In today’s ever-changing mortgage environment, we understand the challenges, especially when it comes to understanding as a clients the intricacies of Interest Rate Differential (IRD) penalties. We’re here to support you every step of the way. Our products that we offer you before we go to one of the big banks are designed to not only meet your immediate needs but also to protect your long-term financial interests. One way we do this look at monoline lenders with a fair IRD penalty calculation.

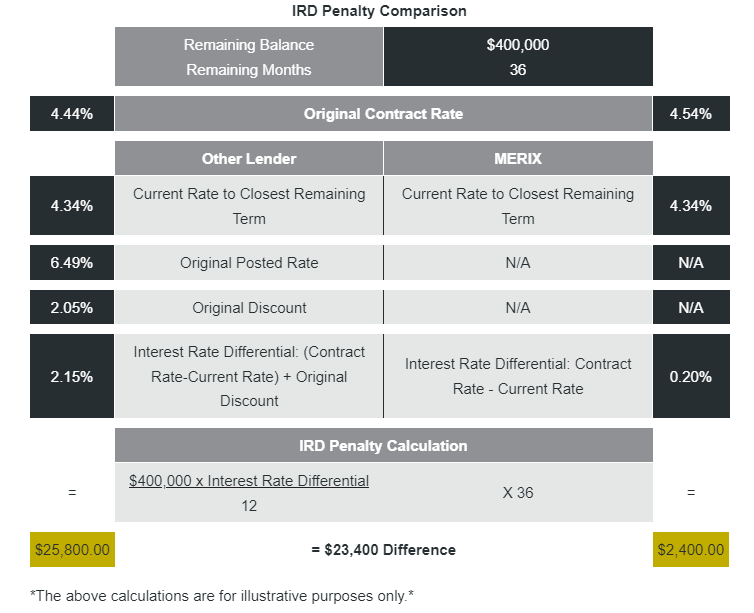

Take this example: one of the big banks has offered you a rate 10 bps lower than what you have been discussing with a mortgage broker. But that lender uses discounted rates. Before you start thinking THIS IS ALL ABOUT THE RATE learn how the math impacts your future if you are like 7/10 Canadians that will look to break there mortgage for a variety of reasons either with the market or your personal lifestyle on what that lower rate could mean later if they need to break their mortgage in two years:

Let’s compare:

Client has a slightly lower payment with the other lender and saves about $780 in interest over the two years.

But when they need to break their mortgage, client penalty costs are $23K+ higher.

Client wanted to break the mortgage to take advantage of lower rates. However, due to the high penalty, it doesn’t make sense for the clients to break their term. They are forced to stay with the other lender.

At the end of the term with the other lender, clients will end up with higher interest costs + higher payments for the last 3 years of the term.

How can you avoid costly mistakes and gain Penalty Protection?

- Understand The Journey – Assess both immediate needs and future financial goals, ensuring you always covered.

- Understand with Confidence – Life is unpredictable, and most clients will need to break their mortgage. A slightly higher monthly payment can act as insurance against hefty penalties helps protect financial well-being.

- Leverage Our Expertise – We provide you with extensive product knowledge and transparent penalty information, so you can confidently be guided through any scenario.

- Review a Visual – Utilize impactful tools like penalty comparisons that not only make the math clear, but helps you understand the conversation beyond just rates.

- Keep the Conversation Going – Your Mortgage Broker is here to support you as an expert resource, empowering you with timely and accurate information, ensuring they feel secure in every decision. We advise and you the client always instructs.

Angela Calla is an 19-year award-winning woman of influence which sets her apart from the rest. Alongside her team, Angela passionately assists mortgage holders in acquiring the best possible mortgage. Through her presence on “The Mortgage Show” and through her best-selling book “The Mortgage Code“, Angela educates prospective home buyers by providing vital information on mortgages. In light of this, her success awarded her with the 2020Business Leader of the Year Award.

Angela is a frequent go-to source for media and publishers across the country. For media interviews, speaking inquiries, or personal mortgage assistance, please contact Angela at hello@countoncalla.ca or at 604-802-3983.

Click here to view the latest news on our blog.