Canadian Inflation Rose In May, Surprising Markets

Inflation unexpectedly rose in May, disappointing the Bank of Canada as it deliberates the possibility of another rate cut next month.

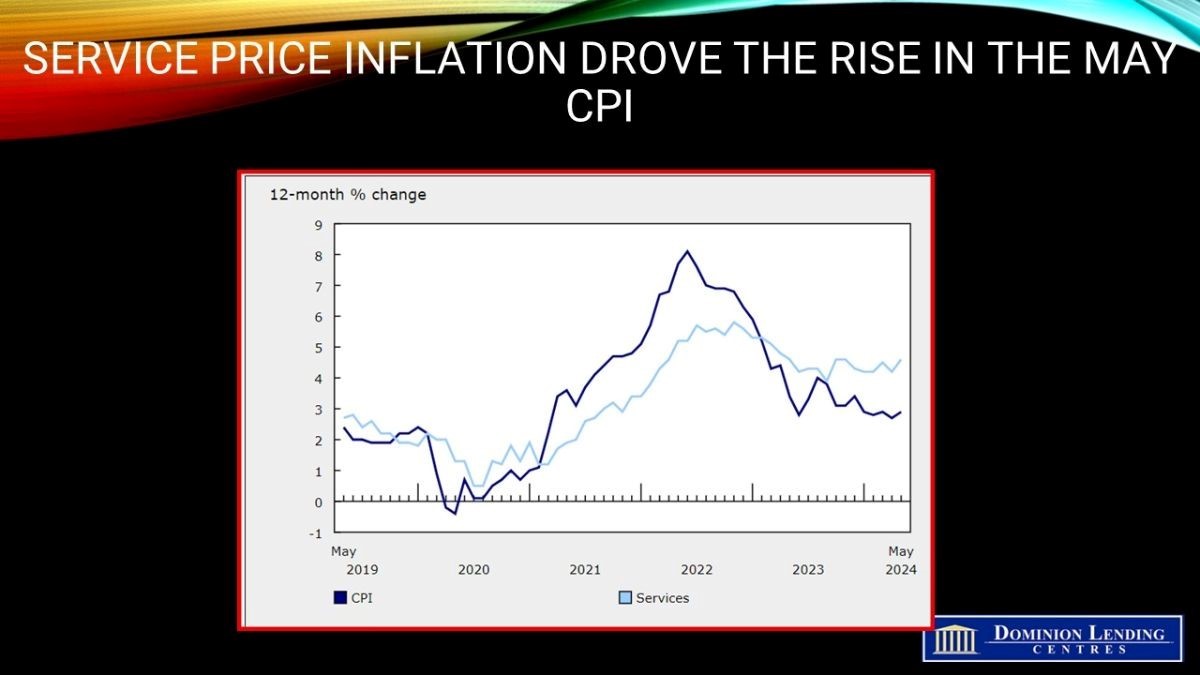

The Consumer Price Index (CPI) rose 2.9% in May from a year ago, up from a 2.7% reading in April. This increase primarily reflects higher prices for services and, to a lesser extent, food. According to a Bloomberg survey, economists had expected 2.6% inflation last month.

Cellular services, travel tours, rent, and air transportation boosted service prices by 4.6% year-over-year (y/y) in May, up sharply from the 4.2% rise in April. Price growth for goods remained at 1%, although grocery prices rose more rapidly.

Monthly, the CPI index climbed 0.6% compared to expectations for a 0.3% gain and up from 0.5% in April. On a seasonally adjusted basis, inflation rose 0.3%.

