The landscape for investors, both in stocks and real estate, is evolving rapidly. One of the key changes making headlines is the proposed new capital gains tax. While aimed at the wealthy, this tax reform is also set to impact the middle class. Understanding its implications and planning accordingly is crucial for investors.

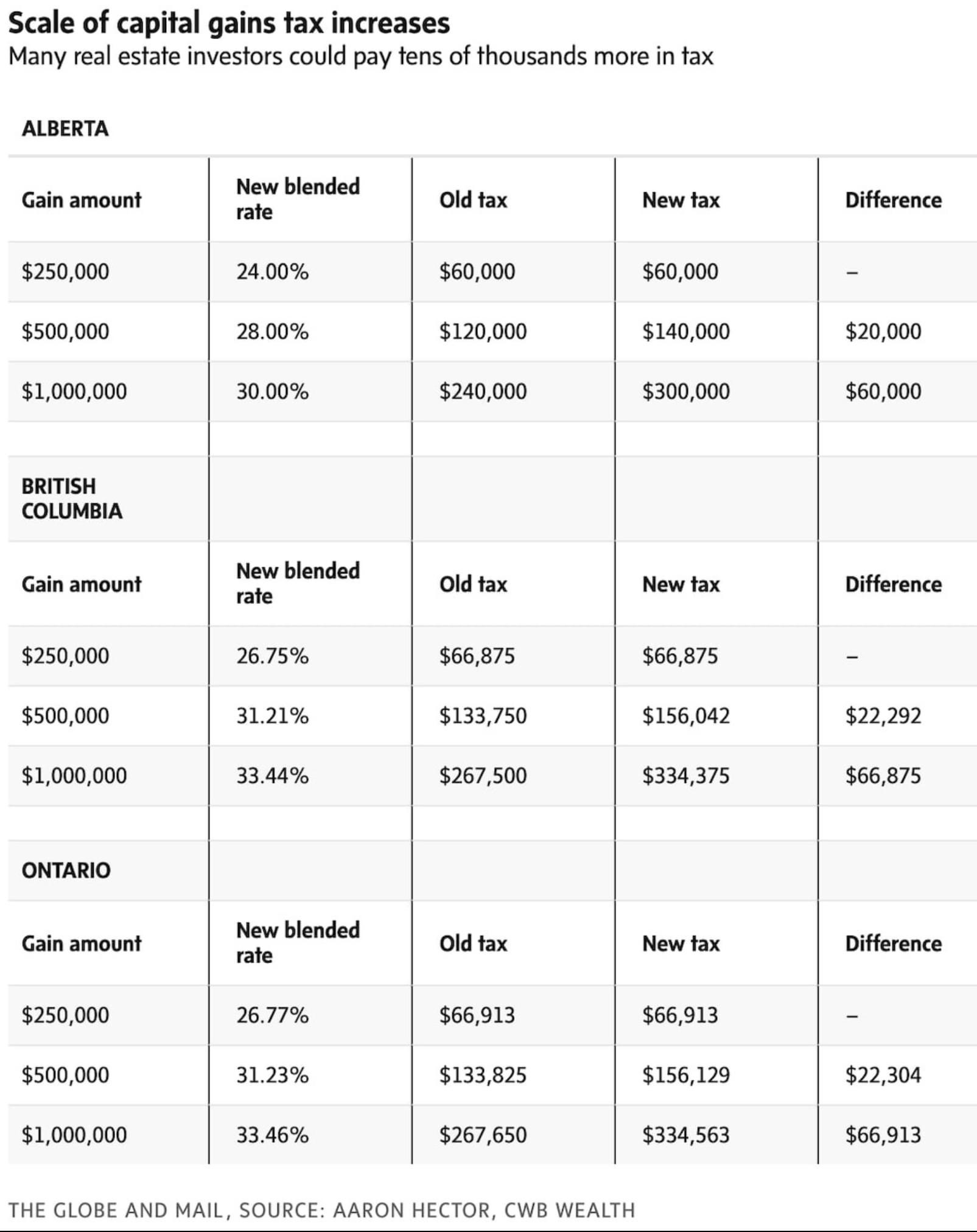

For real estate investors, the new capital gains tax could significantly affect their investment strategies. Currently, when you sell a property that is not your primary residence, you are required to pay capital gains tax on the profit. The proposed changes could increase the tax rate, impacting the overall return on investment.

Given these changes, consulting with a team of professionals is more important than ever. A qualified team can help you navigate the complexities of real estate investment, from purchase to sale. They can provide guidance on tax implications, investment structures, and strategies to optimize your returns while minimizing your tax burden.

The proposed new capital gains tax is set to impact investors across the board. For real estate investors, understanding these changes and seeking professional advice is key. By working with a team of professionals, you can navigate these changes effectively and make informed investment decisions.

Angela Calla is an 19-year award-winning woman of influence which sets her apart from the rest. Alongside her team, Angela passionately assists mortgage holders in acquiring the best possible mortgage. Through her presence on “The Mortgage Show” and through her best-selling book “The Mortgage Code“, Angela educates prospective home buyers by providing vital information on mortgages. In light of this, her success awarded her with the 2020Business Leader of the Year Award.

Angela is a frequent go-to source for media and publishers across the country. For media interviews, speaking inquiries, or personal mortgage assistance, please contact Angela at hello@countoncalla.ca or at 604-802-3983.

Click here to view the latest news on our blog.