Welcome to the October issue of my monthly newsletter!

It’s spooky season, but thankfully with the latest Bank of Canada rate cuts, your mortgage doesn’t have to be! Find out what the decreased interest rates mean for you, plus check out my tips to alleviate your financial stress this Fall.

Scroll down for all the details!

What the Bank of Canada Rate Drops Mean for YOU!

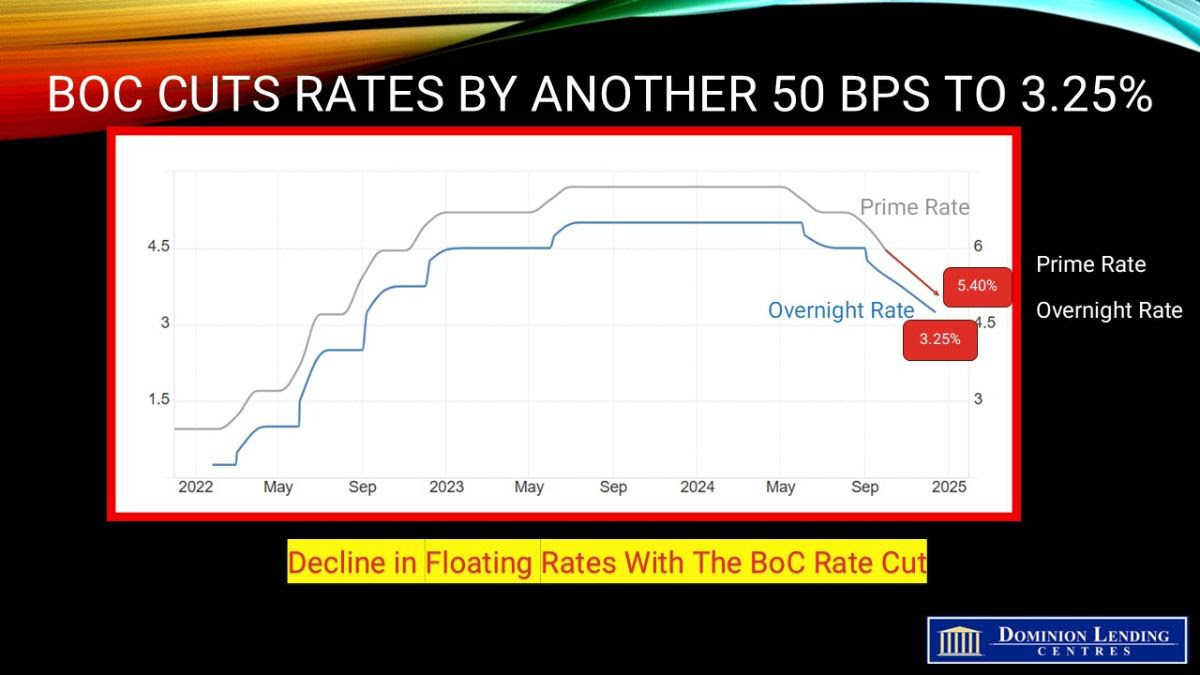

With the Bank of Canada rate decreases throughout the summer and into September, I thought this would be a great opportunity to update you on what this means for your mortgage.

If you’re on an adjustable-rate mortgage, this will result in a slight decrease in your mortgage payments, giving you more cash flow each month!

For example, if your mortgage balance is $750,000 at the previous 6.20% interest rate your approx. compounded monthly payment was likely around $4,924. With the new rate of 5.95% your approx. compounded monthly payment on an adjustable-rate mortgage will be $4,809*. This is an estimated $115/m decrease ($15/m per 100k balance) on your payment. While it may not seem like much, it can certainly add up over time resulting in hundreds of dollars in savings.

*Rates based on example of Prime minus .50% (old prime 6.70 and new prime 6.45)

Borrowers with static-payment variable-rate mortgages will also benefit from Bank of Canada rate decreases. While the monthly payment stays the same on these types of mortgages, the lower interest rate means that more of your monthly payment will go towards paying down your mortgage principal, and less will go towards interest.

Fixed-rate mortgages do not change when the Bank of Canada increases or decreases rates. However, if you have a fixed-rate mortgage, this declining rate environment could make it easier when it comes time to renew or refinance your mortgage. Lower rates give you more borrowing power in the market – this means your money can go further!

Recent changes are also great news for first-time buyers! Not only does a lower interest rate allow for more qualification options and lower payments, but recent Government of Canada changes on mortgage rules have removed many barriers previously faced by first-time home buyers.

