Good News On The Canadian Housing Front

The Canadian Real Estate Association says home sales in March edged up 1.4% in March. Homeowners and buyers were comforted by the fall in fixed mortgage rates as the Bank of Canada paused rate hikes. Bond market yields, though very volatile, have trended downward in March, although they have bounced since the release of this data this morning. The five-year government of Canada bond yield, tied closely to fixed mortgage rates, increased to 3.22% this morning compared to a low of roughly 2.8% in the week of March 20th. Rates had been as high as 3.9% over 52 weeks.

As we move into the all-important spring-selling season, green shoots of growth are evident. A standout in March was a significant sales increase in BC’s Fraser Valley.

The actual (not seasonally adjusted) number of transactions in March 2023 was 34.4% below a historically strong March 2022. The March 2023 sales figure was comparable to what was seen for that month in 2018 and 2019. It was also the smallest year-over-year decline since last September.

As we enter the spring season, some buyers are coming off the sidelines, but these are very tight markets. The inventory of unsold homes is exceptionally low in most regions of the country as sellers have been waiting for prices to rise. Home prices are now stabilizing across the country.

New Listings

The number of newly listed homes dropped a further 5.8% on a month-over-month basis in March. New supply is currently at a 20-year low. The monthly decline from February to March was led by a majority of major Canadian Census Metropolitan Areas (CMAs).

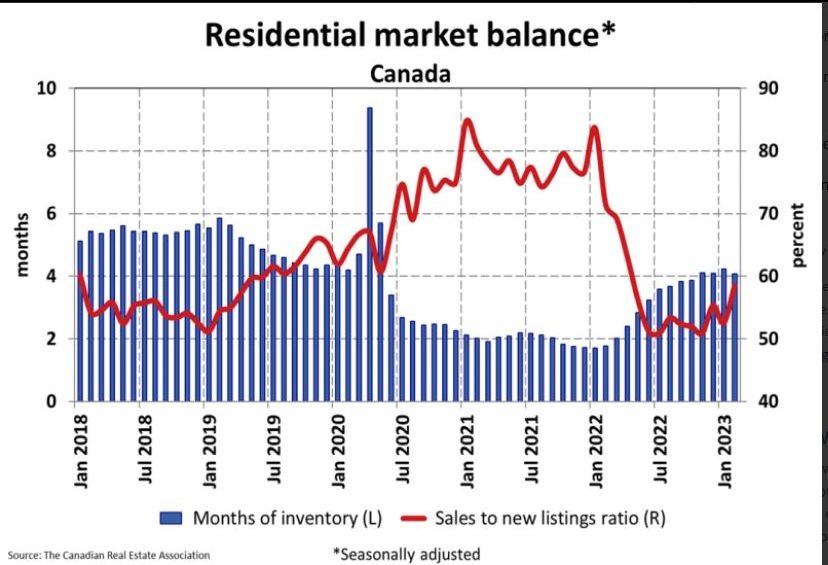

With new listings falling considerably and sales increasing again in March, the sales-to-new listings ratio jumped to 63.5%, the tightest market in a year. The long-term average for this measure is 55.1%. There were 3.9 months of inventory on a national basis at the end of March 2023, down from 4.1 months at the end of February and the lowest level since last October. It’s also now more than a full month below its long-term average.

Home Prices

The Aggregate Composite MLS® Home Price Index (HPI) was up 0.2% on a month-over-month basis in March 2023 – the first increase, albeit a small one–since February 2022. The trend of stabilizing prices from February 2023 to March 2023 was broad-based.

With few exceptions, prices are no longer falling across most of the country, although they’re not rising meaningfully anywhere. The Aggregate Composite MLS® HPI now sits 15.5% below year-ago levels, a smaller decline than in February.

Bottom Line

A gradual turnaround in the Canadian housing market is in train. While inventory remains extremely low, homes are not only selling but also selling fast. Short-term fixed-rate mortgages are popular with buyers. A significant change from before the Bank of Canada started raising rates.

While the Bank will likely hold rates steady for the remainder of this year, I do not expect Macklem to cut rates before then. All of this depends on inflation. We will get another read on that next week. It should be a good number (less than February’s 5.2% y/y posting) because of base effects. Stay tuned.

(This article is courtesy of the Sherry Cooper Assoc.)

Angela Calla is an 19-year award-winning woman of influence which sets her apart from the rest. Alongside her team, Angela passionately assists mortgage holders in acquiring the best possible mortgage. Through her presence on “The Mortgage Show” and through her best-selling book “The Mortgage Code“, Angela educates prospective home buyers by providing vital information on mortgages. In light of this, her success awarded her with the 2020Business Leader of the Year Award.

Angela is a frequent go-to source for media and publishers across the country. For media interviews, speaking inquiries, or personal mortgage assistance, please contact Angela at hello@countoncalla.ca or at 604-802-3983.

Click here to view the latest news on our blog.