Welcome to the December issue of my monthly newsletter!

As the end of the year approaches, I wanted to have one more check-in with you and provide some final tips for 2024! Scroll down and check out my favourite home and finance resolutions, along with some tips for decluttering your home in preparation for 2025. Have a great month!

Resolutions for Your Home and Finances

As the new year approaches, it’s a natural time to reflect on our personal goals and set resolutions for the months ahead. Your home and finances are key areas where small, intentional changes can lead to big improvements in security, stability, and quality of life.

Here are some resolutions to get you started!

Create a Realistic Home Budget

A well-planned budget is essential for financial peace of mind. Whether you’re new to budgeting or want to refine your approach, creating a realistic budget helps prioritize spending, track bills, and put money toward meaningful goals.

- Identify Fixed and Variable Expenses: List out fixed costs, like mortgage payments, utilities, and insurance, as well as variable ones, such as groceries and entertainment.

- Set Savings Goals: Include savings as a “non-negotiable” in your budget, earmarking funds for home repairs, investments, or emergencies.

- Track and Adjust: Track spending throughout the month and adjust where necessary. Financial apps like Mint or You Need a Budget (YNAB) make it easier to stay on course.

Set Goals to Build Home Equity

Building home equity is a key path to increasing net worth. Whether you’re planning to sell or stay in your home long-term, building equity can offer financial flexibility and security.

- Make Extra Mortgage Payments: Even a small additional payment toward your mortgage principal each month can shorten your loan term and reduce interest costs. A biweekly payment plan is another effective method to pay down the principal faster.

- Consider Strategic Home Improvements: Invest in upgrades that boost home value, like kitchen and bathroom remodels, or energy-efficient upgrades like new windows or solar panels. Prioritize improvements that add the most value to your property.

Develop a Plan to Pay Down Debt

Paying down debt (especially after the holidays!) can help free up cash flow. It is key to focus on high-interest debts first, such as credit cards, to maximize your payments.

- Use the Debt Avalanche or Snowball Method: The avalanche method involves paying off high-interest debts first, while the snowball method focuses on smaller debts first. Choose the one that best fits your motivation style

- Consider Refinancing or Consolidation: If you have a high-interest mortgage or multiple debts, refinancing or consolidating might reduce interest rates, making debt repayment more manageable

- Celebrate Milestones: Paying off debt can feel challenging, so celebrate progress. Every milestone achieved brings you closer to financial freedom.?

Commit to Energy Efficiency to Lower Bills

Saving on energy costs can have a significant impact on your budget, especially in colder or warmer months. Simple changes around the home can save you money while benefiting the environment!

- Invest in Smart Thermostats: A programmable thermostat can automatically adjust heating and cooling based on your schedule, saving energy when you’re not home.

- Switch to LED Lighting: LED bulbs use significantly less energy and have a longer lifespan than traditional bulbs.

- Insulate Windows and Doors: Adding weatherstripping to doors and windows keeps drafts out, making your heating and cooling systems more efficient.

Review Your Insurance Policies and Coverage

Insurance is a key element of financial security, but it’s easy to forget about it until something goes wrong. As you head into the new year, this is a great time to make sure you’re fully covered!

- Assess Homeowners and Mortgage Insurance: Review coverage limits and ensure your policy covers potential risks, including natural disasters if you live in high-risk areas.

- Shop for Better Rates: Contact your provider for discounts or shop around for new rates. Bundling policies, like home and auto insurance, can often yield savings.

- Update Beneficiaries and Coverage: Life circumstances change, and your insurance should reflect that. Update your beneficiaries, adjust coverage, and ensure policies align with your financial goals.

Setting resolutions for your home and finances doesn’t have to be daunting! Start with small, actionable goals to help transform your finances – and your mindset – for 2025!

12 Tips for Decluttering Your Space

Decluttering can bring a sense of calm and order to your space, especially as the holiday season approaches.

Here are some practical tips to help get organized:

- Start Small and Set Achievable Goals: Avoid overwhelm by breaking down the decluttering process into manageable steps. Set realistic goals, such as dedicating just 15 minutes a day to tidying up. Begin with a small area—like a single drawer or shelf—and gradually expand to larger spaces as you build momentum and confidence.

- Use the “One-In, One-Out” Rule: For every new item you bring into your home, make it a rule to remove an old one. This simple habit keeps your space from accumulating unnecessary items and helps maintain a balanced, organized environment.