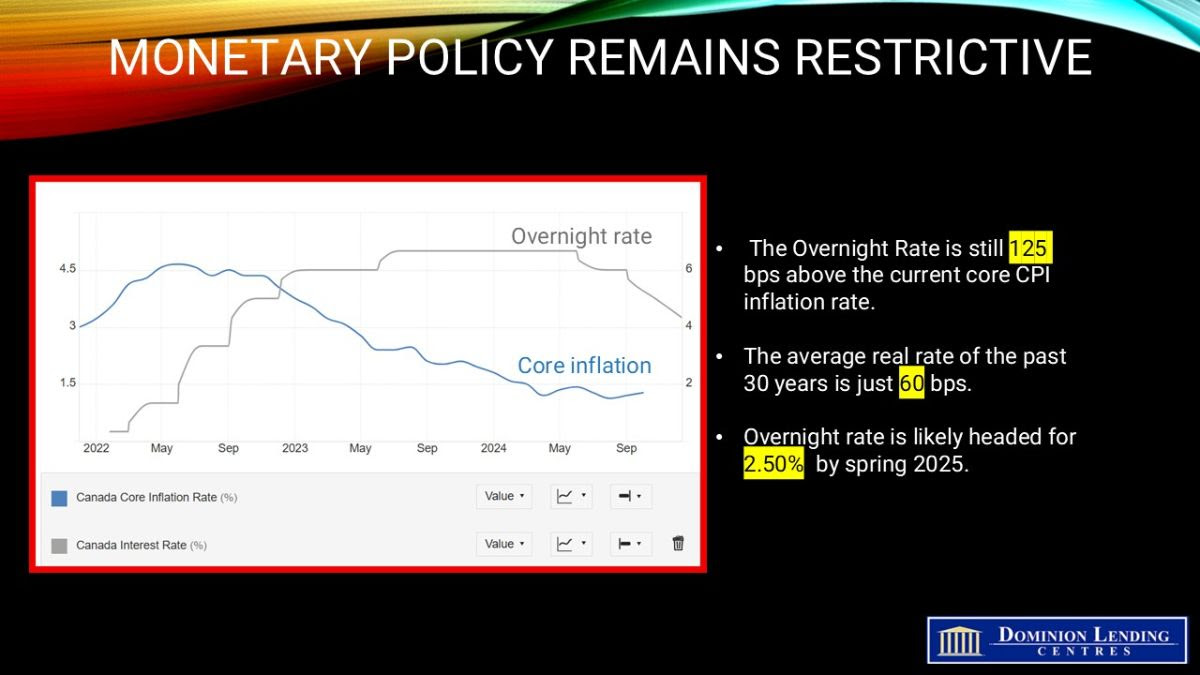

The Bank of Canada has two more decision dates this year in October and December. Experts anticipate the Bank of Canada will continue these quarter-point rate cuts, taking the overnight rate down to 4.0% at year-end and potentially down to 2.75% next year.

Whether you’re a current homeowner, looking to refinance or renew, or wanting to purchase, this is exciting news for Canadians across the country!

However, keep in mind rate is not the be-all-end-all of mortgages. Factors such as type of mortgage, down payment amount, payment schedule, amortization, prepayment penalties, and more will also affect your mortgage and affordability.

If you want more information about your specific mortgage and how this changing environment affects your situation, please don’t hesitate to reach out!