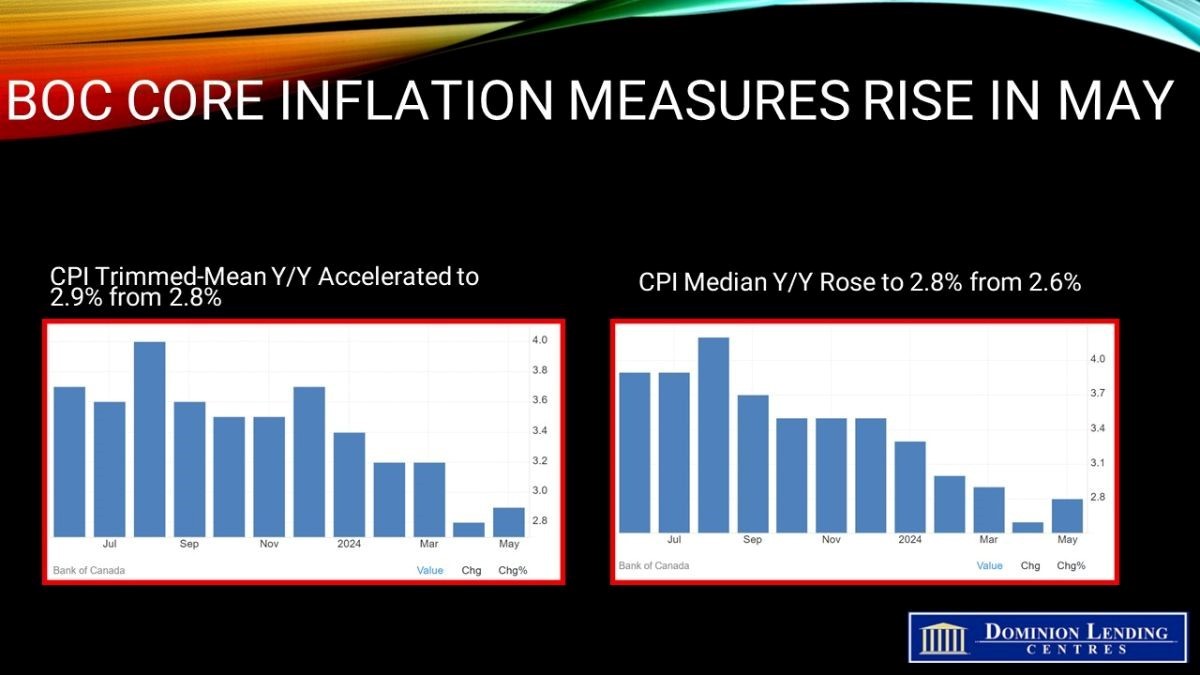

The Bank of Canada’s preferred measures of core inflation, the trim and median core rates, excludes the more volatile price movements to assess the level of underlying inflation. The CPI trim accelerated to 2.9% in May, following a downwardly revised 2.8% rise the previous month. The CPI median rose two ticks to 2.8%. Both measures of core inflation surprised economists on the high side.

Shelter costs have been a massive component of inflation this cycle. In May, rent rose a whopping 0.9%, lifting the yearly rise to 8.9% y/y, the second largest contributor to annual inflation. The single most significant inflation driver–mortgage interest costs–ticked down a bit to 0.8% m/m, reducing the yearly pace to 23.3%. It peaked above 30% last year. Excluding shelter, inflation is rising 1.5% y/y, up from 1.2% last month.

Bottom Line

Today’s inflation reading was undoubtedly a disappointment for the Bank of Canada, and it reduces the chances of another rate cut when they meet again on July 24. However, the June inflation data will be released on July 16. Barring a significant drop in June inflation, the next interest rate cut will likely be at the September meeting. That’s not good for the housing market, which has slowed to a crawl in recent months. The decline in mortgage rates proceeds as market forces drive down bond yields. Canada’s labour market is slowing as the jobless rate ticks up. Tiff Macklem said yesterday that he did not expect the unemployment rate to rise significantly further this cycle.

Interest rate cuts will be more gradual because rapid population growth has boosted economic activity, forestalling a recession and adding to inflationary pressure. The central bank’s overnight policy rate, now at 4.75%, will gradually move to 3.0% by the end of next year.

Article courtesy of Dr. Sherry Cooper, Chief Economist, DLC

Angela Calla is an 19-year award-winning woman of influence which sets her apart from the rest. Alongside her team, Angela passionately assists mortgage holders in acquiring the best possible mortgage. Through her presence on “The Mortgage Show” and through her best-selling book “The Mortgage Code“, Angela educates prospective home buyers by providing vital information on mortgages. In light of this, her success awarded her with the 2020Business Leader of the Year Award.

Angela is a frequent go-to source for media and publishers across the country. For media interviews, speaking inquiries, or personal mortgage assistance, please contact Angela at hello@countoncalla.ca or at 604-802-3983.

Click here to view the latest news on our blog.