, even if the Bank of Canada raised their key interest rate and Prime Rate rose to 3.95%, your rate would still only be 3.15% (3.95% – 0.80%).

$500,000 at 3.15% = $2,410.25/month

$500,000 at 3.89% = $2,600.37/month

With a Variable Rate Mortgage, you would still be saving $190.12 per month.

Let’s go back even further in time to our last recession from October 2008 to May 2009. Granted, the world has changed a lot since then, especially the real estate market! During this time period, Prime Rate rose to 4.50%. In this scenario, even if Prime Rate rose to this past-recession rate of 4.50%, your rate would be 3.70% (4.50% – 0.80%) …again, still lower than the current 5-year Fixed Rates right now.

$500,000 at 3.70% = $2,557.07/month

$500,000 at 3.89% = $2,600.37/month

With a Variable Rate Mortgage, you would still be saving $43.30 per month.

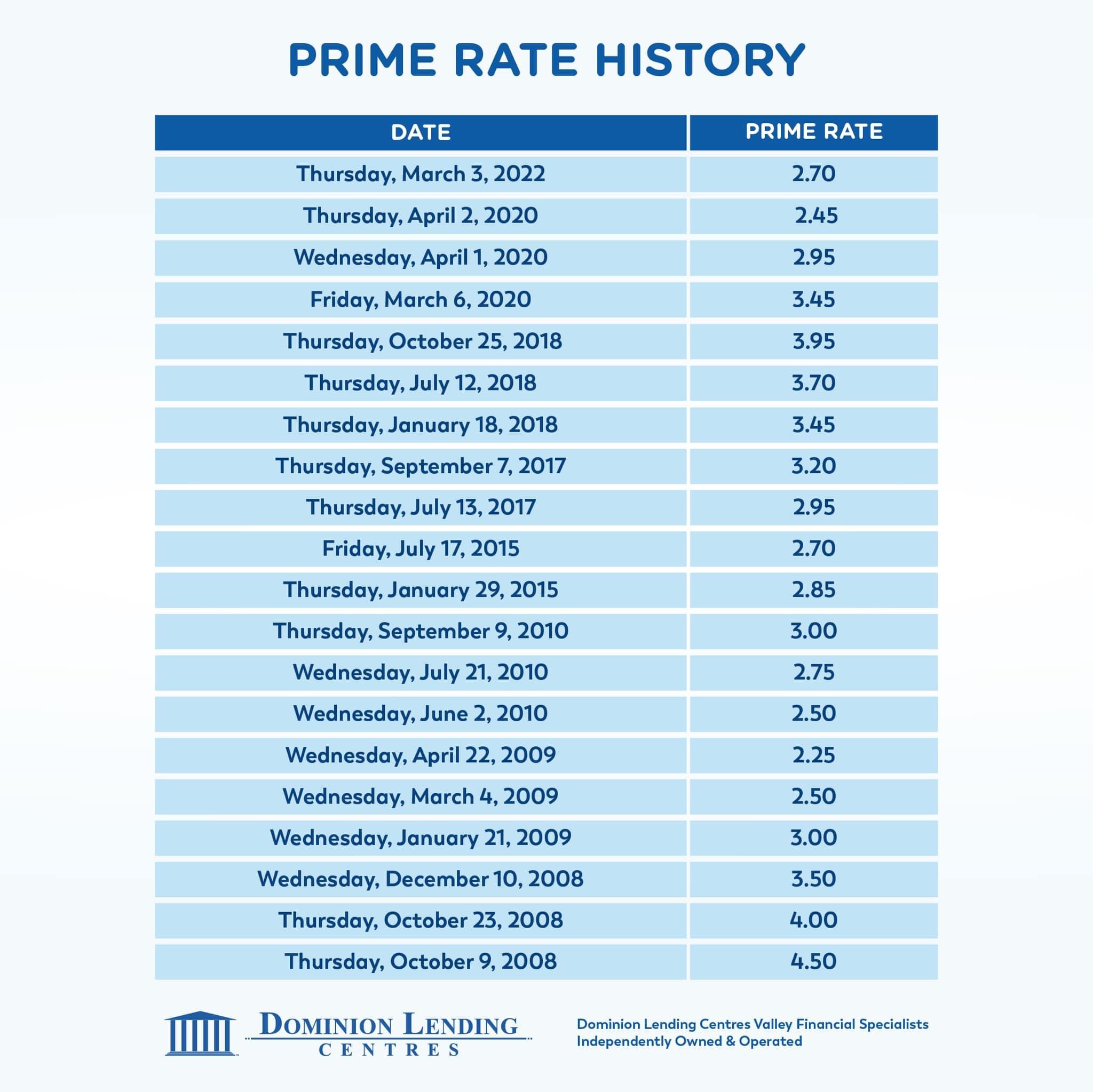

Don’t forget…what goes up must come down! If you look at historical Prime Rate changes over the last 14 years in the chart below, you will see that Prime Rate has fluctuated from as high as 4.50% to as low as 2.25%. With a Variable Rate Mortgage, remember that rates may rise and fall multiple times during the term of your mortgage. While rates may be high for a period of time during your mortgage term, you may actually pay less interest overall due to the period(s) of time where you saved interest (when the Prime Rate was low).

You can always mitigate the risk of rising rates by taking advantage of the savings NOW. We would recommend that you put aside the $505.36/month into a savings account or use it to pay down your principal balance faster. This way, if/when rates rise, you will be ready.

But if you still feel do not feel entirely comfortable with a variable-rate mortgage that is okay as well. The type of mortgage that you choose is entirely your decision and depends on your comfort level. A variable-rate mortgage is not for everyone. If you feel more comfortable with a fixed-rate mortgage, then you should go for it. However, before you do, it’s important to consider a few things:

Flexibility – Not all fixed-rate mortgages are built the same. Some fixed-rate mortgage penalties offer more forgiving penalty calculations if you ever need to get out of your fixed-rate mortgage contract. In general, many of the Big Banks and some Credit Unions include the “original discount” that you receive from their posted rates in their fixed-rate mortgage penalty calculations (called the IRD, or Interest Rate Differential), while others do not. Including the “original discount” into the IRD penalty calculation can increase the cost of the penalty.

If you are set on staying with a lender who includes the “original discount” in their IRD calculations, you may be better off considering the 3 and 4-year fixed-rate options because the difference between the 3 and 4-year contract vs posted rates tends to be smaller than those of the 5-year fixed rates. In contrast, the penalty to break a variable-rate mortgage is just 3 months of interest.

