Weaker-Than-Expected July Jobs Report Keeps BoC Rate Cuts In-Play

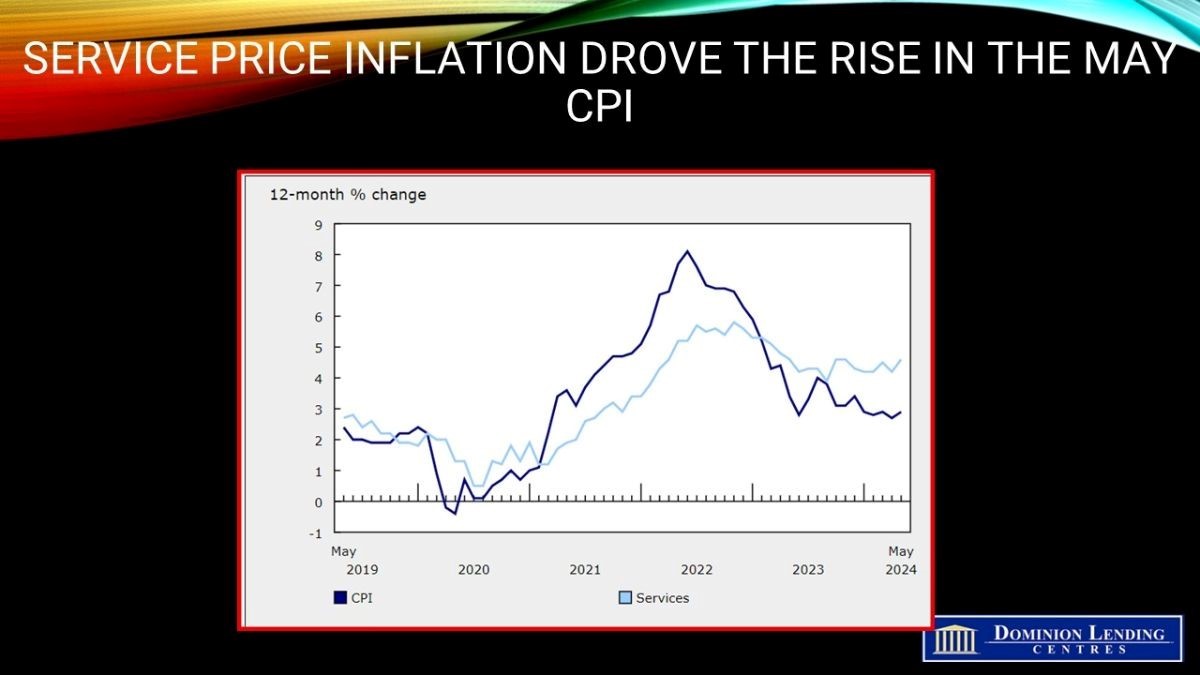

Canadian employment data, released today by Statistics Canada, showed a continued slowdown, which historically would have been a harbinger of recession. This cycle, immigration has augmented the growth of the labour force and consumer spending, forestalling a significant economic downturn.

