MAY’S SOFTER LABOUR MARKET DATA ENDED THE LONGEST RUN OF JOB GAINS SINCE 2017

Ironically, the May Labour Force Survey showed a modest slowdown two days after the Bank of Canada surprised the markets by raising interest rates. Employment was little changed in May, down 17,300, all for youth aged 15 to 24. All other age cohorts enjoyed continued rapid job gains. Total hours worked fell 0.4% but were up 2.2% year-over-year.

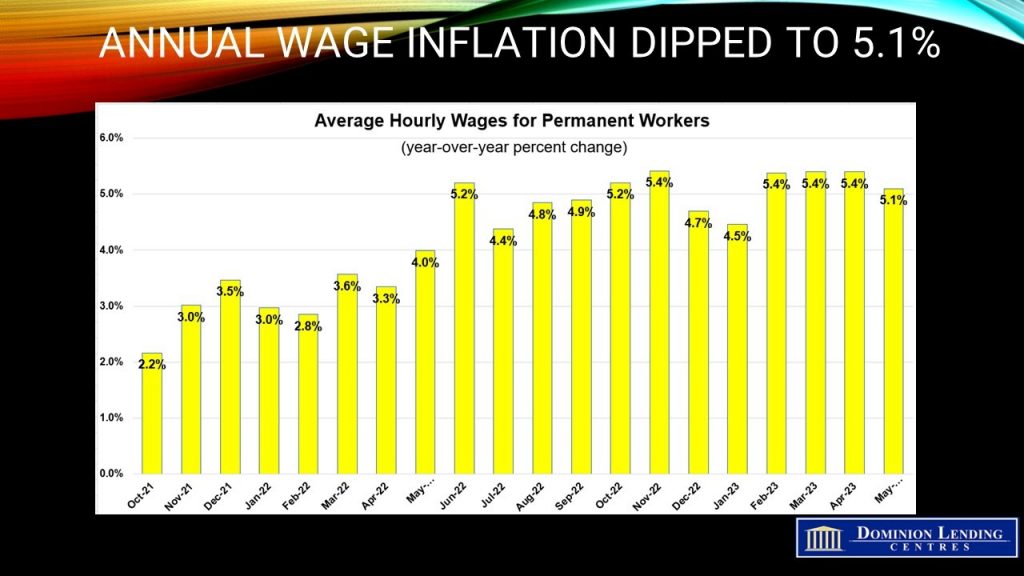

Wages rose by 5.1% last month, a moderate decline from the prior three months.

The employment rate—the percentage of people aged 15 and older—declined by 0.3 percentage points to 62.1% in May. This reflected strong population growth in the month (+83,000) and little change in employment.

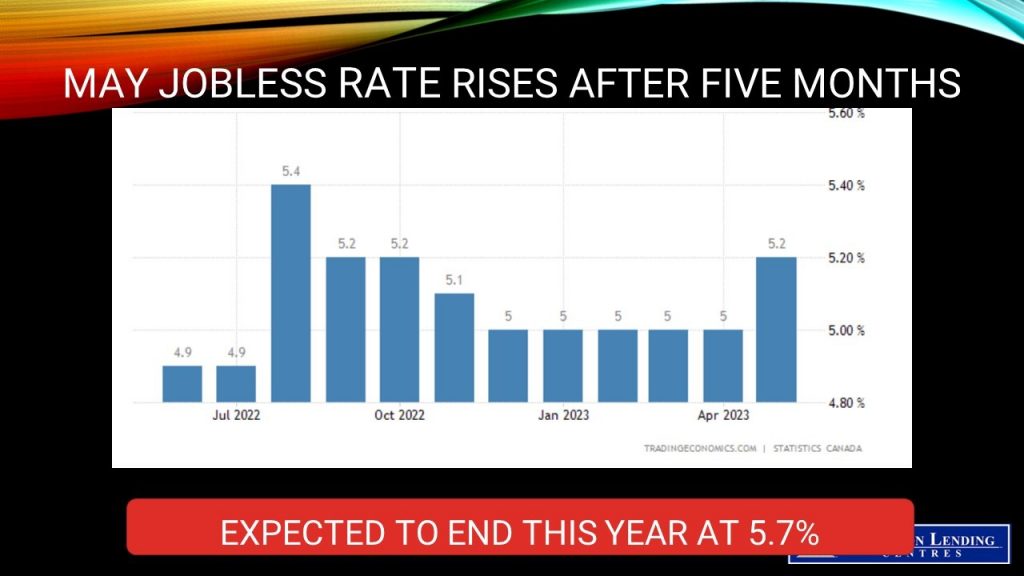

Following five consecutive months of a low 5% unemployment rate, the jobless rate rose 0.2 percentage points to 5.2% last month. This was the first monthly increase since August 2022. According to the median estimate in a Bloomberg survey, the figures missed expectations for a gain of 21,300 positions and a jobless rate of 5.1%.

The data for May concluded the most extended streak of job growth since 2017, during which a total of 423,900 new roles were generated. However, the extent of job losses was deemed statistically negligible, failing to counteract even half of the employment gains observed in April. Despite these losses, wages continued to rise robustly, marking over a 5% annual increase for the fourth consecutive month. This underscores a persistently tight labour market and a resilient economy, undeterred by escalating borrowing costs.

Bottom Line

Following an unanticipated robust beginning of the year, Canada’s employment market demonstrated dynamism well into the second quarter. A confluence of factors, including a tight labour market, solid economic growth, persistent inflation, and a resurgence in housing market activities, propelled Governor Tiff Macklem and his team to increase the overnight lending rate to 4.75% on Wednesday. This hike came after a previously announced halt in January. Policymakers perceived the enduring excess demand in the economy as “more persistent than anticipated.”

It seems improbable that the Bank of Canada would disrupt the interest rate pause that commenced in January merely for the 25 basis point interest rate increase. A single employment report exhibiting softer figures doesn’t constitute a new trend, especially considering that historically, the labour markets remain extraordinarily tight. Before the following decision on interest rates is due on July 12, we anticipate another jobs report, the May Consumer Price Index (CPI) report, and the Bank’s intensely scrutinized Business Outlook Survey. While we project a continued trend of softer data releases over time, it would likely require further unexpected downturns to derail plans for another rate hike in July.

(This article is courtesy of the Sherry Cooper Assoc.)

Angela Calla is an 19-year award-winning woman of influence which sets her apart from the rest. Alongside her team, Angela passionately assists mortgage holders in acquiring the best possible mortgage. Through her presence on “The Mortgage Show” and through her best-selling book “The Mortgage Code“, Angela educates prospective home buyers by providing vital information on mortgages. In light of this, her success awarded her with the 2020Business Leader of the Year Award.

Angela is a frequent go-to source for media and publishers across the country. For media interviews, speaking inquiries, or personal mortgage assistance, please contact Angela at hello@countoncalla.ca or at 604-802-3983.

Click here to view the latest news on our blog.