5 Tips to Manage Financial Stress

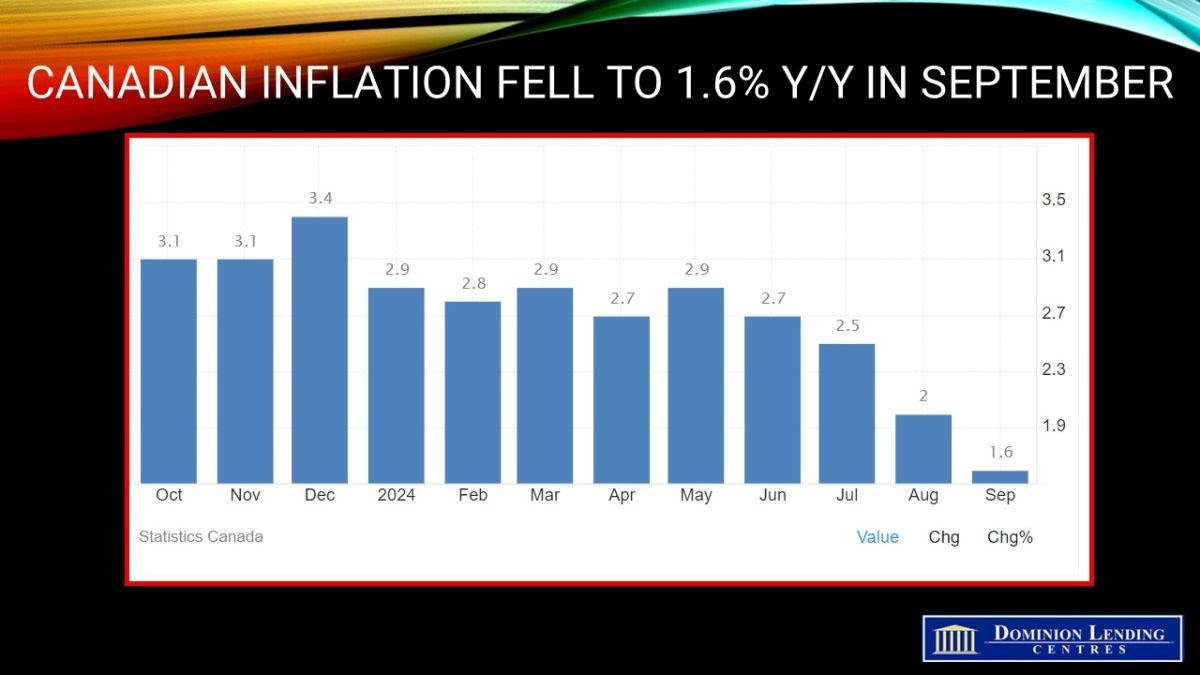

Despite the Bank of Canada taking steps to reduce interest rates, many Canadians still feel pressure due to the overall cost of living and inflation. This uncertainty can be unnerving for many individuals, but don’t fret!

I have some tips and suggestions to help you manage your financial stress and help you to power through these latest economic changes:

- Prioritize What You Can Control: It can be easy to feel like you have no control over your financial situation, especially with the economy in flux. However, dwelling on things you cannot fix will only cause more stress. Instead, we recommend focusing on what you CAN control within your situation. For instance, take a looking at your phone bill and services to see if you can reduce the cost (even temporarily), reviewing your grocery bill and looking for places to switch to cheaper brands or alternatives, perhaps buying in bulk. You’ll not only save money, but you will feel like you have more control and help reduce stress.

- Pay Essential Bills: If you are struggling to pay your monthly bills, prioritizing them can help you gain some control. Knowing which bills are most important to pay first can help reduce anxiety as you’re not scrambling to decide what to do. In some cases, prioritizing your bills can also help you uncover unnecessary spending and you may find something that can be eliminated entirely (even temporarily).

- Automate Payments and Savings: If you’re struggling to keep up with your bills and payments, or are finding that you keep saying you’ll save money, but aren’t, considering automation for your finances can be a step in the right direction. Ensuring that your bills are paid on time will help reduce stress and protect you from wasting money on penalties for missed payments. Alternatively, you can also set up automatic money transfers on the days you are paid to move funds into a separate, savings account before you even see it. Thereby, reducing the likelihood that you’ll skip adding to your savings that month or use that money elsewhere.

- Find Ways to Earn More Money: When cashflow is a problem and you are feeling the strain of trying to afford your current lifestyle, looking for ways to earn additional money can be a lifesaver! Consider part-time work for the weekends, consulting in your area of expertise or picking up extra hours at your current place of work. Now is also a great time to discuss with your manager if you are due for a raise.

- Talk to Your Mortgage Professional: For most people, their mortgage is their largest monthly bill. If you are feeling the financial crunch, now is a great time to talk to meabout potentially changing your payment schedule or even looking for a different mortgage product with better rates (ideally if you are at the end of your term). Do not hesitate to be honest about your situation and ask what your options are.

Regardless of where you find yourself financially, there are often many solutions to help reduce and resolve your stress and ensure that you have healthy monthly cashflow.

