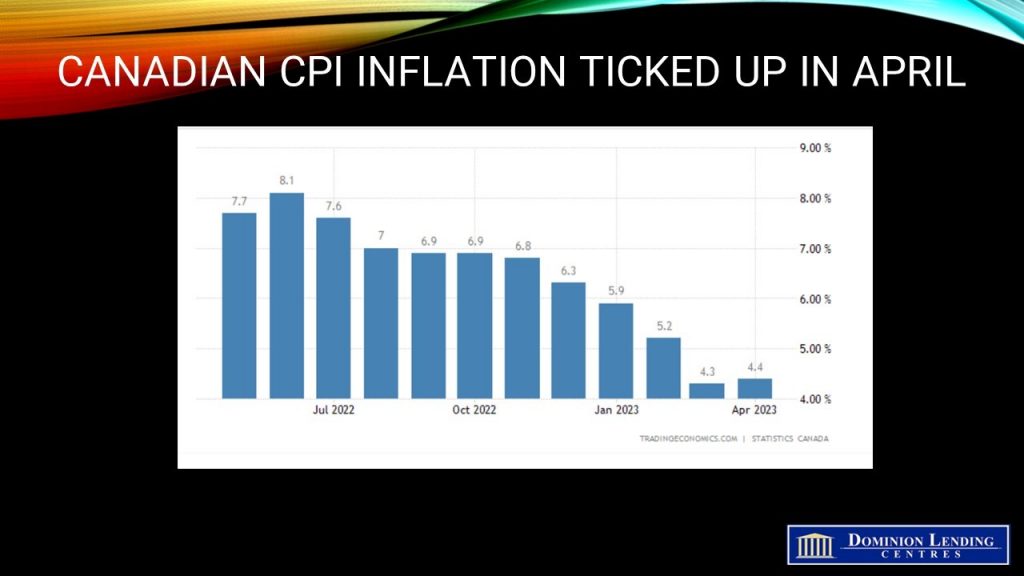

Canadian Inflation Rose More Than Expected in April, But Core Inflation Slowed

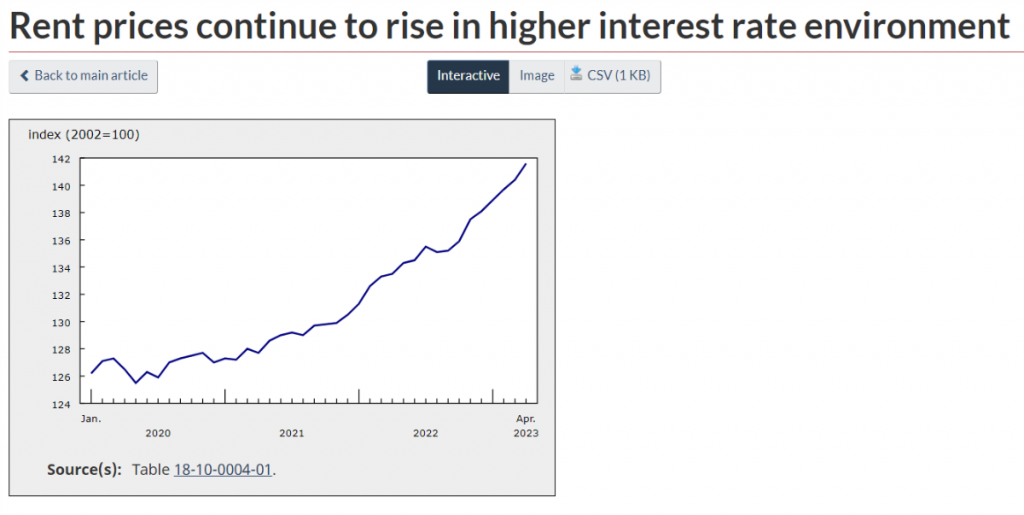

There’s been an unexpected hiccup in the Bank of Canada’s ongoing battle against inflation. Year-over-year, price pressures escalated to 4.4% in April, an uptick from the previous month’s 4.3% and significantly exceeding the average economist’s prediction of 4.1%. This marks the first rise in overall inflation from the last June. Ironically, higher interest rates are intended to tackle inflation, but rising rent prices and mortgage interest costs contributed the most to the all-items CPI increase last month.

This sketches an unusual scenario for the Bank of Canada as it approaches its June 7th rate decision. The economy remains resilient, with Canadians grappling with escalated interest rates and continued price pressures. Spring 2023 increasingly looks like the turnaround point for Canada’s housing market after a year-long slump, and labour markets remained firm in April.

