Bank of Canada Cuts Policy Rate By 25 BPs

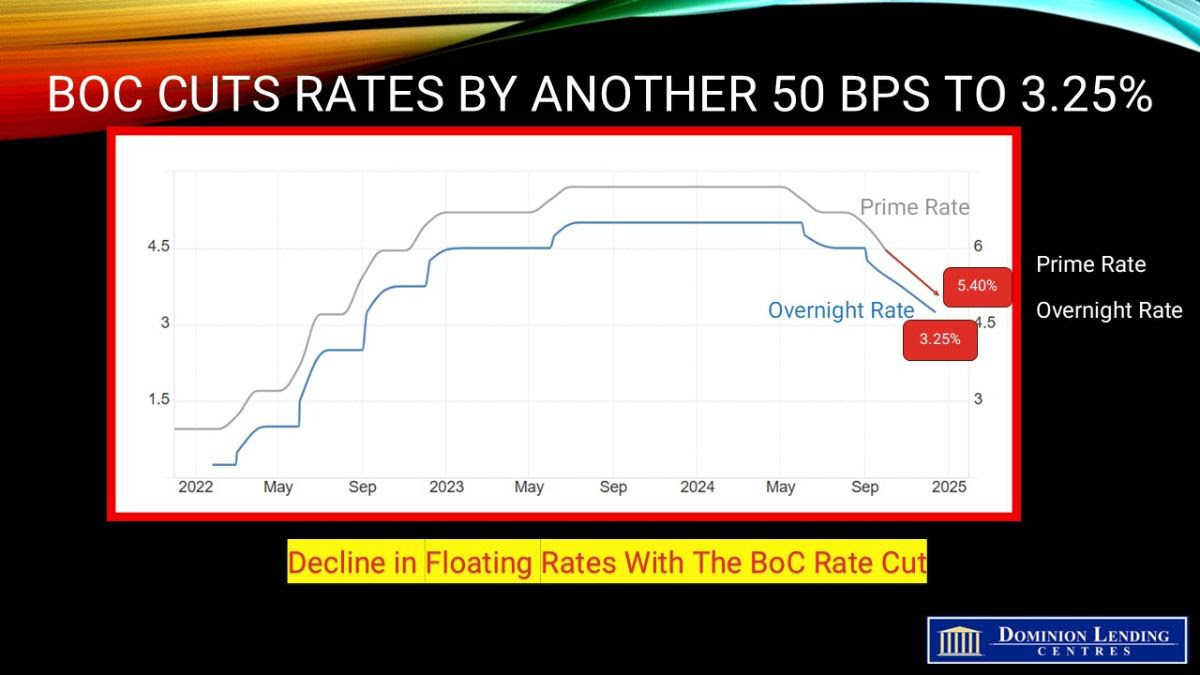

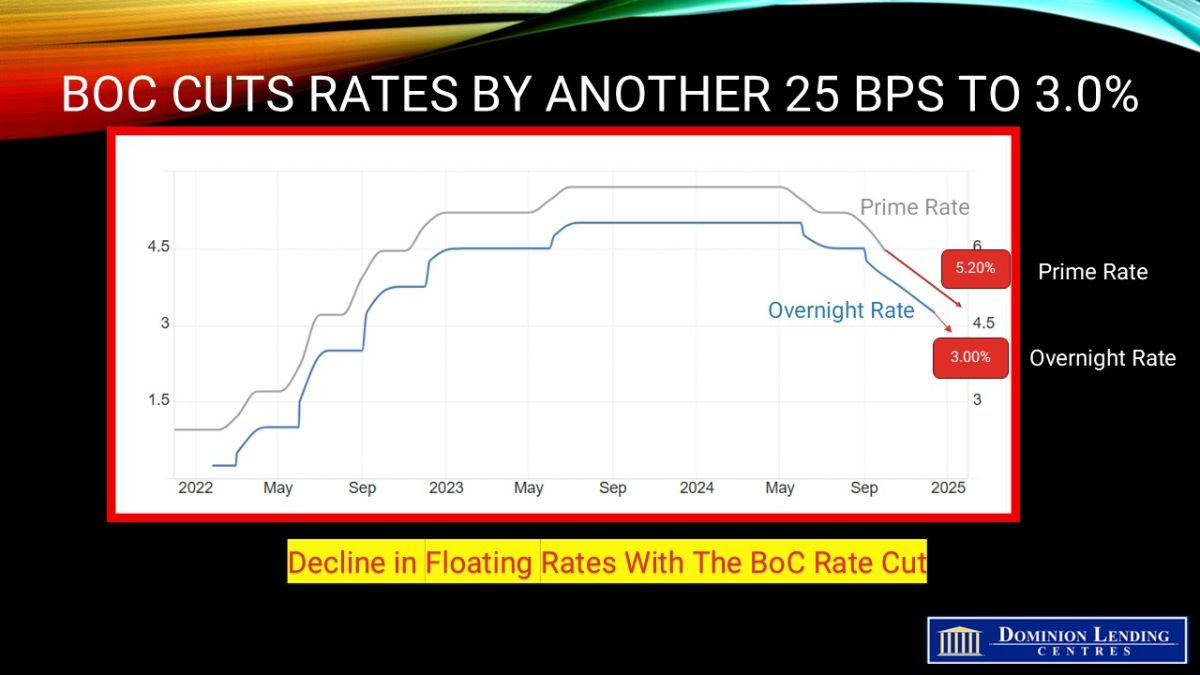

The Bank of Canada (BoC) reduced the overnight rate by 25 basis points this morning, bringing the policy rate down to 3.0%. The market had anticipated a nearly 98% chance of this 25 basis point reduction, and consensus aligned with this expectation. The Federal Reserve is also set to announce its rate decision this afternoon, where it is widely expected to maintain the current policy rate. As a result, the gap between the US Federal Funds rate and the BoC’s overnight rate has widened to 150 basis points. This discrepancy is largely attributed to stronger growth and inflation in the US compared to Canada. Consequently, Canada’s relatively low interest rates have negatively impacted the Canadian dollar, which has fallen to 69.2 cents against the US dollar. Additionally, oil prices have dropped by five dollars, now at US$73.61.

The Bank also announced its plan to conclude the normalization of its balance sheet by ending quantitative tightening. It will restart asset purchases in early March, beginning gradually to stabilize and modestly grow its balance sheet in alignment with economic growth.

The projections in the January Monetary Policy Report (MPR) released today are marked by more-than-usual uncertainty due to the rapidly evolving policy landscape, particularly the potential threat of trade tariffs from the new administration in the United States. Given the unpredictable scope and duration of a possible trade conflict, this MPR provides a baseline forecast without accounting for new tariffs.

According to the MPR projections, the global economy is expected to grow by about 3% over the next two years. Growth in the United States has been revised upward, mainly due to stronger consumption. However, growth in the euro area is likely to remain subdued as the region faces competitiveness challenges. In China, recent policy actions are expected to boost demand and support near-term growth, although structural challenges persist. Since October, financial conditions have diverged across countries, with US bond yields rising due to strong growth and persistent inflation, while yields in Canada have decreased slightly.

The BoC press release states, “In Canada, past cuts to interest rates have begun to stimulate the economy. The recent increase in both consumption and housing activity is expected to continue. However, business investment remains lackluster. The outlook for exports is improving, supported by new export capacity for oil and gas.

