Falling interest rates have raised hopes of a market resurgence

Affordability struggles and eyewatering house prices may have weighed down homebuying activity in British Columbia over the past two years – but falling interest rates are set to spur a busier market for the remainder of this year and into 2025, with mortgage brokers already gearing up for that trend.

Residential sales across the Multiple Listings Service (MLS) in the province should jump by 4.4% by the end of the year, according to the British Columbia Real Estate Association (BCREA), and rise by over 10,000 units throughout 2025.

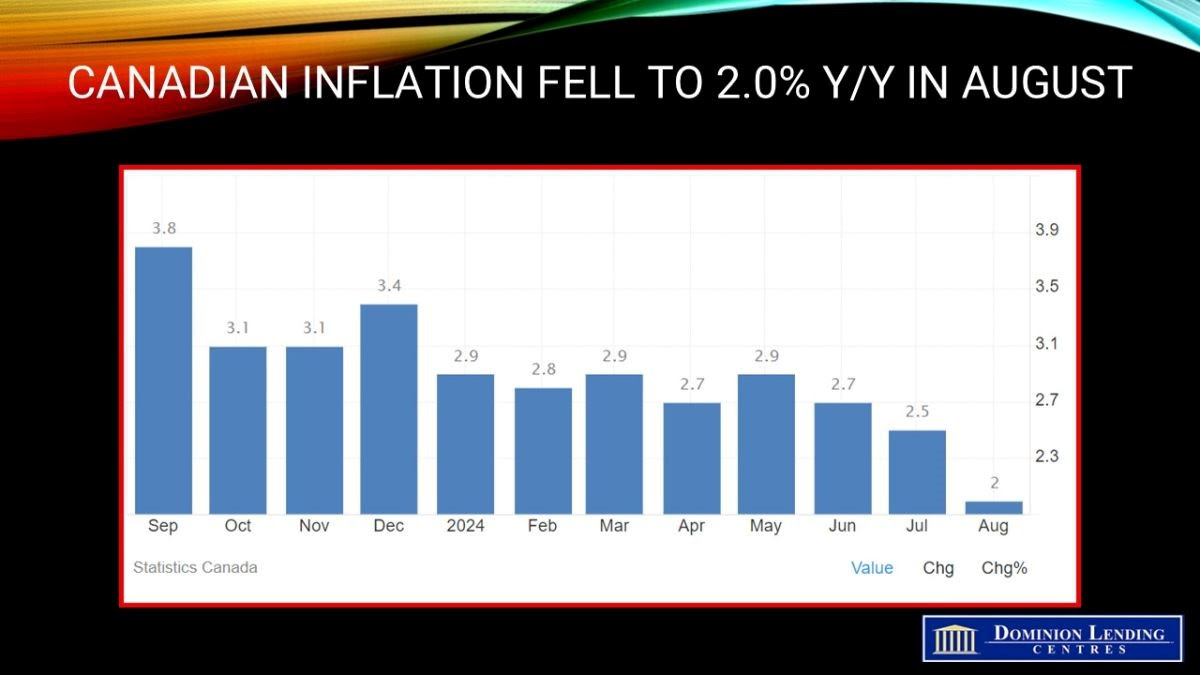

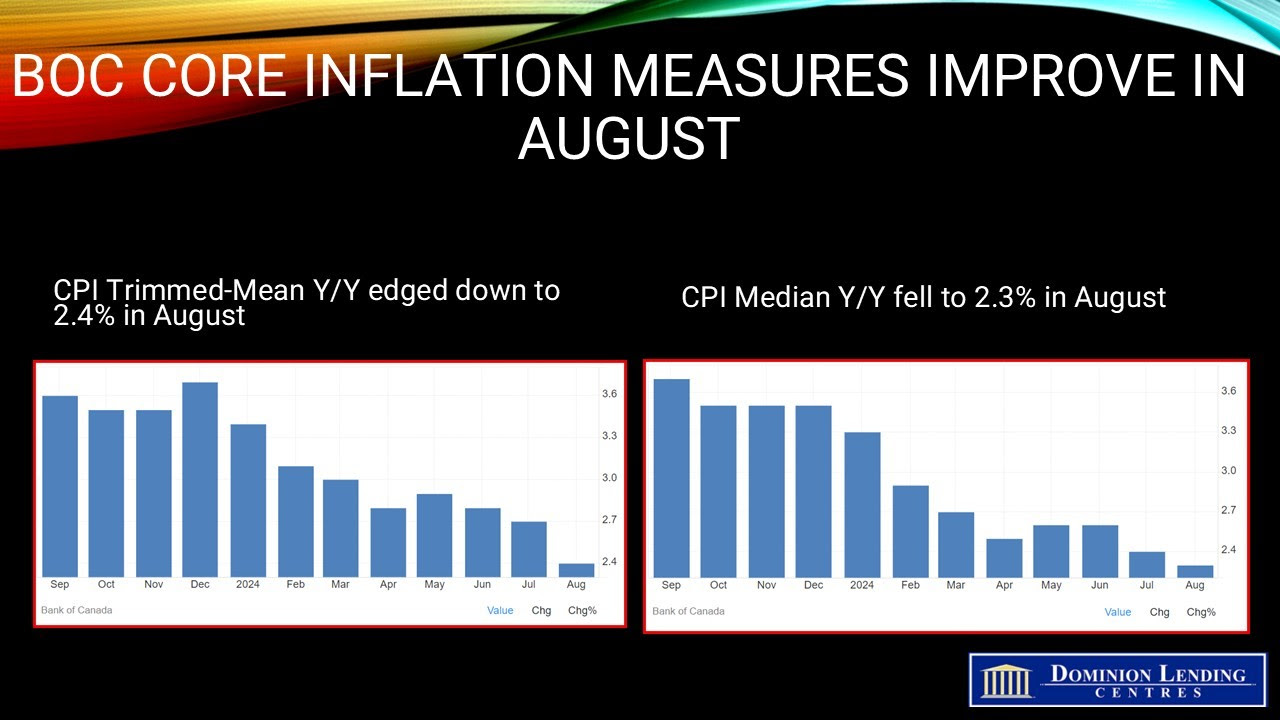

While the total inventory of available homes is now at its highest level since 2019 in the province thanks to tepid market activity during the first half of 2024, two summer rate cuts by the Bank of Canada – and the near certainty of more reductions before the end of this year – suggest better times are ahead for BC’s housing and mortgage markets.