To be sure, inflation is down significantly from the 8.1% year-on-year peak experienced last June. The initial reduction in inflation was swift and relatively straightforward, but predictably, the following phase is proving to be considerably more challenging.

The CPI was up 0.7% in April, following a 0.5% gain in March. Gasoline prices (+6.3%) contributed the most to the headline month-over-month movement. Excluding gasoline, the monthly CPI rose 0.5%. On a seasonally adjusted monthly basis, the CPI rose 0.6%.

Gasoline prices rose 6.3% in April compared with March, the most significant monthly increase since October 2022 and contributing the most to the acceleration in the headline CPI. This increase followed an announcement from OPEC+ (countries from the Organization of Petroleum Exporting Countries Plus) to reduce oil output, pushing prices higher. The switch to summer blend and increased carbon levies also boosted prices.

Nevertheless, gas prices were 7.7% lower in April 2023 compared with April 2022, when prices were higher due in part to Russia’s invasion of Ukraine. Compared with 18 months earlier, gasoline prices were 10.0% higher in April 2023.

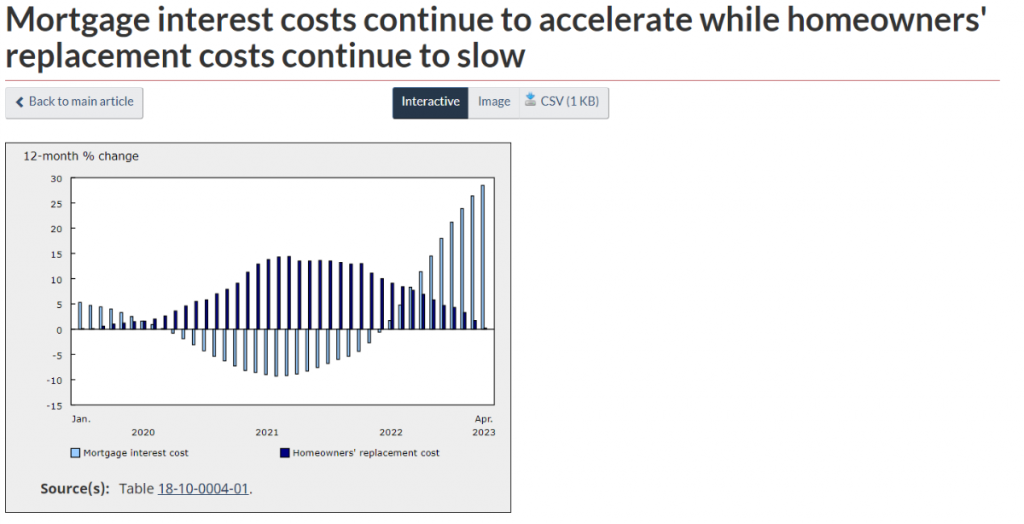

Shelter costs rose 4.9% year-over-year in April after a 5.4% increase in March. Canadians continued to pay more in mortgage interest cost in April (+28.5%) compared with April 2022, as more mortgages were initiated or renewed at higher interest rates. The higher interest rate environment may also contribute to rising rents in April 2023 (+6.1%) by stimulating higher rental demand. The year-over-year increase in the homeowners’ replacement cost index slowed for the 12th consecutive month in April (+0.2%) compared with March (+1.7%), reflecting a general cooling of the housing market.