Economic Insights from Dr. Sherry Cooper

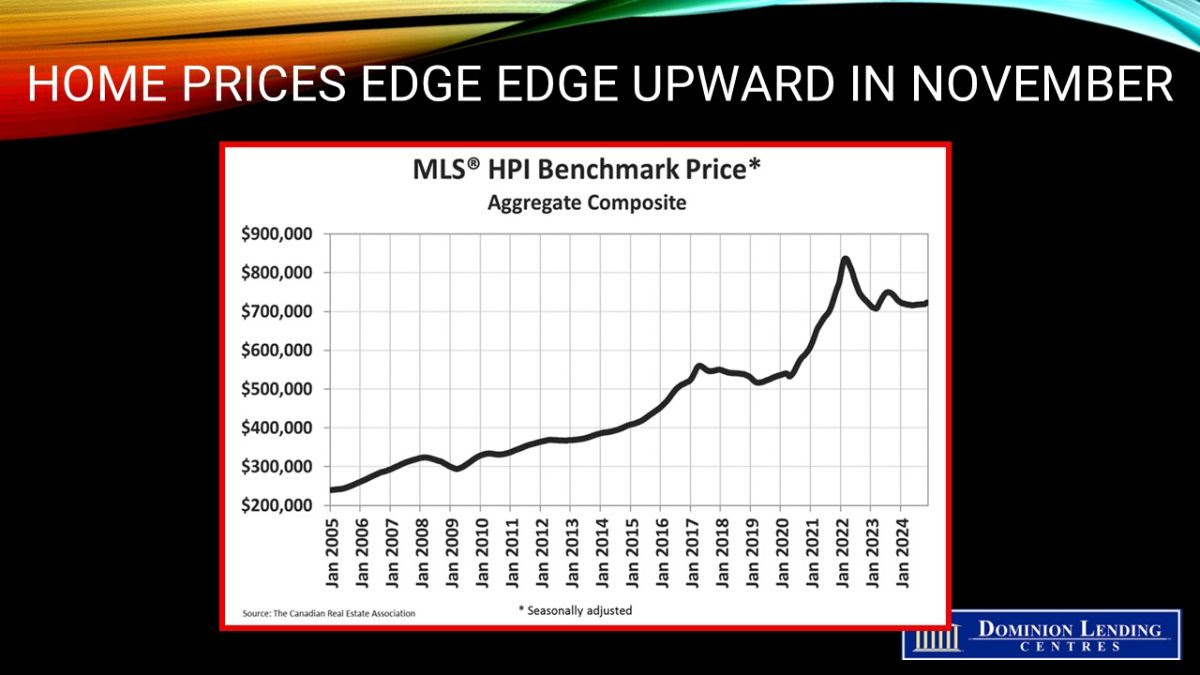

Two significant developments in September will have a lasting positive impact on Canadian housing activity. First were Ottawa’s measures to make housing more affordable. Second was the Fed’s 50 basis point rate cut.

Ottawa has come under increasing pressure to reduce immigration, build more housing, and help first-time homebuyers afford to buy a home. In response, the federal government increased the home price cap for insured mortgages from $1 million to $1.5 million. This is the first time the home value limit has been raised since 2012.

This will allow many more home purchasers to buy with a smaller downpayment (10% rather than 20%) and 30-year amortizations (up from 25 years for non-insured mortgages).

- A $1.5 million home will now require a $125,000 down payment (8.33%). That’s less than half the current $300,000 required ante (assuming the feds keep the minimum down payment tiers the same)

- The maximum insurance premium on a $1.5 million purchase with 30-year amortization will now be $57,750 (again, assuming 10% down on any purchase price portion over $500,000).

This will significantly impact high-cost real estate markets such as Vancouver and Toronto, where the selling prices average $1.1 million in Toronto and $1.2 million in Vancouver. In addition, all insured new-build buyers can get 30-year amortizations, not just first-time buyers.

With mortgage rates falling rapidly, these measures will accelerate the growth in housing demand.

Also, the good news was the Federal Reserve’s 50 basis point rate cut, the first such cut in this cycle. Fifty is double the usual policy change increment. Such moves are typically reserved for emergency Fed meetings or clear and present liquidity threats. This opens the door for the Bank of Canada to have a super-sized rate cut in October or December. This bodes well for building home sales going into the all-important spring season.

