As the Spring season approaches, I have some updates for how to prepare your finances for the coming homebuying season. Plus, check out my fraud awareness tips as March is Fraud Awareness Month!

Spring Forward: Preparing Your Finances for the Home-Buying Season

Spring is one of the busiest seasons in the real estate market, with buyers eager to find their dream home before summer.

If you’re planning to purchase a home in Spring 2025, now is the time to get your finances in order.

Being financially prepared can help you secure a mortgage with favorable terms and make your home-buying journey smoother. Here’s how to get ready:

1. Check and Strengthen Your Credit Score

Your credit score is one of the most important factors in mortgage approval, influencing both your eligibility and the interest rate you’ll receive. A higher score can save you thousands over the life of your mortgage, so it’s worth taking the time to improve it.

- Start by checking your credit report for errors, and if you spot any inaccuracies, dispute them immediately.

- Pay down outstanding debts to lower your credit utilization ratio, which plays a big role in your score.

- Avoid opening new lines of credit in the months leading up to your mortgage application, as this can temporarily lower your score.

- By reaching out to me, I can help preserve your credit score as they will pull your credit report once to shop your application. Note: Multiple credit checks in a short period can lower your credit score.

2. Build a Strong Down Payment

The more you can put down up front, the better. A larger down payment can reduce your monthly mortgage costs, give you access to better loan terms, and, in some cases, eliminate the need for mortgage insurance.

- Set a savings goal based on home prices in your target area so you have a clear plan.

- Explore first-time homebuyer programs that offer down payment assistance—there are plenty of government and lender-based options.

- Make saving a habit by automating deposits into a dedicated home savings account.

- Avoid moving your money around to multiple accounts prior to applying for your mortgage. Lenders require a 90-day history of your down payment and a history of moving your money around can make this more difficult to easily verify your down payment.

3. Reduce Your Debt-to-Income Ratio (DTI)

Lenders use your debt-to-income ratio (DTI), aka GDS/TDS, to assess how comfortably you can handle a mortgage payment on top of your existing obligations. A lower DTI signals financial stability, improves your chances of loan approval and can expand your borrowing power.

- Work on paying off high-interest debts or debts with high monthly payments, like credit cards and personal loans, to free up more of your income.

- Hold off on making large purchases or taking on new loans, such as car financing, before applying for a mortgage.

- If possible, look for ways to increase your income—whether through a raise, side gig, or freelance work—to strengthen your financial standing. Note self employed income or part time non guaranteed hours employment generally require a 2-year history.

4. Get Pre-Approved for a Mortgage

A mortgage pre-approval is a game-changer in a competitive market. It gives you a clear budget, shows sellers that you’re a serious buyer, and can even speed up the closing process.

- Start gathering essential documents like tax returns, pay stubs, and bank statements—lenders and myself will need these to assess your financial health.

- Reach out to me today for information to help you compare mortgage rates and terms, ensuring you get the best deal.

- Take time to discuss your mortgage options with me, from fixed to variable rates, different term lengths, or special programs available to you.

- Download my mobile mortgage app.

5. Budget for Additional Costs

The home price isn’t the only expense you’ll need to plan for. Homeownership comes with extra costs that can catch buyers off guard if they’re not prepared.

- Closing costs typically range from 1.5% to 4% of the home’s purchase price, covering legal fees, land transfer taxes, and more. This is money you need on top of your down payment

- Property taxes, Condo fees and homeowners’ insurance can add to your monthly expenses—make sure to factor them into your budget.

- Set aside a fund for home maintenance and emergency repairs to avoid financial strain when unexpected expenses arise.

6. Research the Housing Market

Spring is a competitive time to buy, so being well-informed about the market can give you an edge.

- Keep an eye on housing prices in your preferred neighborhoods to understand trends and pricing expectations.

- Stay updated on current interest rates, as they directly impact affordability and your monthly payments.

- Work with a trusted real estate agent who can help you navigate bidding wars, negotiate offers, and find the right home for your needs.

7. Consider Locking in an Interest Rate

Interest rates can fluctuate, and even a small increase can affect your monthly payments. If rates are expected to rise, securing a lower rate in advance could save you money over time.