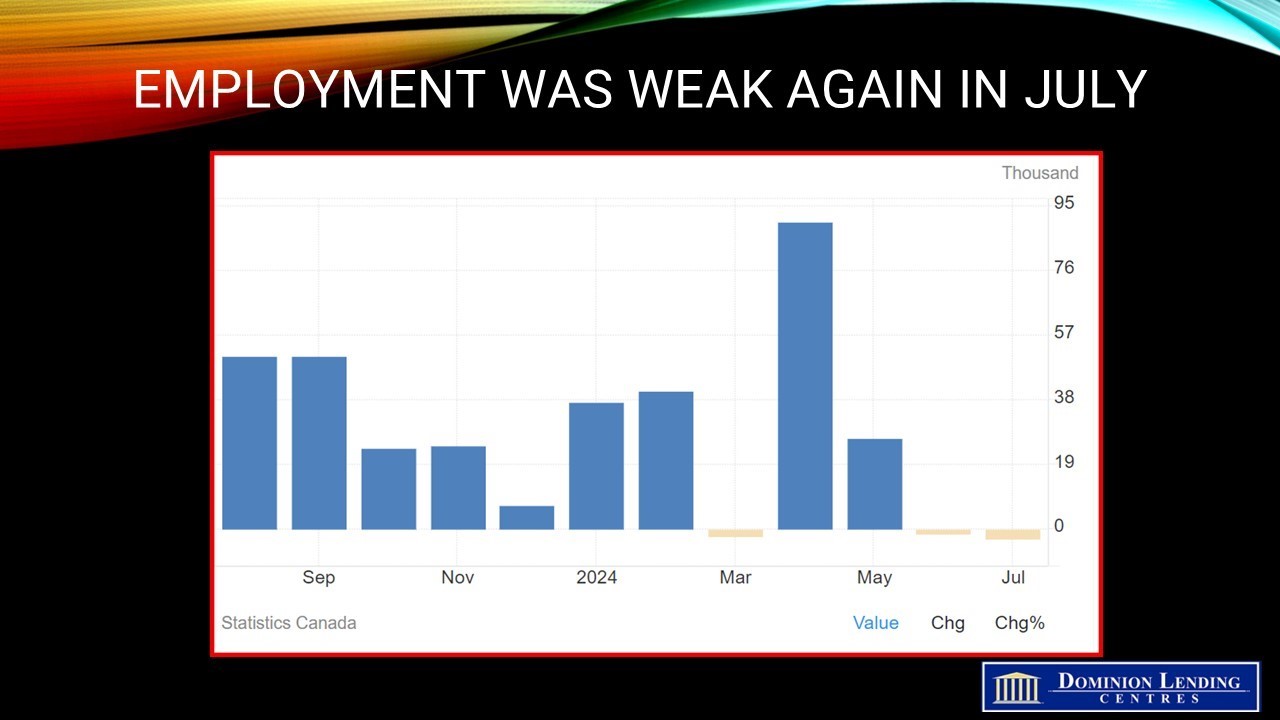

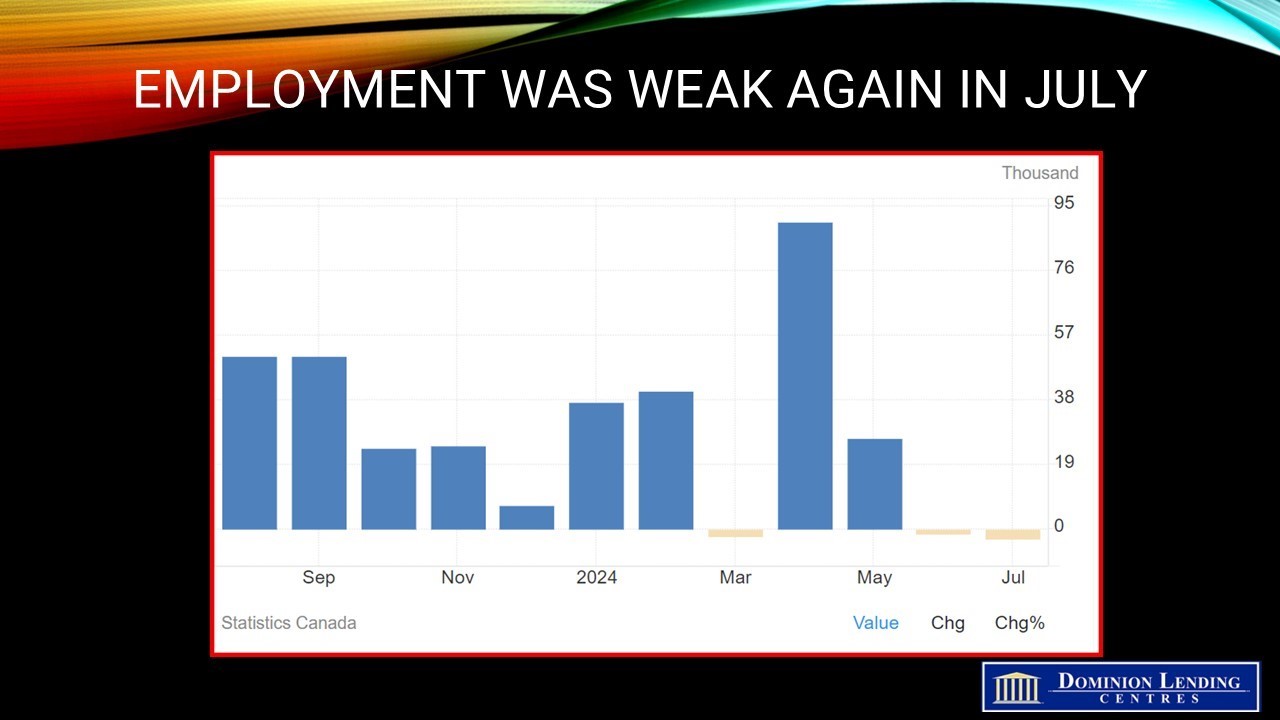

Employment declined again in July, down 2.8K. The employment rate—the proportion of the population aged 15 and older who are working—fell 0.2 percentage points to 60.9% in July. The employment rate has followed a downward trend since reaching a high of 62.4% in January and February 2023 and has fallen in nine of the last ten months.

In July 2024, an increase in full-time work (+62,000; +0.4%) was offset by a decline in part-time work (-64,000; -1.7%). Despite these changes, part-time employment (+3.4%; +122,000) has grown faster than full-time employment (+1.4%; +224,000) on a year-over-year basis.

Public sector employment rose by 41,000 (+0.9%) in July and was up by 205,000 (+4.8%) compared with 12 months earlier. Public sector employment gains over the last year have been led by increases in health care and social assistance (+87,000; +6.9%), public administration (+57,000; +4.8%) and educational services (+33,000; +3.3%) (not seasonally adjusted).

Self-employment changed little in July and was up by 55,000 (+2.1%) year-over-year.