- Sort and Categorize with Purpose: Sorting items as you go makes it easier to stay organized and keep track of where everything belongs. Use boxes or bins labeled “Keep,” “Donate,” “Sell,” and “Recycle/Trash” to give each item a clear destination. This method ensures that you can tackle everything in one go without second-guessing.

- Focus on Essentials and Joy: When deciding what to keep, ask yourself, “Does this item serve a purpose, or does it bring me joy?” If the answer is no, it’s probably time to let it go. Focusing on essentials and things that spark joy can help you make more meaningful decisions about what truly belongs in your home.

- Digitize Paper Clutter: Free up physical space by scanning or photographing important documents and storing them digitally. Use cloud storage or an external hard drive to keep these files secure and easily accessible. This practice reduces paper clutter and provides a backup in case of loss or damage.

- Declutter in Layers for Lasting Results: Tackle clutter in layers to avoid feeling overwhelmed. Start with the most obvious items—like broken or rarely used belongings—and gradually work your way through more sentimental or difficult-to-decide items. Revisiting each area multiple times helps you refine your space down to the things you truly need or cherish.

- Adopt a “Capsule” Mindset for Clothes and Accessories: Build a capsule wardrobe by focusing on versatile, high-quality clothing pieces that you love and regularly wear. Store out-of-season items separately to keep your main closet neat and functional. This approach simplifies decision-making and can make daily routines smoother.

- Set Up Regular Decluttering Routines: Make decluttering a habit by scheduling quick, regular clean-ups—a few minutes each day or a larger session every month. Consistency prevents clutter from building up over time and helps you maintain a tidy, organized space effortlessly.

- Involve the Whole Family: Encourage family members to declutter their own spaces and lead by example. Demonstrating the benefits of a tidy, organized home can inspire everyone to participate, making the whole process faster and more enjoyable.

- Treat Your Space as “Prime Real Estate”: View the most visible and accessible areas of your home as “prime real estate.” Reserve these spaces for the items you use and love the most, and relocate or discard things that aren’t worth taking up valuable room.

- Embrace Simple Storage Solutions: Use baskets, bins, and clear containers to keep your belongings organized and out of sight. Labeling containers makes it easy to find what you need at a glance, keeping everything in order while reducing visual clutter.

- Reevaluate Seasonal Items Regularly: After each season, go through holiday decorations, seasonal clothing, and other temporary items to decide what’s worth keeping. Donate, sell, or discard anything you no longer use. This ongoing process will help prevent excess accumulation year after year.

These tips can help you create a cleaner, more peaceful environment and build habits to stay organized in the long term. Happy decluttering!

