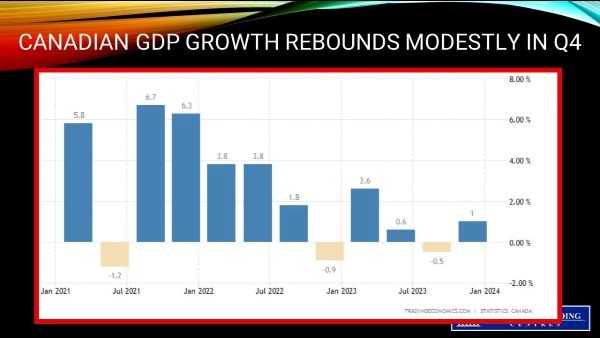

Still No Recession In Canada Thanks to Huge Influx of Immigrants

Real gross domestic product (GDP) rose a moderate 1.0% (seasonally adjusted annual rate), a tad better than expected and the Q3 contraction of -1.2% was revised to -0.5%. This leaves growth for 2023 at a moderate 1.1%. Monthly data, also released today by Statistics Canada, showed that December came in flat, well below the robust flash estimate, while the January preliminary estimate was a strong +0.4% (subject, of course, to revision). The January uptick was driven by the return of Quebec public servants and a mild winter.

The fourth quarter growth was fueled by higher oil exports and was moderated by a significant decline in business investment. Housing investment declined again in Q4–a sixth decline in the last seven quarters. Despite increased activity in Q4 new residential construction and renovations, it was more than offset by a large drop in home ownership transfer costs, reflecting the weakening resale market across Canada. Single-family units and apartments led the rise in new construction, as all provinces and territories, except Prince Edward Island, post a rise in housing starts.

Investment in non-residential structures fell sharply, as did spending on machinery and equipment, especially on aircraft and other transportation equipment. Even government spending declined.

Bottom Line

This is the last major economic release before the Bank of Canada meets again on March 6. The central bank will hold interest rates steady at next week’s meeting, and while some are suggesting the first rate cut this cycle will be as soon as the April confab, the consensus remains at June. With the uptick in growth in Q4, there is no urgency for the Bank to ease.

Policymakers will wait for their favourite core inflation measures to fall within the 1%-to-3% target band. They know that GDP per capita is falling and that mortgage renewals at higher interest rates will dampen household discretionary income. That’s why a June rate cut is widely expected.

(Article courtesy of Dr. Sherry Cooper, Chief Economist, DLC)

Angela Calla is an 19-year award-winning woman of influence which sets her apart from the rest. Alongside her team, Angela passionately assists mortgage holders in acquiring the best possible mortgage. Through her presence on “The Mortgage Show” and through her best-selling book “The Mortgage Code“, Angela educates prospective home buyers by providing vital information on mortgages. In light of this, her success awarded her with the 2020Business Leader of the Year Award.

Angela is a frequent go-to source for media and publishers across the country. For media interviews, speaking inquiries, or personal mortgage assistance, please contact Angela at hello@countoncalla.ca or at 604-802-3983.

Click here to view the latest news on our blog.