Qualification – Did you know that you now qualify for a larger mortgage if you take a variable-rate mortgage? The current government-mandated stress test stipulates that we must use “the higher of the contract rate + 2%, or the 5-year benchmark rate” for qualification. For fixed-rate mortgages, the rate used for qualification would be approximately 5.89% (3.89% contract rate plus 2%). For variable-rate mortgages that are still under 3.25%, the lenders can still use the qualifying rate of 5.25%.

Rate – Different classifications of mortgages have led to an array of interest rate offerings across the mortgage market. If your remaining amortization is below 25 years, if the original purchase price of your home was under $1,000,000, if you purchased your home with less than 20% down, and/or if you have a lot of equity in your home, there may be better rate options out there for you.

Final Thoughts:

So, is it time to lock into a Fixed Rate Mortgage, or should you continue to ride the wave? There is no crystal ball. Ultimately, the decision lies with you and your comfort level after arming yourself with the knowledge above. Will rates rise? Yes, rates will rise someday. Perhaps someday soon. Will rates fall? Also yes, rates will fall someday.

We believe that the Bank of Canada will likely raise their key interest rate aggressively and quickly this year to try to curb inflation. However, we do not foresee them maintaining high-interest rates for a long period of time and believe that we will see rates start to fall again next year. With current real estate prices, high amounts of indebtedness across the country, pandemic recovery, and many other global factors, we do not believe that a high-interest rate environment will be sustainable for our economy.

We’re likely in for a bit of a ride but, with the right knowledge, tools, and a little bit of courage, we are confident that you can and will make a sound mortgage decision.

Angela Calla is an 18-year award-winning woman of influence which sets her apart from the rest. Alongside her team, Angela passionately assists mortgage holders in acquiring the best possible mortgage. Through her presence on “The Mortgage Show” and through her best-selling book “The Mortgage Code“, Angela educates prospective home buyers by providing vital information on mortgages.

In August of 2020, at the young age of 37, Angela surpassed $1 Billion dollars in funded personal mortgages. In light of this, her success awarded her with the 2020Business Leader of the Year Award.

Angela is a frequent go-to source for media and publishers across the country. For media interviews, speaking inquiries, or personal mortgage assistance, please contact Angela at hello@countoncalla.ca or at 604-802-3983.

Click here to view the latest news on our blog.