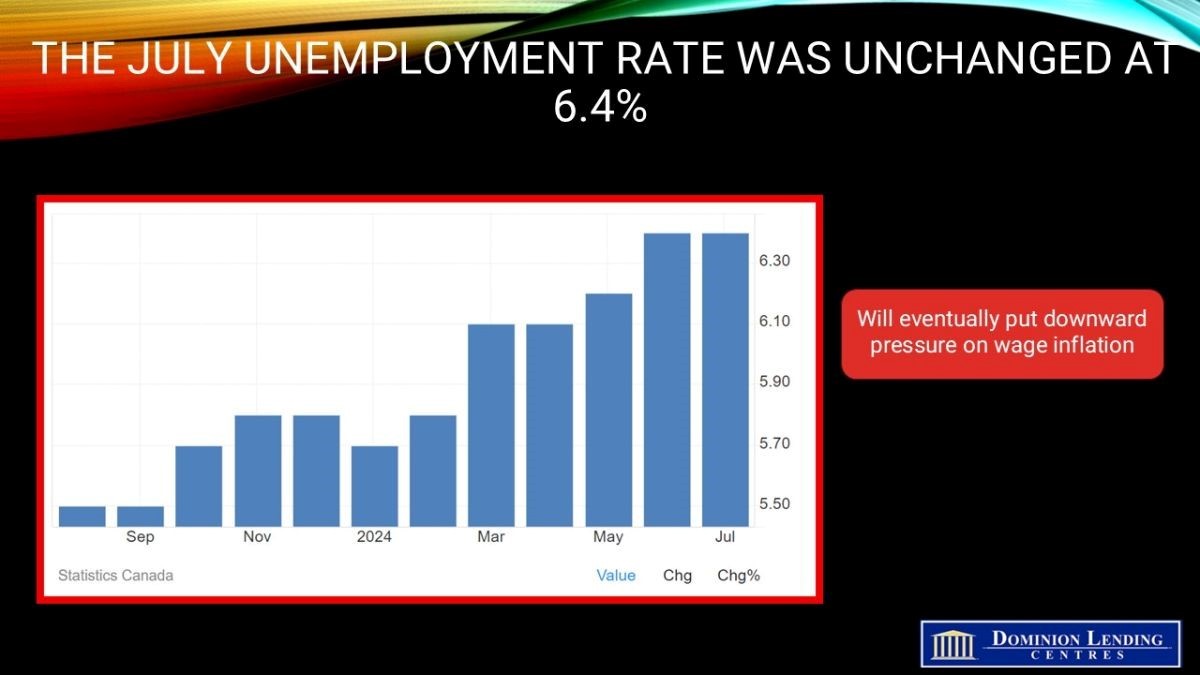

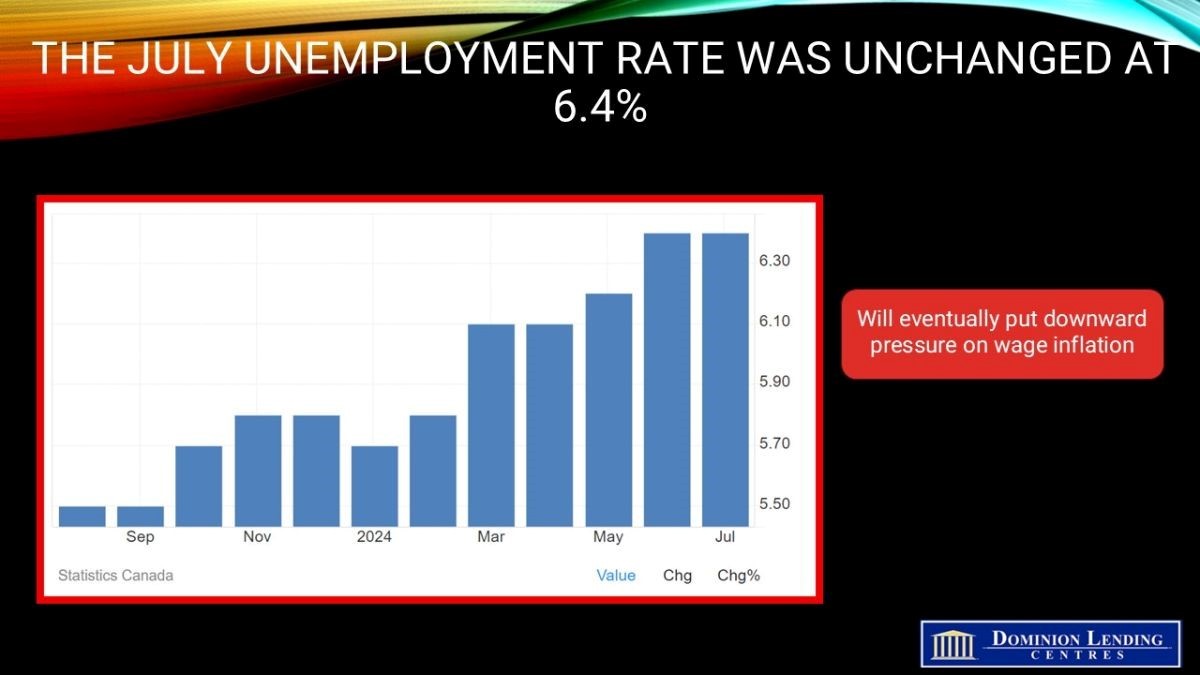

The unemployment rate was unchanged at 6.4% in July, following two consecutive monthly increases in May (+0.1 percentage points) and June (+0.2 percentage points). On a year-over-year basis, the unemployment rate was up by 0.9 percentage points in July.

The jobless rate rose more for recent immigrants, especially youth than those born in Canada.

The unemployment rate for this group was 22.8% in July, up 8.6 percentage points from one year earlier. For recent immigrants in the core working age group, the unemployment rate rose by 2.0 percentage points to 10.4% over the same period.

In comparison, the unemployment rate for people born in Canada was up 0.5 percentage points to 5.6% on a year-over-year basis in July, while the rate for more established immigrants (who had landed in Canada more than five years earlier) was up 1.2 percentage points to 6.3%.