Economic Insights from Dr. Sherry Cooper

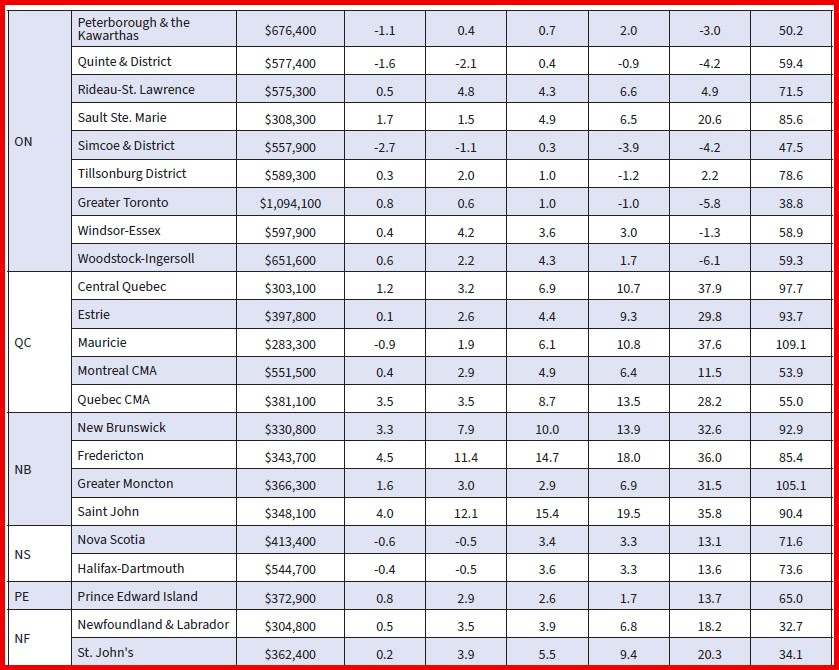

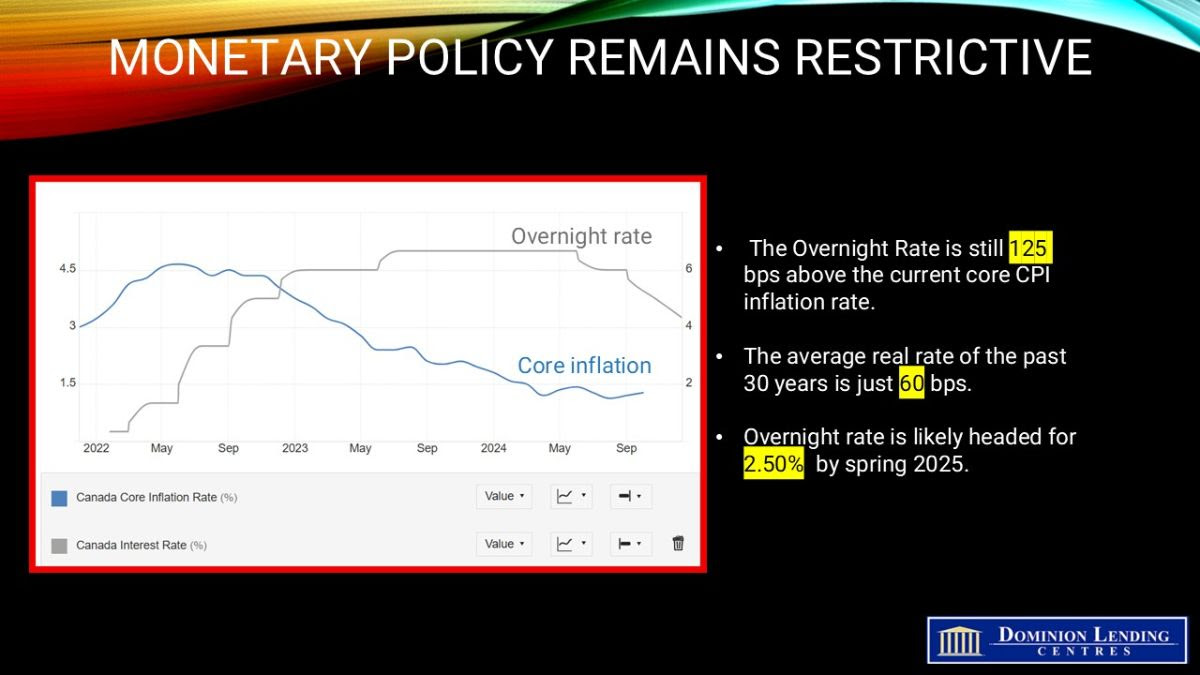

There is an unprecedented disparity between the economic and financial situation in the US and Canada. The Canadian economy is far more interest-sensitive than the US and, therefore, slowed more dramatically in response to the Bank of Canada’s restrictive policy to bring inflation back to its 2% target level.