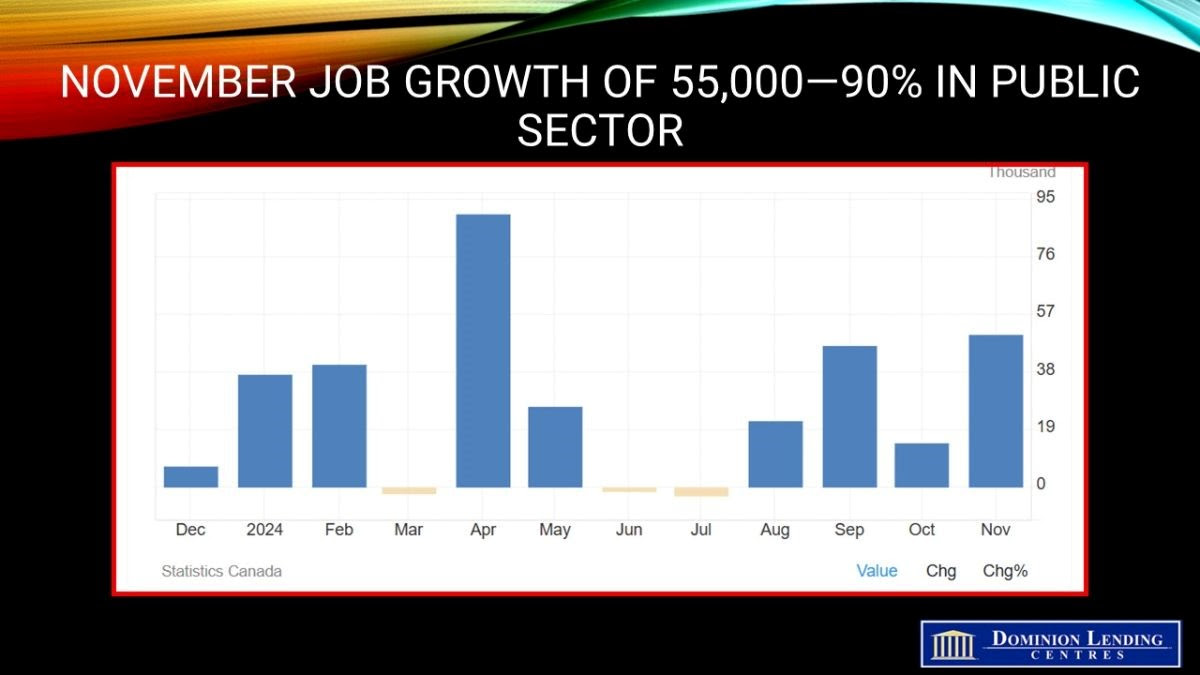

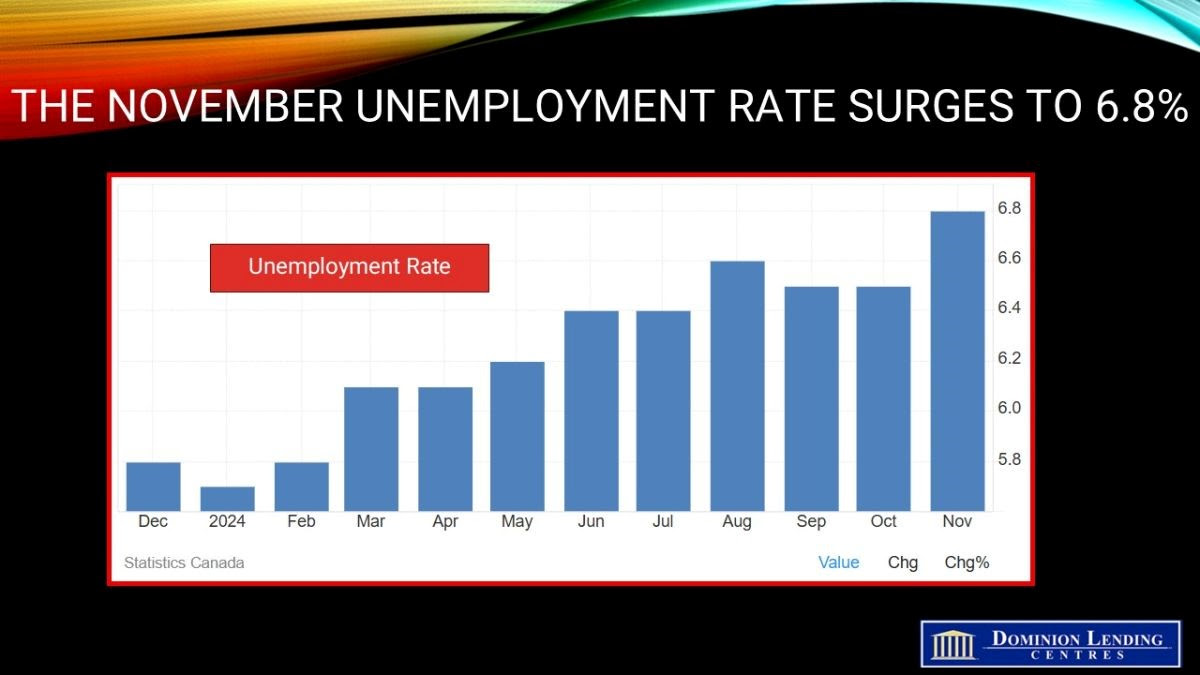

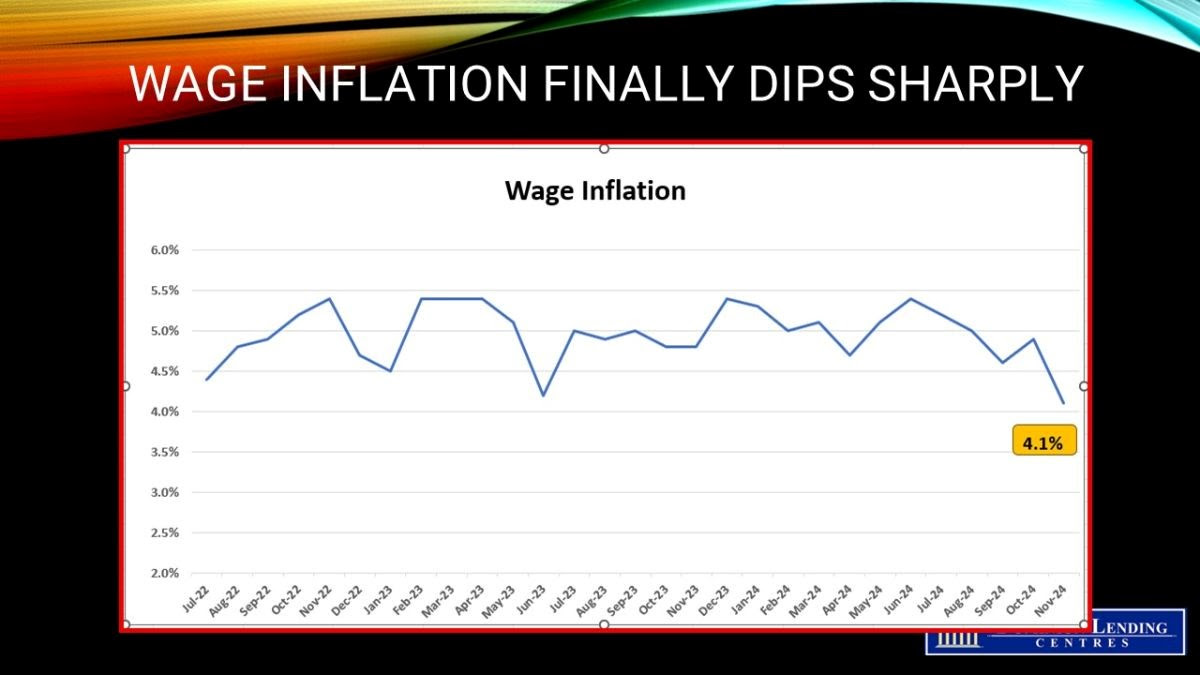

Canada’s labor market remains soft, with the unemployment rate at 6.7% in December. Job growth has strengthened in recent months after a prolonged period of stagnation in the labor force. Wage pressures, previously sticky, are showing some signs of easing.

The Bank forecasts GDP growth to strengthen in 2025. However, with slower population growth due to reduced immigration targets, both GDP and potential growth will be more moderate than previously anticipated in October. Following a growth rate of 1.3% in 2024, the Bank now projects GDP to grow by 1.8% in both 2025 and 2026, slightly exceeding potential growth. As a result, excess supply in the economy is expected to be gradually absorbed over the projection horizon.

