Welcome to the July issue of my monthly newsletter!

Things are starting to heat up as we head into July! For those first-time buyers looking to purchase a home, I have all the details for you below! For those other homeowners hoping to stay cool and enjoy their spaces this season, scroll down for tips on how to turn your backyard into a staycation paradise! Have a great summer!

Entering the Housing Market

With the first Bank of Canada rate drop having occurred in June, many individuals are looking at the housing market with renewed vigor and an expectation that rates will continue to come down to a more sustainable level.

If you are someone who is considering entering the housing market this summer, there are a few things you should keep in mind:

Determine Your Budget: Download my app from Google Play or the Apple iStore to help you calculate mortgage payments, affordability, the income required to qualify, and even estimate your closing costs! It also allows you to connect directly with me through the app so that I can answer any questions you have right in the palm of your hand.

Save For a Down Payment: Your typical down payment should be at least 5% of the purchase price, though 20% down is preferable as anything below that requires default insurance. Your down payment can be done through your own savings account or RRSP’s.

- Thanks to the Federal Government’s Home Buyer’s Plan, first-time homebuyers can leverage up to $60,000 from their RRSPs (maximum of $120,000 for a couple).

- PRO TIP: The First Home Savings Account (FHSA) is specifically designed to help first-time homebuyers save for their down payment without having to pay taxes on the interest earned on their savings.

Take Advantage of First-Time Buyer Programs: Did you know? First-time home buyers are eligible for an exemption, reducing the amount of property transfer tax paid, depending on the property’s value.

- PRO TIP: In addition, Ontario, British Columbia, Prince Edward Island, and the City of Toronto offer land transfer tax rebates for first-time homebuyers.

Get Pre-Approved: This means that a lender has stated (in writing) that you qualify for a mortgage and what amount, based on submitted documentation of your current income and credit history. A pre-approval usually specifies a term, interest rate, and mortgage amount and is typically valid for a brief period, assuming various conditions are met.

There are a few benefits to pre-approval such as:

- It confirms the maximum amount you can afford to spend.

- It can secure you an interest rate for 90-120 while you shop for your new home

- It lets the seller know that securing financing should not be an issue. This is extremely important for competitive markets where lots of offers may be coming in.

Understand the Closing Costs: Closing costs are a one-time fee associated with the sale of a home and are separate from the mortgage insurance and down payment. Typically, these costs range from 1.5-4% of the purchase price, depending on your location. Factoring these costs into your maximum budget can help you narrow down an entirely affordable home and ensure future financial stability and security.

Here are a few closing costs to keep an eye out for:

- Land Transfer Tax: This is calculated as a percentage of the purchase price of your home, with the amount varying in each province. Some cities, such as Toronto, also have a municipal LTT.

- Legal Fees and Disbursements: You can expect to incur a minimum of $500 (plus GST/HST) on legal fees for the preparation and recording of official documents.

- Title Insurance: Most lenders require title insurance to protect against losses in the event of a property ownership dispute. This is purchased through your lawyer/notary and is typically $300 or more.

- PST on CMHC Insurance: Though CMHC insurance itself is financed through the mortgage, PST on the insurance is typically paid at the lawyers and sometimes deducted from your advance.

- Home Inspection Fee: A home inspection is highly recommended as a condition of your Offer to Purchase to prevent any future surprises. This can cost around $500.

- Appraisal Fee: An appraisal is performed to certify the lender of the resale value of the home in the case you default on the mortgage. The cost is usually $400 – $600 but is typically covered by the lender.

- Property Insurance: Property insurance covers the cost of replacing your home and its contents, and must be in place on closing day. This is paid in monthly or annual premiums.

- Prepaid Utility Bills: You may need to reimburse the previous owner of your property for prepaid costs such as property taxes, utilities, and so forth.

- Property Taxes: Property taxes are due on an annual basis and are calculated as a percentage of the home value and vary by municipality. You also may need to reimburse the previous property owner if he/she has already paid property taxes for the full year.