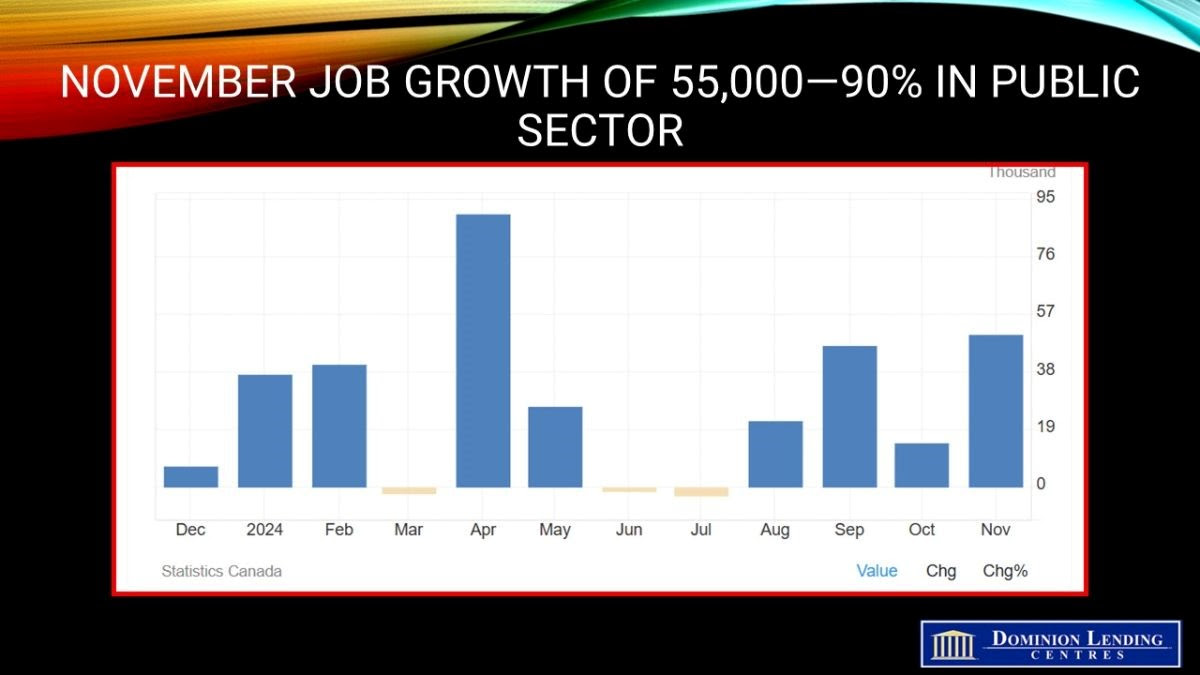

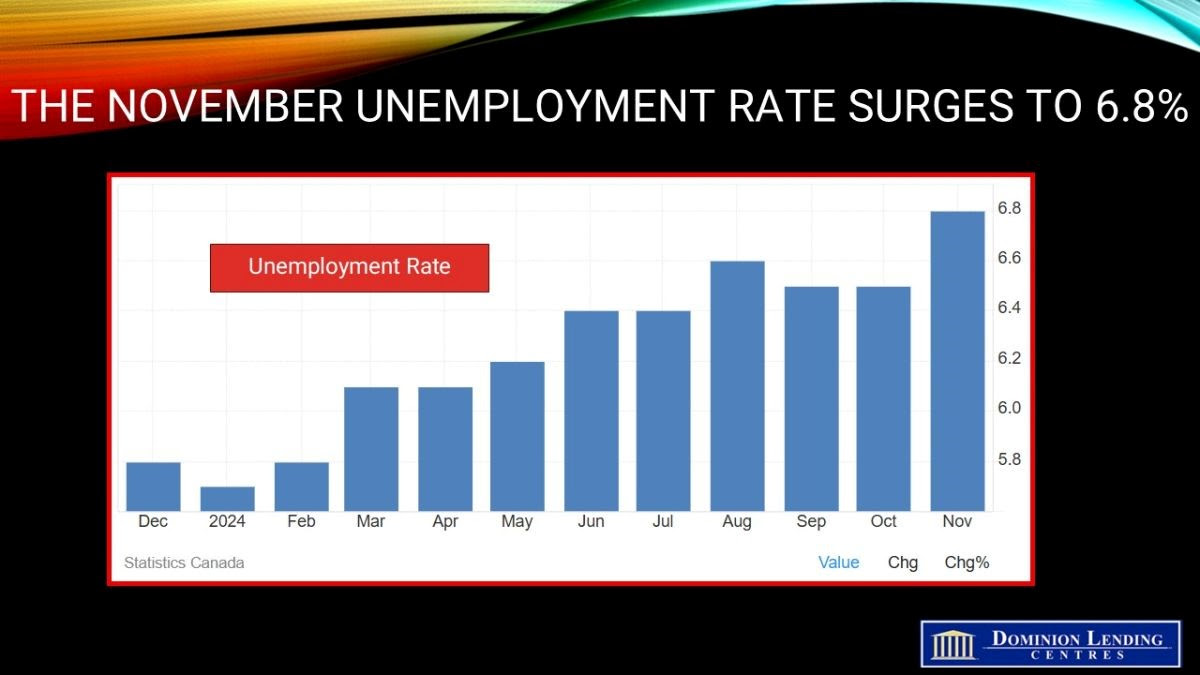

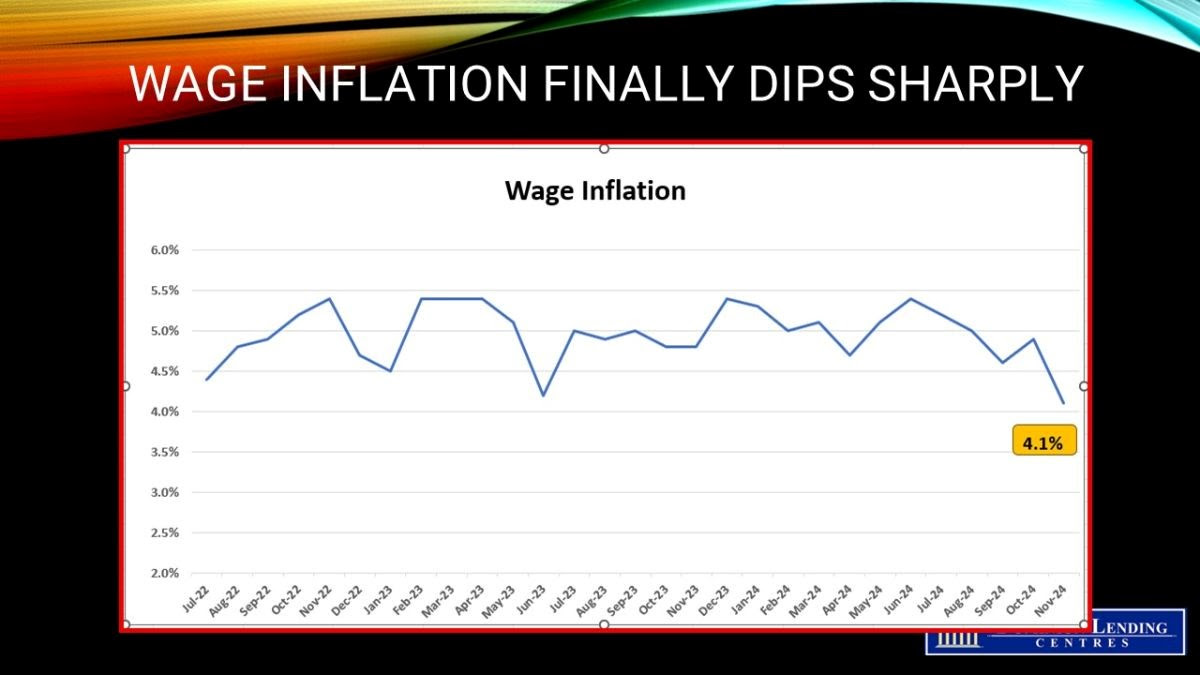

The jobless rate in Canada has reached 6.5%, well above the level in the US, and job vacancy rates have plummeted. Wage inflation has been sticky at 4.9% but will likely edge downward in response to excess supply in the labour market.

Inflation accelerated to 2% y/y in October, compared to the cycle-low 1.6% in September, mainly because gasoline price deflation slowed. The odds of another 50 bps rate cut by the central bank—on the heels of a jumbo cut in October—have diminished, but a 25 bps cut is in the bag.

Market-driven interest rates in Canada are well below those in the US, owing to weaker economic activity and lower inflation. US interest rates surged on the news of the Trump election victory. Ten-year US Treasury yields rose sharply to a post-election high of nearly 4.5% on the presumption that with a Republican majority in the House and the Senate, Trump will move ahead with tax cuts, tariffs and deregulation. Trump has also threatened to limit the independence of the Federal Reserve.