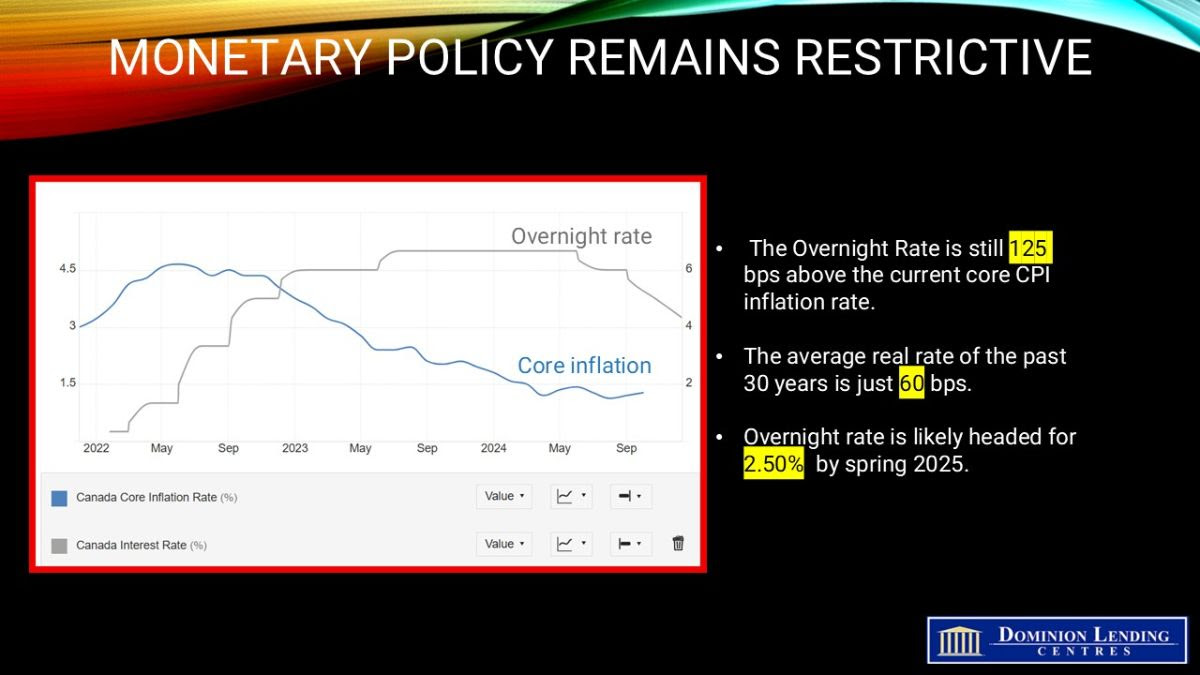

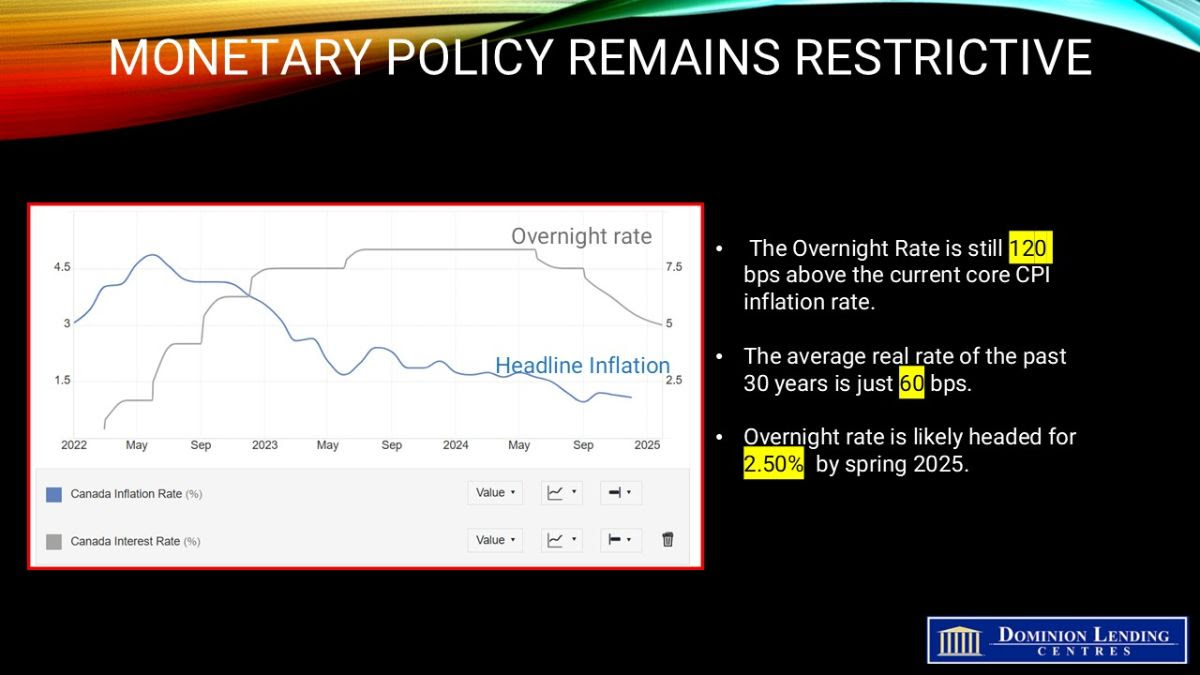

CPI inflation remains close to the 2% target, though with some volatility stemming from the temporary suspension of the GST/HST on select consumer products. Shelter price inflation remains elevated but is gradually easing, as anticipated. A broad range of indicators, including surveys on inflation expectations and the distribution of price changes among CPI components, suggests that underlying inflation is near the 2% target. The Bank forecasts that CPI inflation will remain around this target over the next two years.

Aside from the potential US tariffs, the risks surrounding the outlook appear reasonably balanced. However, as noted in the MPR, a prolonged trade conflict would most likely result in weaker GDP growth and increased prices in Canada.

With inflation around 2% and the economy in a state of excess supply, the Governing Council has decided to further reduce the policy rate by 25 basis points to 3%. This marks a substantial (200 bps) cumulative reduction in the policy rate since last June. Lower interest rates are expected to boost household spending, and the outlook published today suggests that the economy will gradually strengthen while inflation remains close to the target. Nevertheless, significant and widespread tariffs could challenge the resilience of Canada’s economy. The Bank will closely monitor developments and assess their implications for economic activity, inflation, and monetary policy in Canada. The Bank is committed to maintaining price stability for Canadians. Nevertheless, significant and widespread tariffs could challenge the resilience of Canada’s economy. The Bank will closely monitor developments and assess their implications for economic activity, inflation, and monetary policy in Canada. The Bank is committed to maintaining price stability for Canadians.

Bottom Line

The central bank dropped its guidance on further adjustments to borrowing costs as US President Donald Trump’s tariff threat clouded the outlook.

Bonds surged as the market absorbed the central bank’s decision not to guide future rate moves. The yield on Canada’s two-year notes slid some four basis points to 2.79%, the lowest since 2022. The loonie maintained the day’s losses against the US dollar.