Getting Proper Coverage: Purchasing a home is likely the largest investment you will make, and you want to ensure it is protected.

Various insurance items can be obtained for your home, including:

- Title Insurance: Required by most lenders to protect against losses should a property ownership dispute arise. This insurance is done through your lawyer/notary and typically runs $100-$300.

- Mortgage Protection Insurance: An optional debt replacement that protects your family should anything happen in the future. Many homeowners believe they are covered through their life insurance policy, but the Manulife Mortgage Protection Plan is different. Before closing, it’s important to look at the costs and coverage for you!

- Property & Fire Insurance: Mandatory and needs to be arranged before your closing appointment. Not sure how much to budget for? Get quotes from various insurance companies! Your lawyer/notary or myself can provide recommendations

- Default Insurance: Only required if you purchase a house with less than a 20% down payment.

Whether you’re looking at a condo, townhouse, rancher, or a two-story property, there is nothing quite like your first home! However, the mortgage process can be intimidating – and that’s where I come in! If you’re looking to get started on your home-buying journey, don’t hesitate to reach out to me today.

5 Ways to Turn Your Home into a Staycation Paradise

We all invest a lot into our homes, so we want to make sure we are enjoying them to the fullest all year long.

As we head into the prime of summer, there is no better time to update your space to turn it into the perfect staycation paradise so that you can fully enjoy the season!

Here are my top 5 tips for creating that backyard oasis:

- Expand Your Outdoor Entertaining Area: Take your outdoor space to the next level by adding amenities for entertaining. Consider installing an outdoor kitchen or bar area complete with a grill, refrigerator, and seating area. Adding a pergola or canopy can provide shade and shelter, while outdoor speakers and a fire pit create ambiance for evening gatherings under the stars.

- Incorporate Relaxation Zones: Create multiple relaxation zones throughout your home to cater to different activities and moods. Designate a cozy corner with plush seating and soft lighting for reading or meditation. Set up a hammock or hanging chair in the backyard for afternoon naps or stargazing. Incorporate a spa-like bathroom retreat with a luxurious bathtub, candles, and soothing music for a pampering escape.

- Embrace Indoor-Outdoor Living: Maximize the connection between your indoor and outdoor spaces to blur the boundaries and create a seamless flow. Install sliding glass doors or folding patio doors to open up your living areas to the backyard, allowing for easy access and natural ventilation. Arrange indoor furniture to face outdoor views and encourage indoor-outdoor socializing.

- Infuse Tropical Vibes: Bring the vacation vibes home by incorporating tropical elements into your decor. Add pops of vibrant colors, tropical patterns, and lush greenery throughout your home. Hang palm leaf or bamboo curtains, display tropical fruits in bowls, and accessorize with seashells and driftwood for a breezy, island-inspired ambiance.

- Curate Outdoor Activities: Make the most of your outdoor space by curating a variety of activities to enjoy during your staycation. Set up a mini-golf course, bean bag toss, or giant Jenga for backyard games. Create a movie night under the stars with a projector and outdoor screen. Arrange a DIY spa day with facials, massages, and foot baths for a rejuvenating retreat at home.

By incorporating these ideas into your home and yard, you can transform your space into a paradise that grants you relaxation, entertainment, and rejuvenation all summer!