In July, employment in wholesale and retail trade decreased by 44,000 (-1.5%), reflecting a continuing downward trend since August 2023. On a year-over-year basis, employment in the industry was down by 127,000 (-4.2%) in July 2024.

Employment in finance, insurance, real estate, rental, and leasing declined by 15,000 (-1.0%) in July, marking the first decline since November 2023. On a year-over-year basis, employment in this industry showed little change in July 2024.

Public administration saw a rise in employment by 20,000 (+1.6%) in July, following a decline in June (-8,800; -0.7%). Employment in transportation and warehousing also increased in July by 15,000 (+1.4%), partially offsetting declines in May (-21,000; -1.9%) and June (-12,000; -1.1%).

British Columbia experienced the highest job losses, while Ontario and Saskatchewan were the only provinces to add employment.

Adjusted to US standards, the unemployment rate in Canada for July was 5.4%, which was 1.1 percentage points higher than in the United States (4.3%). Compared with 12 months earlier, the unemployment rate increased by 0.8 percentage points in both Canada and the United States.

The employment rate has decreased in both countries over the past 12 months, with a larger decline in Canada. From July 2023 to July 2024, the employment rate (adjusted to US concepts) fell by 1.0 percentage points to 61.5% in Canada, while it declined by 0.4 percentage points to 60.0% in the United States. Compared with 12 months earlier, the unemployment rate increased by 0.8 percentage points in Canada and the United States.

