The federal government is looking to make home-buying more affordable for millennials – and one potential solution would have a noticeable impact on mortgage payments.

Finance Minister Bill Morneau said in January there are “multiple things we’re looking at in order to think about how we can help in that regard,” referring to home-affordability issues for young Canadians. He did not float any concrete policy options.

However, The Globe and Mail’s Bill Curry reported on Wednesday that Ottawa appears to be considering a move that would allow first-time home buyers to obtain 30-year insured mortgages, up from the current 25-year limit. The Canadian Home Builders’ Association has discussed policy changes in recent meetings with officials in the Prime Minister’s Office and Mr. Morneau’s office.

Read more here: The Globe and Mail

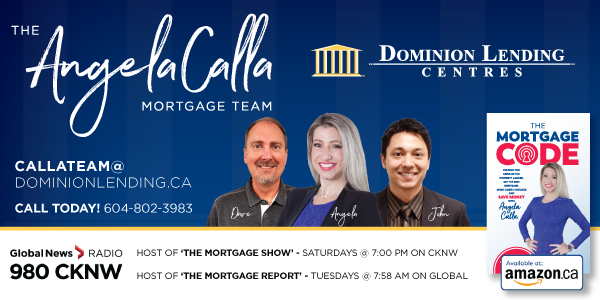

Angela Calla is a 15 year award-winning woman of influence mortgage expert. Alongside her team, passionately assisting mortgage holders get the best mortgage, and educating them on The Mortgage Show on CKNW for over a decade and through her best-selling book The Mortgage Code available on Amazon. To purchase the book click here: The Mortgage Code. Proceeds from a sales will help build a new emergency room at Eagle Ridge Hospital. Angela can be reached at callateam@dominionlending.ca or 604-802-3983.