- Ask me about rate lock options and how long they’re valid for. Rate holds on average are valid for 120 days before they expire and a new rate hold period is requested

- Compare fixed and variable rates to see which aligns best with your financial goals.

- Keep an eye on Bank of Canada rate announcements and economic trends that could impact mortgage rates. Note: With recent Bank of Canada announcements variable rates which are tied to Prime are dropping.

Taking these steps now will set you up for success. The more financially prepared you are, the smoother the process will be—and the better your chances of landing your dream home at the right price.

Fraud Awareness Month: Scams to Avoid

Did you know? March is Fraud Awareness Month, making it the perfect time to learn how to protect yourself and your mortgage from fraud.

Understanding common mortgage scams and how to recognize warning signs can make all the difference in safeguarding your financial well-being.

Common Mortgage Fraud Scams

One of the most frequent types of mortgage fraud involves a fraudster acquiring a property and artificially inflating its value through a series of sales and resales. They then secure a mortgage based on the inflated price, leaving lenders and buyers at risk.

Red Flags to Watch For

Be cautious if you encounter any of the following:

- Someone offers you money to use your name and credit to obtain a mortgage

- You’re encouraged to provide false information on a mortgage application

- You’re asked to leave signature lines or other sections of your mortgage application blank

- A seller or investment advisor discourages you from inspecting the property before purchase

- The seller or developer offers a rebate on closing that isn’t disclosed to your lender

Title Fraud: A Costly Scam

Another major concern is title fraud, which is a form of identity theft. This occurs when a fraudster, using false identification, forges documents to transfer your property into their name. They then take out a new mortgage on your home, collect the funds, and disappear—leaving you to deal with the consequences when your lender starts foreclosure proceedings.

How to Protect Yourself from Title Fraud

- Always visit the property you’re purchasing in person.

- Compare local listings to ensure the asking price is reasonable.

- Work with a licensed real estate agent.

- Be cautious of realtors or mortgage professionals with a financial stake in the deal.

- Request a copy of the land title or conduct a historical title search.

- Include a professional appraisal in the offer to purchase.

- Require a home inspection to check for hidden issues.

- Ask for receipts for recent renovations to verify legitimacy.

- Ensure your deposit is held in trust for added security.

- Consider title insurance—the best time to get it is before fraud occurs, not after.

Stay Vigilant and Take Action

Fraud can have devastating financial consequences, but staying proactive and informed is your best defense. If you suspect fraudulent activity, act quickly—report it to the authorities and take steps to protect your assets.

Knowledge is power, and by staying alert, you can keep your mortgage and finances secure.

Monitoring your credit report can also help stay ahead of any fraud activity pertaining to identity theft!