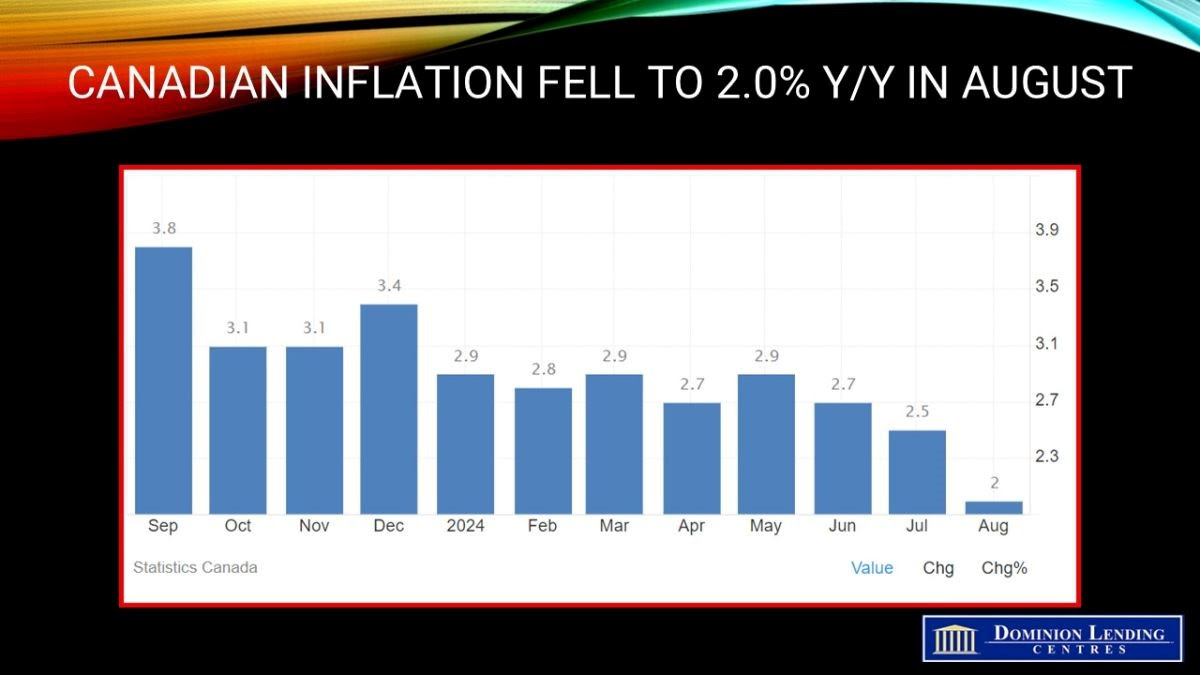

Economic Insights from Dr. Sherry Cooper

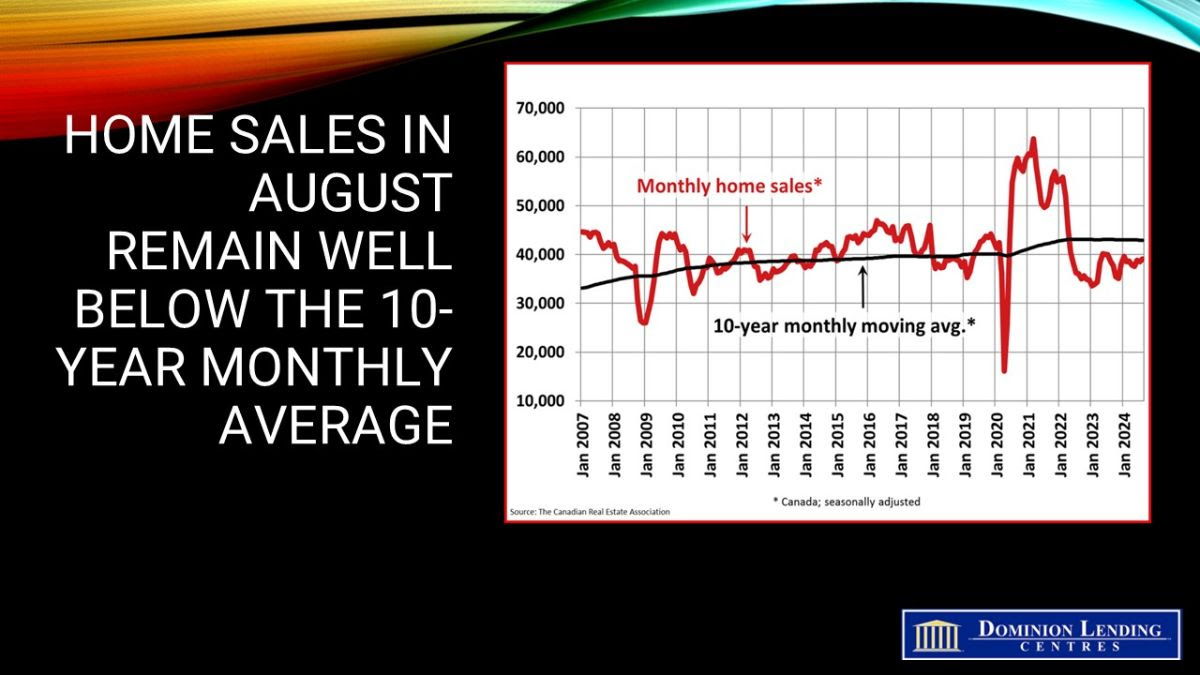

The Bank of Canada finally began an easing cycle on June 5, taking their overnight policy rate down 25 bps to 4.75%–the first major central bank to do so. The housing market has languished over the past year with extremely weak affordability.