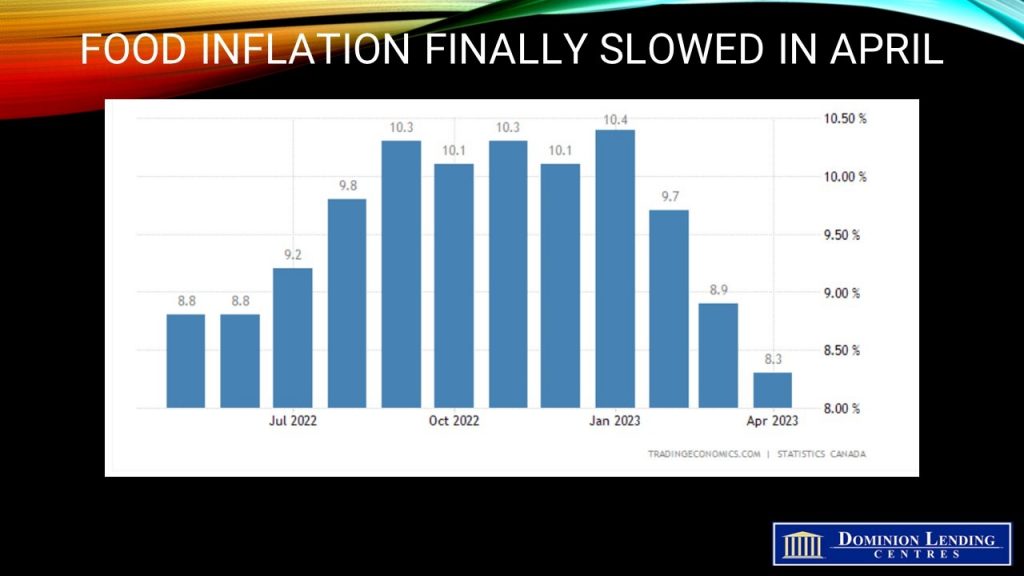

Year over year, prices for groceries rose at a slower rate in April (+9.1%) than in March (+9.7%), with the slowdown stemming from smaller price increases for fresh vegetables and coffee and tea.

Bottom Line

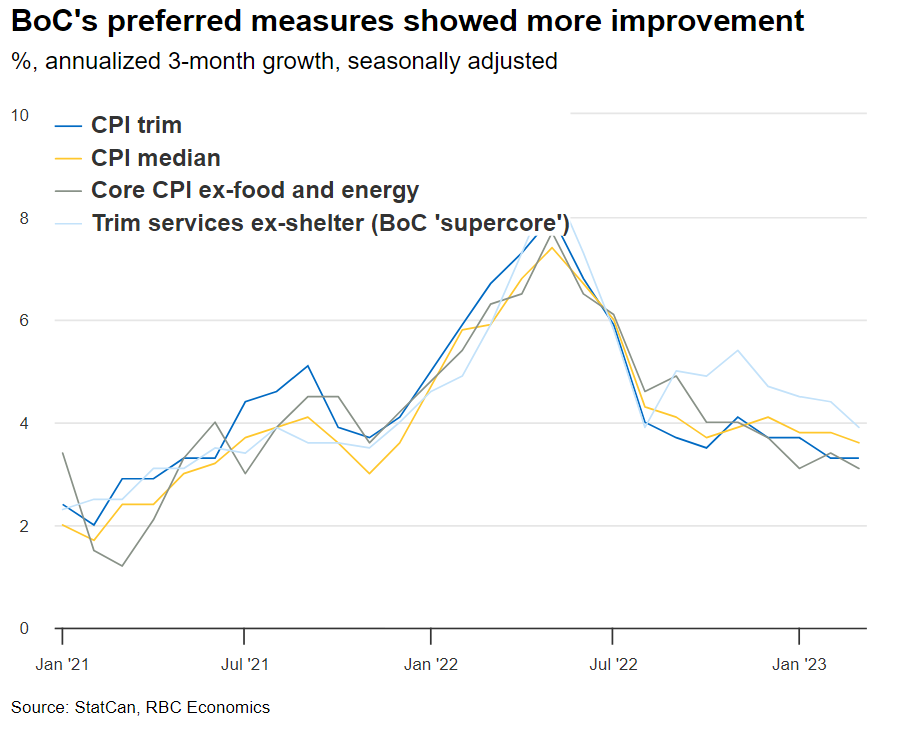

The uptick in April inflation, especially monthly, shows that the road to 2% inflation will be bumpy. Still, the Bank of Canada will be content that their measures of core inflation continue to trend downward (see chart below). The Bank will likely continue the pause in June, but if the May employment numbers continue strong, the Governing Council will indeed warn that they will remain ever vigilant. I do not expect rate cuts this year.

(This article is courtesy of the Sherry Cooper Assoc.)

Angela Calla is an 19-year award-winning woman of influence which sets her apart from the rest. Alongside her team, Angela passionately assists mortgage holders in acquiring the best possible mortgage. Through her presence on “The Mortgage Show” and through her best-selling book “The Mortgage Code“, Angela educates prospective home buyers by providing vital information on mortgages. In light of this, her success awarded her with the 2020Business Leader of the Year Award.

Angela is a frequent go-to source for media and publishers across the country. For media interviews, speaking inquiries, or personal mortgage assistance, please contact Angela at hello@countoncalla.ca or at 604-802-3983.

Click here to view the latest news on our blog.