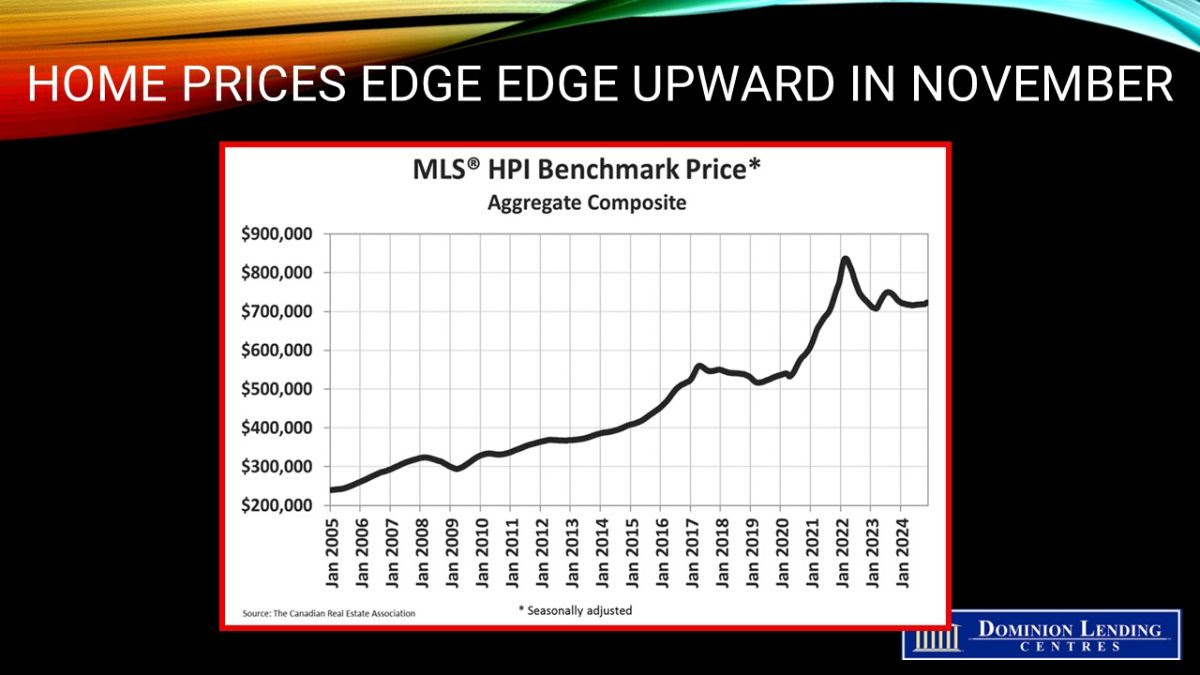

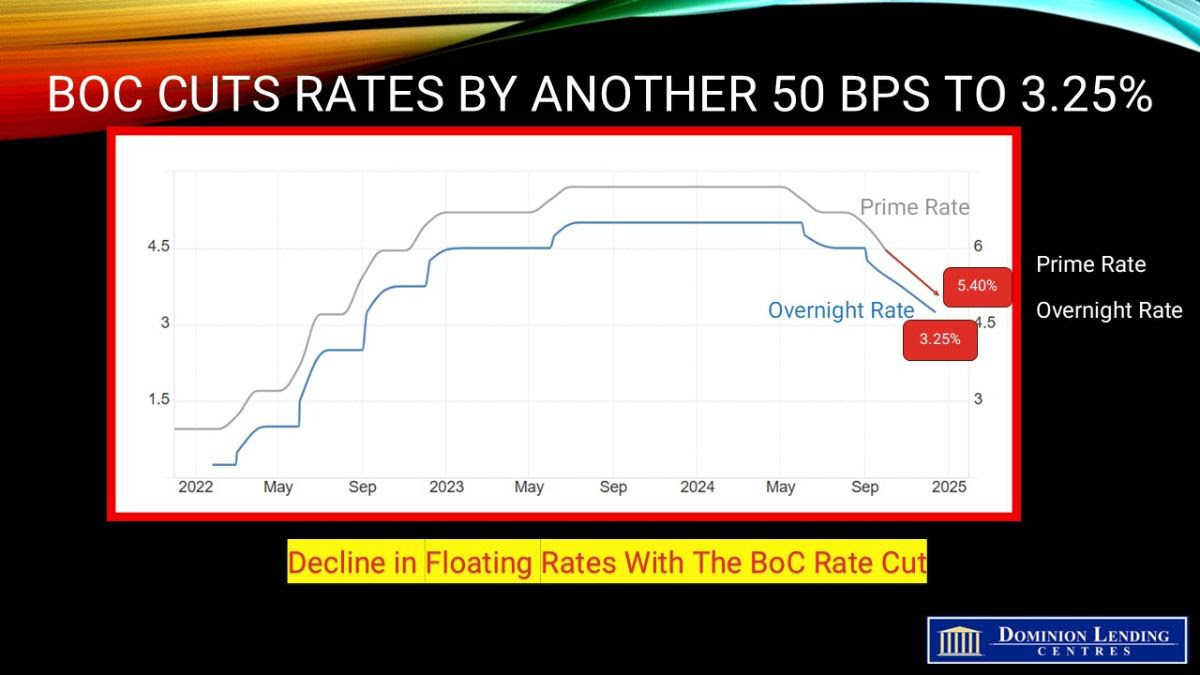

Canadian long-term yields have risen far less since the election. Short-term interest rates are also lower in Canada than in the US. The Bank of Canada has eased monetary policy four times for a total decline in the overnight policy rate of 125 bps, compared to only one rate cut of 50 bps by the Fed. This unprecedented divergence bodes well for a rebounding housing market in Canada.