Economic Insights from Dr. Sherry Cooper

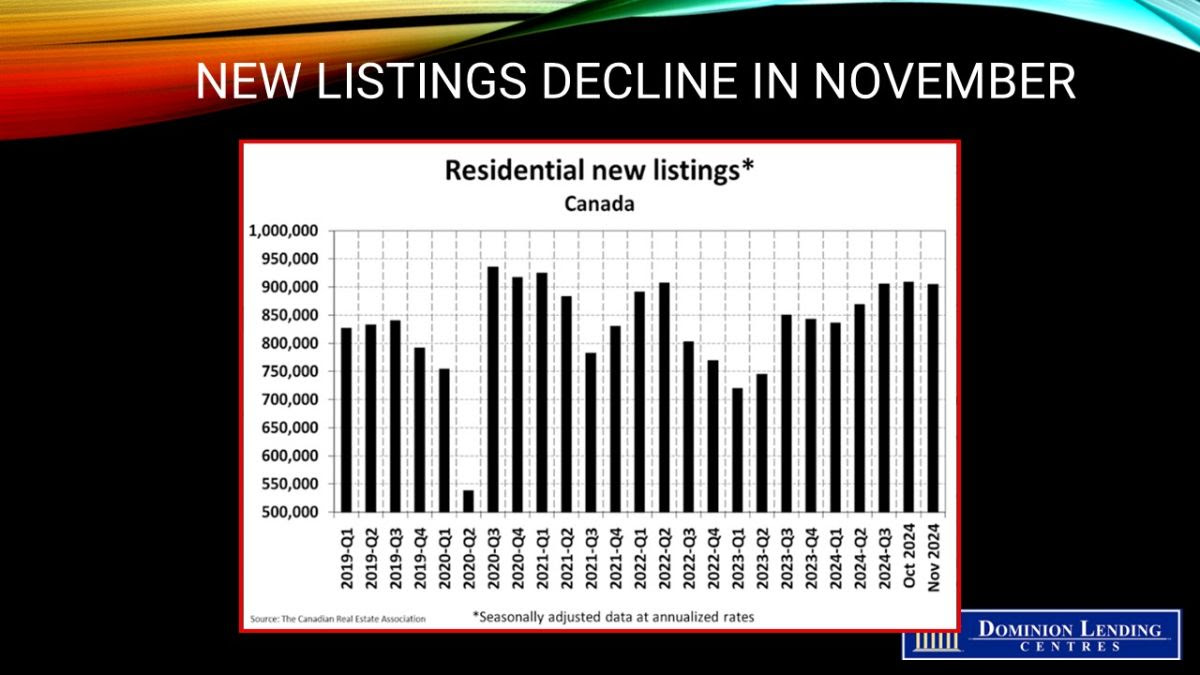

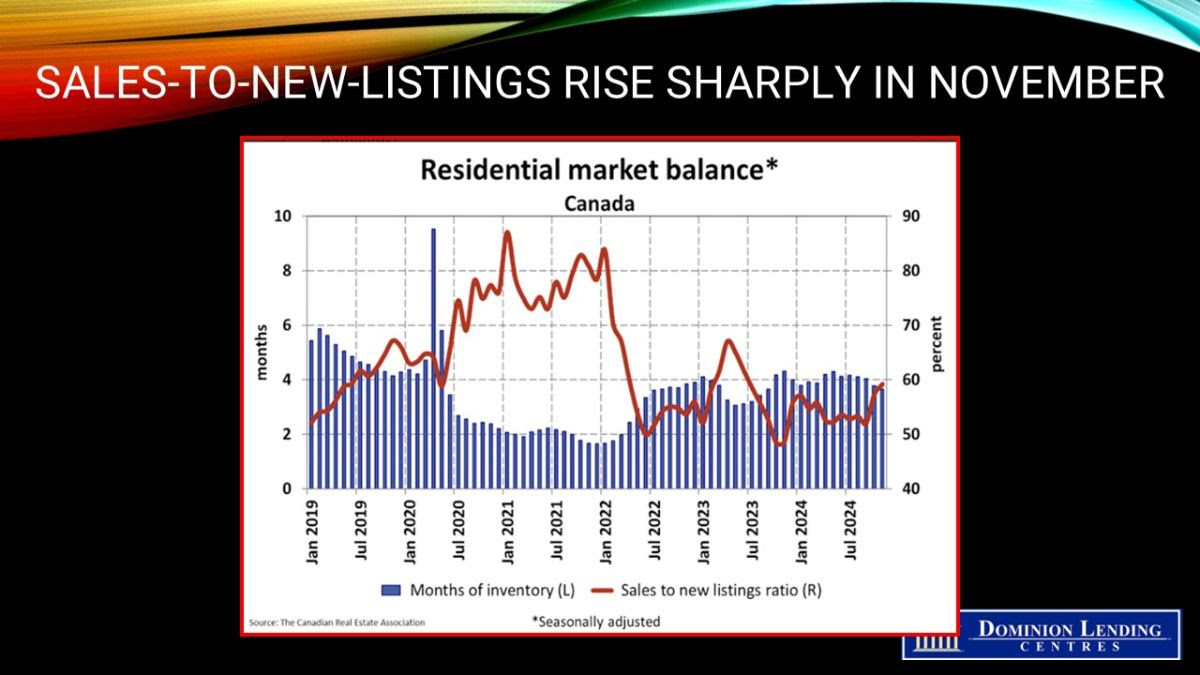

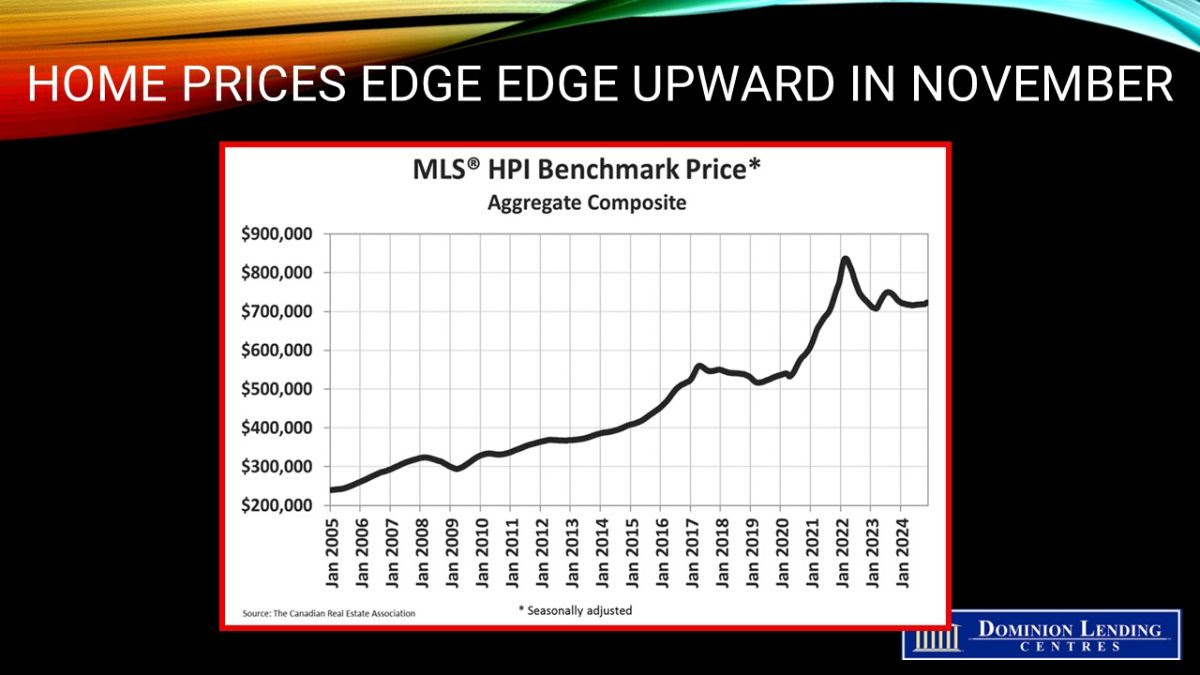

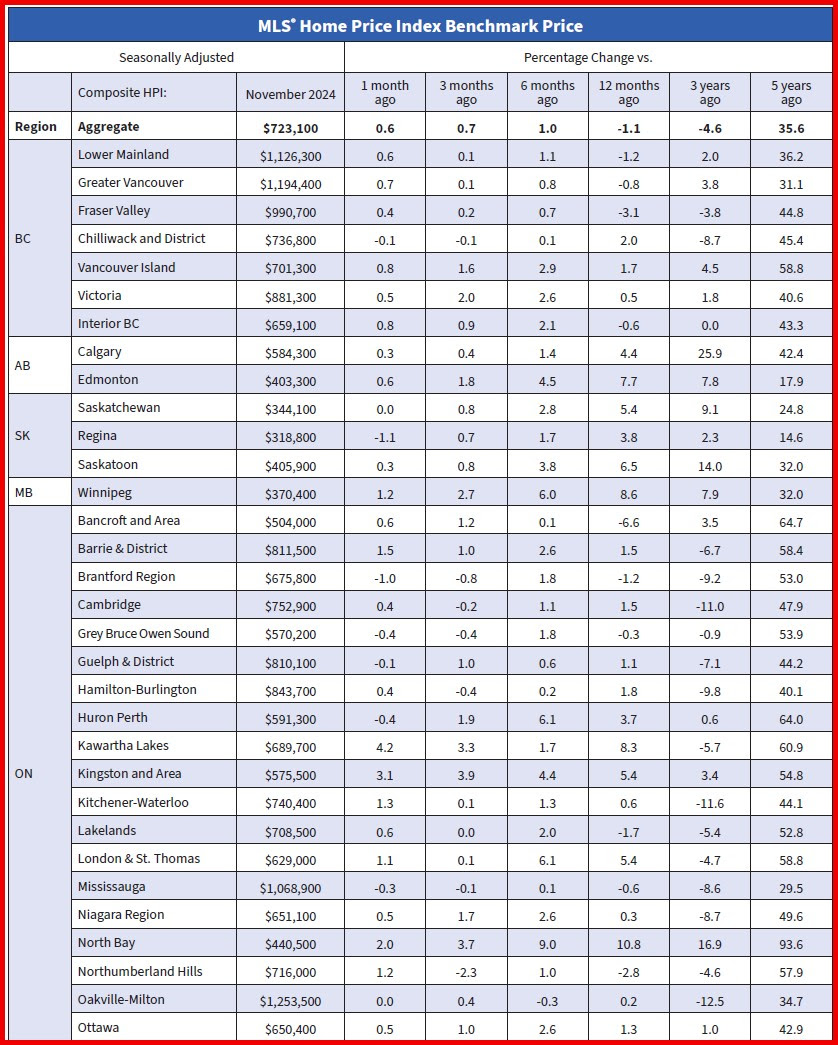

The outlook for the Canadian economy in the coming months presents a picture of cautious optimism with high uncertainty. Economic indicators were expected to strengthen this year, driven by resilient consumer spending and a robust export sector. Housing activity was poised to accelerate this year as well.

However, when the newly inaugurated US president began to threaten Canada with 25% tariffs at the end of January, home sales slowed markedly. However, challenges such as global market volatility and inflationary pressures could temper this growth.

The Bank of Canada will maintain its current monetary policy stance, carefully balancing interest rates to manage inflation while supporting economic activity. The housing market remains a key area of focus, with efforts to address affordability and supply constraints continuing to be critical. Immigration is slated to slow this year, particularly for non-permanent residents, which will ease the housing shortage. Rents have fallen sharply in recent months.

Rising costs, labour shortages, and potential import tariffs on building materials could hinder construction activity.