Angela Calla (pictured, top left), a broker-owner based in Port Coquitlam, told Canadian Mortgage Professional that the Bank of Canada’s rate cuts (which marked the first time it had lowered rates for over four years) had boosted buyer sentiment noticeably. “We’ve seen renewed optimism,” she said, “and desire for education on different strategies. The increased engagement has been fantastic to increase Canadians’ financial literacy.”

How will further rate cuts impact the mortgage outlook?

Further cuts are on the horizon in the months ahead, with the Bank widely expected to lower its policy rate by a further 25 basis points when it meets next week (September 4).

That would bring its trendsetting interest rate to 4.25%, down from a 23-year high of 5% at the beginning of the summer, and it likely wouldn’t be the last cut the central bank makes in 2024.

Calla said a likely resurgence in market activity as rates fall means those buyers who can afford to get into the market now shouldn’t hold off. “If you’re considering a purchase, don’t wait until the rates go down further,” she said.

“More competition is coming in the marketplace. Buy and wait – don’t wait to buy, as prices will increase with a larger pool of buyers.”

For Vancouver-based broker Kyle Green (pictured, top right), the city is unlikely to see a big upswing in housing market activity before the end of the year. Still, that’s not to say buyers won’t face a potentially more challenging landscape, one that could see momentum swing back toward sellers.

That would buck a trend that’s emerged thanks to greater buyer choice and milder competition of late. “I believe Vancouver will be a relatively flat market,” Green told CMP, “potentially [seeing] some small declines in prices as the inventory has increased substantially.

“However, dropping rates may counterbalance this switch from a seller’s market to a buyer’s market which has only really been a recent phenomenon.”

Could variable rates become more appealing for buyers and homeowners?

The central bank’s recent pivot towards rate cuts doesn’t appear to have shifted sentiment in the mortgage market away from shorter-term variable options as the most popular choice among borrowers.

While rock-bottom variable rates during the COVID-19 pandemic saw many borrowers flock to those mortgage types, the Bank’s aggressive series of rate hikes throughout 2022 and 2023 meant they increasingly opted for two-to-three-year fixed options to keep their own rates steady.

Calla said that hasn’t changed markedly – not yet, at least. “Most are still gravitating towards fixed rates for a shorter term,” she said. “Variables are most attractive for very qualified borrowers with smaller-than-average mortgage amounts or those planning to sell in the next year.”

Green said his clients are also mostly inclined to go fixed, “but the tide is starting to turn right now.” The percentage of new business coming through the door and considering variable options, he said, is inching towards 50%.

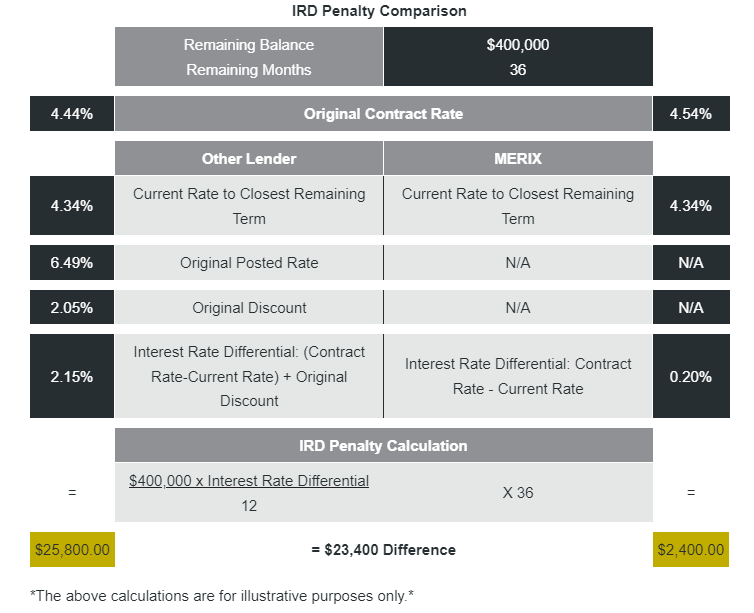

Brokers should also be attuned, he said, to refinance potential for clients in the current market. “There seems to be a potential opportunity to refinance clients who took a three-year fixed in the second half of 2023,” he highlighted.

“Running the numbers, there seem to be surplus savings right now – [so] dig into your databases, brokers.”

Angela Calla is an 19-year award-winning woman of influence which sets her apart from the rest. Alongside her team, Angela passionately assists mortgage holders in acquiring the best possible mortgage. Through her presence on “The Mortgage Show” and through her best-selling book “The Mortgage Code“, Angela educates prospective home buyers by providing vital information on mortgages. In light of this, her success awarded her with the 2020Business Leader of the Year Award.

Angela is a frequent go-to source for media and publishers across the country. For media interviews, speaking inquiries, or personal mortgage assistance, please contact Angela at hello@countoncalla.ca or at 604-802-3983.

Click here to view the latest news on our blog.