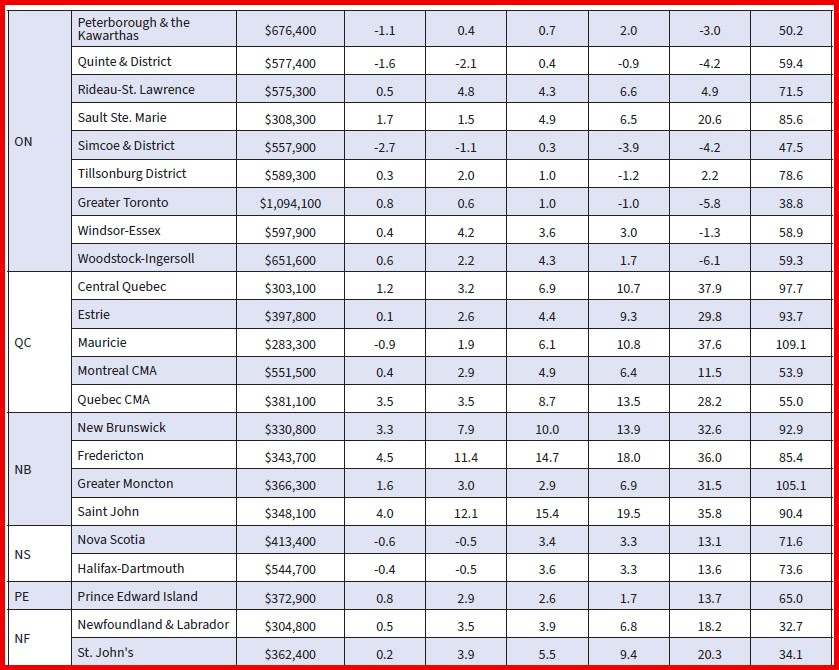

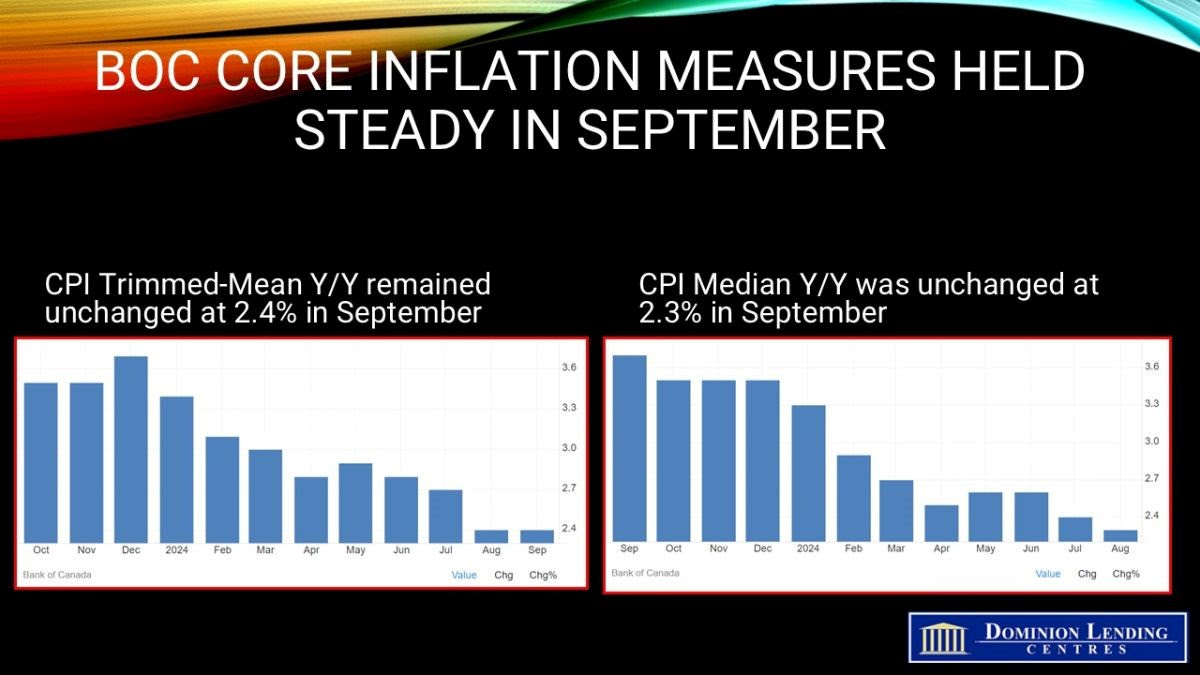

Inflation has fallen considerably, and the Canadian unemployment rate has risen sharply. While retail sales for July showed a considerable rebound, it was mainly because of a surge in car sales. Nonetheless, spending growth pales in comparison to the population surge.

Angela Calla is an 19-year award-winning woman of influence which sets her apart from the rest. Alongside her team, Angela passionately assists mortgage holders in acquiring the best possible mortgage. Through her presence on “The Mortgage Show” and through her best-selling book “The Mortgage Code“, Angela educates prospective home buyers by providing vital information on mortgages. In light of this, her success awarded her with the 2020Business Leader of the Year Award.

Angela is a frequent go-to source for media and publishers across the country. For media interviews, speaking inquiries, or personal mortgage assistance, please contact Angela at hello@countoncalla.ca or at 604-802-3983.

Click here to view the latest news on our blog.