Tariff threats are real and unnerving. Exports account for roughly a third of Canadian economic activity. Canada sends 75% of its exports to the US, led by energy, automobiles, and metals. Threatened attacks on these trade flows might initially spill into higher prices. Still, the primary impact would be to slow economic activity and increase unemployment, already at 6.6%, up from a cycle low of 4.8% in July 2022. In contrast, the US jobless rate is a mere 4.0% and GDP growth is a lot stronger than in Canada despite double the central bank rate cuts than south of the border.

In the event of a trade war, interest rates are more likely to fall as the BoC attempts to backstop the economy. This would decrease mortgage rates, with floating rates falling more than fixed-rate loans. About 1.2 million mortgages will renew this year, most of them at a higher rate, said real estate company Royal LePage in a report out this morning.

Almost 30% of those homeowners said they would choose a variable rate on renewal, up from 24% now on a floating rate. Sixty-six percent said they would renew on a fixed-rate loan, down from 75% now locked in.

Of those who expect their monthly mortgage payment to rise upon renewal this year, 81% said the increase would put a financial strain on their household.

There remains a good chance that Canada could avert a trade war. We’ve already taken action to tighten our border. The US could not easily replace the oil, hydroelectricity power, autos or aluminum it purchases from Canada. We are the largest export market for US products. Excluding oil exports, the US has a trade surplus with Canada. Revisions to the US, Canada, and Mexico trade deal, slated for next year, could be accelerated. The US has much bigger fish to fry than trade concerns with Canada.

On balance, interest rates are likely to fall further. Government actions to improve housing affordability and pent-up housing demand bode well for a housing revival this year. Canadian inflation is under control at about 2%, boosting the chances of additional rate cuts this year.

Angela Calla is an 19-year award-winning woman of influence which sets her apart from the rest. Alongside her team, Angela passionately assists mortgage holders in acquiring the best possible mortgage. Through her presence on “The Mortgage Show” and through her best-selling book “The Mortgage Code“, Angela educates prospective home buyers by providing vital information on mortgages. In light of this, her success awarded her with the 2020Business Leader of the Year Award.

Angela is a frequent go-to source for media and publishers across the country. For media interviews, speaking inquiries, or personal mortgage assistance, please contact Angela at hello@countoncalla.ca or at 604-802-3983.

Click here to view the latest news on our blog.