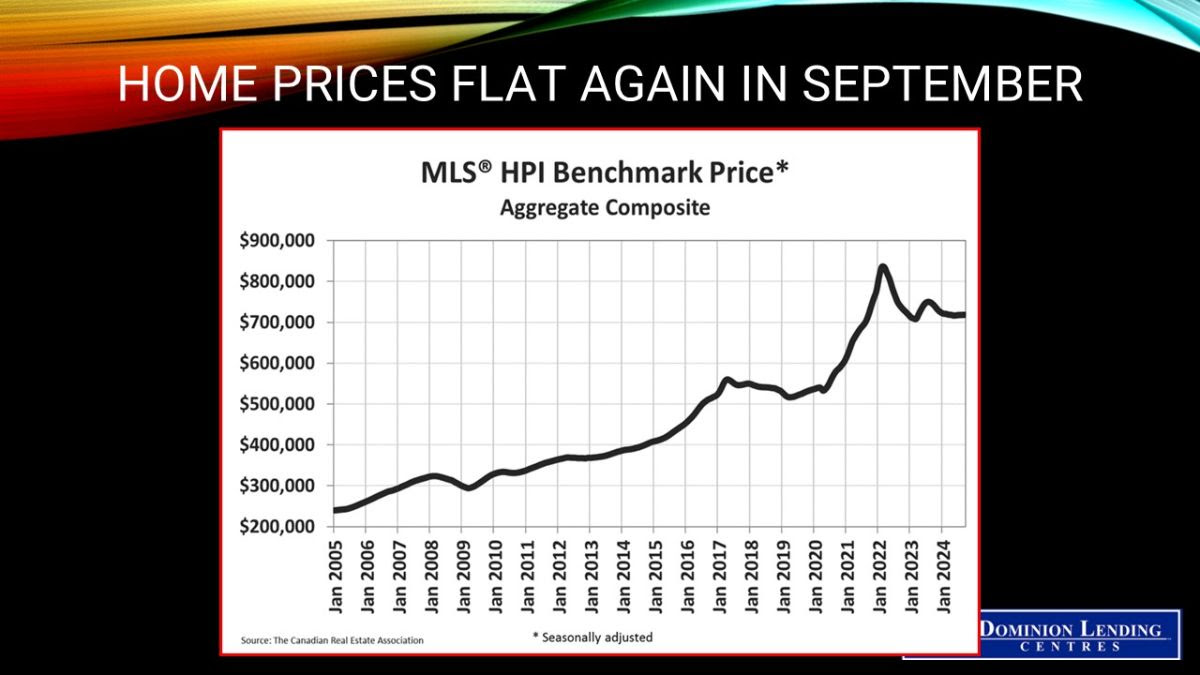

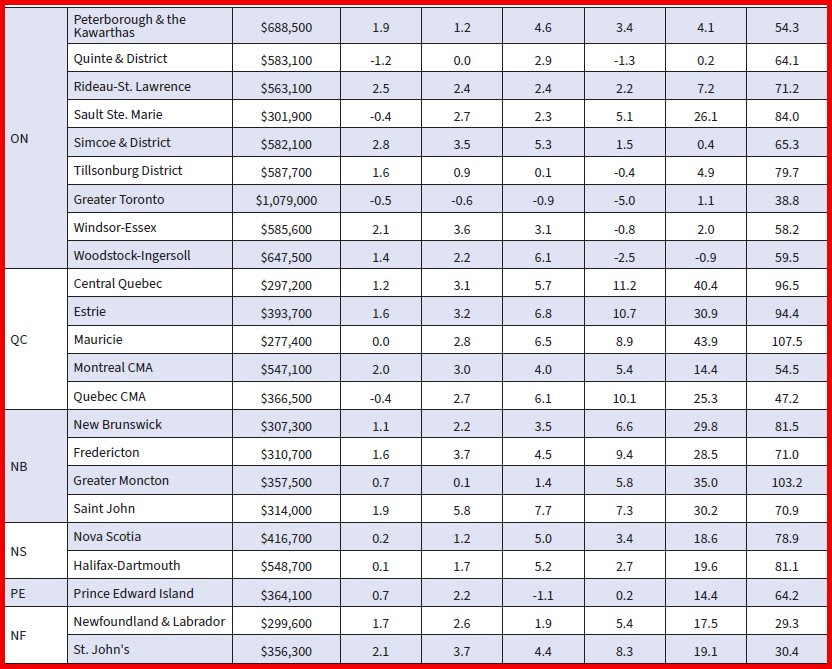

The Multiple-Listing Service Home Price Index fell again in May and is now down 2.4% year-over-year and is off 14.4% from the early 2022 peak when the overnight rate was a mere 25 basis points. Average transaction prices are down 4% y/y and off nearly 15% from the high.