Bottom Line

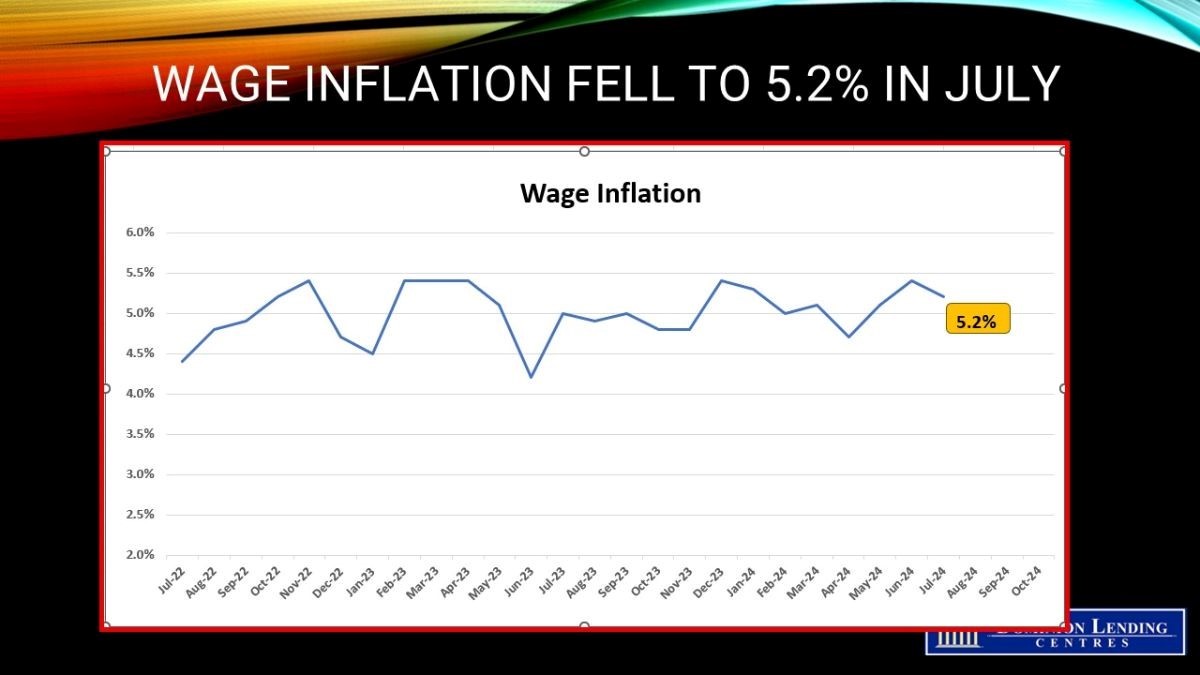

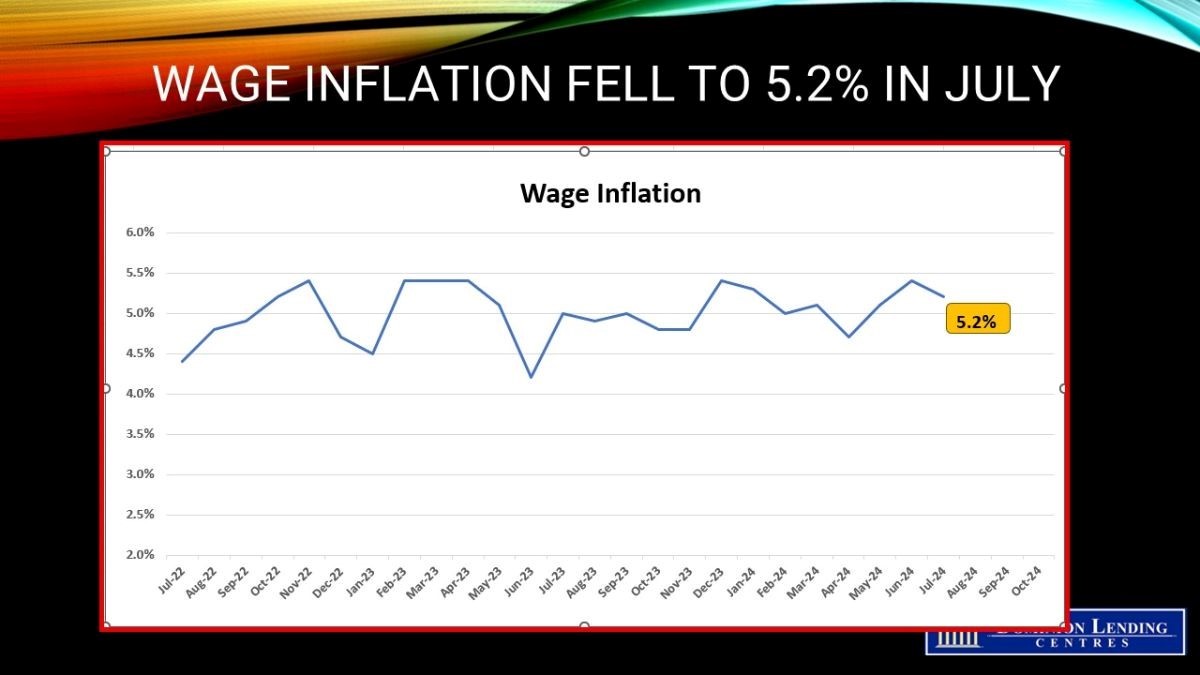

This is the only jobs report before the Bank of Canada meets again on September 4. Traders expect further rate cuts at the three remaining meetings this year.

Last week, weaker employment data in the US contributed to a selloff in global equities, as bonds rallied amid increased bets that the Federal Reserve will be forced to cut borrowing costs more deeply and quickly than previously expected.

The interconnectedness of the economies of the United States and Canada implies that any further weakening in the former is likely to permeate into the latter. This scenario affords Macklem the latitude to normalize borrowing costs without the concern of outpacing the Federal Reserve to a degree that could jeopardize the Canadian dollar.

Article courtesy of Dr. Sherry Cooper, Chief Economist, DLC

Angela Calla is an 19-year award-winning woman of influence which sets her apart from the rest. Alongside her team, Angela passionately assists mortgage holders in acquiring the best possible mortgage. Through her presence on “The Mortgage Show” and through her best-selling book “The Mortgage Code“, Angela educates prospective home buyers by providing vital information on mortgages. In light of this, her success awarded her with the 2020Business Leader of the Year Award.

Angela is a frequent go-to source for media and publishers across the country. For media interviews, speaking inquiries, or personal mortgage assistance, please contact Angela at hello@countoncalla.ca or at 604-802-3983.

Click here to view the latest news on our blog.