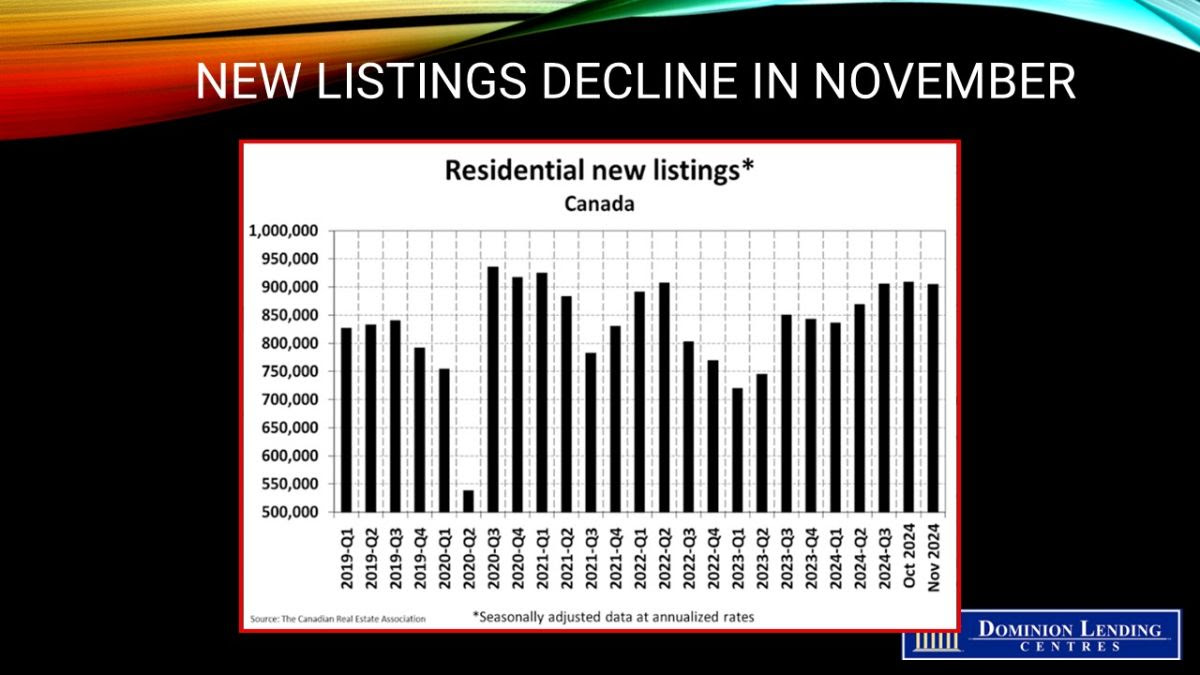

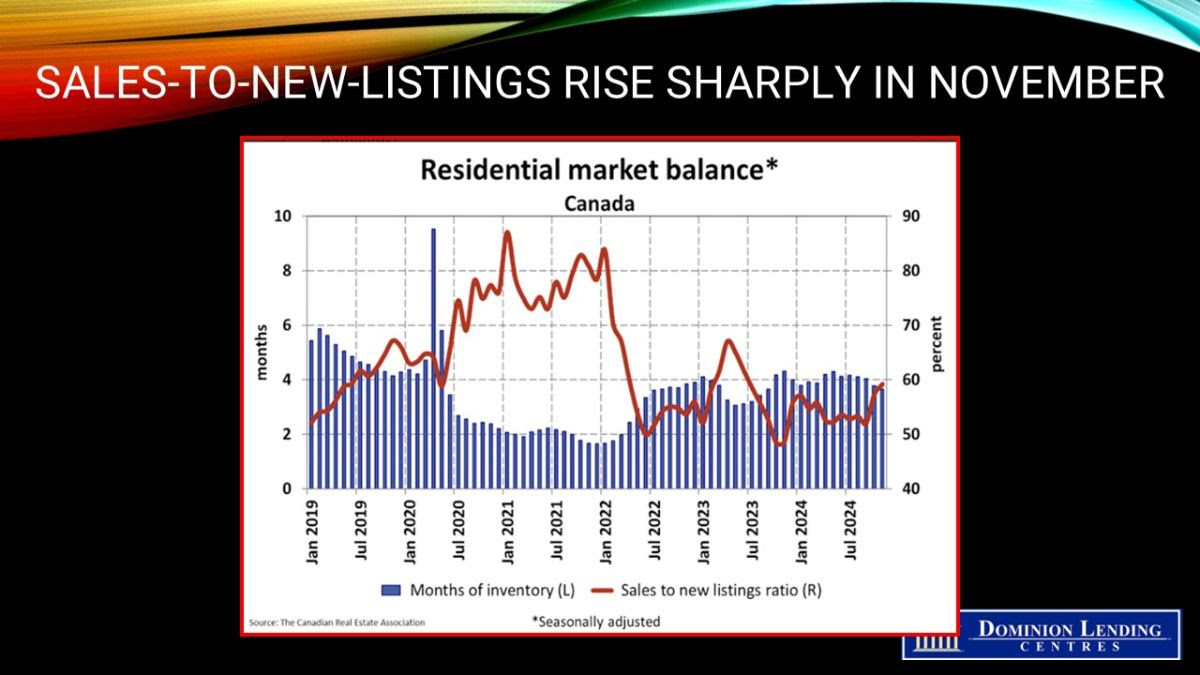

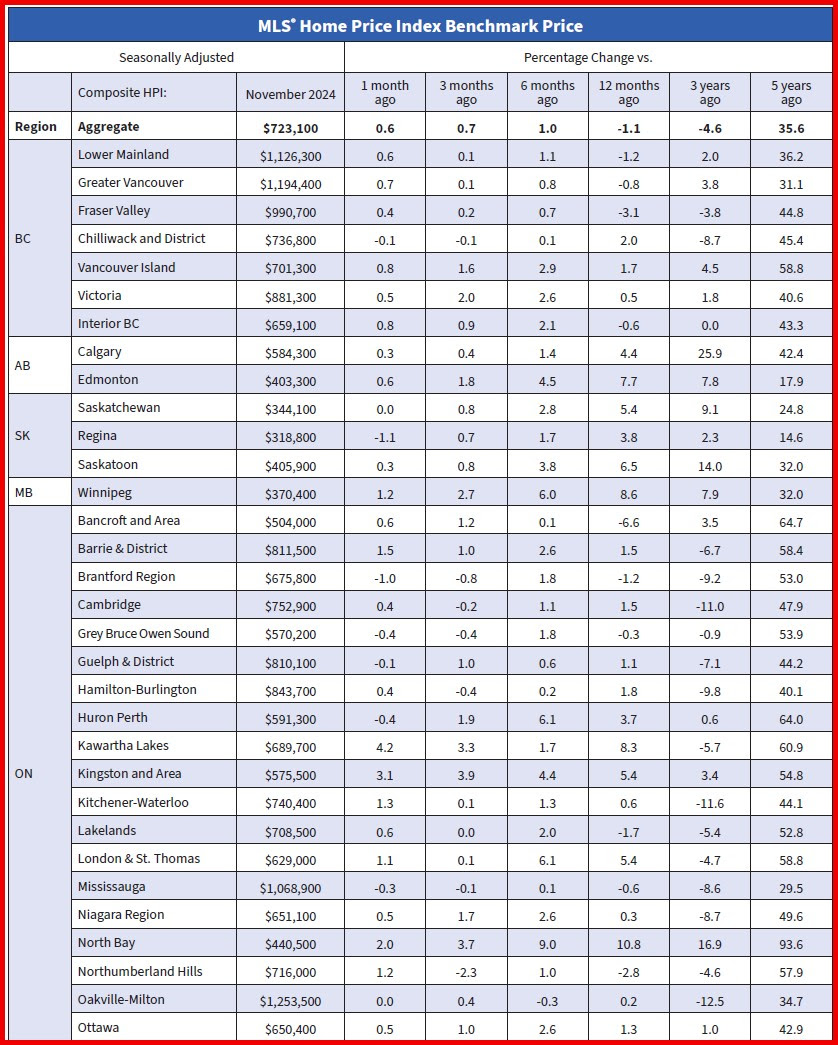

Housing activity picked up in October and early November in response to the surge in new listings, giving potential buyers a broader range of choices and lower interest rates. The steepening yield curve portends more significant declines in variable mortgage rates—tied to the prime rate, which declines with every cut in the overnight rate, than fixed rates, which move with longer-term bond yields.

The Bank of Canada, concerned about a weakening Canadian economy, will continue to cut the overnight rate at every meeting between now and mid-2025. By then, the policy rate will be roughly 2.5%, half the level at the peak in BoC tightening. This will likely trigger a robust spring housing season.

There is plenty of pent-up activity in the Canadian housing market as buyers have waited for lower interest rates and home prices, and sellers have been reticent to list their properties, hoping for a housing recovery. This is beginning to turn around as every easing move by the Bank of Canada boosts economic activity, particularly in the interest-sensitive housing sector.

Angela Calla is an 19-year award-winning woman of influence which sets her apart from the rest. Alongside her team, Angela passionately assists mortgage holders in acquiring the best possible mortgage. Through her presence on “The Mortgage Show” and through her best-selling book “The Mortgage Code“, Angela educates prospective home buyers by providing vital information on mortgages. In light of this, her success awarded her with the 2020Business Leader of the Year Award.

Angela is a frequent go-to source for media and publishers across the country. For media interviews, speaking inquiries, or personal mortgage assistance, please contact Angela at hello@countoncalla.ca or at 604-802-3983.

Click here to view the latest news on our blog.