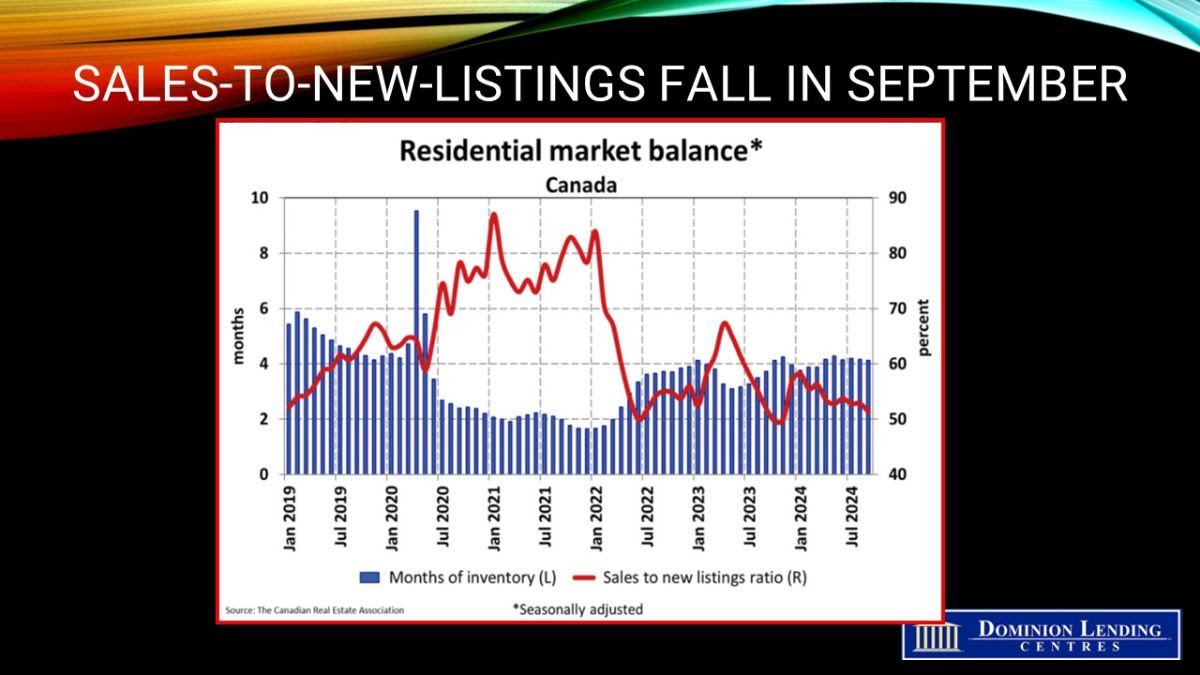

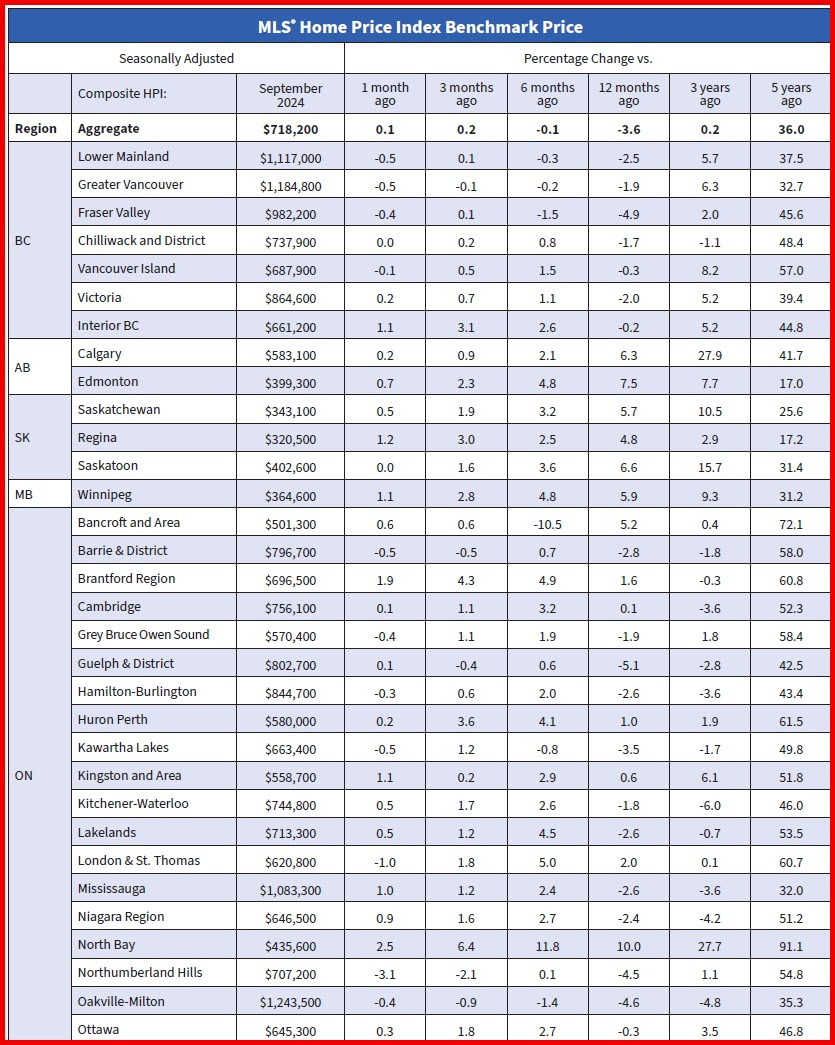

Except for Calgary, housing markets across the country are in a buyers’ market as inventories of active listings have risen and sales have slowed. Calgary prices were up just under 10% y/y in May, pushing new record highs by the month. In the meantime, Vancouver, Toronto, and Montreal prices are all flat or down from a year ago, and they are still tucked below the levels seen at the early 2022 high.