In prepared remarks, Macklem said while “monetary policy has worked to restore price stability,” a broad-based trade conflict would “badly hurt” economic activity but that the higher cost of goods “will put direct upward pressure on inflation.”

“With a single instrument — our policy rate — we can’t lean against weaker output and higher inflation at the same time,” Macklem said, adding the central bank would need to “carefully assess” the downward pressure on inflation and weigh that against the upward pressure on inflation from “higher input prices and supply chain disruptions.”

In the accompanying monetary policy report, the central bank lowered its forecast for economic growth in 2025 due to the federal government’s lower immigration targets. The bank expects the economy to expand by 1.8% in 2025 and 2026, down from 2.1 and 2.3% in previous projections. The central bank trimmed business investment and exports estimates but boosted its consumption forecast.

The bank estimated that interest rate divergence with the Federal Reserve was responsible for about 1% of the depreciation in the Canadian dollar since October.

We expect the BoC to continue cutting the policy rate in 25-bps increments until it reaches 2.5% this Spring, triggering continued strengthening in the Canadian housing market.

Article courtesy of Dr. Sherry Cooper, Chief Economist, DLC

Angela Calla is an 19-year award-winning woman of influence which sets her apart from the rest. Alongside her team, Angela passionately assists mortgage holders in acquiring the best possible mortgage. Through her presence on “The Mortgage Show” and through her best-selling book “The Mortgage Code“, Angela educates prospective home buyers by providing vital information on mortgages. In light of this, her success awarded her with the 2020Business Leader of the Year Award.

Angela is a frequent go-to source for media and publishers across the country. For media interviews, speaking inquiries, or personal mortgage assistance, please contact Angela at hello@countoncalla.ca or at 604-802-3983.

Click here to view the latest news on our blog.