The significant drivers in Calgary’s outperformance have been more substantial population growth (juiced by interprovincial inflows), better affordability, and valuations that might make some sense for investors.

Even with their lackluster performance since the Bank of Canada began hiking interest rates in March 2022, home prices are still high, having tripled in the past two decades, posting an average 5.7% annual rise, while inflation averaged only 2.2% per year over the same period.

Moreover, the total return on the Toronto Stock Exchange over the same period has been much higher still, averaging 7.9% annually over the past two decades. Despite the recent mini selloff in stocks, the TSX has boasted a more robust return than housing over time. And the US stock market has significantly outperformed the TSX.

Of course, there are significant differences between these two asset classes. Stocks are passive investments that do not provide a place to live or require repairs and maintenance. Housing is more than just a financial investment; it is a lifestyle choice that provides the necessary shelter.

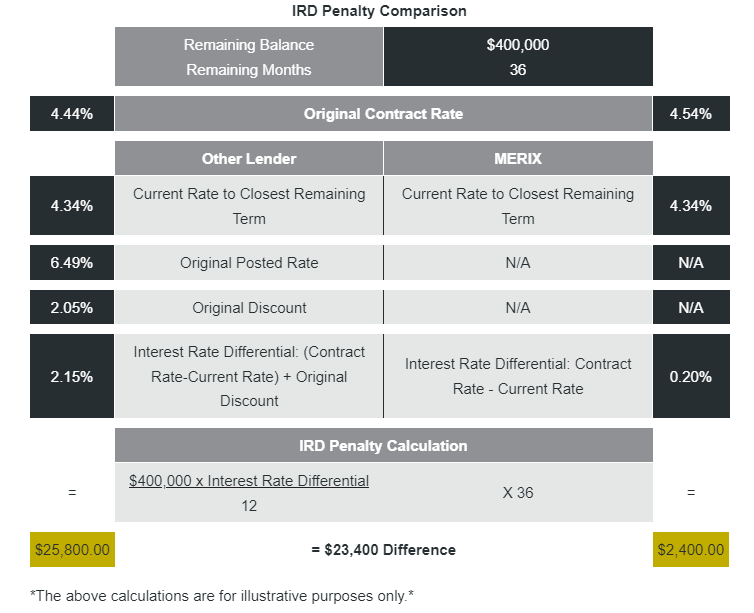

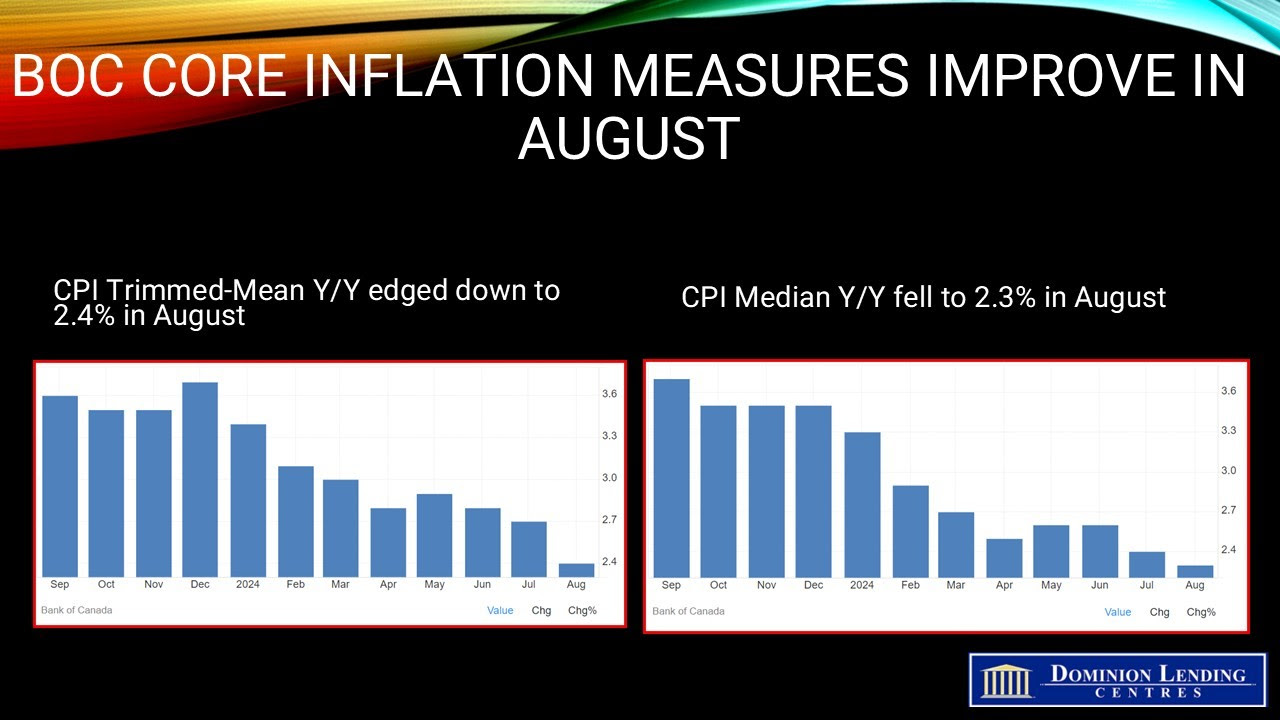

The Bank of Canada will continue to lower interest rates as inflation reaches its 2% target. We expect the overnight rate to fall to about 3% by the end of the easing cycle. But even with only one quarter-point rate cut, bond yields have already fallen significantly in anticipation.

Many mortgage lenders, including three of Canada’s Big Six banks, are slashing fixed mortgage rates, a welcome development for those facing renewal in the coming months. Lenders have already started trimming rates in the wake of a nearly 40-basis-point drop in bond yields, which typically leads fixed mortgage rate pricing.

Over 70% of outstanding mortgages will be renewed within two years. Falling mortgage rates could help soften the payment shock expected for the estimated 2.2 million mortgages that will be renewing at higher rates in the next two years.

But just because rates are falling doesn’t mean all lenders will offer equally low rates in their renewal letters. Typically, they don’t just hand out their especially low rates. That’s where a mortgage broker provides real value, educating borrowers about alternative options, which can be used to haggle a better rate even if they decide not to switch lenders.

For insurable mortgages, the borrower does not need to re-qualify when switching lenders. However, for uninsured mortgage switches, OSFI head Peter Routledge recently rejected renewed calls to remove the mortgage stress test for federally regulated lenders. Knowing your options to improve your bargaining power with your existing lender still pays.

There is a record number of resale condos on the market, and new construction is at a record high. While there remains a longer-term shortage of affordable housing for rent and purchase, it will probably be another year before markets equilibrate and sellers have the advantage.

Housing activity has likely bottomed and will increase as interest rates fall.

Angela Calla is an 19-year award-winning woman of influence which sets her apart from the rest. Alongside her team, Angela passionately assists mortgage holders in acquiring the best possible mortgage. Through her presence on “The Mortgage Show” and through her best-selling book “The Mortgage Code“, Angela educates prospective home buyers by providing vital information on mortgages. In light of this, her success awarded her with the 2020Business Leader of the Year Award.

Angela is a frequent go-to source for media and publishers across the country. For media interviews, speaking inquiries, or personal mortgage assistance, please contact Angela at hello@countoncalla.ca or at 604-802-3983.

Click here to view the latest news on our blog.